Oracle’s decision to acquire NetSuite underscores the growing importance of Cloud applications to its future, or the legacy of its 71-year-old co-founder for that matter. However the benefits of the $9.3-billion purchase for Oracle, NetSuite’s customers and its partners are far from clear.

With another audacious move, Oracle co-founder Larry Ellison, whose family trust owns nearly 40% of NetSuite stock, is coming full circle by turning one of his earliest bets on the Cloud into a full-time preoccupation of his company.

In many respects, Oracle’s purchase of NetSuite serves as the reminder of the impeccable vision of Larry Ellison. The man who helped popularize relational database has always been a believer of the Cloud, even though the path to Oracle’s successes in the Cloud may still be a work in progress.

Still, after buying NetSuite, Textura and oPower in 2016, Oracle will have more than 40,000 Cloud apps customer organizations. The collective Cloud applications revenues of the four including Oracle exceeded $2.6 billion in 2015, compared with $2.56 billion for the No. 2 vendor SAP, as shown in the following exhibit.

Exhibit 1: Top Four Cloud Applications Vendors And Their 2015 Cloud Apps Revenues

| Vendor | 2015 Cloud Apps Revenues | After Recent Acquisitions | 2015 Cloud Apps Revenues |

|---|---|---|---|

| Salesforce | 5171 | Salesforce + Demandware | 5271 |

| SAP | 2568 | SAP | 2568 |

| Microsoft | 2455 | Microsoft + LinkedIn | 2959 |

| Oracle | 1837 | Oracle+NetSuite+Opower+Textura | 2619 |

Source: Apps Run The World, July 2016

Diamond In The Rough

In 1998, NetSuite was co-founded by Evan Goldberg under the name NetLedger and Ellison became one of its original investors. Back then, Ellison spent a tiny fraction of his wealth and energy on the Cloud, which at one point was lumped together with buzzwords like Applications Service Provisioning, On-Demand Computing, Online Services, Applications Management Services and Hosting Providers.

The enterprise apps marketplace was led by an array of established and startup vendors from SAP to Oracle as well as Ariba and Commerce One still delivering software the conventional way. Simultaneously, the likes of Corio and USinternetworking were banking on software rental, hosting and provisioning as the business of the Cloud continued to evolve. In those days, the software business was primarily rooted in license and maintenance sales.

Ellison often dismissed these trends insisting that Oracle already had a good grasp of the Cloud with breakthroughs from unbreakable database to network computer and more recently engineered systems. In his view, whoever controls the stack – from hardware to middleware and from database to applications – will end up the winner. Indeed, the fate of many apps vendors was inextricably linked to Oracle because more often than not their products would be based on Oracle databases.

Meanwhile, highfliers like Ariba started feeling the squeeze as one-to-one engagements(primarily implementing Web-based applications on a singular basis without the use of a shared infrastructure) went out of favor, forcing them to shift their business models by developing a more stable recurring revenue stream at the risk of undermining their license and maintenance revenues. It took years before Ariba, Concur, Ellie Mae and others transformed themselves into full-blown Cloud apps players.

Salesforce.com, NetSuite and more recently Workday became the poster children of Software As A Service and cloud apps as both terms have become interchangeable. In 2003 NetSuite took on its current name from NetLedger as it began to expand beyond financial management apps by adding complementary modules. Its first salvos included buying OpenAir and QuickArrow for professional services automation. Other acquired products included RetailAnywhere, Venda and Bronto for eCommerce, OrderMotion for Order Management, eBizNet for SCM, TribeHR for HR and IQity Cloud for manufacturing. The mission was to offer a suite of Cloud apps that would support both back-end administrative functions as well as customer-facing systems and touchpoints from kiosks to mobile devices.

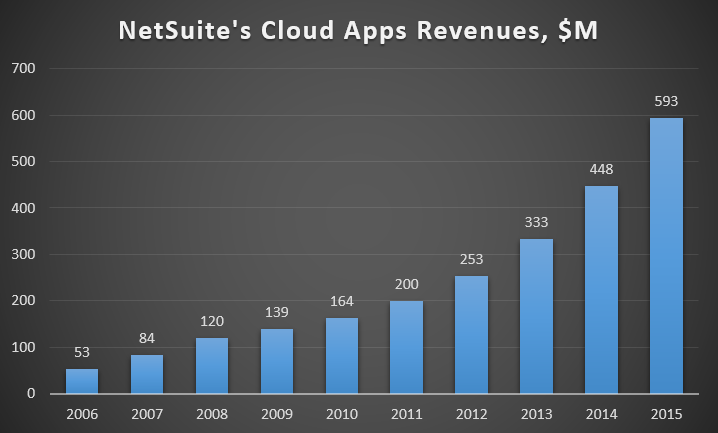

As the following exhibit demonstrates, the steep rise of NetSuite legitimized the value of the multi-tenancy capabilities of its applications with an one-to-many approach that sits on top of a shared infrastructure emerging as the preferred method for massive distribution of business applications. From the beginning vendors like NetSuite and Salesforce have been pricing their apps per user per month, generating dependable subscription revenues that prove to be scalable over time.

Exhibit 2 – NetSuite’s 10x Growth In A Decade

In 2004, Oracle embarked on its buying spree by picking up PeopleSoft for $10.3 billion, followed by a string of purchases including Siebel in 2005, Hyperion in 2007, and Micros in 2014. The total tab exceeded $20 billion.

Despite the heavy investments, its core applications license sales have been slipping for the past few years because of structural changes to the marketplace as many of its customers have abandoned conventional software implementations, the very products that Oracle has been accumulating in hopes of selling more databases. For its fiscal 2016 ended May 31, software license revenues fell 15% and maintenance fees, which accounted for nearly half of its total sales of $37 billion, were flat.

