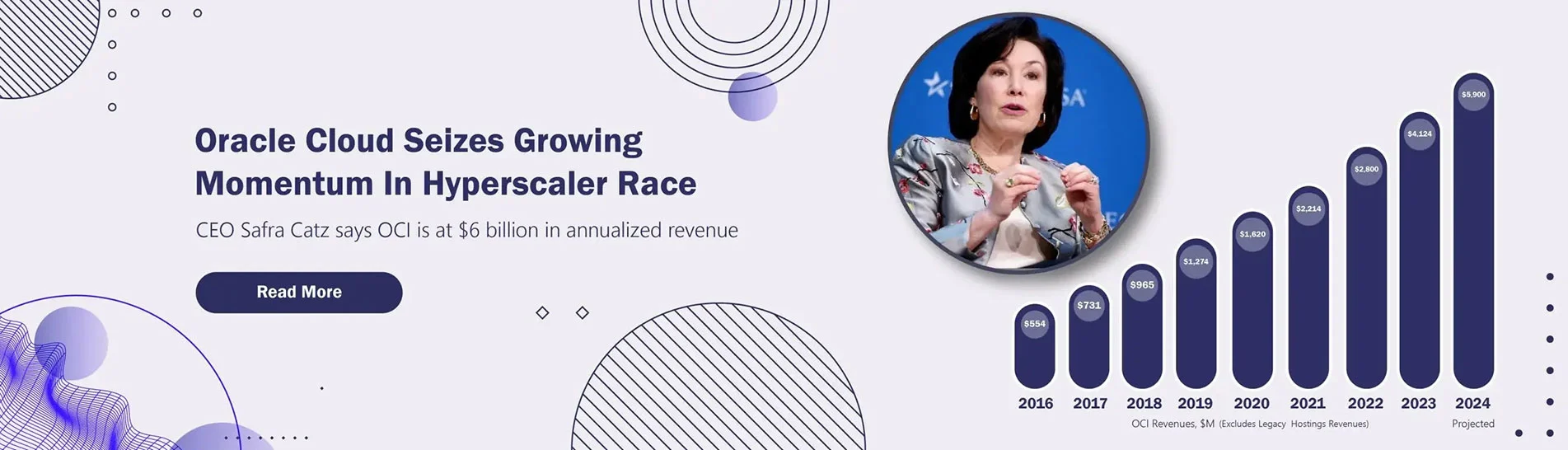

Oracle Cloud Infrastructure (OCI) is on track to achieve nearly $6 billion in revenue in 2024, seven years after transforming itself from a legacy hosting operation with limited international presence into a full-blown Cloud delivery vehicle with 67 customer-facing regions worldwide.

That would amount to a 10-fold increase from over $550 million in 2016 when it was primarily involved in hosting Oracle on-premises applications on behalf of its customers. In its latest earnings call, CEO Safra Catz said OCI emerges as one of the clear drivers of its acceleration, prompting it to double down on its capacity to better serve millions of customers and users in the coming decade.

In addition to the nuts and bolts of providing cloud infrastructure, Oracle has differentiated itself further in the IaaS market with multi-cloud offerings including Oracle OCI Dedicated Region and Exadata Cloud @Customer as on-premises deployment models with significant customers such as Vodafone selecting the former and Deutsche Bank the latter.

In its latest quarter ended in November 2023, excluding legacy hosting services, Oracle’s Gen 2 infrastructure cloud services revenue grew 55%, with an annualized revenue of $6 billion. That compares to a 72% jump in the previous quarter ended in August 2023. On the cloud applications side, Oracle SaaS increased 14% with Fusion Cloud ERP up 19% and NetSuite ERP up 20% in Q2 FY24.

