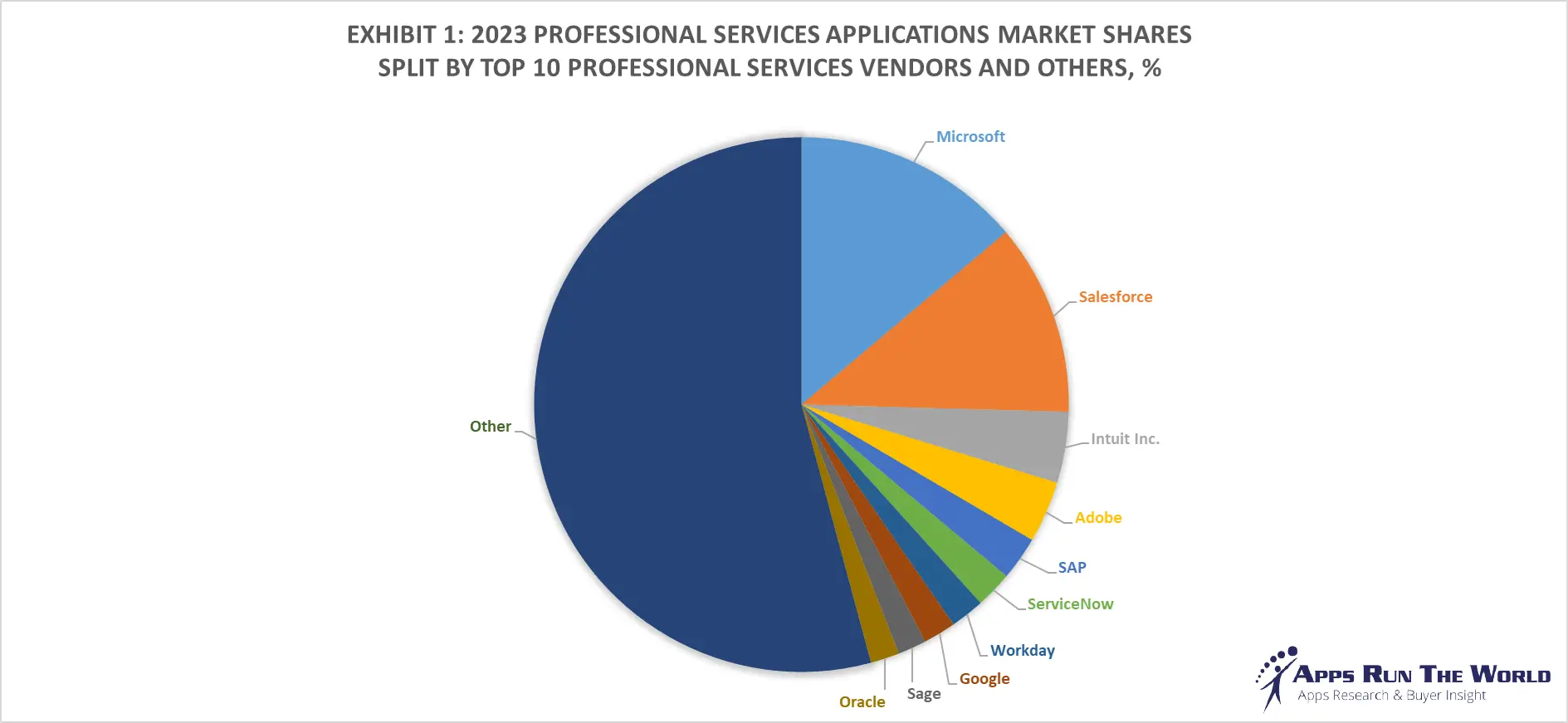

In 2023, the global Professional Services software market surged to nearly $45 billion, growing by 11.2%. The top 10 vendors commanded a significant 45.8% market share, with Microsoft leading at 13.9%, followed by Salesforce, Intuit, Adobe and SAP.

Our APPS TOP 500 Market Report (Preview) covers thousands of Professional Services software vendors, offering deep insights into market dynamics, vendor strengths, AI investments, customer momentum, and go-to-market strategies providing valuable perspectives on market trends and challenges.

