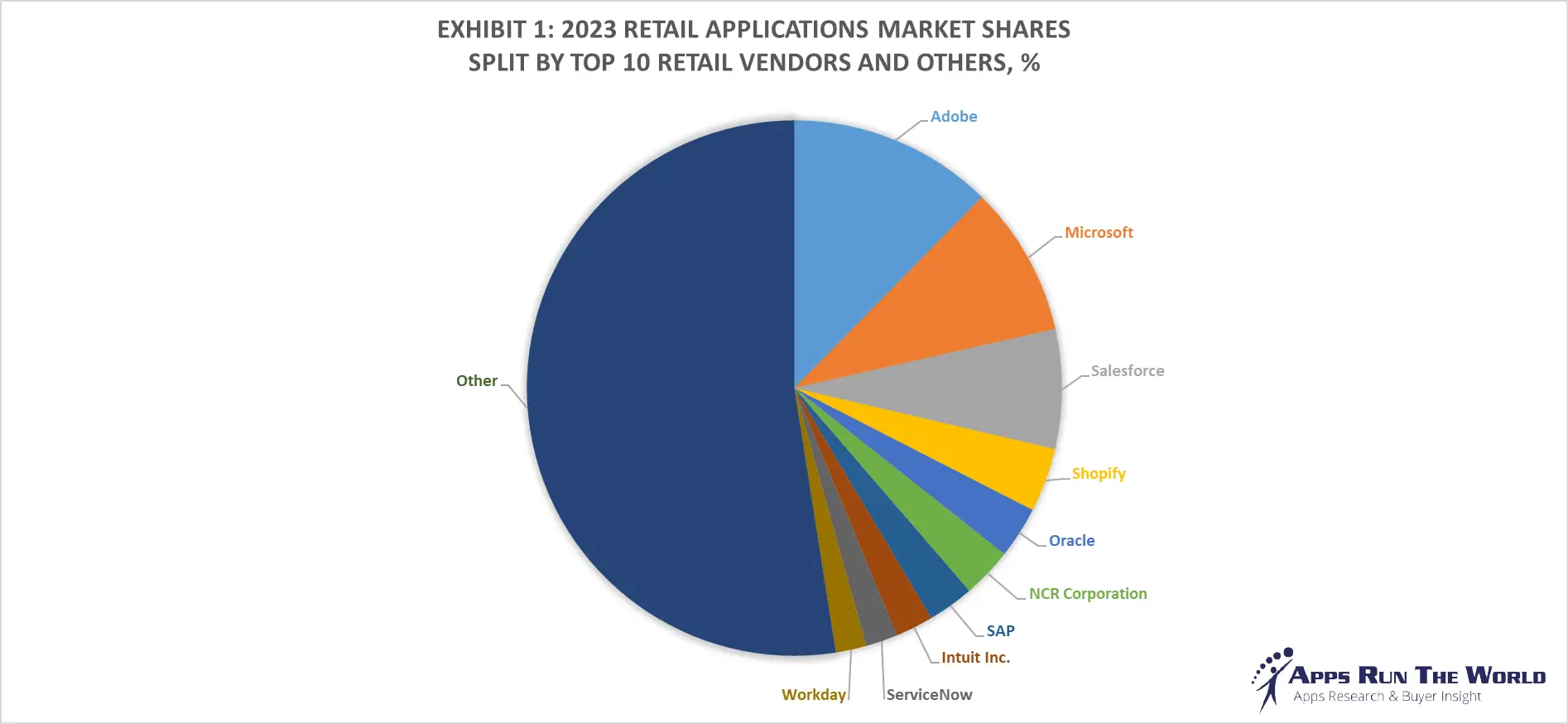

In 2023, the global Retail software market surged to nearly $36.3 billion, growing by 11.9%. The top 10 vendors commanded a significant 47.5% market share, with Adobe leading at 12.4%, followed by Microsoft, Salesforce, Shopify, and Oracle.

Our APPS TOP 500 Market Report (Preview) covers thousands of Retail software vendors, offering deep insights into market dynamics, vendor strengths, AI investments, customer momentum, and go-to-market strategies providing valuable perspectives on market trends and challenges.

