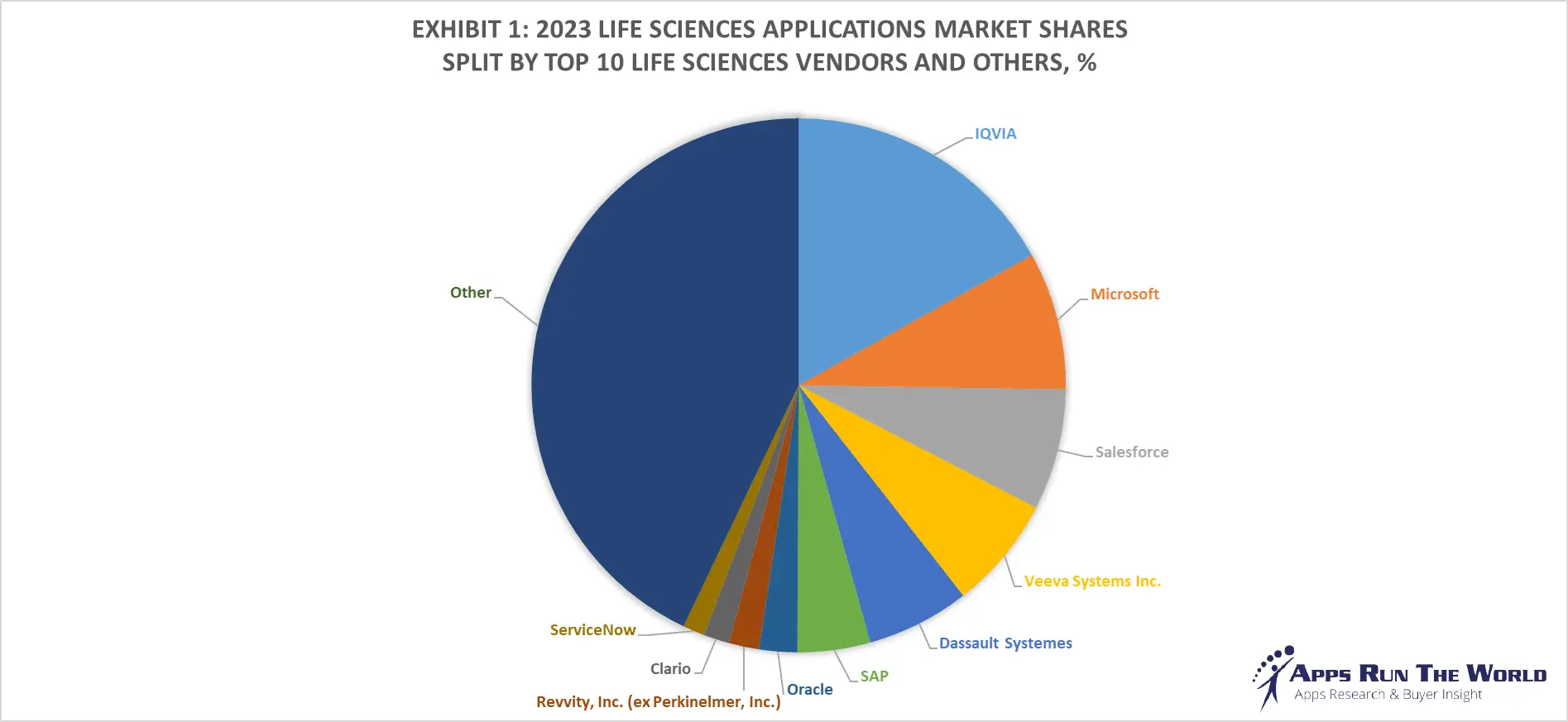

In 2023, the global Life Sciences software market surged to nearly $19 billion, growing by 8.7%. The top 10 vendors commanded a significant 57.1% market share, with IQVIA leading at 16.9%, followed by Microsoft, Veeva Systems, Salesforce, and Dassault Systemes.