Discover thousands of Professional Services Customer Wins with the ARTW Technographics Platform, an essential resource for technology enthusiasts, sales business leaders, and data-driven marketing executives, offering curated insights into the evolving landscape of the software industry, including the latest developments in Professional Services.

We ask the simple question: Who’s buying Professional Services applications from whom and why? And we provide the answers – supported by decades of research – to our clients around the world. (Sample from our Apps Database)

Through our forecast period, the Professional Services applications market size is expected to reach $56.3 billion by 2028, compared with $45 billion in 2023 at a compound annual growth rate of 4.6%.

| Exhibit 2: Worldwide Professional services Software Market 2023-2028 Forecast, $M | |||

|---|---|---|---|

| Year | 2023 | 2028 | 2023-2028 CAGR, % |

| Total | 44975 | 56279 | 4.6% |

Source: Apps Run The World, June 2024

Top 10 Professional Services Software vendors

Professional services (Business, Engineering, IT, legal services) – Timesheet and Billing, Legal Practice Management, Project Management, Project Portfolio Management, Field Service Management Software, Professional Services Automation, Financials, HR, Procurement

Professional services firms invest heavily in new tools that boost collaboration, CRM and HR best practices aided by a mix of new entrants from the industrial ERP space namely Roper as well as Cloud startups like FinancialForce, all of which aim to accelerate legacy system replacements across different segments including AEC, business and IT consulting firms.

Here are the rankings of the top 10 Professional Services software vendors in 2023 and their market shares.

| Rank | Vendor | 2021 Professional Services Apps Revenues, $M | 2022 Professional Services Apps Revenues, $M | 2023 Professional Services Apps Revenues, $M | YoY Growth | 2023 Professional Services Market Share, % |

|---|---|---|---|---|---|---|

| 1 | Microsoft | Subscribe | Subscribe | Subscribe | 7.0% | Subscribe |

| 2 | Salesforce | Subscribe | Subscribe | Subscribe | 12.4% | Subscribe |

| 3 | Intuit Inc. | Subscribe | Subscribe | Subscribe | 7.3% | Subscribe |

| 4 | Adobe | Subscribe | Subscribe | Subscribe | 13.0% | Subscribe |

| 5 | SAP | Subscribe | Subscribe | Subscribe | 5.7% | Subscribe |

| 6 | ServiceNow | Subscribe | Subscribe | Subscribe | 25.1% | Subscribe |

| 7 | Workday | Subscribe | Subscribe | Subscribe | 17.2% | Subscribe |

| 8 | Subscribe | Subscribe | Subscribe | 22.9% | Subscribe | |

| 9 | Sage | Subscribe | Subscribe | Subscribe | 20.1% | Subscribe |

| 10 | Oracle | Subscribe | Subscribe | Subscribe | 7.9% | Subscribe |

| Subtotal | Subscribe | Subscribe | Subscribe | 11.1% | Subscribe | |

| Other | Subscribe | Subscribe | Subscribe | 11.4% | Subscribe | |

| Total | 33147 | 40428 | 44975 | 11.2% | 100.0% |

Source: Apps Run The World, June 2024

Other Professional Services software providers included in the report are: ADP, Ansys Inc., Atlassian, Autodesk, Avionte Staffing Software, Bentley Systems Inc., Box Inc., BQE Software, Bullhorn, Cisco Systems, Citrix, Clio, Connectwise, Constellation Software Inc., Corel Corporation, Dassault Systemes, DATEV, Datto, Dayforce, DocuSign, Dropbox, Enghouse Interactive Inc., Envestnet, FinancialForce.com, Genesys, Google, HCL Technologies Ltd., Hexagon, Thomson Reuters, Huron, IBM, Impartner Software, Infor, Informatica, SS&C Technologies, Keap, Kingdee, Marin Software, Mavenlink, Nice Systems, OBIC Co. Ltd., Open Text Corporation, Pegasystems, Planview, QAD Inc., Qlik, Relex Solutions, RingCentral, SAS Institute, Siemens Digital Industries Software, Teradata Corporation, Thomson Reuters Elite, TOTVS, Tricor Group, UNIT4, Verint Systems Inc., Visma, Workday, and others.

