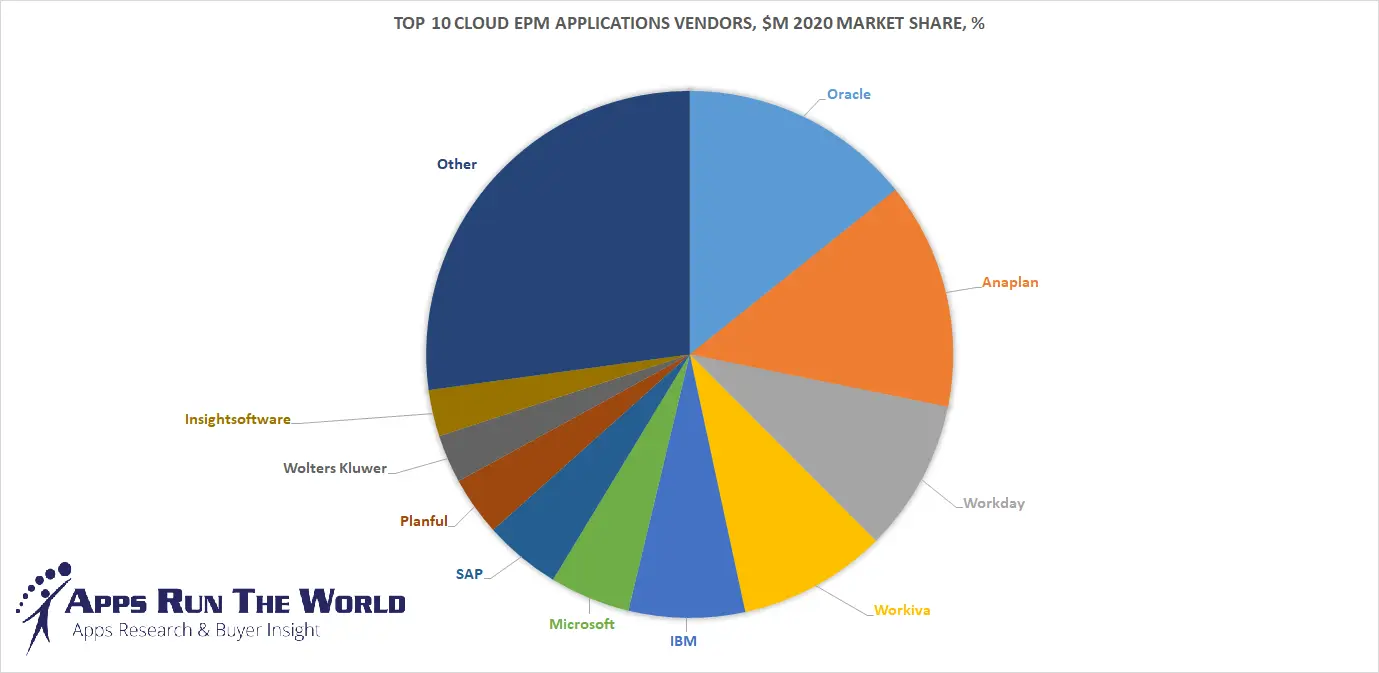

In 2020, the top 10 Cloud EPM software vendors accounted for nearly 74.5% of the global Cloud-based Enterprise Performance Management (EPM) applications market which grew 10.5% to approach nearly $1.82 billion in EPM subscription revenues, slightly above our previous projection.

Last year Oracle led the pack with a 14.3% market share riding on a 30% jump in Cloud EPM subscription revenues. Anaplan was #2, followed by Workday, Workiva and IBM in that order.

We ask the simple question: Who’s buying Cloud EPM applications from whom and why? And we provide the answers – supported by decades of research – to our clients around the world. (Sample from our Apps Database)

Through our forecast period, the Cloud EPM Applications market size is expected to reach $2.3 billion by 2025, compared with $1.82 billion in 2020 at a compound annual growth rate of 5.9%.

| Exhibit 2: Worldwide Cloud EPM Applications Market 2020-2025 Forecast, $M | |||

|---|---|---|---|

| Year | 2020 | 2025 | 2020-2025 CAGR, % |

| Total | 1823 | 2288 | 4.6% |

Source: Apps Run The World, July 2024

Top 10 Cloud EPM Software Vendors

Enterprise Performance Management (EPM) applications are designed for a range of budgeting, forecasting and planning business processes that span multiple functional areas from finance to sales. Specific applications modules include budgeting, planning and forecasting, financial consolidation, capital expenditure planning, activity-based costing, zero-based budgeting as well as sales and revenue forecasting.