Our APPS TOP 500 Market Report (Preview) covers thousands of Life Sciences software vendors, offering deep insights into market dynamics, vendor strengths, AI investments, customer momentum, and go-to-market strategies providing valuable perspectives on market trends and challenges.

Discover thousands of Life Science Customer Wins with the ARTW Technographics Platform, an essential resource for technology enthusiasts, sales business leaders, and data-driven marketing executives, offering curated insights into the evolving landscape of the software industry, including the latest developments in the Life Sciences software market.

We ask the simple question: Who’s buying Life Sciences applications from whom and why? And we provide the answers – supported by decades of research – to our clients around the world. (Sample from our Apps Database)

Through our forecast period, the Life Sciences applications market size is expected to reach $22.5 billion by 2028, compared with $19 billion in 2023 at a compound annual growth rate of 3.5%.

| Exhibit 2: Worldwide Life Sciences Software Market 2023-2028 Forecast, $M | |||

|---|---|---|---|

| Year | 2023 | 2028 | 2023-2028 CAGR, % |

| Total | 18970 | 22484 | 3.5% |

Source: Apps Run The World, June 2024

Top 10 Life Sciences Software vendors

Life Sciences (Pharmaceuticals, medical devices and life technologies) – Clinical trial management, Enterprise Risk, Compliance and Quality Management, Incentive compensation, sales performance management, Financials, HR, Procurement

Compliance, risk management and PLM apps will continue to play a key role in life sciences vertical with CROs assuming more functions previously held by big pharmaceuticals companies, which are wrestling with revenue model changes as drug prices could fluctuate widely with the advent of smart medications in small dosages.

Here are the rankings of the top 10 Life Sciences software vendors in 2023 and their market shares.

| Rank | Vendor | 2021 Life Sciences Apps Revenues, $M | 2022 Life Sciences Apps Revenues, $M | 2023 Life Sciences Apps Revenues, $M | YoY Growth | 2023 Life Sciences Market Share, % |

|---|---|---|---|---|---|---|

| 1 | IQVIA | Subscribe | Subscribe | Subscribe | 4.4% | Subscribe |

| 2 | Microsoft | Subscribe | Subscribe | Subscribe | 7.0% | Subscribe |

| 3 | Salesforce | Subscribe | Subscribe | Subscribe | 12.4% | Subscribe |

| 4 | Veeva Systems Inc. | Subscribe | Subscribe | Subscribe | 9.7% | Subscribe |

| 5 | Dassault Systemes | Subscribe | Subscribe | Subscribe | 8.9% | Subscribe |

| 6 | SAP | Subscribe | Subscribe | Subscribe | 5.7% | Subscribe |

| 7 | Oracle | Subscribe | Subscribe | Subscribe | 7.9% | Subscribe |

| 8 | Revvity, Inc. (ex Perkinelmer, Inc.) | Subscribe | Subscribe | Subscribe | -17.0% | Subscribe |

