After a brief hiatus, Oracle CloudWorld 2022 marked a turning point for the 45-year-old company by positioning it as a multi-dimensional technology vendor that helps its customers and partners navigate uncharted waters with the audacious goal of transforming many industries.

In addition to a series of dramatic overtures that preceded the three-day event, its first major user conference since the onset of the pandemic, the cloud vendor took the unusual steps to galvanize its supporters that would have been unthinkable just a few years earlier. Shortly before the event, Oracle made available on AWS its MySQL Heatwave, which competes with the likes of Snowflake. That follows a similar decision in June to ensure interoperability between Azure and OCI, essentially telling its database customers that their critical workloads can easily traverse across different clouds.

Then, in her keynote, CEO Safra Catz challenged the 10,000+ attendees to make bold moves despite the threats of a looming recession. In his address, co-founder and CTO Larry Ellison spent the bulk of his 90-minute session reiterating the importance of healthcare IT. In the past, one would have expected to hear familiar themes of technology implications of speed, performance, and business process improvements. Not this year.

In order to create a global repository of health records, aided by its recent $28-billion purchase of Cerner, Ellison said Oracle must extend itself to a whole host of key constituents from Integrated Delivery Networks like the Veterans Administration in the United States and National Health Service in the United Kingdom to vendors like Microsoft and AWS as well as implementation partners and other ISVs to automate the entire ecosystem. “We can’t do this by ourselves, it’s impossible,’’ Ellison added.

In fact, among a raft of announcements during the event, the introduction of Oracle Alloy and its Applications Platform underscored a major shift in its Cloud strategy. For example, Oracle Alloy enables the white-labeling of its Oracle Cloud Infrastructure to partners especially telcos like Telecom Italia and Vodafone and integrators or managed service providers. Oracle Applications Platform is making available to customers and partners the same tools Oracle developers use to create Oracle Applications to extend the Fusion platform – its Redwood UX, telemetry for real-time apps performance insights, digital assistants, search and other tools like Visual Builder, table widget and guided learning.

While Oracle was preoccupied with developing and selling its cloud products directly in the past, its chief concern is to make them ubiquitous by leveraging as many channels as possible. Steve Miranda, executive vice president of applications development at Oracle, said its cloud applications will all be extended to improve the usability of on-premise vertical applications like Cerner, Epic and others, while augmenting them with such horizontal capabilities like financial planning, human resources and supply chain that are being continuously updated every 90 days.

Additionally, Miranda said the new partnerships with JP Morgan and FedEx will streamline B2B transactions by incorporating financial services and logistics services into Oracle Fusion Cloud ERP. The alliances could usher in a new way of collaborating with key accounts that transcend the conventional software business model. Directly connecting more than 40,000 buyers, sellers, and service providers would help Oracle better meet the needs of shared users and consumers alike. “We have a very, very large ecosystem,’’ Miranda said.

By optimizing visibility into the financial health of hospitals, Oracle is adding significant value to an industry that is fraught with inefficiency because of ever-demanding regulations and soaring labor costs, said Jennifer Toomey, VP ERP/EPM Marketing of Oracle, adding that Cloud EPM apps for advanced budgeting, planning and forecasting can help providers quickly model scenarios, determine future demand, optimize resources, and make better financial, workforce, and patient care decisions.

Rob Tarkoff, executive vice president of CX applications at Oracle, said it is investing heavily in building CRM offerings by dedicating 600 developers to an array of verticals such as parts management and depot support for asset-intensive industries like high-tech manufacturing, utility, and healthcare. Tarkoff estimates that CX for industries will contribute the most revenues to Oracle over the next three to five years, surpassing those from conventional opportunities for sales force automation.

Compared with the applications hosting business that it ran years ago before commercializing it as OCI, Alloy – generally available in 2023 – will offer extra redundancy and protection, along with the escalated customer support features. Leo Leung, vice president of OCI and Oracle Technology, said, “Alloy is a big step from the old hosting model as we are going to provide the whole integrated stack.’’

If it succeeds, it could sign up millions more cloud infrastructure and applications customers and subscribers, surpassing the current count of about 18,000 accounts running OCI and over 45,000 organizations that are dependent on its Cloud Fusion and NetSuite applications. Also, all of its SaaS applications will be retooled to run on OCI over the next 18 months. Altogether, these efforts could help generate total annual sales of $65 billion for Oracle by the end of its fiscal 2026 in May of that year, up 30% from $50 billion in the current year, according to Doug Kehring, executive vice president of corporate operations at Oracle.