Cloud EPM applications revenues represent a major contributor to the Enterprise Resource Planning market as part of our market sizing exercise. Cloud EPM is moving beyond the finance operations to tackle a full range of budgeting, forecasting and planning challenges with Cloud apps that aim to address Excel-based EPM shortcomings for sales, human resources and operational executives.

Here are the rankings of the Top Cloud 10 EPM software vendors and their market shares in 2020.

| Rank | Vendor | 2019 Cloud EPM Apps Vendors, $M | 2020 Cloud EPM Apps Vendors, $M | Growth, % | 2020 Market Share, % | Recent Developments |

|---|---|---|---|---|---|---|

| 1 | Oracle | 200 | 260 | 30.0% | 14.3% | Riding on the strengths of its back-office systems, Oracle EPM Cloud has become the indispensable tool for finance executives including many that are increasingly running it for standardized planning and forecasting across their global operations. Our estimate is that more than 8,000 companies have standardized on Oracle EPM Cloud with increased adoptions among former Hyperion customers that have migrated to the online product for greater agility, especially for faster close, and increased adoption of scenario modeling. |

| 2 | Anaplan | 191 | 254.03 | 33.0% | 13.9% | As of January 31, 2021, Anaplan served over 1,600 customers and more than 130,000 users in 57 countries. American Airlines, Anheuser-Busch Inbev, and Merck are among Anaplan’s recent wins. |

| 3 | Workday | 146 | 170 | 16.4% | 9.3% | More than 5,500 organizations adopted Workday Adaptive Planning for their global finance teams. |

| 4 | Workiva | 148 | 165.76 | 12.0% | 9.1% | With an installed base of more than 3,500 customers, Workiva helps automate reporting requirements of more than 75% of Fortune 500 companies. Recent customer wins include New York Life Insurance Company, Upland Software, JLL Income Property Trust, American Enterprise Group, Casey’s General Stores, and others. |

| 5 | IBM | 120 | 130 | 8.3% | 7.1% | IBM continues to gain traction in Cloud EPM through AI-powered analytics as well as support from its Netezza server products to drive better visibility into finance and other industry-specific operations like claims processing. In 2020, IBM acquired WDG for its AI-based offerings to help streamline business workflows and IT functions through robotic process automation. |

| 6 | Microsoft | 80 | 90 | 12.5% | 4.9% | Microsoft is counting on Power BI and Power Platform as the all-in-one solution to help customers build and deliver Cloud EPM capabilities to the masses. One of the latest strategies is to offer Power BI Premium for $20 per user per month without requiring signing long-term enterprise license agreements. Try Microsoft Apps. |

| 7 | SAP | 70 | 86 | 22.9% | 4.7% | SAP Analytics Cloud (SAC) is banking on aggressive pricing, new product lineups such as SAP Data Warehouse for the Cloud as well as enhanced support for a growing portfolio of SAP applications like embedding SAC into SAP SuccessFactors to win support of the large installed base of BPC for budgeting, planning and consolidation, which stands at 7,000, and SAP BW for data warehousing, which has 11,000 customers and 21,000 installations worldwide. SAP Analytics Cloud Planning has signed hundreds of partners and over 1,700 customers including Callaway Golf Company, Furst-McNess Company and Roche. |

| 8 | Planful | 55 | 66 | 20.0% | 3.6% | More than 800 customers and 45,000 users in 90 countries including Bose, Boston Red Sox, La-Z-Boy, Mayo Clinic, NPR, OpenTable, Peet’s Coffee & Tea, Swissport, TOMS Shoes, and Vitamin Shoppe have subscribed to Planful (ex Host Analytics) to help them drive revenue and margin growth. |

| 9 | Wolters Kluwer | 52 | 54 | 3.8% | 3% | CCH Tagetik, part of Wolters Kluwer Tax & Accounting division used by finance departments, serves nearly 1,000 companies and 75,000 users in 35 countries. |