| 9 | Clario | Subscribe | Subscribe | Subscribe | 4.6% | Subscribe |

| 10 | ServiceNow | Subscribe | Subscribe | Subscribe | 25.1% | Subscribe |

| Subtotal | Subscribe | Subscribe | Subscribe | 6.6% | Subscribe | |

| Other | Subscribe | Subscribe | Subscribe | 11.7% | Subscribe | |

| Total | 15914 | 17447 | 18970 | 8.7% | 100.0% |

Source: Apps Run The World, June 2024

Other Life Sciences software providers included in the report are: Adobe, Atlassian, ArisGlobal, ADP, Ansys Inc., Aspen Technology, Aurea, Autodesk, AVEVA Group, Axway, Box Inc., Cegedim, Calyx AI, Cisco Systems, Constellation Software Inc., Citrix, Concentra Analytics Ltd, Cornerstone OnDemand, Dropbox, DocuSign, Inc., Edgeverve, Fiserv, Flex Databases, Genesys Telecommunications Laboratories, Google, IBM, IDBS, Infor, Intuit Inc., Jaggaer, Koerber Group, LabWare, McKesson, Model N, Nakisa, NeoGrid, ON24, Open Text Corporation, Optalert Limited, Optymyze, PerkinElmer, PTC, QAD Inc., Qlik, Randstad Sourceright, Rockwell Automation, Roper Technologies, SAS Institute, SCC Soft Computer, Synopsys, Schrodinger, ServiceNow, Siemens Digital Industries Software, Softworks.com, Sopheon, StayinFront, TELUS Health, UKG, Visma, Workday, Xactly, Zoom Video Communications, and others.

Custom data cuts related to the Life Sciences Applications market are available:

- Top 950+ Life Sciences Applications Vendors and Market Forecast 2023-2028

- 2023 Life Sciences Applications Market By Functional Market (16 Markets)

- 2023 Life Sciences Applications Market By Country (USA + 45 countries)

- 2023 Life Sciences Applications Market By Region (Americas, EMEA, APAC)

- 2023 Life Sciences Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2023 Life Sciences Applications Market By Customer Size (revenue, employee count, asset)

- 2023 Life Sciences Applications Market By Channel (Direct vs Direct)

- 2023 Life Sciences Applications Market By Product

- IQVIA, a United States based Professional Services organization with 89000 Employees

- Internet Archive, a United States based Non Profit company with 169 Employees

- AGC Partners, a United States based Professional Services organization with 140 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

