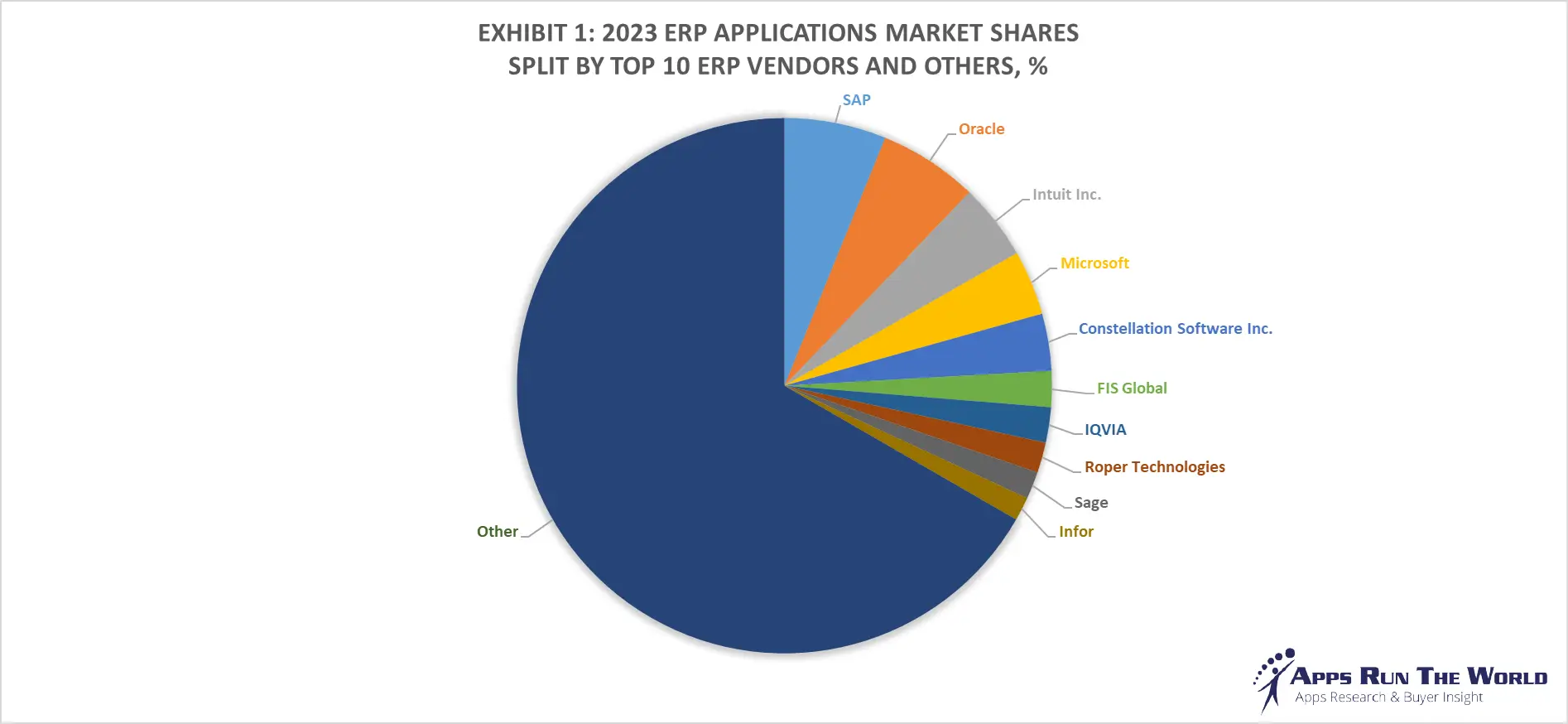

In 2023, the global Enterprise Resource Planning (ERP) software market surged to $124 billion, growing by 3.6%. The top 10 vendors commanded a significant 33.3% market share, with SAP leading at 6.2%, followed by Oracle, Intuit, Microsoft, and Constellation Software.

Our APPS TOP 500 Market Report (Preview) covers hundreds of ERP software vendors, offering deep insights into market dynamics, vendor strengths, AI investments, customer momentum, and go-to-market strategies providing valuable perspectives on market trends and challenges.

Discover thousands of ERP Customer Wins with the ARTW Technographics Platform, an essential resource for technology enthusiasts, sales business leaders, and data-driven marketing executives, offering curated insights into the evolving landscape of the software industry, including the latest developments in ERP.

Our team has analyzed all Fortune 1000 and Global 2000 companies and their IT Environments, including ERP, HCM, ATS, CRM, Procurement, Treasury, and other apps being used globally, but also on a country level.