| 10 | Insightsoftware | 40 | 52 | 30.0% | 2.9% | In 2020, insightsoftware acquired Longview Solutions, Event1, Mekko Graphics, Viareport, IDL Group and Certent to form a powerhouse in financial planning and analysis. In 2021, it also purchased Logi Analytics, resulting in an entity with over 20,000 customers and more than 500,000 users. |

| Subtotal | 1102 | 1327.79 | 20.5% | 72.8% | ||

| Other | 548 | 495.21 | -9.6% | 27.2% | ||

| Total | 1650 | 1823 | 10.5% | 100% |

Source: Apps Run The World, April 2021

Other Cloud EPM software providers included in the report are: 1C Company, A3 Solutions, Abacum, Alfa Financial Software, Aptean, Aptos, athenahealth, Bitam, BlackLine, CAMMS, Centage Corporation, Centric Software, Inc., Comarch SoftM, Constellation Software, Corporater, Cube Software, Datarails, Duzon Digitalware, ENGIE Impact, Epicor, Euna Solutions (Formerly GTY Technology Holdings Inc.), Exact Holding BV, Experian, Fluence Technologies, House of Control, a part of Visma Group, IBM, ICE Mortgage Technology, Ignite Technologies, Infor, Insightsoftware, Intelex Technologies, Jedox, Jirav, Kepion Incorporated, Kingdee, LGI Health Solutions Formerly (Logibec Groupe Informatique), Limelight Software, Locus Technologies, LucaNet AG, MedeAnalytics Inc, Mosaic.tech, NCR Corporation, OneStream Software, OpenGov, Phocas Software, Pigment, Property Vista, Prophix Software, Quantrix, Quorum Software, Rent Manager by London Computer Systems, Roper Technologies, Sage, SAS Institute, SEAC SPA, Senior Sistemas, Serrala, ServiceNow, Simetrik, SmartStream, Solver, Inc., Sphera Solutions, Inc., SS&C Technologies, Talentia Software, Taulia, TechnologyOne, Thomson Reuters, Tigernix Singapore, TOTVS, Tyler Technologies, UI Solutions Group, Unanet, UNIT4, Vena Solutions, Visma, Vormittag Associates Inc., Yonyou and others.

Custom data cuts related to the Cloud EPM Applications market are available:

- Top 80+ Cloud EPM Applications Vendors and Market Forecast 2020-2025

- 2020 Cloud EPM Applications Market By Industry (21 Verticals)

- 2020 Cloud EPM Applications Market By EPM Segments and Categoies

- 2020 Cloud EPM Applications Market By Country (USA + 45 countries)

- 2020 Cloud EPM Applications Market By Region (Americas, EMEA, APAC)

- 2020 Cloud EPM Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2020 Cloud EPM Applications Market By Customer Size (revenue, employee count, asset)

- 2020 Cloud EPM Applications Market By Channel (Direct vs Direct)