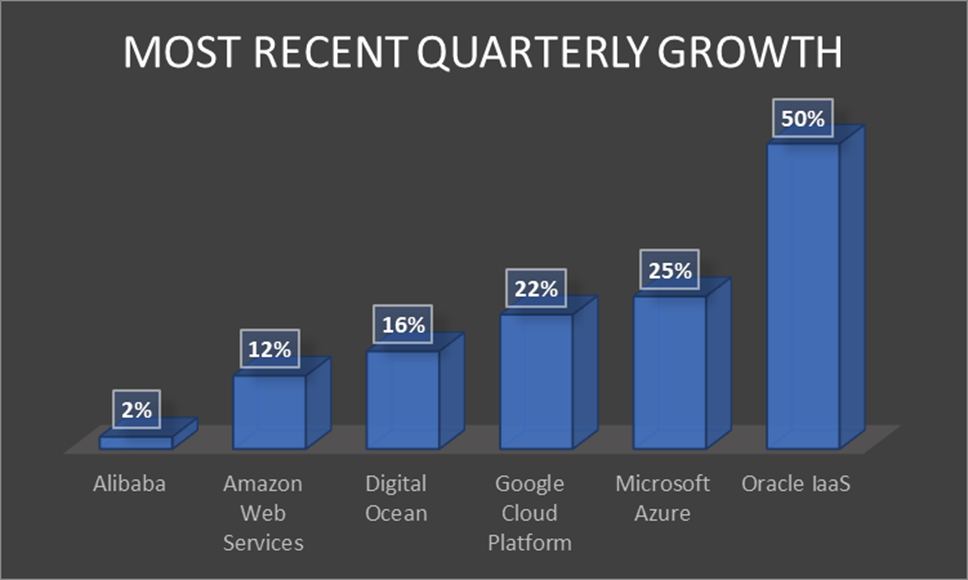

The law of large numbers is likely to prevent OCI from posting consecutive growth of 70%+ over the next few years. Still, Oracle has been outperforming its peers since it broke out its infrastructure as a service (IaaS) revenues 18 months earlier. Following the disclosure, Oracle’s IaaS revenues have expanded by at least 39% quarter to quarter with the latest spiking 50% in constant currency.

By comparison, Microsoft Azure was estimated to grow at 25% in its latest quarter ended September 30. Google Cloud did slightly better than most at 22% in its most recent three-month period, while others trailed either at teens or single digit, as shown in the following exhibit.

Oracle executives said they expect the trend to continue because of its ability to capture more business from a wide range of partners including those under the new Oracle Alloy offering that enables partners to become cloud providers and offer a full range of cloud services to expand their businesses. It also means putting OCI equipment, including Oracle Exadata, in Microsoft Azure data centers in an economic way to run massive Oracle database workloads in the cloud.

Oracle’s on-premise database business has experienced sluggish results for years in light of cloud migration and competitors ranging from MongoDB to Snowflake, but the on-premise database license and maintenance revenues still contribute at least 20% to its top line representing an estimated $10 billion each year. The bulk of that amount will continue to fill Oracle’s coffers for database maintenance and support, but users will be able to yield substantial savings in the forms of eliminating hardware and license costs under the Oracle Database@Azure partnership.

Even without selling database licenses, the math would still be in Oracle’s favor, especially now that OCI will get a cut out of that. Also, Microsoft trumpeted the fact that once Oracle database customers make such moves, some such as GE would be able to generate 30 to 50 percent performance improvement over their on-premise setup.

The imperative is that any gains by OCI will be used to mitigate and recoup future erosion of the $10 billion on-premise database business over the next five to 10 years and that will determine when and how Oracle evolves into a 100% cloud provider.

The next task is to extend OCI to key industries that Oracle has already built a formidable presence after years of buying applications specialists, from iFlex in banking to Cerner in healthcare.

This past quarter shows OCI signing up more than a dozen key accounts in banking and financial services such as Black Rock, Gruppo Banca Sistema in Italy, and SPCBL in India after stepping up its push into banks and FIs with the likes of Deutsche Bank and Tokyo Stock Exchange within Nomura Research Institute’s OCI Dedicated Region. In 2023, Oracle also won over scores of major healthcare institutions in the US and fast-growing regions in Asia and the Middle East that are in the process of putting their Electronic Medical Record systems on OCI.

