Buoyed by its recent acquisition of NetSuite, Oracle posted robust sales of Cloud products in its latest quarter on the strengths of signing new customers to run its Human Capital Management applications and its new Cloud database.

For the second quarter of its fiscal 2017 ended November 30, Oracle said its Cloud HCM applications sales spiked 131% after signing 436 deals including more than half from new customers, while its Database As A Service saw a 700% increase during the quarter resulting in a $100 million+ business per quarter. In addition, Oracle’s latest database release 12.2 has just become available in the Cloud.

Oracle’s soaring HCM applications sales are consistent with our survey results compiled for the upcoming HCM Top 500 Market Report, which focuses on the world’s 500 largest HCM applications vendors split by 22 functional segments. Oracle is ranked No. 1 in the Applicant Tracking segment based on its Cloud HCM product revenues.

Despite strong sales of HCM apps and a steep ramp of its Cloud database, Oracle’s 2QFY17 results were uneven at best, an attribute that appears to be spreading across the enterprise applications market.

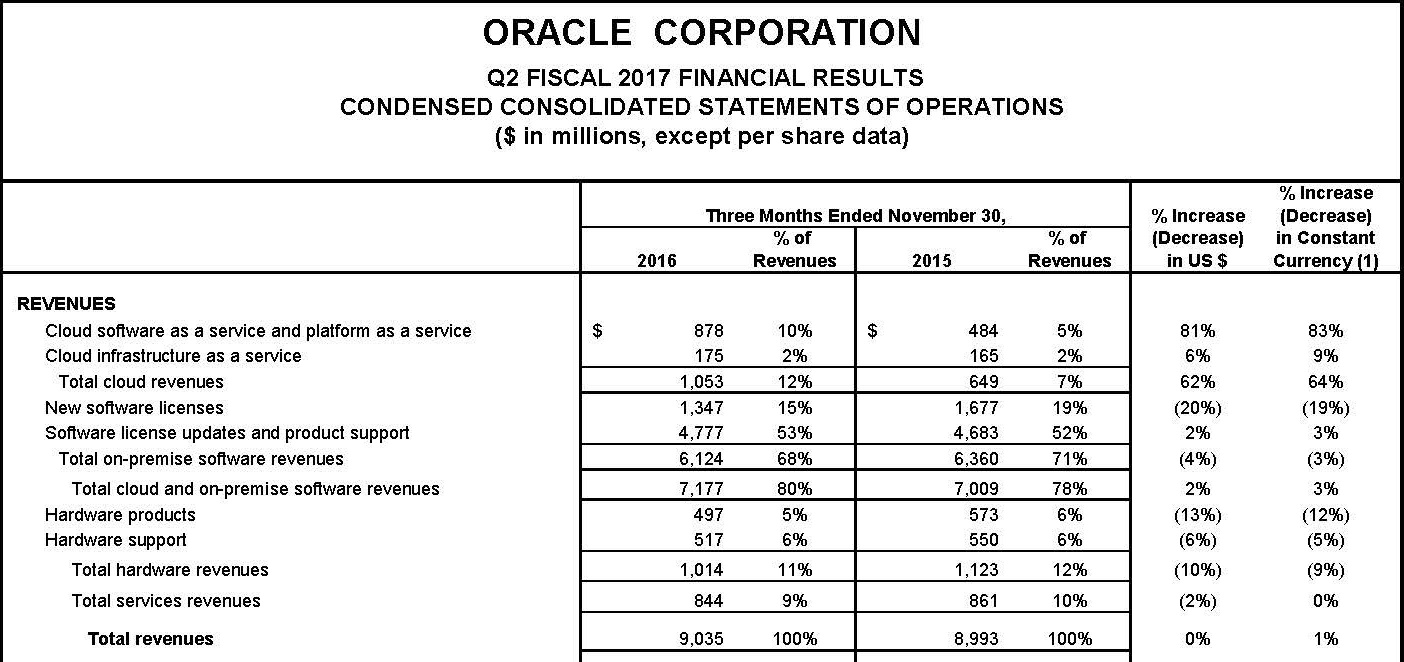

On the upside, Oracle posted 81% jump to $878 million in Cloud applications and platform products during the quarter. Oracle’s 2QFY17 results included 18 business days or about $56 million in incremental Cloud apps revenues following the November 7 purchase of NetSuite, which had averaged $3 million every business day in Cloud subscription revenues in its last quarter prior to its purchase by Oracle. After removing $56 million from its top line in 2QFY17, Oracle’s Cloud apps and platform revenues for the quarter went up about 70%.

Citing adverse impact from a strong dollar, CEO Safra Catz offered a somewhat cautious guidance for the current quarter, suggesting that Oracle would post in the range of 82% to 86% growth for SaaS and PaaS revenues.

Potential Deceleration

If that prevails, Oracle’s 3Q17 results would mean an organic growth of no more than 45% on top of about $165 million in incremental Cloud subscription revenues expected from NetSuite, the same amount that NetSuite posted in its fourth quarter of 2015. It is typical that a certain amount of Cloud subscription revenues from the acquired company would not be recognized for accounting reasons.

Oracle’s projected organic growth of 45% in Cloud apps and platform sales for the current quarter pales against the 77% jump it posted in the first quarter of fiscal 2017, or an estimated 70% increase for 2QFY17.

Compounding the possible deceleration is the fact that Oracle’s software license revenues plummeted 20% to $1.3 billion in the latest quarter, the sharpest contraction that Oracle has seen since the financial crisis of 2008. Oracle Financial Services Software Ltd., the former iFlex division that specializes in banking applications, posted a 31% drop to $11 million in license sales in its latest quarter, the biggest quarterly decline in two years.

