This applications market sizing report focuses on the 2010 performance of the top 10 applications vendors in the human capital management applications market.

The HCM market is made up of these elements: Compensation, Core HR, eLearning, eRecruiting, Performance Management and Workforce Management. Each of the elements contributes heavily to the making of a new type of organizations that place a premium on hiring, retaining and promoting talents as a key enabler for sharpening their competitive edge.

As the job market begins to recover around the world following a protracted recession, the fight for talents is intensifying and forcing companies to invest in applications designed to automate such functions as employee review, corporate learning, succession planning, time and attendance and scheduling.

Not only will the automation of the business processes remove the bottle neck that often debilitates employee morale and productivity, it also provides HR professionals and line of business executives the insights and the supporting data to analyze how their employees handle their jobs and take appropriate measures to address any shortcoming.

HCM applications are designed to be more than just a tool for managers and employees to measure and improve their overall contributions to corporate goals. At the core, companies are turning to these applications to better understand employee sentiments – or the labor pool for that matter – at a time when there’s a widening gap between the large amount of vacant positions and a lack of qualified candidates to fill them. The situation gets murkier with the pairing of the demographic shifts, which result in the retirement of baby boomers in droves in both the private and public sectors, and the arrival of a new generation of young workers who possess different work and lifestyle expectations, not to mention their attitude toward technological use at work and at play.

The labor market is undergoing tremendous change, giving birth to a new set of tools that companies are keen to leverage in order to help them find the right employees, train them continuously, while setting them on the right course for the future, which is fraught with challenges for both the employers and their people assets at best.

Top Line and Bottom Line

On the top line, the HCM applications market is experiencing growing momentum with economic revival at hand in Europe and North America and even brighter prospects in burgeoning economies such as Brazil, China, and India where standardization of HR processes is still a work in progress.

Multinationals and local employment agencies have been adding workers at a brisk pace, while technology innovation has kept pace with new user demands for easy access to personnel records as well as Web 2.0 tools for employees to collaborate through social networks and ubiquitous mobility services.

The introduction of integrated talent management solutions that span multiple HCM elements such as combining eLearning and performance management to facilitate end to end career development has allowed vendors to boost average selling prices.

After more than 10 years of selling Web-based HCM applications, major vendors have solidified their swift ascent to the top ranks of the marketplace through aggressive pricing, mergers and acquisitions, and continuous product enhancements by taking advantage of Cloud-enabled technologies and HR content from strategic partners, while broadening their fledgling ecosystems to expand globally.

The flip side of their expansion is that profitability remains elusive for many HCM applications vendors, a footnote as well as the impetus behind the consolidation wave that has engulfed the market in recent months.

Like many tech sectors that are maturing, the HCM applications market has reached the point of a major shakeout that could thin its ranks. The question is whether this round of consolidation will usher in a new group of powerful players that could set the rules of human resources management, potentially transforming how the masses view the value of work.

Market Overview

The HCM applications market has begun to transform itself from an internal-facing environment to a more transparent approach that is akin to a customer-facing system because of two trends: social networking and Cloudbased technologies.

Whereas HCM systems in the past were designed to store employees’ records, new applications are capable of handling such tasks as delivering ad-hoc learning as part of corporate communications by capturing video, audio clips and other content from an individual, or groups of employees, and delivering them to another.

The popularity of sites from Facebook to Youtube has made even the most staid corporations to rethink their HR policies when their employees are thrusting themselves into the social media scenes with gusto. Recently SuccessFactors acquired Jambok, an eLearning startup that capitalizes on social media revolution, allowing its HCM clients to incorporate social learning tools into their work environments.

Oracle, which is expected to make its latest Fusion HCM Applications generally available in the second half of 2011, is banking on a key feature called Network at Work that allows workers to build their own internal social network and use it to collaborate with other domain experts and colleagues.

Suffice it to say that social media could be the new force that turns corporate hierarchy upside down, tearing down barriers that used to be sacrosanct, similar to the impact of email on how the top brass communicates with its troops and vice versa.

With the advent of Cloud computing, companies are faced with an onslaught of HCM offerings that threaten to give conventional online and offline HR products a run for their money. Fairsail, a Cloud-based HCM solution that leverages the Salesforce.com AppExchange platform, has reached 2,300 users following its founding in 2008 and a new round of funding in recent months.