Custom data cuts related to the Professional Services Applications market are available:

- Top 1100+ Professional Services Applications Vendors and Market Forecast 2023-2028

- 2023 Professional Services Applications Market By Functional Market (16 Markets)

- 2023 Professional Services Applications Market By Country (USA + 45 countries)

- 2023 Professional Services Applications Market By Region (Americas, EMEA, APAC)

- 2023 Professional Services Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2023 Professional Services Applications Market By Customer Size (revenue, employee count, asset)

- 2023 Professional Services Applications Market By Channel (Direct vs Direct)

- 2023 Professional Services Applications Market By Product

- Internet Archive, a United States based Non Profit organization with 169 Employees

- University Of Saarland, a Germany based Education company with 375 Employees

- Newgen Software, a India based Professional Services organization with 4500 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

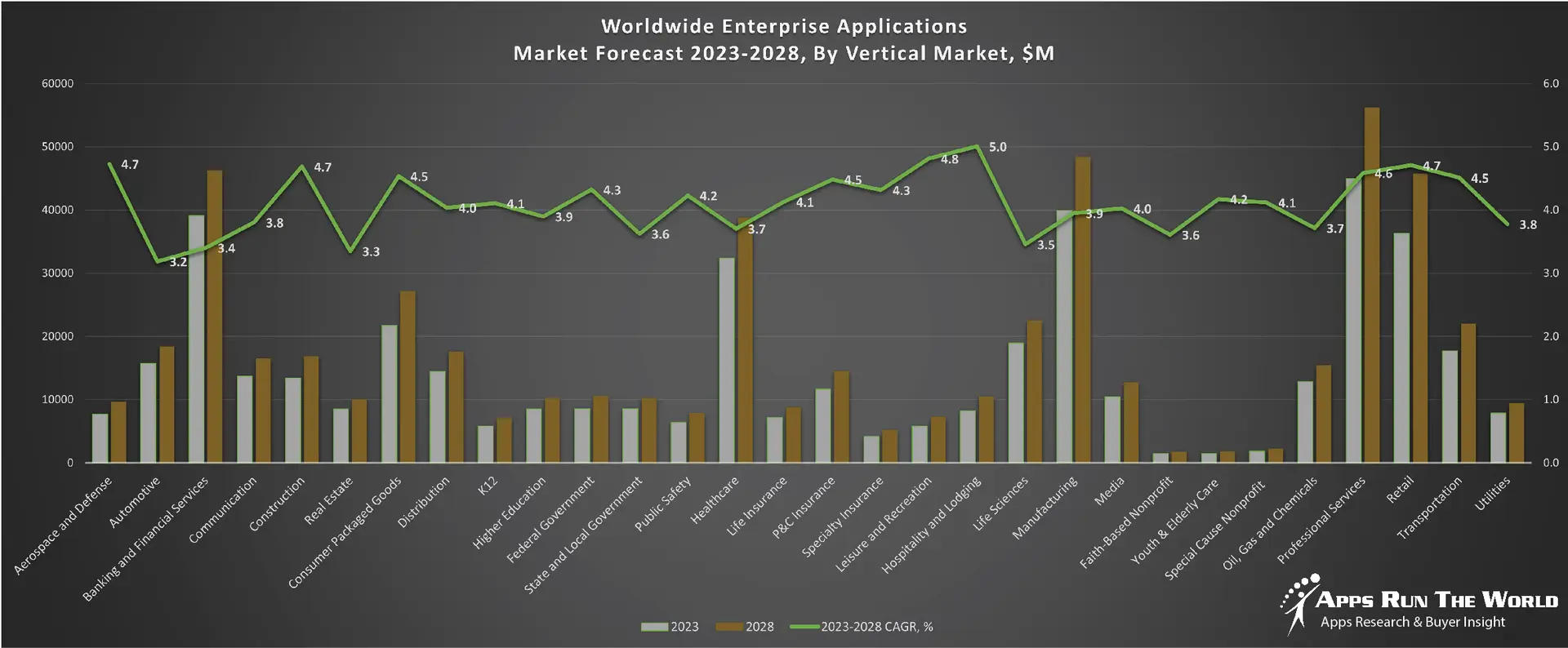

Worldwide Enterprise Applications by Vertical Market

Exhibit 3 provides a forecast of the worldwide enterprise applications by vertical market from 2023 to 2028, highlighting market sizes, year-over-year growth, and compound annual growth rates across different industry sectors from Aerospace and Defense to Utilities.

