The proposed $8.3 billion purchase of Concur by SAP underscores the ERP applications vendor’s desire to create a balanced portfolio of well-established Cloud properties, mitigating the erosion of its traditional way of selling on-premise software.

The deal was significant both for its size and timing. Given the run-up in the Concur stock over the past few years, SAP is paying a 20% premium over an already rich valuation of more than $6 billion. In its press release, SAP said the enterprise value was about $8.3 billion, while it was paying $129 a share for Concur’s 56.87 million outstanding shares, or about $7.3 billion.

By comparison, SAP paid $4.5 billion for Ariba for eProcurement applications in 2012 and $3.4 billion for SuccessFactors for Human Capital Management applications in 2011. More recently SAP paid a reported $1 billion for Fieldglass for services procurement applications primarily in the vendor management system space.

All these deals came at a time when SAP increased investments to boost its Cloud product portfolio in order to offset the decline in its traditional software license revenues, which dropped 4% for the first half of 2014.

With the purchase of Concur, SAP is expected to boost the number of Cloud applications users to 50 million. About 30% of Concur’s 23,000 customers are running their travel and expense management applications along with their ERP systems from SAP. Despite Concur’s No. 1 position in the travel and expense management applications market, there are plenty of opportunities for SAP to extend its lead, leapfrogging best-of-breed TEM vendors like ExpenseOnDemand, KDS Expense, and Spendvision, not to mention ERP vendors like Oracle and Infor, which sell expense management applications as part of their ERP offerings.

The combination of Ariba for automating the procurement of goods and services through its Ariba Network, and Concur’s TripIt for travel booking will create one of the largest business networks handling more than $600 billion in B2B and B2C transactions every year. When commenting on the deal during the analyst call, Bill McDermott, SAP chief executive, boasted that the volume of the SAP business network would be bigger than that of eCommerce heavyweights like Alibaba, Amazon and eBay combined.

One of Concur’s biggest customers is the General Services Administration of the US government under the ETS2 contract that it won in 2012. The contract, which is shared with the travel management company Carlson Wagonlit, allows Concur to provide public-sector employees access to travel and expense management applications and services such as online travel booking, travel authorizations, and voucher processing. Concur projected the ETS-2 contract could generate up to $1.4 billion in revenues through the next 15 years.

In 2014 Concur is expected to yield more than $700 million in total revenues, or at least $616 million in Cloud subscription revenues. That means the addition will provide SAP with the third leg of its Cloud applications strategy beyond the healthy recurring revenues that it already gets from Ariba and SuccessFactors.

Over the next 12 to 24 months, the bulk of SAP’s Cloud subscriptions revenues – projected to top $2 billion in 2015 – will come from three sources with Concur likely contributing the biggest share and SuccessFactors and Ariba splitting the rest. The Concur acquisition also means that SAP will be one step closer to its stated goal of hitting $3.9 billion in Cloud subscription revenues by 2017. Furthermore, SAP is counting on Concur to close in on its biggest target – Salesforce.com.

Last year, the total Cloud subscription revenues for SAP and Concur would catapult the combined entity to a solid No. 2 player behind Salesforce.com, which remains ahead of the pack by a wide margin, as shown in the following table.

Top 10 Cloud Applications Vendors by 2013 Cloud Subscription Revenues and Market Share

Vendor | Market | 2013 Cloud Subscription Revenues, $M | 2013 Cloud Applications Market Share, % |

Salesforce.com | CRM | 3632 | 12.10% |

SAP + Concur | ERP, HCM, eCommerce | 1539 | 5.10% |

Microsoft | Content, Collaboration | 1360 | 4.50% |

Oracle | CRM, HCM, ERP | 1021 | 3.40% |

Adobe | CRM | 901 | 3.00% |

AthenaHealth | Healthcare | 460 | 1.50% |

IBM | CRM, HCM | 425 | 1.40% |

Workday | HCM, ERP | 337 | 1.10% |

Ultimate Software | HCM | 334 | 1.10% |

NetSuite | ERP | 334 | 1.10% |

Source: Apps Run The World, August 2014

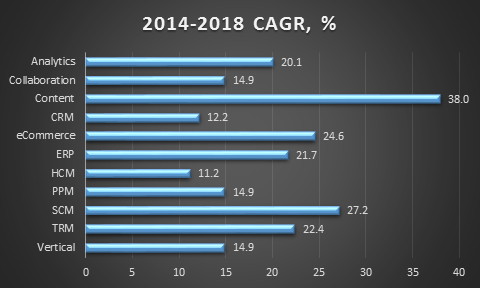

However, Salesforce.com’s lead could be erased further as its biggest product segments Sales Cloud for sales force automation and Service Cloud for customer service and support automation were only logging single-digit growth sequentially, compared with much smaller marketing automation and mobile categories, which saw 10% growth. Salesforce.com also faces the prospects of decelerating growth in its core CRM market because of the law of the big numbers. Based on our most recent forecast, the Cloud-based CRM applications market is projected to grow at a compound annual growth rate of 12% through 2018, compared with 25% for eCommerce and 22% for Cloud-based ERP, which encompasses financial management capabilities including travel and expense management, as shown in the following graphic.

Cloud Applications Market Forecast By Product Category

At SAPPHIRENow in June, I suggested to SAP executives that it would need to make bold moves in order to expand its Cloud sales before its declining on-premise revenues became too much of a drag on its top line. My suggestion was that either SAP had to expand its Cloud product portfolio by making significant acquisitions rapidly or face the consequences of tumbling software license sales that could lead to severe cuts to its operations.

Based on our extensive study of the world’s 500 Cloud applications vendors, the options for SAP were limited. Either it had to grow its Cloud business fast, or risk downsizing the entire company to the point of irrelevance. And there would be no middle ground because neither its investors nor customers have the patience for middling performance from SAP in a fast-changing marketplace exacerbated by the move to the Cloud and mobile.

After the SAP customer conference, I stepped up the rhetoric by penning a piece that presented a critical view of SAP’s Cloud strategy, which garnered plenty of attention both within SAP and outside the company. You can read it here.

Whether SAP’s top brass heeded my advice was beside the point. What mattered was the fact that SAP executives sprang into action by pursuing some of the biggest Cloud properties and setting their sight on Concur, the leading Cloud vendor for travel and expense management applications.

Coupling the audacious move with the largest acquisition in its history, SAP is easing concerns from skeptics – myself included – by putting the Cloud as its No. 1 priority while shedding its past with conviction.