Oracle ended its latest fiscal year by becoming one of the fastest-growing Cloud providers as the 44-year-old enterprise software vendor is gearing up to move past the pandemic.

In our latest research study that tracks the growth of more than 3,000 enterprise software vendors, Oracle grew the most in both the Cloud Infrastructure As A Service(IaaS) and Cloud ERP markets among the leading vendors as the Austin company continues to expand beyond its database stronghold.

Oracle saw a 119% jump in IaaS revenues in 2020. In addition, Oracle topped the Cloud ERP market in 2020, ahead of the second-ranked Intuit by a margin of two to 1 in Cloud revenues and the fifth-ranked SAP by a margin of three to 1.

Oracle ended its fiscal 2021 on May 30 without skipping a beat, achieving a 36% jump in earnings on record revenues of $40.5 billion, a 4% rise and the highest in its history. In its fourth quarter, Oracle posted a 8% growth in revenues including a 11% jump in applications cloud services and maintenance fees.

Analysis of Oracle’s latest results reveals the following trends:

Cloud ERP Fuels Overall Growth

In 4Q21, Oracle reported a 46% jump in its Fusion Cloud ERP business contributed to an annualized revenue of $4.4 billion for its back-office apps. Our research shows Oracle Cloud ERP(including both Fusion ERP and NetSuite) amounted to $3.1 billion in Cloud subscription revenues in 2020, up 33% from 2019, the highest growth rate among the top 10.

Among the 1,275 Oracle Cloud ERP customers listed in our Buyer Insight Master Database, more than half run multiple Oracle Fusion Cloud Applications and provide ample opportunities for the vendor to standardize their Cloud environment.

Additionally, about 45% of these 1,275 customers had been running different products from Oracle prior to them adopting Oracle Cloud ERP in 2017. That level of retention and account control enables the vendor to sustain and maintain its wallet share with key clients such as FedEx, Johnson and Johnson, and Tesco among its more than 8,000 Oracle Cloud ERP customers.

Steve Miranda, Executive vice president of Oracle applications, said the crux of Oracle Cloud ERP is continuous and cutting-edge innovation – more than 15 years in the making – that leverages its Gen 2 Cloud Infrastructure to mitigate integration and implementation risks for the most complex IT and back-office environments.

In the midmarket ERP segment, Oracle NetSuite signed more than 2,000 new customers in fiscal 2021 resulting in a total of 24,000 including many fast-growing enterprises. Evan Goldberg, co-founder of NetSuite who remains in charge of Oracle NetSuite, said 70% of tech IPOs last year were NetSuite customers. In April 2021, Oracle acquired FarApp for its eCommerce, logistics, retail and hospitality connectors for Oracle NetSuite to easily integration into Amazon, eBay as well as shipping and logistics software vendors like ShipStation.

OCI Rises To The Occasion

In fiscal 2021, Oracle Cloud Infrastructure more than doubled to post $2.3 billion in Cloud subscription revenues. Our IaaS estimates for OCI were $1.9 billion in 2020, up 119% with a steeper ramp than its bigger rivals. On its earnings call, CTO Larry Ellison cited a 103% increase in OCI consumption during the latest quarter, especially in helping customers move Oracle database workloads to the Cloud as well as run new applications for crash simulation and other advanced robotic solutions for car makers and manufacturers. While the law of the big numbers prevents its rivals from growing exponentially, Oracle has been enjoying its fast-follower status as it is able to learn from the mistakes of others by mitigating problems in advance like permission, configuration and even hardware-specific issues commonly found in first-generation IaaS offerings.

That has earned the support of many customers whose insatiable demand for scalability and up-time availability is of particular concern to them during the pandemic. For instance, Zoom, the hugely popular video conferencing apps vendor, chose to expand the list of IaaS providers by turning to OCI, in addition to its use of AWS and Azure in 2020. In Zoom’s most recent 10K, Zoom considers AWS and OCI its primary IaaS providers, whereas AWS and Azure were only the IaaS providers highlighted in the year-earlier filing. That underscores the upgrading of the relationship between Zoom and Oracle, certainly something that AWS is keenly aware of.

