This applications market sizing report focuses on the 2010 performance of the top 10 applications vendors in the enterprise resource planning applications market.

With the global financial crisis behind them, major ERP applications vendors have begun to confront a new reality as technology adoption trends are accompanying shifting user requirements to embrace a different way of delivering software and perhaps automating business processes along the way.

Similar to the uneven pace of the economic recovery, ERP vendors are struggling to orient themselves in this new competitive landscape. Some have kicked off a new round of mergers and acquisitions to turbo-charge their sales, while others have focused their attention on new and untapped opportunities in oft-overlooked verticals or emerging countries.

Whatever the case, the ERP market, which has experienced a brutal recession and now perhaps a more vicious consolidation cycle, will never look the same again.

Top Line and Bottom Line

On the top line, the ERP applications market is expected to regain its momentum with the return of big software purchases and increased IT spending especially among customers in high-growth countries. In places like Brazil, China and the Middle East, the proliferation of infrastructure projects have sparked new implementations of scalable business management systems in order to handle large amounts of transactions.

Since March 2011 a number of blockbuster mergers and acquisitions have swept through the ERP applications market challenging the key players in high-growth verticals, while ushering a new world order for the software industry.

The latest round of market consolidation is likely to bump up near-term sales for many of the acquisitive players, but their rapid expansion could come at a steep price, which may not necessarily translate into the kind of returns their investors have in mind.

The reshuffling of the top ERP vendors may also entail additional costs for the users, who now may have to spend extra time assessing the product direction of their new technology providers, which may deem some of their acquired applications – especially those designed to be implemented in-house exclusively – not strategic to their future.

This brings the whole discussion to the continuous migration of on-premise ERP applications vendors to Cloudbased delivery, a move that many have been undertaking with limited success. The more aggressive these ERP applications are moving to the Cloud, which covers all kinds of off-premise and remote environments that host the applications on behalf of the licensed users, the more likely that they will see sharply reduced software license revenues and perhaps maintenance fees in the short run because of the need to spread out the on-demand subscription fees over the span of the contracts.

Coupling the imminent revenue shortfall is the possibility that their expenses will rise because of the investments associated with building out their own Cloud infrastructure or paying dearly to hosting partners that can guarantee 100% uptime given the mission-critical nature of their applications. On both fronts, the bottom line of these ERP applications vendors in transition will be impaired and it’s not clear when any of them would be able to turn a profit consistently over the next three to five years.

5 Market Definition and Overview

The market for enterprise resource planning applications is defined as follows:

Integrated applications suites designed to automate a range of business processes from back-office operations to financial management and from sales distribution to customer information management within a vertical or across multiple industries.

The ERP applications market has hit some rough patches over the past few years because of the lingering effects of the recession and now there are signs that the major vendors are in better financial shape than ever as customer orders – including many seven-figure and even eight-figure ones – have begun trickling in and small to midsized businesses are reinvesting in new systems in order to stay competitive and grow globally.

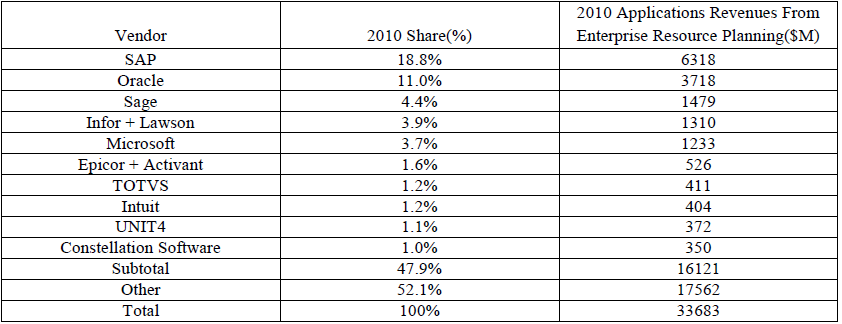

But the most dramatic developments remained the latest wave of mergers and acquisitions among top ERP applications vendors including Infor’s pending purchase of Lawson for about $2 billion, to become the No. 4 player in the market with their combined 2010 ERP software revenues. Without the addition of Lawson, Infor’s current standing is No. 5. Epicor, which is in the process of merging with Activant in a $2-billion buyout backed by UK private equity firm Apax Partners, would become the No. 6 player with their combined 2010 software revenues, instead of staying at No. 10.