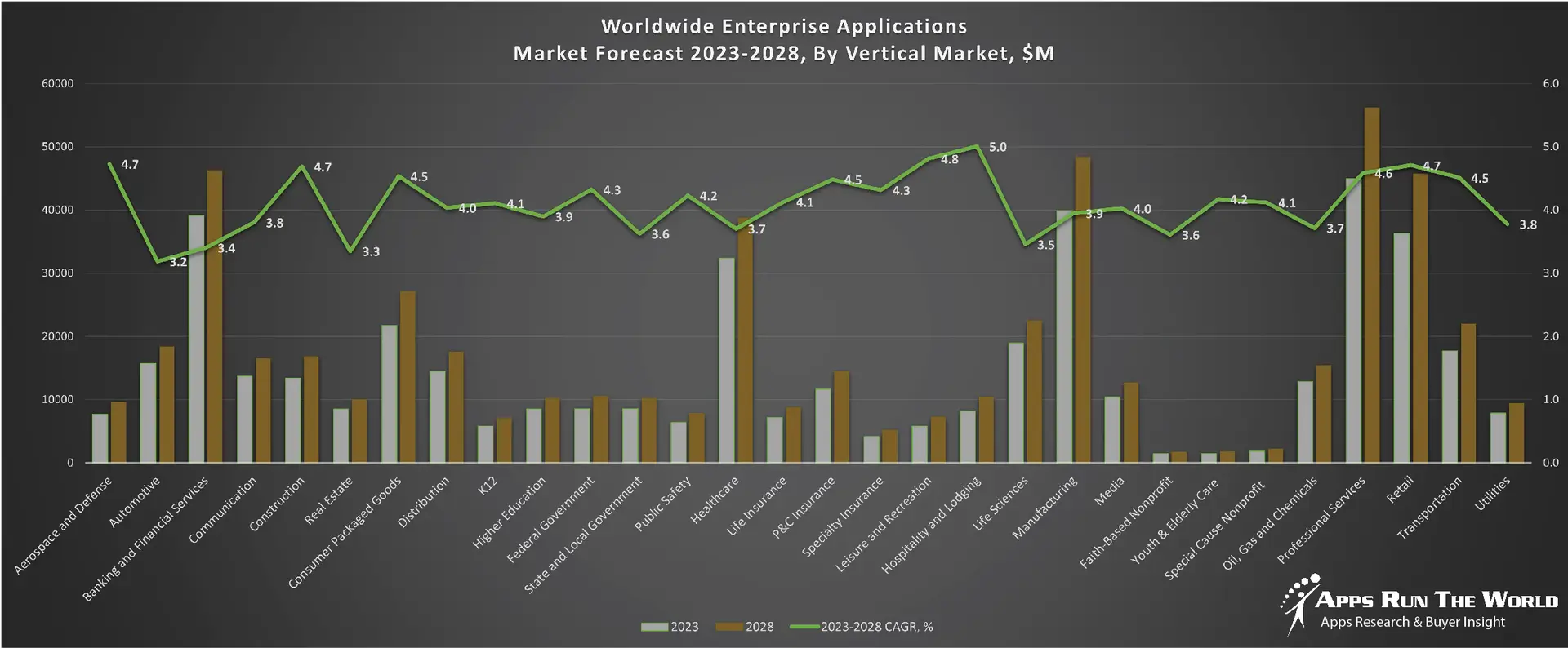

Worldwide Enterprise Applications by Vertical Market

Exhibit 3 provides a forecast of the worldwide enterprise applications by vertical market from 2023 to 2028, highlighting market sizes, year-over-year growth, and compound annual growth rates across different industry sectors from Aerospace and Defense to Utilities.

Exhibit 3: Worldwide Enterprise Applications by Vertical Market Forecast 2023-2028 by Functional Market ($M)

Source: Apps Run The World, June 2024

Exhibit 4 shows our projections for the enterprise applications market by vertical segment, based on the buying preferences and the customer propensity to invest in new software within those industries as they continue to upgrade and replace many legacy industry-specific applications that have been identified and tracked in our Buyer Insight Database.

Life Sciences Software Purchases Win/Loss Analysis As Part Of Enterprise Applications Buyer Insight Customer Database

On the buyer side, customers are investing in Life Sciences systems based on new features and capabilities that are expected to replace their existing legacy systems. In many cases, competitive upgrades and replacements that could have a profound impact on future market-share changes will become more widespread.

Since 2010, our global team of researchers has been studying the patterns of the latest Life Sciences software purchases by customers around the world, aggregating massive amounts of data points that form the basis of our forecast assumptions and perhaps the rise and fall of certain vendors and their products on a quarterly basis.

Updated continuously, our database features extensive win/loss analysis. Each year our research team identifies tens of thousands of these Life Sciences customer wins and losses from public and proprietary sources.

The research results are being incorporated into regular updates in our Enterprise Applications Buyer Insight Customer Database. You can access the Quarterly Win/Loss Analysis Scoreboard and our Enterprise Applications Buyer Insight Customer Database by becoming a subscriber.

| Customer | Industry | Empl. | Revenue | Country | Vendor | New Product | Function |

| Dräger | Life Sciences | 11290 | $2.50B | Germany | Aras | Aras PLM Platform | Product Lifecycle Management |

| Lundbeck | Life Sciences | 5119 | $2.62B | United States | Benefitfocus | Benefitfocus Marketplace | Employee Benefits Enrollment & Administration Software |

| Brainlab | Life Sciences | 1300 | $650.0M | Germany | Box | Box | Content Management |

| The University of North Carolina at Pembroke | Life Sciences | 500 | $120.0M | United States | Ivanti | Ivanti IT Service Manager | IT Service Management |

| Ipsen | Life Sciences | 5400 | $2.18B | France | Kinaxis | Kinaxis RapidResponse | Supply Chain Concurrent Planning Platform |

| Santen Pharmaceutical | Life Sciences | 3805 | $225.0M | Japan | Kinaxis | Kinaxis RapidResponse | Supply Chain Concurrent Planning Platform |

| Air Liquide | Life Sciences | 68000 | $16.38B | France | Medallia | Medallia Experience Cloud | Customer Experience |

| Horizon Pharma plc | Life Sciences | 1010 | $1.06B | Ireland | Medidata Solutions | Medidata Clinical Cloud | Clinical Trial Management |