- 2020 Cloud EPM Applications Market By Product

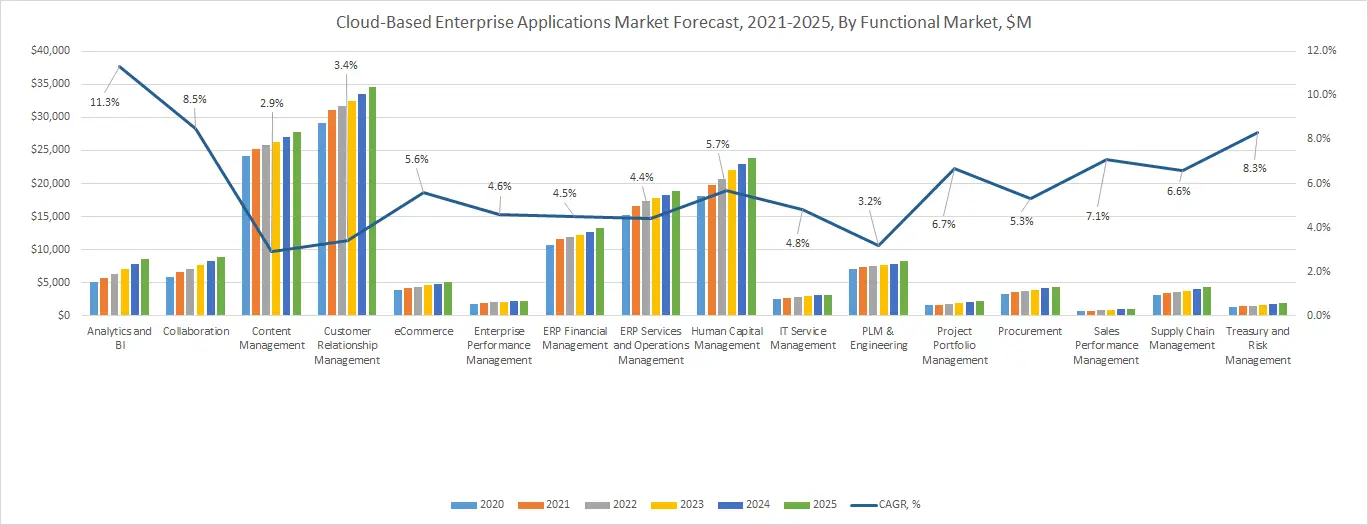

Exhibit 4 shows the enterprise applications market by functional area. The highest growth functional markets revolve around smaller segments like Analytics and BI, Collaboration, eCommerce, PPM and TRM, where first movers remain less established than those that for decades have been entrenched in functional areas like Content Management and CRM.

Cloud EPM Win/Loss Analysis As Part Of Enterprise Applications Buyer Insight Customer Database

On the buyer side, customers are investing in Cloud EPM systems based on new features and capabilities that are expected to replace their existing legacy systems. In many cases, competitive upgrades and replacements that could have a profound impact on future market-share changes will become more widespread.

Since 2010, our global team of researchers have been studying the patterns of the latest Cloud EPM software purchases by customers around the world, aggregating massive amounts of data points that form the basis of our forecast assumptions and perhaps the rise and fall of certain vendors and their products on a quarterly basis.

Updated continuously, our database features extensive win/loss analysis. Each year our research team identifies tens of thousands of these Cloud EPM customer wins and losses from public and proprietary sources.

The research results are being incorporated into regular updates in our Enterprise Applications Buyer Insight Customer Database. You can access the Quarterly Win/Loss Analysis Scoreboard and our Enterprise Applications Buyer Insight Customer Database by becoming a subscriber.

List of Cloud EPM Customers

| Customer | Industry | Empl. | Revenue | Country | New Product |

|---|---|---|---|---|---|

| Albertsons | Retail | 270000 | $62.46B | United States | Oracle EPM Cloud |

| Ambarella Inc. | Utilities | 680 | $320.0M | United States | Oracle EPM Cloud |

| Bukhatir Group | Construction and Real Estate | 5000 | $820.0M | United Arab Emirates | Oracle EPM Cloud |

| Cardtronics | Banking and Financial Services | 1987 | $1.35B | United States | Oracle EPM Cloud |

| City of Jacksonville | Government | 5870 | $1.28B | United States | Oracle EPM Cloud |

| Delaware Life Insurance Company | Insurance | 300 | $186.0M | United States | Oracle EPM Cloud |

| Harper College | Education | 1965 | $231.0M | United States | Oracle EPM Cloud |

| Hearst Corporation | Communications | 20000 | $11.40B | United States | Oracle EPM Cloud |

| MGM Resorts International | Leisure and Hospitality | 45000 | $5.16B | United States | Oracle EPM Cloud |

| Stallion Oilfield Services | Oil, Gas and Chemicals | 1100 | $700.0M | United States | Oracle EPM Cloud |

| Aviva | Banking and Financial Services | 31700 | $83.34B | United Kingdom | Anaplan |

| Barclaycard | Banking and Financial Services | 10000 | $2.00B | United Kingdom | Anaplan |

| Berluti | Retail | 13000 | $42.00B | France | Anaplan |

| Booking.com USA | Professional Services | 26500 | $14.53B | Netherlands | Anaplan |

| Diageo | Distribution | 28420 | $14.41B | United Kingdom | Anaplan |

| United Continental Holdings, Inc. | Transportation | 87887 | $43.26B | United States | Anaplan |

