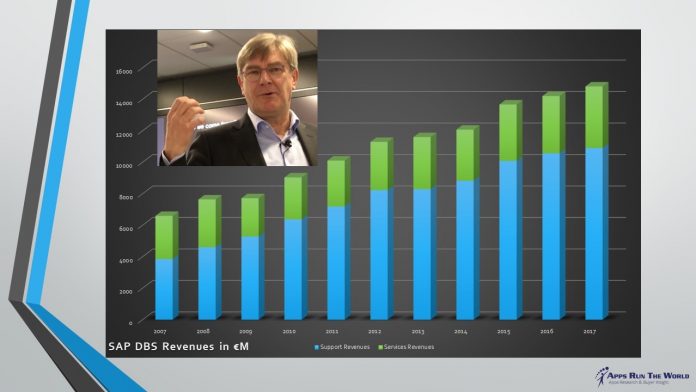

Despite having an incumbent advantage that earns SAP nearly €15 billion in maintenance and services revenues, the No. 1 Enterprise Resource Planning applications vendor is wasting no time to shore up its services and support operations.

Under the SAP Digital Business Services (DBS) umbrella, the operations have been devising new ways to modernize its installations, automate the support function and improve the value quotient, all in the hopes of making the service business stickier than ever.

During an analyst event in July, SAP DBS executives laid out their vision of remaking service and support delivery against the Intelligent Enterprise slogan, which aims to help companies digitize their back to front-end processes by leveraging an extensive portfolio of onpremise and Cloud software from SAP, along with the full involvement of its services and support operations.

The DBS strategy review forms the basis of this two-part series that examines how leading ERP vendors such as SAP and Oracle are transforming their service and support operations at a time when customer expectations of the long-term value of their enterprise software are changing. You can view the first part here.

In addition to increased competition from third-party support providers and many other Cloud vendors, SAP DBS faces some unique challenges including a sprawling installed base that spans across the globe with multiple ERP instances often found within a single organization that could take years if not decades to reorganize.

Michael Kleinemeier, who runs DBS as member of the nine-person SAP executive board, said because of its familiarity with the software landscape of its customers, SAP has the unique advantage of harmonizing and standardizing different business processes and the underlying master data (ERP for back office and CRM for front office, for instance) that are converging at rapid pace.

Unlike its counterparts in the Cloud business and product development, SAP DBS is primarily involved in servicing, implementing and supporting those products like S/4 HANA, C/4 HANA and SuccessFactors that have been sold. In other words, the entire company rests on DBS to make sure things are working as advertised.

SAP DBS has about 19,000 employees, including 8,000 dedicated to software support and more than 1,000 for new services offerings like Leonardo. The professional services component makes up the rest. SAP also works closely with outside systems integrators and consulting firms such as Accenture.

During the analyst event, SAP DBS announced a number of new initiatives including the new MaxAttention, its premium offering that spans from architecture planning to innovation services and from security strategy to platform as a service. More enhancements are being added to its new Chief Customer Office campaign to drive customer care as well as tweaks to its Enterprise Support with a forthcoming Cloud-based application lifecycle management tool.

Additionally, SAP DBS is experiencing increased traction with its artificial intelligence-based customer support capabilities such as machine-generated translation in languages like Brazilian Portuguese and Japanese for SAP Notes and Knowledge Base.

A Safety Net For All

SAP DBS has three things working in its favor.

- Backing up tens of thousands ERP customers with varying needs, DBS acts not just as their first line of defense against system outage, but also the nerve center that mitigates different risks and risk profiles associated with compliance requirements, software updates and upgrades, as well as an assortment of incident management and support cases. Additionally, SAP is able to provide proactive advice and guidance based on customer usage and deployment patterns against benchmarking business and IT KPIs, while recommending support and services elements for further improvement.

- It’s that kind of all-encompassing reassurance that DBS can offer to a mix of companies that all have something in common being part of SAP user community, but their use of SAP is anything but identical. Exxon may be one of the SAP’s biggest ERP customers, but its uptime requirements and support cases covering six instances of SAP are different from those like drug distributor AmerisourceBergen or utility CenterPoint Energy, according to DBS executives.

- Compared with Exxon that has a huge global footprint, both AmerisourceBergen and CenterPoint Energy are primarily concerned about a single system often found in one data center. However, AmerisourceBergen’s SAP instance has grown to be an 85 Terabyte system with a throughput that processes two to three million items at high speed. Meanwhile, CenterPoint Energy’s SAP is now running 500 million events per second, allowing for nearly zero downtime when it runs SAP for tasks like energy trading. It’s up to SAP DBS to ensure all three are being sufficiently supported regardless of their differences.

SAP DBS Extends Through Co-Innovation

In 2018, SAP DBS is banking on co-innovation with 150+ customers to ensure their needs are being met, especially those that are pursuing a whole host of digital transformation initiatives covering S/4 HANA adoptions, Leonardo services and SAP Cloud offerings in order to sustain their growth.

At the analyst event, DBS executives like Maggie Buggie, senior vice president and global head of SAP Leonardo Services, detailed a series of these digital-first projects from the likes of Continental Tires, Mercedes Benz, National Health Services, Philips Lighting, Queensland Government, Tomorrowland, and others.

Striking a range of partnerships to optimize and consume Leonardo services, these companies layer their own domain expertise and insights on top of off-the-shelf SAP solutions and made-to-order professional services from SAP DBS with the goal of setting a new agenda and redefining the entire industry in some cases.