Increased customer engagement comes a long way to providing extra runway for Oracle to pitch its Cloud infrastructure service to these demanding accounts by helping them run non-Oracle workload as well. For example, Oracle announced extensive VMWare support earlier this year, thus ensuring on-premise virtualization software on VMWare can be lifted and shifted to OCI without changing the underlying code, or security standard, according to Clay Margouyrk, executive vice president of OCI.

Oracle is ready to take OCI to the next level by signing not thousands, but rather tens of thousands of new accounts every year in order to drive economy of scale needed to succeed following activation of scores of new Cloud regions over the past couple of years. Oracle plans to operate 38 cloud regions in total by the end of 2021. After posting more than $2.3 billion in subscription revenues in fiscal 2021, CEO Safra Catz said the vendor is planning to double its Capex on its cloud services to $4 billion – especially in propelling OCI further in its current year.

Oracle Adapts its Core To Expand

One of the key aspects of Oracle’s transformation from an on-premise vendor to the Cloud is that it has done a remarkable job maintaining a firm grip on its maintenance revenues.

Based on our analysis of Oracle’s historical revenues since 2001, the vendor’s maintenance revenues have grown steadily every five years – jumping from $3.5 billion – mostly from its flagship database – in 2001 to a little under $20 billion – again with the majority coming from its database products – in 2021. In fact, maintenance fees as a percentage of its total sales rose from 33% in 2001 to a little under 50% in 2021.

A good example is Oracle Financial Services Global Business Unit formed and grown through acquisition of i-flex solutions in 2005 and i-flex’s leading core banking solution FLEXCUBE. ARTW’s research (Oracle doesn’t break out these numbers publicly) estimates that the solution brings in multi-millions in maintenance revenue fees that continue to accelerate, representing a 10-fold increase from 2001 as more global banks decide to standardize around the platform.

Outside of FLEXCUBE, Oracle Financial Services has steadily added to its product offerings in finance and risk solutions, financial crime management and compliance, revenue management and billing and insurance, including health and life. Most recently, the business unit unveiled several new componentized cloud solutions to help banks quickly modernize critical functions around treasury, liquidity, and supply chain management.

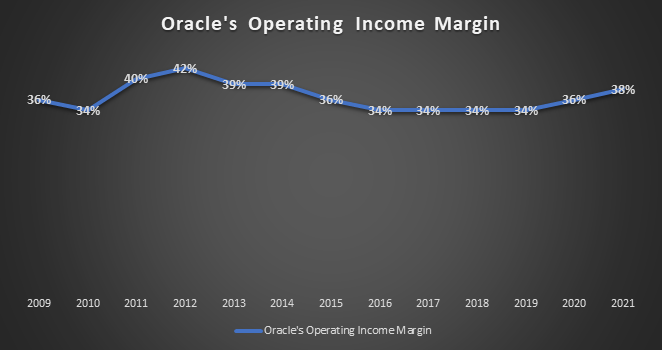

Their reliance has resulted in solid earnings for Oracle. In its fiscal 2021, Oracle’s net profit margin (income minus operating expenses) stood at 38% after recovering from 34% over the past five years when the vendor was investing in Cloud migration. That is still four points below its recent high of 42% in fiscal 2012. By comparison, the net profit margins were 2% at Salesforce, 24% at SAP and 30% at AWS in their latest fiscal years. Catz said its 47% non-GAAP profit margin in 2021 was the highest among its competitors.

Catz added its profit margins will continue to improve once the current wave of Cloud infrastructure service rollout is complete.