Discover thousands of Retail Customer Wins with the ARTW Technographics Platform, an essential resource for technology enthusiasts, sales business leaders, and data-driven marketing executives, offering curated insights into the evolving landscape of the software industry, including the latest developments in Retail.

We ask the simple question: Who’s buying Retail applications from whom and why? And we provide the answers – supported by decades of research – to our clients around the world. (Sample from our Apps Database)

Through our forecast period, the Retail applications market size is expected to reach $45.7 billion by 2028, compared with $36.3 billion in 2023 at a compound annual growth rate of 4.7%.

| Exhibit 2: Worldwide Retail Software Market 2023-2028 Forecast, $M | |||

|---|---|---|---|

| Year | 2023 | 2028 | 2023-2028 CAGR, % |

| Total | 36320 | 45713 | 4.7% |

Source: Apps Run The World, June 2024

Top 10 Retail Software Vendors

Retail (Enterprises involved in the sale of goods, services, general and convenience stores, restaurants) – Multi-channel retail software, Point of Sale system, Store management system, Trade Promotions Management, Fresh food software, Price Optimization, Health, and Safety Software, Workplace Risk Management solutions, Retail Execution Management solutions, Financials, HR, Procurement

Multichannel retailing led by eCommerce will dominate the IT agenda of retailers as the capturing and analysis of real-time customer and inventory data will help facilitate better planning and demand forecasting.

Here are the rankings of the top 10 Retail software vendors in 2023 and their market shares.

| Rank | Vendor | 2021 Retail Apps Revenues, $M | 2022 Retail Apps Revenues, $M | 2023 Retail Apps Revenues, $M | YoY Growth | 2023 Retail Market Share, % |

|---|---|---|---|---|---|---|

| 1 | Adobe | Subscribe | Subscribe | Subscribe | 13.0% | Subscribe |

| 2 | Microsoft | Subscribe | Subscribe | Subscribe | 7.0% | Subscribe |

| 3 | Salesforce | Subscribe | Subscribe | Subscribe | 12.4% | Subscribe |

| 4 | Shopify | Subscribe | Subscribe | Subscribe | 15.5% | Subscribe |

| 5 | Oracle | Subscribe | Subscribe | Subscribe | 3.1% | Subscribe |

| 6 | NCR Corporation | Subscribe | Subscribe | Subscribe | 8.3% | Subscribe |

| 7 | SAP | Subscribe | Subscribe | Subscribe | 5.7% | Subscribe |

| 8 | Intuit Inc. | Subscribe | Subscribe | Subscribe | 7.3% | Subscribe |

| 9 | ServiceNow | Subscribe | Subscribe | Subscribe | 17.5% | Subscribe |

| 10 | Workday | Subscribe | Subscribe | Subscribe | 18.7% | Subscribe |

| Subtotal | Subscribe | Subscribe | Subscribe | 10.6% | Subscribe | |

| Other | Subscribe | Subscribe | Subscribe | 13.2% | Subscribe | |

| Total | 27732 | 32454 | 36320 | 11.9% | 100.0% |

Source: Apps Run The World, June 2024

Other Retail software providers included in the report are: 7shifts, ACI Worldwide, Inc., ADP, Aptos, Atlassian, Aurea, Avalara, Blue Yonder, Cisco Systems, Citrix, Constellation Software Inc., CoStar Group, Dailypay, Dayforce, DocuSign, Inc., Dropbox, Edgeverve, an Infosys company, Epicor, Exact Holding BV, Fiserv, Genesys Telecommunications Laboratories, Global Payments Inc., GoodData, Google, Infor, Informatica, Kingdee, Kooomo, Nice Systems, Openbravo, Open Text Corporation, Partech, Pegasystems, Pitney Bowes, PRGX Global Inc., PTC, Qlik, Reflexis Systems, Roper Technologies, Inc., Sage, SAS Institute, ServiceNow, Sitecore, SolarWinds, SPS Commerce, Inc., Symphony RetailAI, Tango Analytics, Teradata Corporation, TOTVS, UKG, Verint Systems Inc., Visma, Vonage, Workday, Workwell Technologies, Wunderkind (formerly BounceX) Yonyou, Zendesk, Zoom Video Communications, Zoho Corp. and others.