Source: Apps Run The World, June 2024

We ask the simple question: Who’s buying ERP applications from whom and why? And we provide the answers – supported by decades of research – to our clients around the world. (Sample from our Apps Database)

Through our forecast period, the ERP applications market size is expected to reach $148.2 billion by 2028, compared with $124.2 billion in 2023 at a compound annual growth rate of 3.6%.

| Exhibit 2: Worldwide ERP Software Market 2023-2028 Forecast, $M | |||

|---|---|---|---|

| Year | 2023 | 2028 | 2023-2028 CAGR, % |

| Total | 124200 | 148234 | 3.6% |

Source: Apps Run The World, June 2024

Top 10 ERP Software Vendors

ERP Financial Management software covers finance-specific business processes such as accounts payable, accounts receivable, general ledger, and fixed asset accounting, as well as online functions such as invoicing, factoring, electronic payments and financial reporting. FM applications revenues represent a major contributor to the Enterprise Resource Planning market as part of our market sizing exercise.

ERP Services and Operations Management covers integrated applications suites designed to automate a range of business processes from back-office operations to financial management and from sales order capture to customer information management. Currently ERP also covers functions not being addressed by other functional markets. Examples include Environment and Health and Safety, Governance, Risk and Compliance, as well as industry-specific applications for 21 verticals.

Buoyed by NetSuite, Workday, and Xero, the ERP FM market has never looked more promising, but incumbents are fighting back with quick conversion toolkits, GL upgrades, and embedded analytics for easy reporting.

Industry-specific ERP applications continue to exert considerable influence over direction of enterprise applications market, but growth remains muted because of entrenched presence of legacy systems.

Here are the rankings of the top 10 ERP software vendors in 2023 and their market shares.

| Rank | Vendor | 2021 ERP Apps Revenues, $M | 2022 ERP Apps Revenues, $M | 2023 ERP Apps Revenues, $M | YoY Growth | 2023 ERP Market Share, % |

|---|---|---|---|---|---|---|

| 1 | SAP | Subscribe | Subscribe | Subscribe | 5.7% | Subscribe |

| 2 | Oracle | Subscribe | Subscribe | Subscribe | 6.2% | Subscribe |

| 3 | Intuit Inc. | Subscribe | Subscribe | Subscribe | 7.3% | Subscribe |

| 4 | Microsoft | Subscribe | Subscribe | Subscribe | 11.9% | Subscribe |

| 5 | Constellation Software Inc. | Subscribe | Subscribe | Subscribe | 23.9% | Subscribe |

| 6 | FIS Global | Subscribe | Subscribe | Subscribe | 2.5% | Subscribe |

| 7 | IQVIA | Subscribe | Subscribe | Subscribe | 2.0% | Subscribe |

| 8 | Roper Technologies | Subscribe | Subscribe | Subscribe | 16.2% | Subscribe |

| 9 | Sage | Subscribe | Subscribe | Subscribe | 20.1% | Subscribe |

| 10 | Infor | Subscribe | Subscribe | Subscribe | 4.8% | Subscribe |

| Subtotal | Subscribe | Subscribe | Subscribe | 9.0% | Subscribe | |

| Other | Subscribe | Subscribe | Subscribe | 9.1% | Subscribe | |

| Total | 104127 | 113831 | 124200 | 9.1% | 100.0% |

Source: Apps Run The World, June 2024

Other ERP software providers included in the report are: ACI Worldwide, Acumatica, Adobe, Allscripts, Amadeus, Aptean, Asseco Group, athenahealth, Avalara, Blackbaud, BlackLine, Bottomline Technologies, Capita Software, CDK Global, Cegid, CGI Group Inc., Cision, CompuGroup, CoStar Group, Cox Automotive, CSG Systems International, DATEV, Ellucian, Epic Systems, Epicor, Ericsson, Exact Holding BV, Exela Technologies, FICO, FinancialForce, Finastra, GE Digital, Greenway Health, Guidewire, HealthStream, IBM, IFS, Jack Henry & Associates, Blue Yonder, Kingdee, LexisNexis, MYOB, NCR Corporation, NextGen Healthcare, OBIC Co. Ltd., RealPage, Reynolds and Reynolds, Roper Technologies, SABRE Corp, Salesforce, Sapiens, Sopra Steria Group SA, SS&C Technologies, Temenos Group AG, TietoEVRY, TOTVS, Trimble, Tyler Technologies, UNIT4, Visma, Wolters Kluwer, Workday, Xero, Yardi, Yonyou, Zoho Corp., Zuora, and many others.

Custom data cuts related to the ERP Applications market are available:

- Top 900+ ERP Applications Vendors and Market Forecast 2023-2023

- 2023 ERP Applications Market By Industry (21 Verticals)

- 2023 ERP Applications Market By ERP Segments and Categories

- 2023 ERP Applications Market By Country (USA + 45 countries)

- 2023 ERP Applications Market By Region (Americas, EMEA, APAC)

- 2023 ERP Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2023 ERP Applications Applications Market By Customer Size (revenue, employee count, asset)

- 2023 ERP Applications Market By Channel (Direct vs Direct)

- 2023 ERP Applications Market By Product

- Hitachi Systems, a Japan based Professional Services organization with 268655 Employees

- Medtronic Plc, a United States based Manufacturing company with 95000 Employees

- SAP, a Germany based Professional Services organization with 109973 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

