Following the pandemic-induced growth period, HR software vendors have succumbed to a fair amount of volatility due to cost-cutting moves by their customers, sentiment shifts over diverse, equitable, inclusive employee programs, as well as abrupt changes to the global economic and political conditions.

Recently, Dayforce for its Core HR and payroll apps and Verint for its workforce engagement and call center systems have been taken private at prices far below their peaks not too long ago, while jobboard CareerBuilder + Monster filed for bankruptcy in July 2025.

To a certain extent, the September 2025 HR Tech Conference turned out to be a proxy to gauge the health of the HCM market with thousands of attendees and exhibitors in search of the bright and shiny objects. At the Las Vegas event, many vendors interviewed attribute the next wave of growth to the invisible hands of digital agents that are smart and intelligent enough to perform tasks for everything from imposing automatic court-ordered payroll deductions like garnishment from Oracle to improving onboarding experience from Enboarder, and even delivering real-time health plan gap analysis for benefits administrators from WTW.

Yvette Cameron, Senior VP Global HCM Product Strategy at Oracle, unveiled more than a dozen digital agents designed to automate a slew of activities from internal mobility and recruiting to career development and skills. She expects role-based agents for concierge services for employees, managers and payroll analysts to be particularly effective in streamlining workflow, while also providing a template for companies to create their own agents to their liking.

Cameron said the onslaught of agents, in addition to internal creations using tools like Oracle Agent Studio, will be a test case on how HR leaders and their IT counterparts need to divvy up their workload to optimize AI agentic development. “There is going to be a landgrab between the Chief People Officer and the Chief AI officer,’’ Cameron added.

Many HR software vendors including Oracle said HR executives are likely to have an upper hand, or at least the discretion of leveraging agents to achieve specific business objectives in mind because of their domain expertise, whereas IT key stakeholders should be responsible for aggregating and validating common data repositories, in addition to the use of both large language models and specialized smaller data models for maximum efficiency and resource management.

Another development that Oracle, Darwinbox and a growing number of HR software vendors can agree on is the Model Context Protocol (MCP), an emerging standard that is being used to fast track agent-building by allowing for easy integration into back-end systems and the associated data.

Oracle, for example, uses MCP to ensure tight integration between its HR apps and its other back-office ERP systems and even external products like those from Salesforce.

Darwinbox, on the other hand, considers its Super Agent an open AI teammate capable of orchestrating multi-step workflows across HR, IT, and Finance, allowing Darwinbox users to optimize decision support based on relevant data and insights derived from different software tools from Jira to Hubspot and from Sharepoint to Microsoft Teams, according to Chaitanya Peddi, co-founder of Darwinbox.

With Atlassian and ServiceNow making their presence felt at HR Tech with lavish booths as they turn HCM into the next frontier and adjacency to IT Service Management, Darwinbox’s moves represent a preemptive strike and how the evolution of agents will blur the lines that used to separate neatly defined functional markets including Collaboration, CRM, HR, ITSM and others.

It’s one thing to make agents commercially available, but it’s something else altogether when vendors have to figure out how to price them effectively. As the following exhibit demonstrates, the path to growing the market for AI add-ons exponentially will depend on a combination of carrot, stick – similar to the early days of cloud applications and mobile apps marked by trials and errors including dubious freemium offers and undifferentiated bundles.