Custom data cuts related to the Retail Applications market are available:

- Top 1000+ Retail Applications Vendors and Market Forecast 2023-2028

- 2023 Retail Applications Market By Functional Market (16 Markets)

- 2023 Retail Applications Market By Country (USA + 45 countries)

- 2023 Retail Applications Market By Region (Americas, EMEA, APAC)

- 2023 Retail Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2023 Retail Applications Applications Market By Customer Size (revenue, employee count, asset)

- 2023 Retail Applications Market By Channel (Direct vs Direct)

- 2023 Retail Applications Market By Product

- Zinnov, a India based Oil, Gas and Chemicals organization with 100 Employees

- Internet Archive, a United States based Non Profit company with 169 Employees

- ACCEO Solutions, a Canada based Professional Services organization with 1000 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

Worldwide Enterprise Applications by Vertical Market

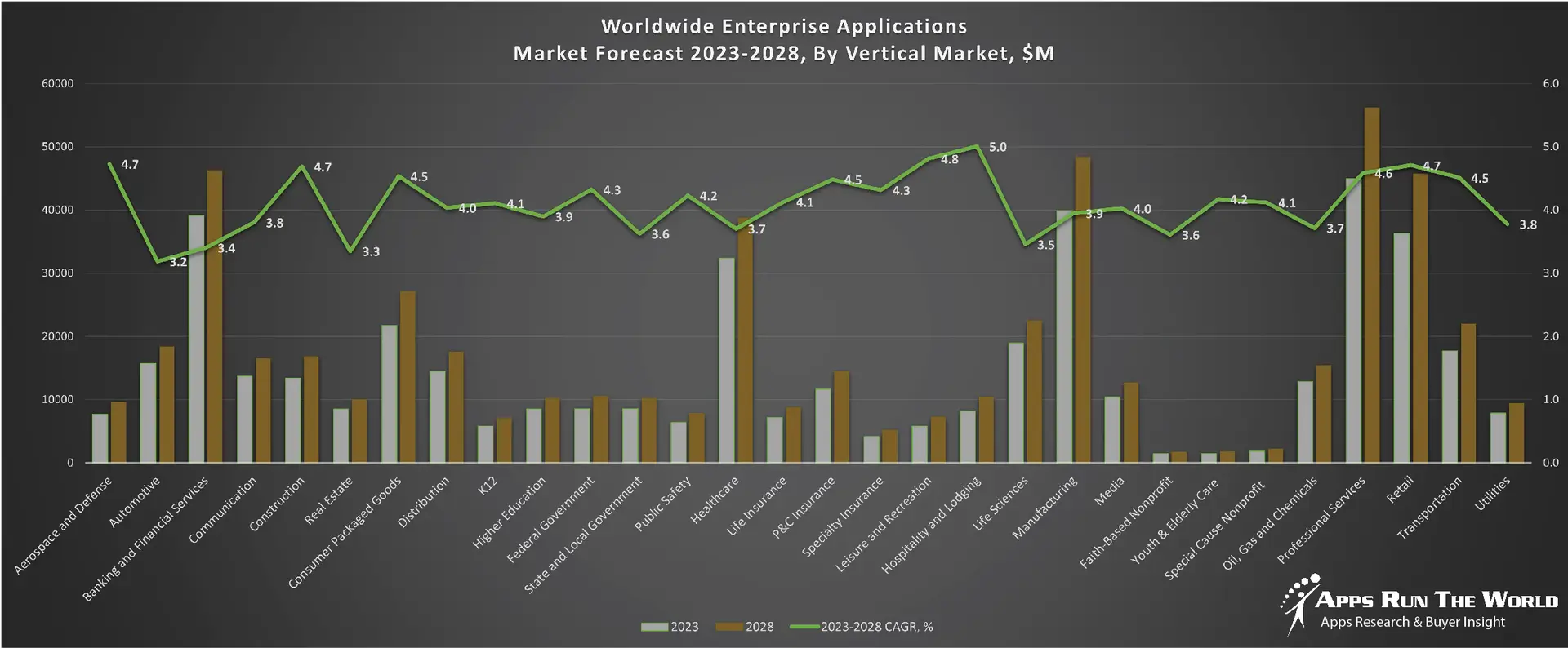

Exhibit 3 provides a forecast of the worldwide enterprise applications by vertical market from 2023 to 2028, highlighting market sizes, year-over-year growth, and compound annual growth rates across different industry sectors from Aerospace and Defense to Utilities.