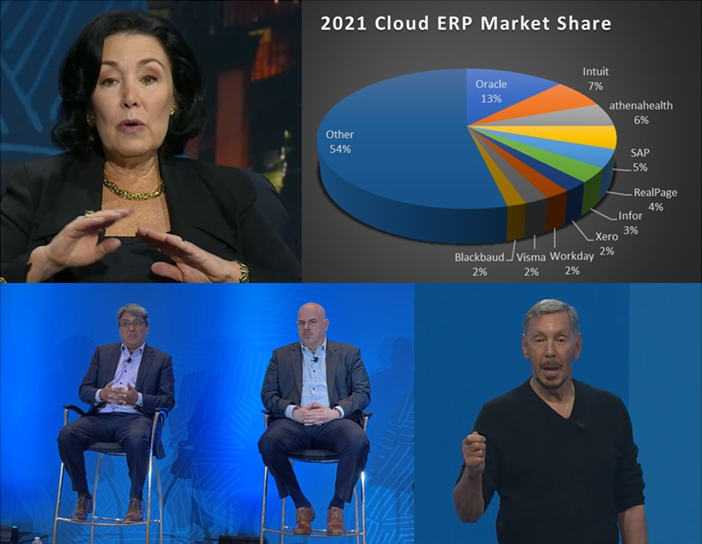

Oracle Dominates Cloud ERP Market

A lot is riding on the twin pillars of its multi-dimensional initiative with the first supporting its thriving cloud apps business. In 2021, Oracle continued its dominance in the Cloud ERP applications market with the most recurring revenues among hundreds of rivals, according to our most recent market sizing report, as shown in the following exhibit. Among the top 10, Oracle also registered the highest growth in Cloud ERP having signed and taken live a number of multinational accounts in 2021.

Exhibit 1 – Worldwide Top 10 Cloud ERP Applications Vendors, $M

| Vendor | 2020 | 2021 | Growth, % | 2021 Market Share, % |

|---|---|---|---|---|

| Oracle | 2705 | 3551 | 31.0% | 13% |

| Intuit | Subscribe | Subscribe | 30.0% | 7% |

| athenahealth | Subscribe | Subscribe | 4.0% | 6% |

| SAP | Subscribe | Subscribe | 28.0% | 5% |

| RealPage | Subscribe | Subscribe | 2.0% | 4% |

| Infor | Subscribe | Subscribe | 20.0% | 3% |

| Xero | Subscribe | Subscribe | 15.0% | 2% |

| Workday | Subscribe | Subscribe | 10.0% | 2% |

| Visma | Subscribe | Subscribe | 7.0% | 2% |

| Blackbaud | Subscribe | Subscribe | 8.0% | 2% |

| Subtotal | Subscribe | Subscribe | 19.0% | 46% |

| Other | Subscribe | Subscribe | 2.0% | 54% |

| Total | 25845 | 28164 | 9.0% | 100% |

Source: Apps Run The World, November 2022

Underpinning its No. 1 position is its ability to migrate legacy systems among its vast installed base in conjunction with winning net new customers.

Flagstar Bank, for example, has standardized on the use of Cloud EPM applications from Oracle for an array of financial closing and consolidation tasks, in lieu of running Essbase in the past. Because of the migration, Flagstar Bank can now conduct its forecasting processing work in one hour, compared with five hours in the past, said Damon Hrydziuszko, VP of Financial Systems at the bank. “The audit trail is amazing in the cloud, we actually can see what changes have been made,’’ Hrydziuszko said, adding that the bank is in the process of standardizing its back-office systems on all Oracle Cloud EPM applications to augment and replace its PeopleSoft and Fiserv software.

Likewise, in June 2022, the state of Missouri awarded a multi-million-dollar software contract to Oracle over competitors like Infor, SAP and Workday as all departments covering some 35,500 employees are expected to replace their legacy accounting and Core HR systems from CGI with Oracle Cloud ERP and HCM, strengthening its position in the public sector vertical.

