The rising valuation of Cloud vendors, coupled with an insatiable appetite for well-established enterprise applications companies, could fuel a merger mania in 2014 bidding up targets and final prices to the highest level since 2007.

For the first half of 2014 the announced value of mergers and acquisitions in the enterprise applications market has already approached $21.1 billion. If the same trend pervades in the second half, 2014 could end up becoming the bonanza year for investment bankers, eager sellers as well as anybody else hankering for a piece of the Cloud action.

And Cloud applications vendors were hotly sought after during the first six months of the year, accounting for some of the biggest deals. ExactTarget, Skillsoft, Digital Insight, Active Network, and Dealer.com were all picked up this year north of $1 billion each by Salesforce.com, Charterhouse Capital, NCR, Vista Equity Partners and Dealertrack, respectively. Adding to the mix were Evolution1, KANA Software, Vocus, PeopleAnswers and Dude Solutions(stock sale) fetching a total sum of over $10 billion for these 10 Cloud applications vendors. Fattening the $10 billion pot further would be the estimated value of another $1 billion for the combined purchases of three other Cloud applications vendors Fieldglass, Seewhy and Silverpop. That could mean a grand total of $11 billion, more than half of the announced value of the major deals in 2014.

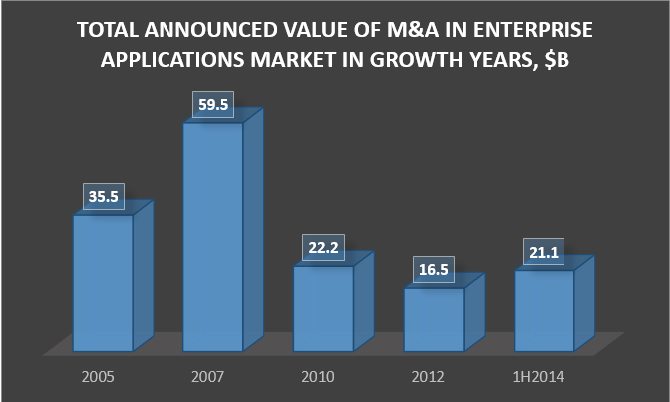

Based on our vendor database, the number and the size of deals over the past 12 months has been increasing every quarter all pointing to a blockbuster year for buyers and sellers in the enterprise applications market. Stroking the enthusiasm of acquisitive vendors and institutional investors – namely private equity firms is the specter that 2014 could emerge as the second most active year for enterprise software M&A since the peak of 2007, as shown in the following table.

Table 1 Announced Value of Mergers and Acquisitions In Enterprise Applications Market, $B

| 2005 | 2007 | 2010 | 2012 | 1H2014 | |

|---|---|---|---|---|---|

| Total Announced Value of Deals, $B | 35.5 | 59.5 | 22.2 | 16.5 | 21.1 |

Source: Apps Run The World, July 2014

Serial acquirers like Constellation Software, Real Page, and Trimble have continued to push into new markets through relentless purchases. ERP vendor Constellation Software, for one, typically buys anywhere from a dozen to two dozen companies in any given year.

Less well-known ones are getting into the action in a convincing fashion. Cloud-based eLearning vendor Desire2Learn is a case in point. In 2014 Desire2Learn purchased the Achievement Standards Network for digital data representations for the education vertical. That followed its 2013 purchases of Wiggio, a collaboration tool for students; and Knowillage Systems for its adaptive learning engine.

Such frenetic tie-ups are expected to redraw the competitive landscape, especially in hotly-contested markets such as CRM, HCM and even contingent labor management.

In December 2013, eLance and Odesk merged to form a huge player in the contingent labor management applications space with combined billing of more than $750 million for millions of freelancers and contractors that subscribe to the two sites. That touched off a frenzy among the incumbents. In January 2014, IQNavigator acquired ProcureStaff Technologies, a division of Volt Information Sciences, adding more customers to consume an enlarged portfolio of indirect spend and contingent labor management applications. Two months later, SAP topped it off by announcing its deal to buy Fieldglass for contingent labor management applications.

For customers, the segment consolidation could prompt them to raise questions about the future of the remaining contingent labor management players such as Avionte Staffing, Beeline, Peoplefluent, and Provade, which may find it necessary to find partners to merge in order to safeguard their territories.