| Santen Pharmaceutical | Life Sciences | 3805 | $225.0M | Japan | Medidata Solutions | Medidata Edge CTMS | Clinical trial management system |

| Alliance Pharma plc | Life Sciences | 200 | $136.6M | United Kingdom | Microsoft | Microsoft Dynamics AX | Enterprise Resource Planning |

| Unilab | Life Sciences | 6000 | $1.10B | Philippines | NetSuite | NetSuite OneWorld | Enterprise Resource Planning |

| Boehringer Ingelheim | Life Sciences | 50000 | $21.14B | Germany | SAP | SAP SuccessFactors Employee Central | Human Capital Management |

| Moderna Therapeutics | Life Sciences | 600 | $910.0M | United States | SAP | SAP S/4 HANA | Enterprise Resource Planning |

| Otsuka Pharmaceuticals Europe | Life Sciences | 600 | $132.0M | United Kingdom | SAP | SAP Business One HANA | Enterprise Resource Planning |

| Otsuka Pharmaceuticals Europe | Life Sciences | 600 | $132.0M | United Kingdom | SAP | SAP Ariba | Source-to-Pay Procurement and Supply Chain Cloud |

| Teva Pharmaceuticals | Life Sciences | 57000 | $22.39B | Israel | SAP | SAP SuccessFactors Employee Central | Human Capital Management |

| EVER Pharma | Life Sciences | 850 | $100.0M | Poland | Veeva Systems | Veeva CRM | Customer Relationship Management |

| Merck & Co | Life Sciences | 69000 | $40.12B | United States | Veeva Systems | Veeva CRM | Customer Relationship Management |

| Santhera Pharmaceuticals | Life Sciences | 106 | $23.0M | Switzerland | Veeva Systems | Veeva CRM | Customer Relationship Management |

| 3M | Life Sciences | 91000 | $31.70B | United States | Workday | Workday HCM | Human Capital Management |

| Roche | Life Sciences | 91700 | $48.42B | Switzerland | Adobe Systems | Adobe Experience Manager | Web Content Management |

| Excellims | Life Sciences | 55 | $6.0M | United States | Autodesk | Autodesk Fusion Lifecycle | Cloud Product Lifecycle Management |

| Rotech Healthcare | Life Sciences | 4000 | $500.0M | United States | Descartes Systems | Descartes Route Planning and Fleet Scheduling | Route Planning and Fleet Scheduling |

| Medical Alert | Life Sciences | 100 | $10.0M | United States | Five9 | Five9 Cloud | Customer Service and Support |

| MedicAlert Foundation | Life Sciences | 130 | $60.0M | United States | Five9 | Five9 Cloud | Customer Service and Support |

| AstraZeneca | Life Sciences | 50000 | $24.71B | United States | Genesys | Genesys Customer Experience Platform | Customer Experience Platform |

| 23andMe | Life Sciences | 305 | $85.0M | United States | Host Analytics | Host Analytics Cloud EPM Suite | Enterprise Performance Management |

| Relypsa | Life Sciences | 400 | $90.0M | United States | Host Analytics | Host Analytics Cloud EPM Suite | Enterprise Performance Management |

| Allergan Plc | Life Sciences | 31200 | $15.07B | Ireland | IBM | IBM Kenexa BrassRing | Applicant Tracking Systems |

| Eli Lilly and Company | Life sciences | 41275 | $19.96B | United States | Interactive Intelligence | PureCloud | Customer Engagement Platform |

| Asahi Kasei | Life Sciences | 29127 | $18.50B | Japan | JDA Software Group | JDA Supply Chain Software | Supply Chain Management |

| Comprehensive Pharmacy Services | Life Sciences | 2000 | $250.0M | United States | Kronos | Kronos Workforce Central | Human Capital Management, Workforce Management |