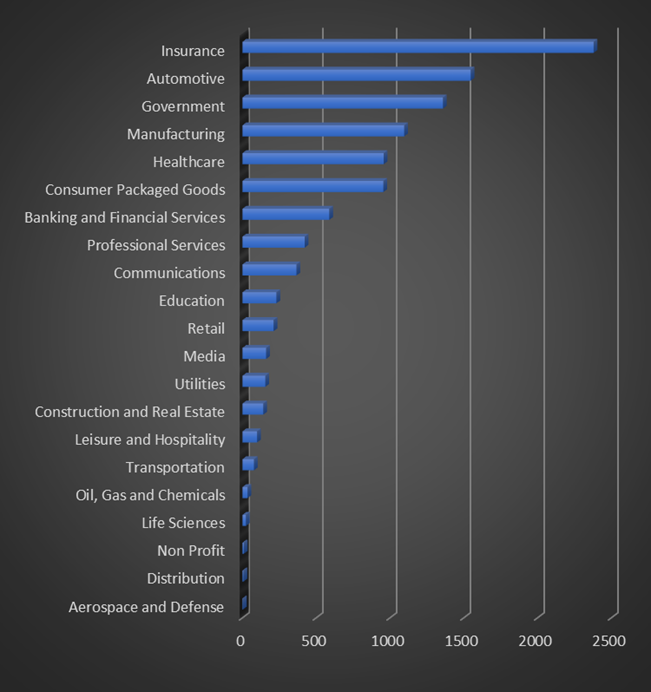

Based on our survey of 340 purchases of Oracle applications in 2022, the government vertical represented the third largest buyer group, following insurance and automotive, according to their projected spend as a percentage of their revenues, as shown in Exhibit 2.

Exhibit 2 – Worldwide Projected Spend on Oracle Applications in 2022 By Industry, in $ millions

Source: Apps Run The World, November 2022

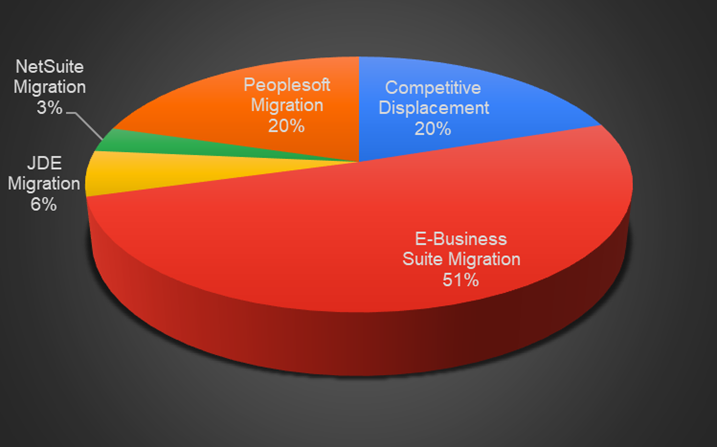

Exhibit 3 shows that among the 517 purchases of Oracle Cloud ERP applications between 2012 and 2022, most are migration from Oracle’s on-premise systems, while competitive displacements represented 20% of these implementations, as shown in the graphic below.

Exhibit 3 – Worldwide Purchases of Oracle Cloud ERP Applications Between 2012 and 2022, By Type of Migration, %

The decade-long march toward making Oracle Cloud ERP successful is manifesting itself by delivering significant benefits to existing and net new accounts that now consider Oracle their primary Cloud applications provider.

For example, Baptist Health in Florida with 24,000 employees and $4 billion in revenue recently went live with Oracle Cloud ERP and HCM replacing its legacy Lawson systems. The integrated delivery network attributed its decision to modernize its back office, unify processes, and increase visibility across the organization as a prerequisite before opening its new flagship hospital in the summer of 2023.

Oracle has similar successes with other cloud applications. In 2022, Community Health Systems, Inc. in Tennessee, Con Edison Clean Energy and In-N-Out Burger purchased its Cloud EPM applications for budgeting and planning, while ABM Industries, Mayo Clinic and Mercedes-Benz Group all expanded their use of Oracle HCM applications this year.

Telecom equipment provider Nokia went further by standardizing on Oracle Cloud HCM for its global workforce of 87,000 employees in 2022. In the retail vertical, Oracle Fusion Cloud HCM is the system of record at Kroger and Albertson’s, among its more than 3,000 Cloud HCM applications customers, said Chris Leone, executive vice president of HCM applications at Oracle.

OCI Aims to Excel In Multicloud

The second pillar is to drive more adoptions of its Oracle Cloud Infrastructure, a late bloomer that has begun to gain traction over the past few years. In its latest quarter ended August 30, 2022, Oracle disclosed that it signed over 1,000 new customers which helped achieve a 58% jump in OCI sales to reach nearly $900 million, its first-time revelation of the OCI’s standalone performance in more than six years.