Contingent labor management is only a microcosm of a larger force at work when the draw of Cloud applications is attracting so many vendors to emerging segments such as subscription billing management that are getting crowded by the day. Aria Systems, Avangate, Billing Platform, Chargebee, Cleverbridge, ElasticPath, Fusebill, Pay Simple, Recurly, SaaSoptics, SaaSy, Simplify, Stripe, Vindicia, and Zuora are among dozens of Cloud applications vendors that specialize in subscription billing management in the Cloud.

That does not even take into account of first-generation eCommerce billing vendors like CyberSource, Digital River and many others. For these vendors and their backers, the consolidation wave may not be too far off.

The following table shows the growing number of mergers and acquisitions among major enterprise applications vendors since the beginning of 2013.

Table 2: Selected Mergers and Acquisitions in Enterprise Applications Market Between 2013 and First Half of 2014

| Acquired Vendors | Key Markets | Acquirers | Announced Value, $M | Year Announced |

|---|---|---|---|---|

| Micros Systems | Retail apps | Oracle | 5300 | 2014 |

| ExactTarget | CRM | Salesforce.com | 2500 | 2014 |

| Skillsoft | eLearning | Charterhouse Capital Partners | 2325 | 2014 |

| Applied Systems | Insurance ERP | Hellman & Friedman | 1800 | 2014 |

| Digital Insight | Online banking | NCR | 1650 | 2014 |

| UNIT4 | ERP | Advent International | 1600 | 2013 |

| Responsys | CRM | Oracle | 1500 | 2013 |

| GXS | eCommerce | Open Text | 1065 | 2014 |

| Active Network | CRM | Vista Equity Partners | 1050 | 2014 |

| Dealer.com | Automotive ERP | Dealertrack | 1000 | 2014 |

| Passport Health | Healthcare ERP | Experian Health | 850 | 2013 |

| Kronos(stock sale) | HCM | Blackstone and GIC | 750 | 2014 |

| Accelrys | Product Lifecycle Management | Dassault Systemes | 750 | 2014 |

| Evolution1 | HCM | WEX | 533 | 2014 |

| Cegedim Life Sciences | CRM | IMS Health | 520 | 2014 |

| KANA Software | CRM | Verint | 514 | 2014 |

| Vocus, Inc. | CRM | GTCR | 447 | 2014 |

| API Healthcare | HCM | GE Healthcare | 340 | 2014 |

| Total Specific Solutions | Government, Healthcare ERP | Constellation Software | 324 | 2013 |

| PeopleAnswers | HCM | Infor | 200 | 2014 |

| Jaspersoft | Analytics | Tibco | 185 | 2014 |

| Sage Nonprofit | Nonprofit ERP | Accel KKR | 101 | 2013 |

| Dude Solutions(stock sale) | ERP | Warburg Pincus | 100 | 2014 |

| PNI Digital Media | Retail apps | Staples | 74 | 2014 |

| Venda | eCommerce | NetSuite | 50.5 | 2014 |

| Andera | Banking apps | Bottomline | 47 | 2014 |

| Vertical Response | CRM | Deluxe Corp. | 27 | 2013 |

| SERUS | Supply chain management | E2Open | 26 | 2014 |

| Autotask | Project management apps | Vista Equity Partners | NA | 2014 |

| Axium | ERP for Professional Services | Deltek, Inc. | NA | 2014 |

| Fieldglass | Contingent Labor Management | SAP | NA | 2014 |

| Homecare Homebase | Healthcare ERP | Hearst | NA | 2014 |

| Hybris | eCommerce | SAP | NA | 2013 |

| Maxwell | Construction ERP | Viewpoint Construction Software | NA | 2014 |

| P2 Energy | ERP for Energy | Advent International | NA | 2013 |

| Seewhy | CRM | SAP | NA | 2014 |

| Silverpop | CRM | IBM | NA | 2014 |

| Tradecard | Supply chain management | GTNexus | NA | 2013 |

| TribeHR | HCM | NetSuite | NA | 2013 |

| Triple Point Technology | Treasury and Risk Management | ION Trading | NA | 2013 |

Source: Apps Run The World, July 2014