| TCI – Tokyo Chemical Industry | Life Sciences | 1500 | $1.00B | Japan | Manhattan Associates | Manhattan SCALE | Warehouse Management System |

| Karyopharm Therapeutics | Life Sciences | 200 | $20.0M | United States | Microsoft | Microsoft Dynamics GP | Enterprise Resource Planning |

| LabAnswer | Life Sciences | 250 | $30.0M | United States | Microsoft | Microsoft Project Online | Project Portfolio Management |

| LANXESS | Life Sciences | 16200 | $9.02B | Germany | Microsoft | Microsoft Dynamics CRM | Customer Relationship Management |

| Shimadzu Scientific Instruments Inc | Life Sciences | 500 | $50.0M | United States | Microsoft | Microsoft Dynamics GP | Enterprise Resource Planning |

| Stryker | Life Sciences | 33000 | $12.00B | United States | Microsoft | Microsoft Dynamics GP | Enterprise Resource Planning |

| Synteract | Life Sciences | 710 | $175.0M | United States | Microsoft | Microsoft Dynamics GP | Enterprise Resource Planning |

| Synthetic Genomics, Inc. | Life Sciences | 200 | $20.0M | United States | Microsoft | Microsoft Dynamics GP | Enterprise Resource Planning |

| Vital Pharmaceuticals | Life Sciences | 200 | $20.0M | United States | Microsoft | Microsoft Dynamics GP | Enterprise Resource Planning |

| 23andMe | Life Sciences | 305 | $85.0M | United States | NetSuite | NetSuite OneWorld | Enterprise Resource Planning |

| Applied Biosystems | Life Sciences | 200 | $18.0M | United States | Oracle | Oracle Service Cloud (ex RightNow) | Customer Experience Platform |

| Boehringer Ingelheim | Life Sciences | 50000 | $21.14B | Germany | Oracle | Oracle Talent Acquisition Cloud | Talent Acquisition |

| Pfizer | Life Sciences | 78300 | $48.85B | United States | Oracle | Oracle Siebel | Customer Relationship Management |

| Smiths Medical | Life Sciences | 7500 | $2.90B | United States | Oracle | Oracle Agile PLM | Product Lifecycle Management |

| Thermo Fisher Scientific | Life Sciences | 51000 | $17.00B | United States | Oracle | Oracle Service Cloud (ex RightNow) | Customer Experience Platform |

| Servier | Life Sciences | 21400 | $4.30B | Russia | QuintilesIMS | QuintilesIMS Nexxus Mobile Intelligence CRM | Multichannel CRM |

| UCB | Life Sciences | 7500 | $4.20B | Belgium | QuintilesIMS | QuintilesIMS Nexxus Application Suite | Suite for Healthcare and Life Sciences |

| Air Liquide | Life Sciences | 68000 | $16.38B | France | Salesforce | Salesforce Service Cloud | Customer Service Software |

| Air Liquide | Life Sciences | 68000 | $16.38B | France | Salesforce | Salesforce Marketing Cloud | Marketing Automation |

| Air Liquide | Life Sciences | 68000 | $16.38B | France | Salesforce | Salesforce CRM | Customer Relationship Management |

| Alere | Life Sciences | 17400 | $4.00B | United States | Salesforce | Service Cloud | Customer Service and Support |

| Beckman Coulter | Life sciences | 12000 | $3.66B | United States | Salesforce | Service Cloud | Customer Service and Support |

| Cardinal Health | Life Sciences | 32500 | $121.50B | United States | Salesforce | Service Cloud | Customer Service and Support |

| Carestream | Life sciences | 8100 | $2.40B | United States | Salesforce | Service Cloud | Customer Service and Support |

| Genentech | Life Sciences | 13720 | $4.25B | United States | Salesforce | Service Cloud | Customer Service and Support |

| HHS.gov | Life Sciences | 79540 | $33.70B | United States | Salesforce | Service Cloud | Customer Service and Support |