| Vodafone UK | Communications | 93000 | $54.59B | United Kingdom | Anaplan |

| AGF Investments | Banking and Financial Services | 900 | $471.0M | Canada | Workday Adaptive Planning (ex Adaptive Insights) |

| Airlines Reporting Corporation | Professional Services | 450 | $140.0M | United States | Workday Adaptive Planning (ex Adaptive Insights) |

| Alternative Futures Group | Non Profit | 2500 | $80.0M | United Kingdom | Workday Adaptive Planning (ex Adaptive Insights) |

| BAI Communications | Communications | 450 | $150.0M | Australia | Workday Adaptive Planning (ex Adaptive Insights) |

| Royal Australasian | Education | 470 | $75.0M | Australia | Workday Adaptive Planning (ex Adaptive Insights) |

| Cleo Communications | Professional Services | 300 | $30.0M | United States | Workday Adaptive Planning (ex Adaptive Insights) |

| California Academy of Sciences | Non Profit | 745 | $65.0M | United States | Workday Adaptive Planning (ex Adaptive Insights) |

| Aon Affinity | Insurance | 50000 | $11.01B | United Kingdom | Workiva Wdesk |

| Armstrong Flooring | Manufacturing | 1700 | $626.0M | United States | Workiva Wdesk |

| Bel Fuse | Manufacturing | 6935 | $464.0M | United States | Workiva Wdesk |

| City of Rochester, N.Y | Government | 3000 | $751.0M | United States | Workiva Wdesk |

| Cloudera | Professional Services | 2719 | $794.0M | United States | Workiva Wdesk |

| Donegal Insurance Group | Insurance | 900 | $650.0M | United States | Workiva Wdesk |

| Hawaiian Electric Industries | Oil, Gas and Chemicals | 3900 | $2.52B | United States | Workiva Wdesk |

| JLL Income Property Trust | Banking and Financial Services | 60000 | $6.00B | United States | Workiva Wdesk |

| Pioneer Energy Services | Oil, Gas and Chemicals | 2400 | $590.0M | United States | Workiva Wdesk |

| Republic Airways | Transportation | 5500 | $1.30B | United States | Workiva Wdesk |

| Aegea | Utilities | 2500 | $850.0M | Brazil | IBM Planning Analytics |

| Fraser Property Australia | Construction and Real Estate | 700 | $1.64B | Australia | IBM Planning Analytics |

| Genpact Philippines | Professional Services | 96300 | $3.52B | United States | IBM Planning Analytics |

| Laura Ashley | Retail | 1000 | $257.0M | United Kingdom | IBM Planning Analytics |

| London South Bank University | Education | 1700 | $188.0M | United Kingdom | IBM Planning Analytics |

| RAC Insurance | Professional Services | 1400 | $930.0M | Australia | IBM Planning Analytics |

| A.Y. McDonald Mfg. Co. | Utilities | 400 | $100.0M | United States | Microsoft Power BI |

| 8×8 | Professional Services | 1675 | $446.0M | United States | Microsoft Power BI |

| Accent Food Services | Retail | 700 | $100.0M | United States | Microsoft Power BI |

| ADT Inc. | Professional Services | 3000 | $700.0M | United States | Microsoft Power BI |

| American Traffic Solutions | Government | 600 | $150.0M | United States | Microsoft Power BI |

| AmeriHealth Administrators | Insurance | 500 | $200.0M | United States | Microsoft Power BI |

| BC Housing | Government | 850 | $320.0M | Canada | Microsoft Power BI |

| CAA South Central Ontario | Insurance | 1400 | $478.0M | Canada | Microsoft Power BI |

| Clasen Quality Chocolate | Manufacturing | 180 | $40.0M | United States | Microsoft Power BI |

| BBC Global News Ltd (GNL) | Media | 22401 | $1.85B | United Kingdom | SAP Analytics Cloud |

| Borchers Americas, Inc. | Life Sciences | 175 | $50.0M | United States | SAP Analytics Cloud |

| Delivery Hero | Distribution | 18070 | $1.10B | Germany | SAP Analytics Cloud |