Exhibit 3: Worldwide Enterprise Applications by Vertical Market Forecast 2023-2028 by Functional Market ($M)

Source: Apps Run The World, June 2024

Exhibit 4 shows our projections for the enterprise applications market by vertical segment, based on the buying preferences and the customer propensity to invest in new software within those industries as they continue to upgrade and replace many legacy industry-specific applications that have been identified and tracked in our Buyer Insight Database.

Professional services Software Purchases Win/Loss Analysis As Part Of Enterprise Applications Buyer Insight Customer Database

On the buyer side, customers are investing in Professional services systems based on new features and capabilities that are expected to replace their existing legacy systems. In many cases, competitive upgrades and replacements that could have a profound impact on future market-share changes will become more widespread.

Since 2010, our global team of researchers has been studying the patterns of the latest Professional services software purchases by customers around the world, aggregating massive amounts of data points that form the basis of our forecast assumptions and perhaps the rise and fall of certain vendors and their products on a quarterly basis.

Updated continuously, our database features extensive win/loss analysis. Each year our research team identifies tens of thousands of these Professional services customer wins and losses from public and proprietary sources.

The research results are being incorporated into regular updates in our Enterprise Applications Buyer Insight Customer Database. You can access the Quarterly Win/Loss Analysis Scoreboard and our Enterprise Applications Buyer Insight Customer Database by becoming a subscriber.

| Customer | Industry | Empl. | Revenue | Country | Vendor | New Product | Function |

| Accenture | Professional services | 449000 | $34.85B | Ireland | SAP | SAP Business Suite on HANA | Enterprise Resource Planning |

| Accenture | Professional services | 449000 | $34.85B | Ireland | SAP | SAP Business Warehouse | Enterprise Data Warehouse |

| Apple | Professional Services | 132000 | $233.12B | United States | Oracle | Oracle Agile PLM | Product Lifecycle Management |

| Apple | Professional Services | 132000 | $233.12B | United States | SugarCRM | SugarCRM | Customer Relationship Management |

| Arm Limited | Professional services | 6250 | $1.35B | United Kingdom | Microsoft | Microsoft Dynamics CRM | Customer Relationship Management |

| Arm Limited | Professional services | 6250 | $1.35B | United Kingdom | SAP | SAP S/4 HANA | Enterprise Resource Planning |

| Arm Limited | Professional services | 6250 | $1.35B | United Kingdom | SAP | SAP Ariba | Source-to-Pay Procurement and Supply Chain Cloud |

| Arvato Financial Solutions UK | Professional services | 3500 | $1.00B | United Kingdom | SAP | SAP SuccessFactors Employee Central | Human Capital Management |

| athenahealth | Professional Services | 4668 | $924.0M | United States | Oracle | Oracle ERP Cloud | Enterprise Resource Planning |

| Booking.com | Professional Services | 15000 | $2.20B | Netherlands | Anaplan | Anaplan | Planning and Performance Management Platform |

| Booking.com | Professional Services | 15000 | $2.20B | Netherlands | SAP | SAP S/4HANA Finance | Enterprise Resource Planning |

| Care.com | Professional Services | 600 | $146.0M | United States | Workday | Workday Financial Management | Financial Management |

| Carhartt | Professional Services | 4000 | $600.0M | United States | IBM | IBM Watson Commerce | eCommerce |

| CenturyLink | Professional Services | 47000 | $21.30B | United States | Adobe Systems | Marketo | Marketing Automation |