In the meantime, Constellation Software, which is the No. 9 vendor that targets dozens of market niches from moving and storage facilities to cabinet manufacturers, has announced a plan to evaluate its strategic options including the possible sale to another company or investor group.

The following table illustrates the new ranking of the 10 largest 2010 worldwide ERP applications vendors and their shares based on aggregated license, maintenance and subscription revenues on a pro-forma basis.

The musical chairs under way in the ERP applications market will have broad implications for all the parties involved.

SAP and Oracle will have to pursue additional acquisitions in order to sustain their lead over the rest of the pack in the coming months. Oracle, for example, acquired ATG for $1 billion in January to shore up its eCommerce capabilities.

The next tier of major ERP vendors Sage, Infor/Lawson and Microsoft will do anything possible to rise above their rivals in order to claim the all-important No. 3 spot. Given their industry-specific expertise, they have every intention to close in on the No. 1 ERP leader by marshaling their global resources and ecosystems in any close vendor evaluation process and positioning themselves as the clear alternative to the incumbent.

Then there are Epicor/Activant, TOTVS, Intuit, UNIT4, and Constellation Software finishing the lineup of the top 10 with each securing between 1% and 2% share of the market. With a combination of organic growth and welltimed acquisitions, these five formidable players will continue to excel in their strategic areas(UNIT4 in professional services, for example) while ensuring their supremacy in major theaters and markets(Constellation Software in German public transportation market; Epicor in Italy, retail and manufacturing; Intuit in US accountancy; TOTVS in Brazil; and UNIT4 in Benelux).

In order to keep up with their momentum, these top 10 vendors will set their sights on one another or on those that trail behind them. The list includes CDC in Asia Pacific, Cegid in France, Deltek in Washington DC for government contractors, Netsuite in Cloud-based ERP, QAD in automotive, and Visma in the Nordic countries. All these vendors will have extra reasons to be concerned about the rash of mergers and acquisitions for fears of being marginalized after the dust is settled.

Customers

Another key ramification on the latest consolidation wave has to do with its direct correlation on deal size. The more products these vendors are able to sell after acquiring them, the higher prices they can fetch from customers. The formula has worked well for Oracle.

Since 2005 Oracle’s big deals, which are considered those that command software license sales of more than $500,000, have typically represented somewhere between 30% and 40% of its license revenues. By the third quarter of Oracle’s fiscal 2011 ended February 28, that figure has climbed to 53%, the highest level over the past 10 years.

In dollar terms, Oracle received $1.17 billion from such big deals in the third quarter of fiscal 2011, compared with $807 million in year earlier period. The $366 million jump could be attributed to the return of large ERP transformation deals, some claiming as much as $50 million in license revenues that Oracle signed in the third quarter of fiscal 2011. As a result, a host of large multinationals, banks and government agencies have chosen to standardize on Oracle ERP applications, middleware and database products.

The rising value of these deals is a double-edged sword for both the vendors and their customers. For one thing, companies may have no choice but to embrace the standardization approach in order to mitigate the risks that come after years of downsizing their IT operations. When economic recovery becomes increasingly resolute, the decision to concentrate one’s purchasing power within a handful of IT providers is considered prudent. What’s not clear is whether such a move would end up costing them more because of the hidden costs covering everything from higher maintenance fees to all-encompassing enterprise license agreements.

Even for small and midsized customers, the era of affordable computing and ERP solutions has come to a screeching halt with the onslaught of Cloud-based services, which at one point were considered the antidote to the shackles placed upon users by on-premise software vendors.

Consider the QuickBooks Online offering from Intuit. The Web-based product is no different than any other Cloudbased services one can get these days by eliminating the need to install any software on one’s desktop. It should 7 come as no surprise to anyone that Intuit stands to reap greater profit potential from QuickBooks Online, which sells for anywhere from $12.95 a month for a single user to $63.16 a month for payroll-included version. Many choose the Online Essential version priced at $24.95 a month for up to three users, paying close to $300 a year. By comparison, discounted version of the desktop version of QuickBooks Pro 2011 can be had for $127.99 at Amazon.

What it amounts to is that the fact that the trend toward ERP standardization and Cloud-services, which could go hand in hand, is the start of a new tax that vendors are levying on users for the hard work of providing ease of use applications that are easy to implement because they have been pre-integrated, not to mention the option of easy access from any browser with a secure Internet connection.