Workday, another disruptive Cloud-based HCM vendor, saw 90% growth in 2010 on the strengths of winning key accounts such as Chiquitas, Flextronics, McKees Foods, many of which have seen reduced total cost of ownership, better performance and improved HR processes after replacing traditional on-premise systems with Workday’s Cloud-based approach.

Jockeying for the best position to provide these Cloud-based systems has triggered a growing number of mergers and acquisitions in the HCM applications market just within the past few months. Among the top 10 HCM vendors, the consolidation wave has already reshaped the competitive landscape and their ranking.

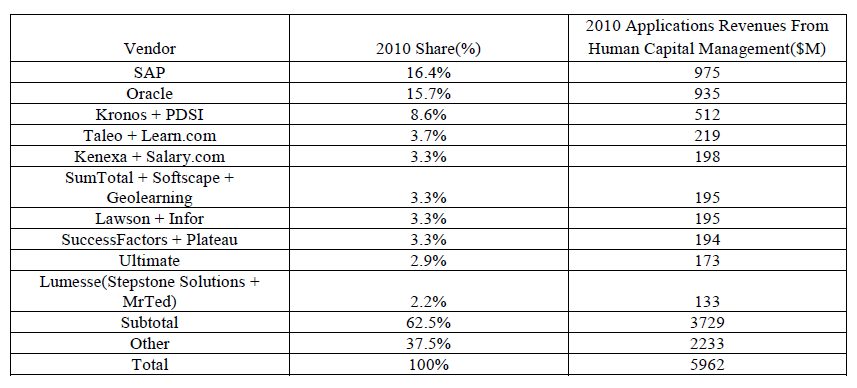

The following table illustrates the new ranking of the 10 largest 2010 worldwide HCM applications vendors and their shares based on aggregated license, maintenance and subscription revenues including those of their recent acquisitions on a pro-forma basis.

With the exception of SAP, Oracle and Ultimate Software, all the top 10 HCM applications vendors have made at least one acquisition in the HCM market in recent months.

In doing so, vendors such as SumTotal, Kenexa, SuccessFactors and Lawson could add a full percentage point if they are able to retain the recurring revenue streams of their acquired companies.

Another way to look at the changing competitive landscape is that over the past few years the top three HCM vendors(SAP, Oracle and Kronos) have only edged up slightly in their combined shares from 35% in 2006 to 39% in 2010.

However the other seven vendors that followed them have doubled their combined shares during the period from 11% in 2006 to 22% in 2010.

Some of these seven vendors like Kenexa, Taleo, SumTotal, and Lawson were on the list of top 10 vendors in 2006, but SuccessFactors, Ultimate and Stepstone(now known as Lumesse) were not underscoring their swift ascent to the 2010 list.

One of the biggest driving forces behind their ascent has to do with their successes with their Cloud-based HCM applications, which include a combination of on-demand, hosted and Software As A Service delivery models over the public Cloud via the Web infrastructure or private Cloud via virtualized or hosted environments within a private network. The growing acceptance of their Cloud strategy has meant easy access to their applications without incurring significant IT investments on the part of their customers.

Customers

Judging from the explosive growth of customers and users, Cloud-based delivery of HCM applications has taken the market by storm. Since 2000 Taleo has seen a sharp increase in the number of customers running its eRecruiting and talent management applications via on-demand delivery. The figure soared from 50 in 2000 to more than 5,400 in 2010. When Taleo went public in 2004, it had 365,000 registered users relying on its applications to complete the recruiting process. Today the number has topped 20 million.

Similarly Cornerstone OnDemand, which raised $137 million in its initial public offering in March 2011, had 3.3 million users in 2009 and that figure now exceeds 5.2 million. The significant increase can be attributable to OEM partners such as ADP, which has helped promote Cornerstone’s talent management applications to its more than 30 million core HR and payroll users.

There are signs that Cloud-based HCM applications have won the business of not only a growing number of large and midsized organizations, but also securing their complete support that leads to full-blown replacements of their existing legacy systems.

For example, Texas Roadhouse, a restaurant chain with 33,000 employees, recently migrated to the on-demand platform from Ultimate Software after using its on-premise products for years and found improved processing speed and HR transaction performance.

In the fourth quarter of 2010, Ultimate signed its biggest deal with an unnamed customer with 90,000 employees around the country and the implementation will start in 2012.

The substantial gains in mind share and expected utilization have changed the rules of the game in the HCM applications market as Cloud-based vendors begin to position themselves as the viable alternative to on-premise systems to the extent that the on-demand delivery model has subsumed the traditional marketing pitch of on-premise vendors.