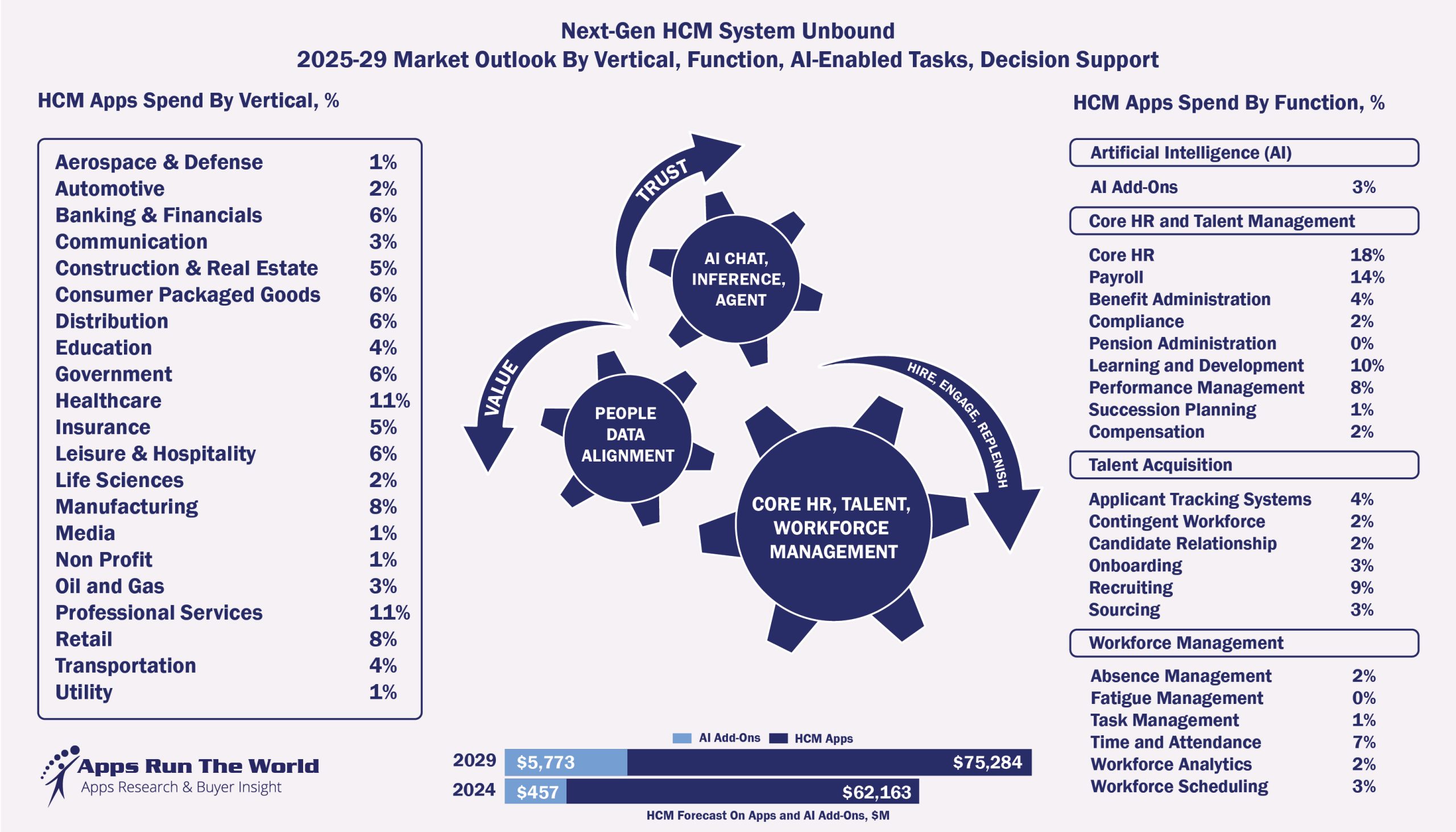

Our assumption is that these AI add-ons, primarily in the form of Agents, could generate as much as $5.7 billion in software sales by 2029, up from $457 million in 2024.

Exhibit 1 – Worldwide HCM Applications Market Outlook 2024-2029 and Contributions From AI Add-Ons, $M

Vendors like Oracle and ADP are in favor of offering agents for free to new and existing applications customers as long as they subscribe to the bundles.

Mike Sicilia, the new CEO of Oracle, said in May that partly because of the flexibility of such bundle arrangements, its customers have yielded hundreds of millions of dollars in cost savings, in addition to efficiency gains and manual work elimination through AI implementations as an adjunct to their industry-specific solutions.

ADP reported that its ADP Assist has resulted in more than four million interactions including proactive nudges, recommended HR and payroll best practices and automation task completion since its agent was introduced in 2024.

Both SAP and Workday are taking a consumption-based approach by enticing its customers to use its Agents as part of their current subscription and encouraging scaling out by applying SAP AI Credits and Workday Flex Credits, respectively.

SAP, for one, has been making its Digital Agent Joule available for its HR customers since 2023 and it is expanding use of Generative AI across its products including WalkMe for digital adoption for employees and SuccessFactors Enterprise Service Management for rapid ticket case resolution. In August 2025, SAP also acquired SmartRecruiters for its AI-powered hiring platform for more than 4,000 customers.

Workday, on the other hand, is unequivocal about its ability to monetize AI. In its latest quarter, the vendor reported more than $150 million in annual recurring revenue for its AI SKUs including those for recruiting, talent mobility, contract intelligence and contract negotiation and Workday Extend Professional Tier.

In return for its heavy investment in best-in-class AI agents for HR, Finance and Planning, Workday CEO Carl Eschenbach is wasting no time to monetize its Illuminate agents on the heels of a raft of acquisitions all in the AI space since August 2025. That includes a $1.1 billion purchase of Sana, a Swedish AI Learning company with more than 15,000 users, Paradox for its recruiting agent that has powered 189 million AI-assisted candidate conversations, and Flowise for low-code agent-building platform.

Regardless of how vendors are cranking out agents at scale and profit from them, the crux of the issue is whether customers find these digital avatars making good on their promises to not just automating simple or routine tasks, but also helping instill, inspire and perpetuate the distinct culture and values of an organization among their employees and key stakeholders.

In many ways, it is similar to the gradual refinement from static brochureware in the 2000s to the dynamic and omnichannel online presence of many organizations that aim to resonate with a new generation of users and followers. Doing agents may be easy at first, but doing it well with style and long-lasting impact requires special handling.

Enboarder CEO Dan Finnigan added the use of agents has to be optimized against a specific goal that aligns with its people and relevant data for cultivating belonging and enterprise-wide collaboration.