For example, the Leonardo project at Tomorrowland involves the collaboration and co-innovation of the chief digital marketing officer of Tomorrowland, Global Head Partnerships, a smattering of digital and interactive agencies as well as data scientists at SAP DBS. Their mission is to transform and commercially scale Tomorrowland from an event-based music centric brand into a broader lifestyle brand by leveraging an ability to influence a global audience having already attracted over 720 million followers across all media platforms – including 200 million+ unique visitors annually and over 1 billion points of contact and impressions on social and online media – in addition to hundreds of thousands of actual attendees at its musical venues, according to Buggie.

The recent implementation of SAP Cloud at Microsoft is another example of co-innovation at work using a combination of technologies and services from all parties involved. By migrating from onpremise SAP HCM to SAP SuccessFactors for core HR with plans to onboarding, the 230,000-strong Windows developer aims to transform its onboarding processes for its employees and new hires. Also, it hopes to determine whether onboarding successes will result in better retention or compress the number of days to get new hires to become fully productive. Combining SAP SuccessFactors and SAP DBS Value Assurance for Cloud Solutions, in conjunction with Accenture and Microsoft, the project underscores a team collaboration to ensure the implementation project follows best practices, proper cloud methodology, and a balanced governance model.

After rolling out SuccessFactors successfully in Sweden, Norway and Canada, Microsoft will expand it into a global HR transformation project modeled after the SAP DBS Value Assurance framework across all 109 countries where it operates.

Customer Experience A Top Priority

SAP DBS is both the frontrunner that helps determine success for any new implementation and sometimes the last resort to correct mistakes. Over the past year, SAP has been moving aggressively to address its shortcomings through the Chief Customer Office program, which seeks out dissatisfied SAP customers to help them turn things around.

During the analyst event, executives from mushroom and can producer Giorgi Global Holdings and other midmarket companies revealed how DBS’ special attention to rectify failed implementations and underutilized SAP products in the past had won them over. It’s as if SAP DBS were finally placing them in front of the queue in order to help them realize the benefits of optimizing SAP products despite the fact that both have been long-time customers of SAP.

While these midmarket customers were not considered household names, the fact that SAP DBS was able to put them under a special program to address pre-existing problems (SAP CRM and Business Warehouse in one case and limited engagement as in Giorgi’s assessment of its previous relationship with SAP) underscores the extent of its customer outreach, something that is being reiterated by Kleinemeier and other executives as the linchpin to how DBS can make a difference – innovation through better customer experience.

Overcoming Unique Challenges

Amid massive technology changes in the marketplace, SAP DBS serves as a stabilizing force preoccupied with renewing customer maintenance contracts and bolstering engagement with customers through onpremise and Cloud upgrades and purchases. It also faces challenges that are unique to SAP’s software heritage.

While DBS executives suggested that progress has been made to make it easier than ever for existing ERP customers (98% of them are on ECC) to adopt S/4 HANA, it’s not clear whether one division of any given customer would choose to upgrade while leaving other systems largely intact. For example, Exxon may not be in a hurry to migrate its six instances of SAP to S/4 HANA all at once and even at that it could take years.

Not all SAP DBS executives are a patient bunch. Tom Janoshalmi, head of strategy and portfolio of SAP DBS, said the new Integration Content Advisor, which became available in February 2018 as part of S/4 HANA, specifically addresses the data integration challenge of many SAP customers wanting to upgrade to the new ERP system in an accelerated fashion.

DBS accelerates customer journeys to the new digital core, SAP S/4HANA. For example, SAP Model Company allows customers to explore in a live SAP S/4HANA system that can be set up in a cloud infrastructure environment in hours. With the Model Company approach, paper-based blueprints are replaced with end-user experience from day 1. Crowdsourced knowledge and machine learning tools are also available to accelerate integration. One of these tools is the Integration Content Advisor (ICA) designed to accelerate every interface implementation, to learn continuously and to reduce efforts by 60% or more.

In the past, competitors would circle around the SAP ERP installed base with what they called Surround SAP strategy, trying to peel off disgruntled customers or others that had no shortage of SAP shelfware. Now SAP is surrounding itself with a growing number of acquired Cloud applications from Ariba to Concur and from SuccessFactors to the most recent Coresystems.

Back then, SAP DBS or its predecessor only had its core systems to worry about. Now it has many different Cloud products to service, support and stay ahead of the competition in terms of optimizing customer experience. For SAP DBS, keeping a consistent customer experience across all these products may turn into a moving target.

Then, there are the third-party support providers like Rimini Street and Spinnaker Support that have made a bundle selling cut-rate support and services for a range of enterprise software products from Oracle to SAP and more recently Cloud products like Salesforce.

SAP said it is not concerned about third-party support given the broad range of services from SAP Support including adequate updates, upgrades and patches embedded in an automatic upgrade path, which is only available from SAP; and provision of application lifecycle management tool SAP Solution Manager that is not accessible without SAP Support.

Customers not under maintenance will also miss next-generation support capabilities such as Expert Chat, Schedule an Expert service, built-in support or AI-driven support engagements and interactions based on best practices from tens of thousands of customer cases. Cloud customers using third-party support providers also risk giving up continued access to the systems and their daily updates often done in the background. Plus they might end up paying more as their cloud subscription fee will not disappear.