The NetSuite purchase is a testament to how the Cloud has changed the mindset of legacy vendors like Oracle, which still counts maintenance fees for the bulk of its recurring revenues. The question is when and how such recurring revenues will recede or even collapse because of shifting customer preferences. Oracle’s major Cloud purchases including Eloqua, RightNow, Taleo, Textura and oPower recently, and now NetSuite are all designed to mitigate future losses of those maintenance revenues.

Altogether, Oracle’s cloud apps sales jumped at an estimated rate of more than 40% in its fiscal 2016. During the latest earnings call, Oracle emphasized its Cloud momentum by the closing of 1,640 Cloud apps customers, resulting in a total installed base of 12,000. Additionally, Oracle has an estimated 50,000 on-premise apps customers.

Increased Customer Intimacy

By comparison, NetSuite is used by 10,000 companies covering over 30,000 subsidiaries and entities. There are many overlaps between Oracle and NetSuite. Land O’Lakes, for example, is a long-time customer of Oracle running demand planning apps(formerly Demantra) as well as Oracle JD Edwards Enterprise One apps for manufacturing, order management, financial management and plant maintenance. In 2010, Land O’Lakes deployed Enterprise One for its dairy business. In 2012, the company announced plans to adopt NetSuite OneWorld for its US subsidiaries as well as joint ventures in US, Mexico and China. As a result, the combination of Oracle and NetSuite is likely to result in greater mind share among its installed base.

However it’s not clear whether that would translate into incremental revenues given the fact many of these projects have been approved and implemented separately – Oracle on the client-server side and NetSuite in the Cloud. A tighter integration between the two would be necessary in order to ensure the data from one system would flow directly into the other or vice versa, a bridge that could drive better workflow and greater visibility into one’s global operations.

Based on our regular surveys of over 100,000 end users including over 5,000 running NetSuite, the vendor tends to do well in the midmarket by targeting customers with anywhere between $25 million and $250 million in annual revenues. These customers typically pay about $25,000 in annual subscription for an assortment of apps from NetSuite. About 12,000 of these customers account for more than half of its installed base. For Oracle, the NetSuite purchase will mean better access to these midmarket customers, which are likely to grow in size resulting in more complex apps requirements.

Over the past few years, NetSuite has found increased successes with bigger firms like 3M, JCPenney, Land O’Lakes, Motorola, NCR, Qualcomm, Shaw Industries, and Valeant Pharmaceutical selling them its OneWorld product. There are an estimated 1,000 of these customers that pay an average of $100,000 per year in subscription to OneWorld and other products. Some of them may be running Oracle or SAP at the headquarters with NetSuite being used at the subsidiary level. Our assumption is that the NetSuite purchase would have little impact on Oracle’s ability to completely convert these customers to its fold due to a range of multinational support and technology infrastructure issues.

NetSuite remains heavily entrenched in English-speaking countries with North America, UK and Ireland representing more than 80% of its revenues. In order for NetSuite to provide country-level support and legislative updates across Europe and other regions, much of that may have to come from its partners.

Another issue lies in the extensive partnership with Microsoft, incorporating products like Azure, Office 365, Azure Active Directory into NetSuite’s offerings. NetSuite also relies heavily on a group of Cloud providers including CenturyLink, AWS, Rackspace and VM Farms to host many of its core and acquired products, according to our latest Cloud Top 500 market report. It could take years before NetSuite can unwind these long-term hosting arrangements.

Equally daunting is the task for NetSuite to start leveraging the growing Cloud footprint of Oracle. The economy of scale that Oracle aims to achieve by expanding its Infrastructure As A Service and Platform As A Service(primarily its Cloud database 12c) offerings may not be compatible with the direction NetSuite has set when announcing the deal with Microsoft in 2015.

As a result, chances of converting NetSuite customers to the all-Oracle stack are not only slim, but also impractical as Oracle aims to drive more customers to its Cloud to spread its rising costs(which soared 49% in its fiscal 2016), rather than its traditional on-premise products like JDE Enterprise One.

Future of Partner and HR Strategies

Over the past few years, NetSuite has transformed itself from one that primarily relied on direct sales to a more channel-friendly organization. NetSuite resellers, many of which used to represent Microsoft Dynamics, Sage, SAP and others, reported to us that they have been drawn to its generous discounts in the range of 55% off list, the nimbleness of its culture and its increased commitment to the channel.

Indirect sales now account for 20% of NetSuite revenues, up substantially in dollar terms over the past few years. Some resellers said they now average over $1 million each in NetSuite product sales annually. The challenge for NetSuite is to start mapping out migration plan to Oracle’s sprawling channel organization. NetSuite may run the risks of alienating some of these partners, especially those that have already been turned off by the ever-shifting channel programs from the large vendors, an annual ritual that sometimes pits one set of resellers against another.

Another issue that could complicate the NetSuite purchase lies in its HCM strategy, which started off with its 2013 purchase of TribeHR for a set of low-end core HR apps. Then came the 2015 alliance with Ultimate Software under which they refer leads to one another. The partnership is gathering momentum. In the first half of 2016, Ultimate attributed 12% of its new bookings to its referral relationship with NetSuite, compared with 5% in 2015.

NetSuite’s HCM strategy with TribeHR and Ultimate Software could founder as Oracle has made unseating rivals like SAP SuccessFactors, Ultimate and Workday its top priority by building out a comprehensive portfolio of on-premise and Cloud HR apps. To let anything other than Oracle HCM Cloud to succeed would almost border on heresy.

Regardless of the outcome, it’s fair to assume that Ellison, prior to his retirement, would rather be known as the visionary who foretells the Cloud impact as he seizes every opportunity possible to claim leadership in a market that could redraw the competitive landscape for decades to come. And that may well be Larry’s true legacy.