Some Oracle watchers have already suggested its aggressive investment in OCI has created “feature parity with other hyperscalers.” With OCI’s rapid growth – revenue is expected to top $5 billion by the end of the fiscal year – and thousands of organizations running mission-critical workloads in Oracle’s cloud, it’s only a matter of time before the market views OCI in the same light as Microsoft Azure and AWS.

What Oracle is counting on is the fact that many of its on-premises customers have yet to move their critical workloads into the cloud.

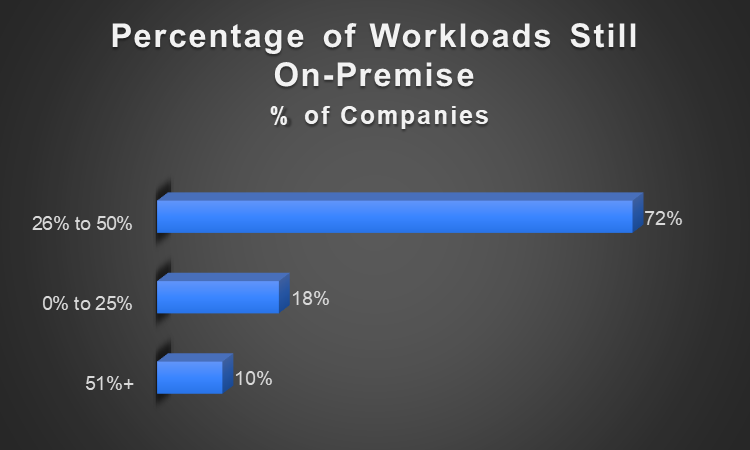

Based on the results of 223 use cases of OCI from our Buyer Insight Master Database, there are still many more Oracle customers planning to move additional on-premises workloads – accounting for as much as half of their daily system requests, queries and performance objectives – to the cloud and by doing so reap even more benefits like streamlining their Oracle investments and achieving enterprise-wide efficiency gains. Among these 223 organizations, 160 entities, or 72% of the surveyed users, have somewhere between 26% and 50% of their workloads still sitting behind their firewalls, as shown in Exhibit 4. See exhibit 5 below for more details on the cloud migration benefits for these Oracle’s on-premises customers.

Exhibit 4 – Percentage of Workloads Still On-Premises Among Oracle Apps Customers

Source: Apps Run The World, November 2022

Another approach that Oracle is banking on is to keep siphoning shares from AWS, Microsoft Azure and to a lesser extent Google Cloud Platform by convincing its largest accounts that it would be to their advantage by spreading their cloud investments over multiple hyperscalers in order to mitigate their risks.

Coincidentally, among its closest competitors, only Amazon, Microsoft, Alphabet’s Google have higher market cap than Oracle, which has outperformed SAP and Salesforce for most of the past 12 months.

Not only is Oracle considered a safer bet by investors, it is also far ahead of Amazon and Google in enterprise applications at a time when the latter two are only realizing the criticality of having their own offerings with Amazon Connect for contact centers and Looker for analytics, respectively. Microsoft remains a larger-than-life threat because of its depth and breadth of its apps and tools as well as SQL Server database. Hence, the announcements of opening up MySQL to Azure and AWS could sway some users to consider taking the multi-cloud journey, amid the intensified cloud infrastructure contest where the winner could be picked simply because customers want to reduce overprovisioning costs during peak times or egress fees with hyperinflation running rampant.

The Upshot and Risks Facing Oracle

It will take years before Oracle’s multi-cloud strategy can prevail in the hotly contested IaaS market even with the flexibility of new initiatives like Alloy. The white-labeling of OCI by its partners like Teléfonos de México (TelMex) will help expand its reach by going after the white space in emerging markets, but it may also run up against rules and regulations that prevent industries such as banking and financial services in geos like Turkey from considering putting their on-premise-only systems in the private cloud hosted by OCI even within the country.

The risk Oracle faces is that by verticalizing its cloud applications, some industries are more insulated than others because structural reforms may be needed attested by the forays of such entities as ABB Power Grids, IBM Watson Health and even GE Digital to expand into industry-specific software all ended with disappointing results.

Hence, the time-honored tradition of running different Global Business Units has worked to the advantage of Oracle after buying slew of industry-specific ISVs including iFlex for banking, Micros for Retail and Hospitality and now Cerner for healthcare, leaving much of the business practices and existing applications intact, according to Mike Sicilia, executive vice president of Oracle’s global business units.

Sicilia added that Oracle has no plans to change the delivery model of its GBUs.