During its fiscal 2021, Oracle implemented a series of measures to shore up its operations. That included the relocation of its headquarters from Redwood Shores in California, a symbolic landmark along Highway 101, to a newly built corporate campus in Austin, Texas. Under its late CEO Mark Hurd, Oracle was already investing heavily in Austin by hiring thousands of new employees – mostly for the Oracle Direct division involved in inside sales of its Cloud products. To make it more palatable for out-of-state recruits, the Austin campus offers housing for some of its employees. The desire to relocate there intensified during the pandemic as the work from home phenomenon made it even more attractive for Oracle to settle its headquarters in an affordable region like Texas where cost of living is lower than California.

Additionally, Oracle has recently announced a plan – covering an upfront payment of $175 million before tax subsidies – to build a 65-acre campus and hire up to 8,500 employees in Nashville, Tennessee, modeled after the Austin headquarters.

In Europe, Oracle relocated many of its employees from its UK and Poland offices to Oracle Global Service Ltd.(OGS) in Scotland, thus boosting the OGS headcount to 2,106 in 2020 from 187 a year earlier and its revenues to $385 million in 2020 from $22 million in 2019. The move is notable as Oracle is taking steps to streamline its European operations by positioning Scotland, which aligns itself closer to European Union, as the buffer against the whims of the UK government following Brexit.

For a technology company that has been one of the biggest beneficiaries of the Silicon Valley for more than four decades, the bottom line to these measures is that Oracle is making every move to ensure that it stays closer to its customers by not favoring a single locale, country, ideology or even any geo-political debate.

Product Innovation Remains Key To Its Future

True to its form, Oracle rests its future with product innovation. In the Cloud ERP market where it dominates, each new release could bring more than 1,000 new features and increasingly the vendor is switching on the machine learning spigot to spur product development. Ellison said the vendor is banking on its heavy investments in neural network and machine learning technologies to speed product releases, along with the coupling of its Cloud-native autonomous database to run programs more efficiently, securely and at low-cost without the intervention of manual labor for software patching and debugging.

In fiscal 2021, Oracle is expected to double down on its CX applications by marrying digital advertising, lead-generation, and lead-qualification into a fully integrated online selling system, said Rob Tarkoff, Executive Vice President and General Manager, Oracle Advertising and Customer Experience. One of the recent wins of Oracle CX is Aon, which experiences considerable value by consolidating six different CRM apps into an Oracle Cloud system with fully integrated CX features.

In the HCM market where Oracle saw a 35% spike in Fusion Cloud HCM sales in 4Q21 after a 23% rise in 3Q21, Chris Leone, who heads Oracle HCM product management, said the new year promises to deliver increased use of AI and machine learning, better Employee Experience access to all backend systems, while reinforcing the needs to ensure diversity and inclusion, and enhanced cybersecurity protection for work from home employees.

Oracle is also putting a concerted focus on industries solutions and recently ranked among the top vendors in our vendor database of 3,000 industry-focused cloud offerings. The company already has nine industries global business units who are focused solely on front-office solutions for utilities, hospitality, financial services, food and beverage, retail, life sciences, construction and engineering, and communications (networks and applications). According to Ellison, two more business units are on the horizon – State and Local and Healthcare. In industry cloud solutions alone, Oracle now offers 60 application skus, serving 100,000 customers and 16 million users.

Next Chapter for Oracle

After years of cultivating its Cloud applications business, Oracle is beginning to harvest as Oracle Cloud ERP is now No. 1 and its other Cloud applications are chalking up customer wins consistently.

Having thwarted the attempts of HANA from SAP and others to unseat its database, Oracle’s dominance in database management remains undisputed. The new Oracle Autonomous Database just posted a 66% increase in revenues in its latest quarter.

In the brutally competitive IaaS market where winners are often graded by pennies per gigabyte, not seven-figure license fees, Oracle has proven that it can be a viable alternative to AWS, Microsoft Azure or Google Cloud Platform in terms of cost, performance and Cloud security as customers like Zoom, Nvidia and Carrefour are moving their workloads onto OCI.

The question thus becomes the decision by Oracle to relocate its long-time California headquarters to Texas may portend a shift as it aims to redefine its future by becoming a truly agnostic player that rids of its previous baggage.