| Hospira | Life Sciences | 16000 | $4.64B | United States | Salesforce | Service Cloud | Customer Service and Support |

| Mindray | Life Sciences | 7500 | $1.30B | China | Salesforce | Service Cloud | Customer Service and Support |

| Pfizer | Life Sciences | 78300 | $48.85B | United States | Salesforce | Service Cloud | Customer Service and Support |

| 23andMe | Life Sciences | 305 | $85.0M | United States | SAP | SAP Concur | Travel & Expense |

| Alkaloid | Life Sciences | 1600 | $113.0M | Macedonia | SAP | SAP ERP ECC 6.0 | Enterprise Resource Planning |

| Allergan Plc | Life Sciences | 31200 | $15.07B | Ireland | SAP | SAP SuccessFactors Employee Central | Human Capital Management |

| Applied Medical | Life Sciences | 2200 | $900.0M | United States | SAP | SAP Product Lifecycle Management | Product Lifecycle Management |

| Eastman Chemical Company | Life Sciences | 15000 | $9.65B | United States | SAP | SAP S/4 HANA | Enterprise Resource Planning |

| Eastman Chemical Company | Life Sciences | 15000 | $9.65B | United States | SAP | SAP Digital Boardroom | Digital Boardroom |

| Lubrizol | Life Sciences | 9000 | $7.00B | United States | SAP | SAP BusinessObjects | Business Intelligence Software |

| Moderna Therapeutics | Life Sciences | 600 | $910.0M | United States | SAP | SAP SuccessFactors Learning | Learning management system |

| Moderna Therapeutics | Life Sciences | 600 | $910.0M | United States | SAP | SAP Concur | Travel & Expense |

| Moderna Therapeutics | Life Sciences | 600 | $910.0M | United States | SAP | SAP BusinessObjects | Business Intelligence Software |

| Pfizer | Life Sciences | 78300 | $48.85B | United States | SAP | SAP Portfolio and Project Management | Project Portfolio Management |

| Roche | Life Sciences | 91700 | $48.42B | Switzerland | SAP | SAP Treasury and Risk Management | Treasury and Risk Management |

| Seqirus UK | Life Sciences | 2000 | $200.0M | United Kingdom | SAP | SAP S/4 HANA | Enterprise Resource Planning |

| Sigma-Aldrich | Life Sciences | 9600 | $2.79B | United States | SAP | SAP Treasury and Risk Management | Treasury and Risk Management |

| Teva Pharmaceuticals | Life Sciences | 57000 | $22.39B | Israel | SAP | SAP SuccessFactors Performance & Goals | Performance & Goals Management |

| Teva Pharmaceuticals | Life Sciences | 57000 | $22.39B | Israel | SAP | SAP SuccessFactors Talent Solutions | Recruiting, Onboarding, Learning, Performance and Goals, Compensation, Succession and Development |

| Adama Brasil | Life Sciences | 4500 | $3.08B | Israel | SDL | SDL Web Experience Management solutions | Web Experience Management solutions |

| Waters | Life Sciences | 6500 | $2.04B | United States | SDL | SDL Knowledge Center | Content Management |

| Edwards Lifesciences | Life Sciences | 9800 | $2.60B | United States | Skillsoft | SumTotal Learn | Learning Management System |

| 23andMe | Life Sciences | 305 | $85.0M | United States | Workday | Workday HCM | Human Capital Management |

| DuPont | Life Sciences | 52000 | $25.27B | United States | Workday | Workday HCM | Human Capital Management |

Source: Apps Run The World, June 2024

More Enterprise Applications Research Findings

Based on the latest annual survey of 3,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 500 largest Enterprise Applications Vendors (Apps Top 500) ranked by their 2019-2023 product revenues.

Their 2023 results are being broken down, sorted and ranked across 16 functional areas (from Analytics to Treasury and Risk Management) and by 21 vertical industries (from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year our global team of researchers conduct an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market. We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 100,000 organizations around the world.

The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.