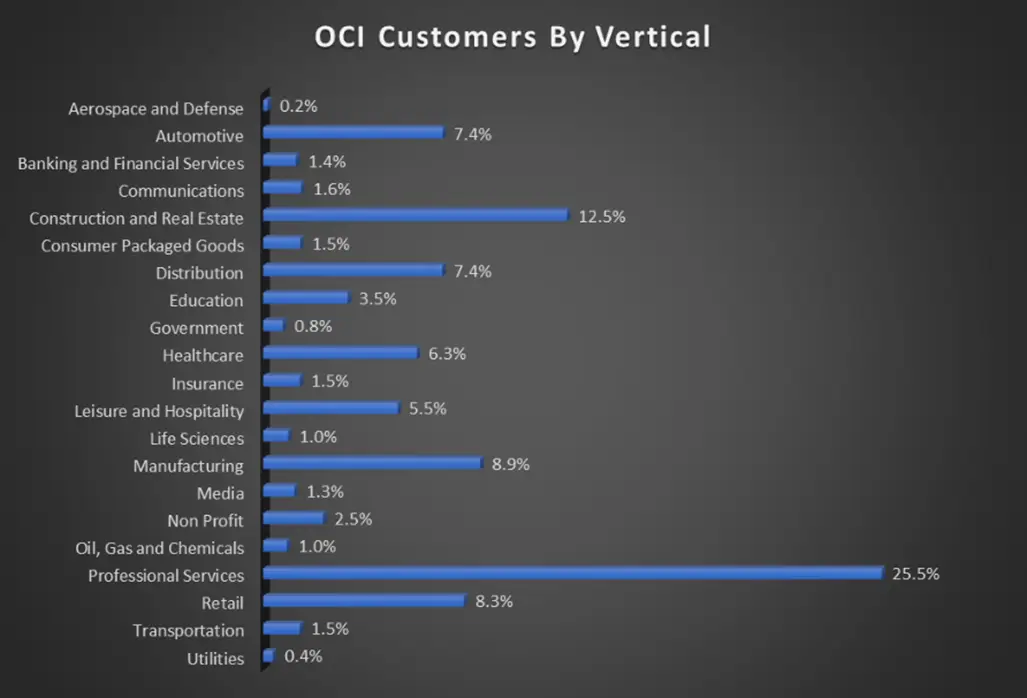

Based on our Buyer Insight Technographic Database, OCI is estimated to have secured more than 25,000 customers with additions of thousands of net new accounts every quarter. That figure does not include tens of thousands of customers of Oracle Cloud applications that are already running the software on OCI.

Our latest tally of OCI customers includes more than 1,000 that have signed up in 2023, among the 19,102 that we have been tracking since 2016, as shown in the following exhibit.

These customers include the likes of major retailers like Loblaw Companies in Canada, insurance carrier Seguros SURA Colombia, HVAC manufacturer Rheem, Virgin Australia airline and Berkshire Hathaway Energy.

The number of OCI customers in Communications, Construction and Healthcare has grown steadily over the past year. Communications also includes managed service providers and fiber networking companies that are often listed under professional services.

In 2023, OCI has signed with both Telmex and AT&T Mexico, two of the biggest carriers locally, to provide over 100 cloud services to users and organizations in Mexico covering tens of millions of users. The same applies to Vivo or Telefonica Brasil, América Móvil-owned Claro in Colombia, and MCM Telecom in Mexico, all of which are partnering with OCI to boost cloud migration and 5G service adoptions throughout Latin America.

In Asia and Europe, OCI is widening its reach by partnering with carriers such as Arelion in Sweden, Liberty Global B.V. in six European countries, KDDI and NTT in Japan – where OCI is seen as the preferred IaaS partner over others in part due to Oracle’s laser focus on enterprise software, rather than competing with communication service providers for a slice of eCommerce, advertising and even Generative AI revenues that AWS, Google and Microsoft are gravitating toward their future.

In the government vertical, OCI has opened an Australian government region and announced a partner-led sovereign cloud project in New Zealand. Additionally, Oracle continued to add government authorizations, which public sector agencies require before they can migrate their public health, defense, and other mission-critical services to the dedicated cloud offered by Oracle.

None of these efforts come easy or cheap. During Oracle’s 2QFY24 earnings call, Catz expects its capital expenditure – primarily associated with the global expansion of OCI – to double to $8 billion in fiscal 2024 from $4 billion in fiscal 2022. Oracle chairman and CTO Larry Ellison said that will entail building 100 new data centers to complement its existing 67, insisting that it can still operate them more efficiently than its peers because of automation.

By comparison, Amazon, Google and Microsoft are each spending at least $20 billion a year in CapEx on their cloud operations and all three have been saying they expect to invest even more as they are compelled to dominate the tasks of running large language models.

With this momentum, Oracle appears to be highly focused on broadening its OCI reach across strategic industries and regions in order to become a clear alternative to its IaaS peers.

- Aries Craft India, a India based Professional Services organization with 10 Employees

- Mail3, a Vietnam based Professional Services company with 10 Employees

- Ernst & Young, a United Kingdom based Professional Services organization with 406209 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|