Oracle, for one, is pitching its Oracle Fusion HCM as an on-demand product that redefines the total Cloud ownership experience because of its security, performance, reliability, ease of customization, and most importantly availability as a service.

Top 10 Applications Vendors In Enterprise Market

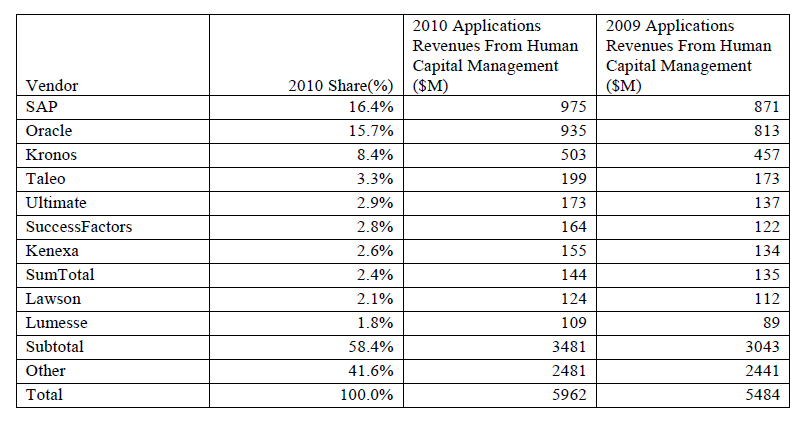

The following table lists the 2010 shares of the top 10 applications vendors in the Human Capital Management(HCM) market and their 2009 to 2010 applications revenues(license, maintenance and subscription) from the market.

Vendors To Watch

In 2011 a number of major contenders are vying to unseat the top 10 HCM applications vendors as customer defections and channel alliances collide, triggering a bloodbath in the marketplace.

Among the key vendors to watch are Cornerstone OnDemand, Halogen, Peopleclickauthoria, Workday, as well as a slew of aggressive players from Jive to Socialtext that have turned social media technologies into a disruptive force capable of transforming the HCM applications market.

Both Peopleclickauthoria and Workday have received strong backing from major investors, the former from Bedford Funding and the latter from New Enterprise Associates.

Recently Peopleclickauthoria purchased Aquire to beef up on workforce planning and analytics capabilities following its successes in selling eRecruiting and Vendor Management solutions to handle large-scale hiring for big retailers and major employers.

Workday, on the other hand, posted $150 million in booking in 2010 after earning a 99% customer satisfaction response from its base of more than 200 clients, more than 130 of whom have already gone live with Workday HCM and payroll applications. Workday now plans to go public in the second half of 2012.

What these vendors have in common is their distinct value propositions: Cornerstone OnDemand for its OEM strategy, Halogen for its healthcare domain expertise, Peopleclickauthoria for its contingent workforce recruitment, and Workday for intuitive user interface that puts green-screen ERP systems to shame.

The question is whether the rise of this new breed of HCM applications vendors will come at the expense of the incumbents or help propel the market to new heights because of their ability to expand into previously untapped opportunities.

Outlook

On the upside, the worldwide HCM applications market is poised to grow in a measured but sustainable pace as global economic recovery is lowering unemployment, which in turn could prompt organizations to spend more on identifying and retaining talents through process automation.

The recent hiring of 50,000 workers in one day by McDonald’s suggested that such large-scale workforce expansion could take place across different industries.

Additionally the positive outlook from HCM applications vendors echoed the optimism for their products as well as the synergistic benefits many of them should be able to realize from the latest round of mergers and acquisitions

On the downside, any sudden spurt of hiring may well be ephemeral because of uncertainty over geopolitical risks and other macroeconomic factors from rising commodity prices to weak housing market, all of which could hurt consumer spending and make any meaningful job growth elusive at best.

The lackluster job picture is the result of lingering effects of a stubborn recession that has forced employers to think twice before reverting to the hiring mode prior to the financial crisis. It is conceivable that developing countries such as US and many parts of Western Europe will continue to face high single-digit unemployment rates – covering those that have ceased to look for jobs – in the years to come.

What’s more likely is a growing emphasis of the other end of the employee lifecycle through more extensive use of retention and workforce planning tools as well as career development programs, all of which could have a direct impact on how and where HCM applications vendors will make their money in the long run.

Download the whole Market Report for free:

Human Capital Management Applications Market 2010-2015