| Cintas | Professional services | 41000 | $6.48B | United States | SAP | SAP SuccessFactors Employee Central | Human Capital Management |

| Code42 | Professional Services | 524 | $100.0M | United States | Digital River | Digital River Global Commerce | eCommerce |

| Delaware International | Professional services | 1800 | $263.0M | Belgium | SAP | SAP S/4 HANA | Enterprise Resource Planning |

| Delaware International | Professional services | 1800 | $263.0M | Belgium | SAP | SAP Analytics Cloud | Analytics Cloud |

| Denver Broncos | Professional Services | 1400 | $300.0M | United States | Ceridian | Dayforce HCM | Human Capital Management |

| Domino’s Pizza | Professional Services | 14100 | $2.79B | United States | Atlassian | Jira Service Desk | IT Service Management |

| Experian | Professional Services | 17000 | $4.81B | United States | ServiceNow | ServiceNow IT Service Management | IT Service Management |

| Extreme Networks | Professional Services | 3000 | $598.0M | United States | Kinaxis | Kinaxis RapidResponse | Supply Chain Concurrent Planning Platform |

| Professional Services | 13598 | $19.77B | United States | Microsoft | Microsoft Office 365 | Content Management | |

| Fanatics, Inc | Professional Services | 1800 | $200.0M | United States | Oracle | Oracle CX Cloud | Customer Experience |

| Fanatics, Inc | Professional Services | 1800 | $200.0M | United States | Oracle | Oracle Marketing Cloud | Marketing Cloud |

| Fujitsu | Professional Services | 173155 | $39.62B | Japan | Box | Box | Content Management |

| Genpact | Professional services | 78000 | $2.74B | Bermuda | IBM | IBM Planning Analytics | Enterprise Performance Management |

| Goodwill of Central and Southern Indiana | Professional Services | 3500 | $156.4M | United States | WorkForce Software | WorkForce Suite | Workforce Management |

| Grant Thornton UK | Professional Services | 8500 | $1.31B | United Kingdom | UNIT4 | Unit4 Business World On! | Enterprise Resource Planning |

| ICAEW | Professional Services | 737 | $390.0M | United Kingdom | Xactly | Xactly Incent Enterprise | Sales Performance Management |

| ILF Consulting Engineers | Professional Services | 2000 | $200.0M | Austria | Deltek | Deltek ERP | Project ERP Solution |

| IntegraMed Fertility | Professional Services | 2200 | $450.0M | United States | Medallia | Medallia Experience Cloud | Customer Experience |

| ITRS Group | Professional Services | 180 | $20.0M | United Kingdom | Xactly | Xactly Incent Enterprise | Sales Performance Management |

| Lincoln Sentry | Professional Services | 230 | $10.0M | Australia | SAP | SAP Analytics Cloud | Analytics Cloud |

| Metro AG | Professional Services | 135890 | $42.72B | Germany | Wolters Kluwer | CCH Tagetik | Enterprise Performance Management |

| Microsoft | Professional services | 131300 | $110.00B | United States | SAP | SAP SuccessFactors Employee Central | Human Capital Management |

| Microsoft | Professional services | 131300 | $110.00B | United States | SAP | SAP S/4 HANA | Enterprise Resource Planning |

| Nielsen | Professional Services | 56000 | $6.57B | United Kingdom | G Suite (formerly Google Apps for Work) | Collaboration | |

| Oceana Group | Professional Services | 6053 | $420.0M | South Africa | CA Technologies | CA Service Desk Manager | IT Service Management |

| Office Depot Europe B.V. | Professional Services | 6500 | $11.60B | Netherlands | SAP | SAP Commerce Cloud | eCommerce & Omni-Channel Commerce Solution |

| Office Depot Europe B.V. | Professional Services | 6500 | $11.60B | Netherlands | SAP | SAP C/4 HANA | Customer Relationship Management |

| Office Depot Europe B.V. | Professional Services | 6500 | $11.60B | Netherlands | Workday | Workday HCM | Human Capital Management |

| Optus | Professional Services | 8350 | $6.30B | Australia | Ceridian | Dayforce HCM | Human Capital Management |