Catz reiterates that the above-average performance in its Cloud apps and PaaS sales will more than offset its license revenue declines. Furthermore she predicts the upside of its Cloud growth will more than make up any potential slip in its cash cow maintenance business, which could manifest itself once its license revenues stop growing. Larry Ellison, chief technology officer of Oracle, said he would not be concerned about that because its database customers will continue paying for support regardless of how and where it will be hosted even when they are accessing that over the Cloud.

Another pocket of softness lies in Oracle’s CX offerings, which grew 15% organically during the quarter. By comparison, the Marketing Cloud from Adobe, which also posted quarterly results simultaneously as Oracle, saw a 32% jump. Mark Hurd, CEO of Oracle, said Oracle Cloud Services apps sales rose 24% during the quarter. By comparison, Salesforce posted a 26% jump in its Service Cloud operations in its latest quarter.

The uneven results from Oracle were not different from other enterprise applications vendors. Xactly’s stock took a beating after reporting losing two seven-figure deals in its latest quarter, despite posting a 26% increase in Cloud subscription revenues for its sales performance management applications. Similarly, Verint, which offers workforce management apps for call centers as well as cyber intelligence services, were below analyst forecasts when it reported its results earlier this month.

That followed the same kind of blemish that soured the outlook for HCM apps vendors Workday and Cornerstone OnDemand when they expressed caution in light of recent volatility in Europe and the Americas because of Brexit and the US election, respectively.

With heightened volatility, many enterprise applications vendors could face stormy conditions for an extended period of time when things that used to be sure bets no longer apply. With the incoming administration that calls for the repeal of a number of legislations including the Affordable Care Act, Athenahealth, which specializes in healthcare enterprise apps, said during its recent investor summit with a slide that proclaims “Government mandates are evaporating and becoming less significant.’’

When the law of the land is changing, a new era of selling technology products, or anything for that matter, may be the new order of the day.

Oracle’s Catz is poised to make her stance heard regardless of which way the market turns. For one thing, Catz has been named by president-elect Donald Trump to join the executive committee of his transition team while still keeping her job at Oracle, according to press reports.