Exhibit 3: Worldwide Enterprise Applications by Vertical Market Forecast 2023-2028 by Functional Market ($M)

Source: Apps Run The World, June 2024

Exhibit 4 shows our projections for the enterprise applications market by vertical segment, based on the buying preferences and the customer propensity to invest in new software within those industries as they continue to upgrade and replace many legacy industry-specific applications that have been identified and tracked in our Buyer Insight Database.

Retail Software Purchases Win/Loss Analysis As Part Of Enterprise Applications Buyer Insight Customer Database

On the buyer side, customers are investing in Retail systems based on new features and capabilities that are expected to replace their existing legacy systems. In many cases, competitive upgrades and replacements that could have a profound impact on future market-share changes will become more widespread.

Since 2010, our global team of researchers has been studying the patterns of the latest Retail software purchases by customers around the world, aggregating massive amounts of data points that form the basis of our forecast assumptions and perhaps the rise and fall of certain vendors and their products on a quarterly basis.

Updated continuously, our database features extensive win/loss analysis. Each year our research team identifies tens of thousands of these Retail customer wins and losses from public and proprietary sources.

The research results are being incorporated into regular updates in our Enterprise Applications Buyer Insight Customer Database. You can access the Quarterly Win/Loss Analysis Scoreboard and our Enterprise Applications Buyer Insight Customer Database by becoming a subscriber.

| Customer | Industry | Empl. | Revenue | Country | Vendor | New Product | Function | Market |

| 1-800-Flowers.com | Retail | 4000 | $1.12B | United States | IBM | IBM Commerce | eCommerce | eCommerce |

| A.F. Blakemore & Son Limited | Retail | 8100 | $1.71B | United Kingdom | Visma | Visma Retail Suite | Enterprise Resource Planning | ERP |

| Adidas | Retail | 60000 | $19.00B | Germany | ServiceNow | ServiceNow IT Service Management | IT Service Management | ITSM |

| AmeriPride | Retail | 6000 | $600.0M | United States | Ultimate Software | UltiPro | Human Capital Management | HCM |

| Ann Summers | Retail | 1332 | $133.0M | United Kingdom | Microsoft | Microsoft Dynamics 365 for Finance and Operations | Enterprise Resource Planning | ERP |

| Aqualisa Products Limited | Retail | 300 | $40.0M | United Kingdom | UNIT4 | Unit4 Prevero | Enterprise Performance Management | EPM |

| Ashley Furniture Industries | Retail | 23000 | $4.00B | United States | Salesforce | Salesforce Commerce Cloud | eCommerce | eCommerce |

| Ashley Furniture Industries | Retail | 23000 | $4.00B | United States | Salesforce | Salesforce Service Cloud | Customer Service Software | CRM |

| Assurance | Retail | 2200 | $200.0M | United States | ServiceNow | ServiceNow IT Service Management | IT Service Management | ITSM |

| Aston Martin | Retail | 1850 | $1.15B | United Kingdom | Microsoft | Microsoft Power BI | Business Intelligence | Analytics and BI |

| Aston Martin | Retail | 1850 | $1.15B | United Kingdom | Microsoft | Microsoft Project Online | Project Portfolio Management | PPM |

| Aston Martin | Retail | 1850 | $1.15B | United Kingdom | Microsoft | Microsoft Office 365 | Content Management | Content Management |

| Ballance Agri-Nutrients | Retail | 728 | $547.0M | New Zealand | SAP | SAP Marketing Cloud | Marketing Automation | CRM |

| Ballance Agri-Nutrients | Retail | 728 | $547.0M | New Zealand | SAP | SAP Commerce Cloud | eCommerce & Omni-Channel Commerce Solution | eCommerce |

| Ballance Agri-Nutrients | Retail | 728 | $547.0M | New Zealand | SAP | SAP S/4 HANA | Enterprise Resource Planning | ERP |