Worldwide Enterprise Application Market

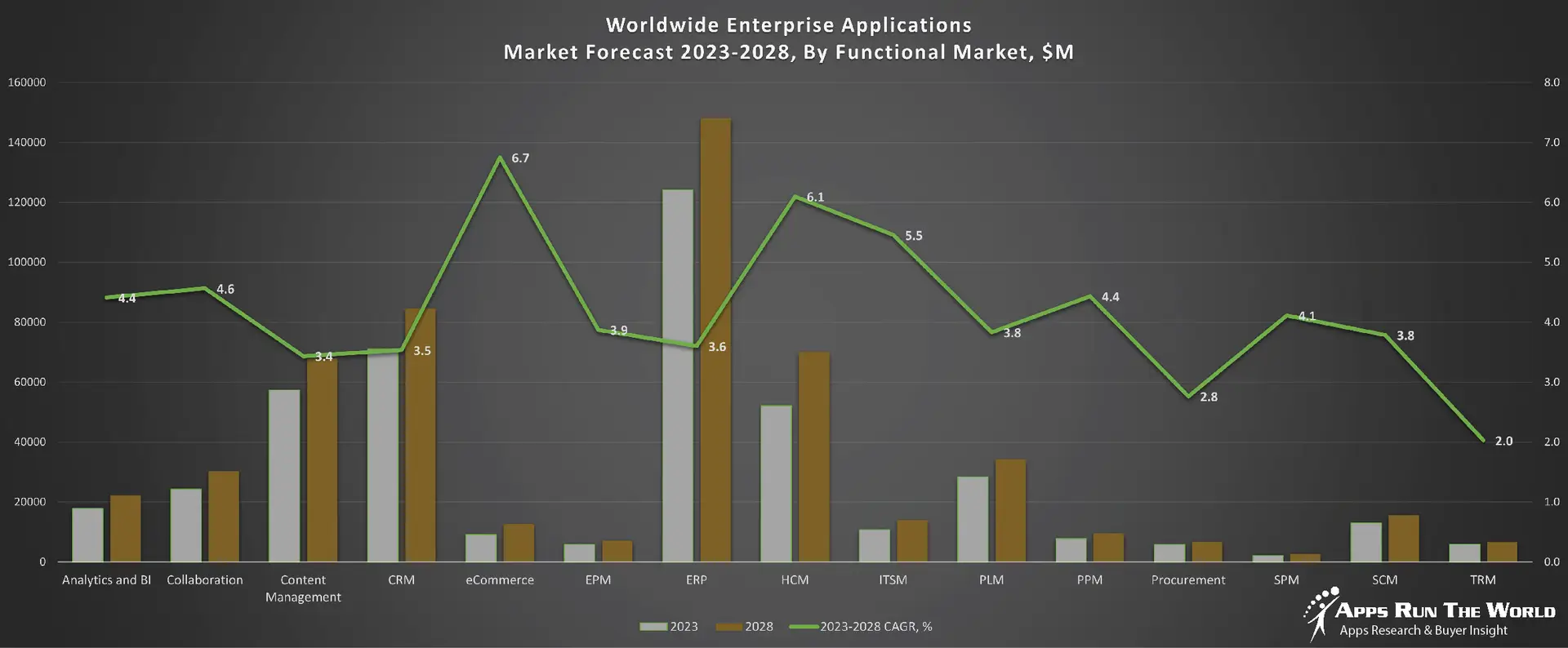

Exhibit 3 provides a forecast of the worldwide enterprise application market from 2023 to 2028, highlighting market sizes, year-over-year growth, and compound annual growth rates across various functional segments. The data shows strong growth in emerging areas like eCommerce, Human Capital Management, and IT Service Management, while traditional segments like ERP and CRM continue to dominate in market size.

Exhibit 3: Worldwide Enterprise Application Market Forecast 2023-2028 by Functional Market ($M)

Source: Apps Run The World, June 2024

Exhibit 4 shows the enterprise applications market by functional area. The highest growth functional markets revolve around smaller segments like eCommerce, Enterprise Performance Management, Sales Performance Management and Treasury and Risk, where first movers remain less established than those that for decades have been entrenched in functional areas like ERP, CRM and PLM.

ERP Win/Loss Analysis As Part Of Enterprise Applications Buyer Insight Customer Database

On the buyer side, customers are investing in ERP systems based on new features and capabilities that are expected to replace their existing legacy systems. In many cases, competitive upgrades and replacements that could have a profound impact on future market-share changes will become more widespread.

Since 2010, our global team of researchers have been studying the patterns of the latest ERP software purchases by customers around the world, aggregating massive amounts of data points that form the basis of our forecast assumptions and perhaps the rise and fall of certain vendors and their products on a quarterly basis.

Updated continuously, our database features extensive win/loss analysis. Each year our research team identifies tens of thousands of these ERP customer wins and losses from public and proprietary sources.

The research results are being incorporated into regular updates in our Enterprise Applications Buyer Insight Customer Database. You can access the Quarterly Win/Loss Analysis Scoreboard and our Enterprise Applications Buyer Insight Customer Database by becoming a subscriber.