| FC Bayern München Basketball | Media | 2100 | $550.0M | Germany | SAP Analytics Cloud |

| Lincoln Sentry | Professional Services | 230 | $10.0M | Australia | SAP Analytics Cloud |

| Live Oak | Banking and Financial Services | 628 | $215.0M | United States | SAP Analytics Cloud |

| Manchester City Football Club (MCFC) | Media | 500 | $659.0M | United Kingdom | SAP Analytics Cloud |

| Princes Foods | Consumer Packaged Goods | 200 | $20.0M | United Kingdom | SAP Analytics Cloud |

| ISS #2, LLC | Professional Services | 2900 | $800.0M | United States | Planful |

| Demandbase | Media | 350 | $50.0M | United States | Host Analytics Cloud EPM Suite |

| Haggar Clothing Co. | Consumer Packaged Goods | 1100 | $220.0M | United States | Host Analytics Cloud EPM Suite |

| Hilcorp Energy Company | Oil, Gas and Chemicals | 3000 | $3.00B | United States | Host Analytics Cloud EPM Suite |

| Mesa Airlines | Transportation | 2800 | $1.40B | United States | Host Analytics Cloud EPM Suite |

| Percolate | Media | 293 | $20.0M | United States | Host Analytics Cloud EPM Suite |

| Quicken | Banking and Financial Services | 150 | $100.0M | United States | Host Analytics Cloud EPM Suite |

| Relypsa | Life Sciences | 400 | $50.0M | United States | Host Analytics Cloud EPM Suite |

| APCOA PARKING Holdings | Utilities | 5000 | $800.0M | Germany | CCH Tagetik |

| Auto Trader UK | Automotive | 820 | $311.0M | United Kingdom | CCH Tagetik |

| C. Steinweg-Handelsveem | Professional Services | 3500 | $1.55B | Netherlands | CCH Tagetik |

| Carbonite, Inc. | Professional Services | 1000 | $125.0M | United States | CCH Tagetik |

| China Life Insurance | Banking and Financial Services | 102817 | $94.09B | China | CCH Tagetik |

| Metro AG | Distribution | 152426 | $43.34B | Germany | CCH Tagetik |

| National General Holdings Corp. | Insurance | 8440 | $4.61B | United States | CCH Tagetik |

| Timex | Consumer Packaged Goods | 5500 | $2.00B | United States | CCH Tagetik |

| TOM FORD | Consumer Packaged Goods | 600 | $130.0M | United States | CCH Tagetik |

| Vaillant Group | Retail | 13000 | $2.76B | Germany | CCH Tagetik |

| Dalakraft | Utilities | 50 | $4.0M | Sweden | Insightsoftware BizVIew |

| Grilstad | Consumer Packaged Goods | 405 | $120.0M | Norway | Insightsoftware BizVIew |

| Multiconsult | Professional Services | 2984 | $441.0M | Norway | Insightsoftware BizVIew |

| USA | Professional Services | 38280 | $27.48B | Netherlands | Insightsoftware CXO Software |

| Wadinko | Banking and Financial Services | 50 | $4.0M | Netherlands | Insightsoftware CXO Software |

| Wessanen | Manufacturing | 1250 | $731.0M | Netherlands | Insightsoftware CXO Software |

Source: Apps Run The World, April 2021

Further Readings

An expanded version of this report covers the top 80+ Cloud EPM Software vendors, offering in-depth analysis of the market dynamics, vendors’ Strengths, Customers, Opportunities, Risks and Ecosystems as well as their ability to gain Shares (SCORES) within their respective space.

We also offer win-loss analysis of the quarterly Cloud EPM wins of these top 10 Cloud EPM vendors and whether incumbents and upstarts pose any real threat to their standing amid shifting market requirements and user preferences.

More Enterprise Applications Research Findings

Based on the latest annual survey of 3,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 500 largest Enterprise Applications Vendors (Apps Top 500) and the world’s 500 largest Cloud Applications Vendors (Cloud Top 500) ranked by their 2015-2020 product revenues.

Their 2019 results are being broken down, sorted and ranked across 16 functional areas (from Analytics to Treasury and Risk Management) and by 21 vertical industries(from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year our global team of researchers conduct an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market.

We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 100,000 organizations around the world.

The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.