| Ballance Agri-Nutrients | Retail | 728 | $547.0M | New Zealand | SAP | SAP Business Suite on HANA | Enterprise Resource Planning | ERP |

| Bloomin’ Brands | Retail | 100000 | $4.34B | United States | Host Analytics | Host Analytics Cloud EPM Suite | Enterprise Performance Management | EPM |

| Brooks Brothers | Retail | 5500 | $900.0M | United States | SAP | SAP SuccessFactors Employee Central | Human Capital Management | HCM |

| Brookstone | Retail | 2000 | $500.0M | United States | Kronos | Kronos Workforce Dimensions | Workforce Management | HCM |

| Brookstone | Retail | 2000 | $500.0M | United States | SPS Commerce | SPS Commerce Sourcing | Supply Chain Management | SCM |

| Canon Europe | Retail | 19000 | $9.13B | United Kingdom | Oracle | Oracle Demantra | Demand Management and Supply Chain Management | SCM |

| Charoen Pokphand Foods PCL | Retail | 23337 | $16.0M | Thailand | JDA Software Group | JDA Enterprise Supply Planning | Enterprise Supply Chain Management | SCM |

| Circle K Europe | Retail | 90000 | $40.00B | Norway | Anaplan | Anaplan | Planning and Performance Management Platform | EPM |

| Clas Ohlson | Retail | 5000 | $8.21B | Sweden | PTC | PTC FlexPLM | Product Lifecycle Management | PLM & Engineering |

| Del Monte | Retail | 5600 | $1.60B | Singapore | Anaplan | Anaplan | Planning and Performance Management Platform | EPM |

| doTERRA | Retail | 2300 | $1.50B | United States | SAP | SAP Commerce Cloud | eCommerce & Omni-Channel Commerce Solution | eCommerce |

| doTERRA | Retail | 2300 | $1.50B | United States | SAP | SAP S/4 HANA | Enterprise Resource Planning | ERP |

| doTERRA | Retail | 2300 | $1.50B | United States | SAP | SAP Product Content Management | Web Experience Content Management | Content Management |

| doTERRA | Retail | 2300 | $1.50B | United States | SAP | SAP Service Cloud | Customer Service and Support | CRM |

| doTERRA | Retail | 2300 | $1.50B | United States | SAP | SAP Marketing Cloud | Marketing Automation | CRM |

| Eastman Kodak Company | Retail | 5800 | $1.53B | United States | Kyriba | Kyriba | Treasury and Risk Management | TRM |

| Equatorial Coca-Cola Bottling Company | Retail | 6000 | $686.0M | Spain | Epicor | Epicor ERP | Enterprise Resource Planning | ERP |

| Ermes Group | Retail | 1951 | $156.0M | Cyprus | IBM | IBM Watson Commerce | eCommerce | eCommerce |

| Foodstuffs North Island | Retail | 22000 | $5.02B | New Zealand | JDA Software Group | JDA Transportation Manager | Supply Chain Management | SCM |

| Gymshark | Retail | 1300 | $130.0M | United Kingdom | Shopify | Shopify Plus | eCommerce Platform | eCommerce |

| Kesko Oyj | Retail | 23173 | $10.68B | Finland | SAP | SAP SuccessFactors Employee Central | Human Capital Management | HCM |

| Laura Ashley | Retail | 1000 | $257.0M | United Kingdom | IBM | IBM Cognos Controller | Enterprise Performance Management | EPM |

| Maverik, Inc. | Retail | 5000 | $400.0M | United States | Oracle | Oracle Primavera Unifier | Project Portfolio Management | PPM |

| McCarthy Building Companies, Inc | Retail | 2500 | $200.0M | United States | Oracle | Primavera P6 Enterprise Project Portfolio Management | Project Portfolio Management | PPM |

| MINISO Co. Ltd. | Retail | 10000 | $1.80B | Japan | SAP | SAP SuccessFactors Employee Central | Human Capital Management | HCM |

| MINISO Co. Ltd. | Retail | 10000 | $1.80B | Japan | SAP | SAP Cloud for Customer | Customer Relationship Management | CRM |