| Peab | Professional Services | 13187 | $4.36B | Sweden | UNIT4 | Unit4 Business World | Enterprise Resource Planning |

| Pittsburgh Public Schools | Professional Services | 5000 | $578.0M | United States | Tyler Technologies | Minus ERP | Enterprise Resource Planning |

| Proofpoint, Inc | Professional Services | 2047 | $612.0M | United States | Xactly | Xactly Incent Enterprise | Sales Performance Management |

| Prophet | Professional Services | 550 | $30.0M | United States | Oracle | NetSuite OneWorld Professional Services Automation | Enterprise Resource Planning |

| Ricoh IT Solutions | Professional Services | 958 | $100.0M | Japan | Oracle | Oracle EPM Cloud | Enterprise Performance Management |

| Royal Bank of Scotland | Professional Services | 70000 | $12.66B | United Kingdom | ServiceNow | ServiceNow IT Service Management | IT Service Management |

| SAIC | Professional Services | 15000 | $4.30B | United States | NetSuite | Netsuite OpenAir | Professional Services Automation |

| Salesforce | Professional Services | 21587 | $6.67B | United States | G Suite (formerly Google Apps for Work) | Collaboration | |

| SAP SuccessFactors | Professional Services | 3000 | $600.0M | United States | ServiceNow | ServiceNow IT Service Management | IT Service Management |

| Servcorp Limited | Professional Services | 1000 | $400.0M | Australia | Dropbox | Dropbox Business | Content Management |

| StepStone | Professional Services | 900 | $262.0M | Germany | SAP | SAP Business ByDesign | Enterprise Resource Planning |

| Taulia Inc | Professional Services | 250 | $20.0M | United States | Xactly | Xactly Incent Enterprise | Sales Performance Management |

| Tennant | Professional services | 4300 | $1.00B | United States | SAP | SAP Product Lifecycle Management | Product Lifecycle Management |

| The Whiddon Group | Professional Services | 2000 | $400.0M | Australia | SugarCRM | SugarCRM | Customer Relationship Management |

| Tommy Bahama | Professional Services | 1500 | $172.0M | United States | SAP | SAP Commerce Cloud | eCommerce & Omni-Channel Commerce Solution |

| TomTom | Professional Services | 4800 | $903.0M | Netherlands | Workday | Workday HCM | Human Capital Management |

| Travelopia | Professional Services | 4013 | $1.33B | United Kingdom | SAP | SAP S/4 HANA | Enterprise Resource Planning |

| United States Olympic Committee | Professional Services | 500 | $350.0M | United States | Ultimate Software | UltiPro | Human Capital Management |

| Valmet | Professional Services | 12300 | $3.30B | Finland | Infor | Infor LN | Enterprise Resource Planning |

| Valmet | Professional Services | 12300 | $3.30B | Finland | Infor | Infor d/EPM | Enterprise Performance Management |

| Veolia ANZ | Professional services | 4000 | $1.10B | Australia | SAP | SAP S/4 HANA | Enterprise Resource Planning |

| Virgin Mobile USA | Professional Services | 600 | $150.0M | United States | SugarCRM | SugarCRM | Customer Relationship Management |

| Virtusa | Professional Services | 9800 | $600.0M | United States | Microsoft | Microsoft Office 365 | Content Management |

| Wipro | Professional Services | 172912 | $7.74B | India | SAP | SAP Treasury and Risk Management | Treasury and Risk Management |

| ZS Associates | Professional Services | 5000 | $850.0M | United States | SAP | SAP SuccessFactors Employee Central | Human Capital Management |

Source: Apps Run The World, June 2024

More Enterprise Applications Research Findings

Based on the latest annual survey of 3,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 500 largest Enterprise Applications Vendors (Apps Top 500) ranked by their 2019-2023 product revenues.

Their 2023 results are being broken down, sorted and ranked across 16 functional areas (from Analytics to Treasury and Risk Management) and by 21 vertical industries(from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year our global team of researchers conduct an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market. We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 100,000 organizations around the world.

The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.