After years of complaining about high costs of ERP systems that fail to deliver on their promised benefits, customers are beginning to see the table has turned against them once again. This time, however, the outcome may appear to be more benevolent than a pact with the devil, something customers may actually be able to live with. After all, all innovation comes with a price.

Top 10 Applications Vendors In Enterprise Market

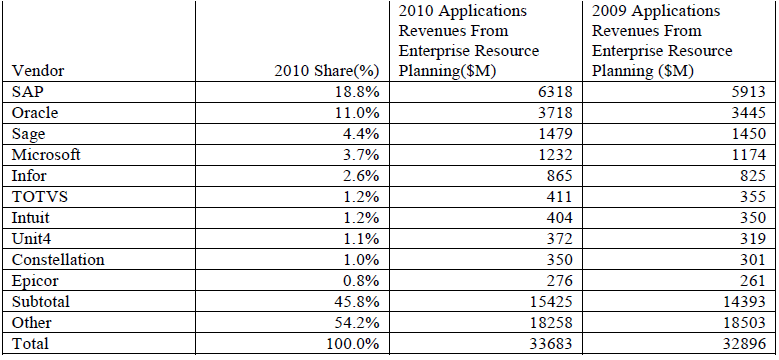

The following table lists the 2010 shares of the top 10 applications vendors in the enterprise resource planning market and their 2009 to 2010 applications revenues(license, maintenance and subscription) from the market.

Vendors To Watch

In 2011 all eyes will be on SAP and Oracle, both of which have announced grand strategies to breathe new life into their ERP applications. SAP has considered in-memory computing, Cloud services and mobility its top three priorities for the year. The last of the new triumvirate has been buttressed by its 2010 acquisition of Sybase known for its mobile database technologies. The high-profile launch of HANA, the in-memory analytic offering from SAP, could be a game changer. The same applies to a raft of on-demand offerings including the improved Business ByDesign, its Cloud-based ERP solution that has attracted 400 customers, compared with a handful in early 2010. Now SAP plans to secure more than 1,000 Business ByDesign customers by the end of 2011.

Similarly Oracle is bulking up with its Fusion Applications, its latest ERP offering that has become more on-demand than on-premise in its marketing pitch even though it can support either delivery model. Volume shipment will kick in during the second half of 2011.

Sage, Infor and Microsoft are also gunning for dominance in Cloud-based services in 2011, suggesting that selling ERP applications will never be the same again.

Outlook

On the upside, near-term growth of the worldwide ERP applications market is optimistic given the macro conditions driven by pent-up demand in developing and mature countries alike. In the first three months of 2011, both SAP and Microsoft reported low double-digit organic growth in their enterprise applications product revenues, not a bad sign for a traditionally weak quarter.

The consolidation wave shows no signs of receding, bidding up valuation of ERP applications vendors as well as the expected revenue boost such combinations would bring.

The move toward Cloud-based software delivery will help these vendors sell add-ons and complementary Web services, triggering a full-scale technology refresh cycle that has been held back by the recession. Then there’s the globalization factor that has stirred people’s imagination prompting them into action by pursuing ERP standardization as a means to optimize their visibility into every part of their far-flung operations.

On the downside, one should not overlook the drawbacks of the consolidation trend. For example, before Lawson completes the deal with Infor in September 2011, one of its first priorities is to collect more than $230 million in maintenance fees from its S3 customers by May 31. These customers may have to demand some explicit understanding – similar to the Customer Assurance Program offered by PeopleSoft in its final days prior to its acquisition by Oracle in 2004 – from Infor as to how and to what extent their products would be supported in the long run.

The same risk also applies to the pending merger between Epicor and Activant, a deal that could result in heavy debt load for the new management team, who may have no choice but to scale back customer support operations in order to sustain cash flow.

Scenarios such as these will continue to reverberate throughout the ERP applications market, benefitting some vendors and their customers but hurting others along the way. Whatever the case, the competitive landscape is bound to change leaving all the players scrambling for their best bargaining position.

No doubt ERP, which has been eclipsed by social media and Cloud computing in terms of the buzz level over the past year, will once again be on the minds of a growing list of customers, investors and other key stakeholders all waiting to jump into action, while pondering how they will be able to capitalize on any changes that come their way.

Download the whole Market Report for free:

Enterprise Resource Planning Applications Market 2010-2015