| MINISO Co. Ltd. | Retail | 10000 | $1.80B | Japan | SAP | SAP S/4 HANA | Enterprise Resource Planning | ERP |

| Nebraska Furniture Mart | Retail | 5006 | $1.21B | United States | WorkForce Software | EmpCenter | Workforce Management | HCM |

| Office Depot | Retail | 24067 | $14.50B | United States | Oracle | Oracle SCM Cloud | Supply Chain Management | SCM |

| Office Depot | Retail | 24067 | $14.50B | United States | Oracle | Oracle EPM Cloud | Enterprise Performance Management | EPM |

| Office Depot | Retail | 24067 | $14.50B | United States | Oracle | Oracle HCM Cloud | Human Capital Management | HCM |

| Penti | Retail | 3000 | $600.0M | Turkey | SAP | SAP S/4 HANA | Enterprise Resource Planning | ERP |

| Pet Supplies Plus | Retail | 1100 | $3.00B | United States | SPS Commerce | SPS Commerce Fulfillment (EDI) | Electronic Data Interchange | SCM |

| Pimkie | Retail | 5500 | $1.20B | France | Kyriba | Kyriba | Treasury and Risk Management | TRM |

| QuestMark | Retail | 3500 | $1.00B | United States | Adobe Systems | Magento Commerce | eCommerce | eCommerce |

| Roche Bros | Retail | 4600 | $389.0M | United States | Kronos | Kronos Workforce Central | Human Capital Management, Workforce Management | HCM |

| Rosenbauer Group | Retail | 3100 | $870.0M | Austria | Infor | Infor Business Intelligence 10x | Business Intelligence | Analytics and BI |

| Rosenbauer Group | Retail | 3100 | $870.0M | Austria | Infor | Infor LN | Enterprise Resource Planning | ERP |

| Rubio’s Coastal Grill | Retail | 4200 | $1.00B | United States | Ceridian | Dayforce HCM | Human Capital Management | HCM |

| Southeastern Grocers | Retail | 66000 | $10.50B | United States | iCIMS | iCIMS Recruit Applicant Tracking System | Applicant Tracking System | HCM |

| Splunk | Retail | 3200 | $1.27B | United States | SAP | SAP Sales Cloud (ex CallidusCloud) | Sales Performance Management | SPM |

| Staples Solutions | Retail | 61500 | $20.22B | United States | PTC | PTC FlexPLM | Product Lifecycle Management | PLM & Engineering |

| Team Sportia | Retail | 900 | $180.0M | Sweden | SAP | SAP Commerce Cloud | eCommerce & Omni-Channel Commerce Solution | eCommerce |

| The Shilla Duty Free Shop | Retail | 800 | $2.50B | South Korea | SAP | SAP Commerce Cloud | eCommerce & Omni-Channel Commerce Solution | eCommerce |

| Vaillant Group | Retail | 13000 | $2.76B | Germany | SAP | SAP S/4 HANA | Enterprise Resource Planning | ERP |

| Vaillant Group | Retail | 13000 | $2.76B | Germany | Wolters Kluwer | CCH Tagetik | Enterprise Performance Management | EPM |

| Vineyard Vines | Retail | 2800 | $300.0M | United States | Pitney Bowes | Complete Cross-Border | eCommerce | eCommerce |

| Vivobarefoot | Retail | 70 | $10.0M | United Kingdom | Oracle | NetSuite Commerce | eCommerce | eCommerce |

| Warren Equipment Company | Retail | 1700 | $500.0M | United States | Ultimate Software | UltiPro | Human Capital Management | HCM |

| Watami Co | Retail | 2825 | $843.0M | Japan | Infor | Infor CloudSuite Food & Beverage | Enterprise Resource Planning | ERP |

Source: Apps Run The World, June 2024

More Enterprise Applications Research Findings

Based on the latest annual survey of 3,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 500 largest Enterprise Applications Vendors (Apps Top 500) ranked by their 2019-2023 product revenues.

Their 2023 results are being broken down, sorted and ranked across 16 functional areas (from Analytics to Treasury and Risk Management) and by 21 vertical industries(from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year our global team of researchers conduct an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market. We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 100,000 organizations around the world.

The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.