The big SAPPHIRENOW conference ended on a high note with Jennifer Lopez as headline entertainment and a fitting tribute to the new chapter of SAP as the vendor capitalizes on the multiplicity of a global brand, not too different from what J. Lo has been able to accomplish.

J. Lo is a singer, dancer, fashion designer, TV host, and movie star with a huge fan base(Twitter lists her having 32 million followers). SAP, which used to be known for its enterprise applications, now embodies platform, Cloud, database and business network – not to mention other buzzwords that pervade its product portfolio from analytics to mobility and from Industry Cloud to Internet of Things. SAP now claims 80 million Cloud subscribers.

Multiple personalities were on full display at SAPPHIRENOW with key themes revolving around its new ERP suite S/4HANA and HANA Cloud Platform in addition to a host of Cloud applications either acquired or developed internally. SAP Business Network, for example, was in the spotlight following the inclusion of Concur and Fieldglass, both of which were acquired less than a year ago.

Much of its keynotes was devoted to its core products like ERP and platform strategy, extending the reach of SAP HANA, the in-memory database product now emerging as its crown jewel.

The genesis of SAP’s different traits stems from decades of product development efforts in the ERP market – mostly Financials, Core HR, Sales & Distribution as well as integration software. For the past five years, its product strategy has been largely shaped by SAP HANA, the in-memory database that has captured the imagination and ultimately fulfilled the vision of delivering database with zero response time. That results in crunching large amounts of data at lightning speed because it does not require tapping into a traditional disk-based database thanks to the latest hardware technology.

SAP kept extending the HANA brand with other advances including the launch of HANA Cloud Platform last year, its major foray into the Platform As A Service business competing with the likes of Amazon Web Services and Microsoft Azure.

HCP also offers features like HANA Cloud Integration, which can be traced back to PI, or Process Integration for hard-wired point to point software connectivity using SAP Web Application Server. The difference is that it can now leverage the Cloud as the transport mechanism, or what the general public can do by using the Internet for making Voice Over IP calls from point A to point B and vice versa. SAP Cloud integration enables different software packages to integrate business processes.

Why are HCP and HCI important? Because they are making it possible for ERP systems to extend themselves by moving data between on-premise and Cloud applications, while extending them to other Cloud services for added functionality. That attribute is expected to prevent SAP from falling victim to a large number of third-party Cloud applications that are threatening to loosen its grip on its enterprise customers.

With the advent of HANA, SAP’s priority quickly shifted to ensuring its ERP applications can withstand two seismic changes in the marketplace – explosive use of mobile phones, devices and the natural by-product big data ranging from structured ones(mountains of information about processes – think purchase orders and invoices), and unstructured data(videos and chats come to mind).

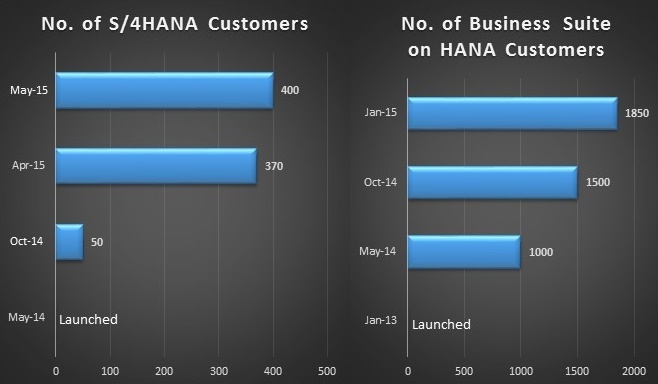

In 2013, SAP started putting its Business Suite on HANA and it quickly grew to more than 1,000 customers about 16 months later. At this year’s SAPPHIRE NOW, the excitement over Business Suite on HANA was shifted to S/4HANA, three months after its official launch in February 2015.

By the time SAP announced its first-quarter earnings in April 2015, it had already secured more than 370 customers. At this year’s SAPPHIRENOW, the number exceeded 400. At that rate, customer wins for S/4HANA could easily eclipse those of Business Suite on HANA.

It’s worth noting that the prequel of S/4HANA was Simple Finance, which was officially launched in June 2014 and became generally available three months later. In other words, S/4HANA has been selling for eight months to reach the customer count of 400 and change, as shown in the following graphic.

Source: Apps Run The World, 2015

At the conference, the value of S/4HANA was buttressed by the testimonials of half a dozen customers including DASA of Brazil, Florida Crystals, La Trobe of Australia and SAP itself that have gone live with S/4HANA – all running Simple Finance.

The first three have been SAP customers for the past 10 to 15 years. Florida Crystals, the sugar company with brands like Domino and C&H, was able to go-live in four weeks primarily because of considerable prep work including the use of Business Suite on HANA and Cloud hosting by Virtustream.

Another thing to keep in mind is that customers buying S/4HANA are often those that have already adopted Business Suite on HANA, which raises the question to what extent do these two products share common properties.

For starters, both take advantage of SAP HANA for speed and performance gains as well as the attractive User Interface called Fiori for greater usability. However in order to run Simple Finance, one must license the product separately. Through the third quarter, SAP is making available certain features like Accounting for free when they upgrade from Business Suite on HANA to S/4HANA.

Running Central Finance, another key feature of Simple Finance, in many cases could also mean implementing Simple Finance – in the Cloud or at the subsidiary level – without interfering their use of Business Suite on HANA. That kind of flexibility underscores SAP’s newfound flexibility, while reaffirming its commitment to innovation without disruption.

For many customers, it’s a safe bet to run S/4HANA especially among those that have invested heavily in different SAP applications from ECC(the current iteration of R/3) to Business Suite on HANA, as long as these customers remain committed to the SAP system landscape.

The brand extension of SAP ERP – from R/3 to ECC and from Business Suite on HANA to S/4 – is a continuum and as such the associated risks are kept to a minimum. If someone likes J. Lo’s music, one should feel the same for her talents on TV or in fashion expanding her fan base along the way.

Multiple Traits of HCP

HANA Cloud Platform, another focal point of this year’s SAPPHIRE NOW, carries multiple traits, not too different from the many roads all leading to S/4HANA.

Trait #1 is that it serves as the Cloud extension of S/4HANA. Seventy-five percent of S/4HANA customers – or about 300 – are expected to implement S/4HANA in an on-premise mode because of their preference of a controlled environment. However, in order for these customers to take advantage of other Cloud applications like SuccessFactors, their best option is to adopt HCP.

In the past some of these SuccessFactors customers might have run the Cloud applications for talent management, but they also happened to be SAP ERP customers. Their approach to access both would require using integration products like Dell Boomi or Mulesoft. HCP renders those non-SAP products obsolete.

Trait #2 is for HCP to capture the hearts and minds of developers that are providing add-ons to SAP Cloud applications like SuccessFactors, Hybris, Ariba and eventually Concur and Fieldglass. Their products need to be written for HCP in order to talk to these SAP Cloud applications.

Ditto for a growing number of Fiori applications that are being developed by ISVs that want to capitalize on the SAP’s vast installed base of 290,000 customers. Many of them are expected to start leveraging Fiori following SAP’s decision last year to make it freely available as part of their new or existing software license agreements with the vendor. A SAP executive puts it bluntly, “They can’t do Fiori apps on AWS.” In other words, HCP is the window to the SAP Cloud.

Trait #3 is for other ISVs such as NFL to develop its Fantasy Football League or Accenture selling JobPoint employee reward app on top of HCP because they align themselves with SAP’s value propositions in professional sports or human capital management, respectively. There are about 900 of these apps from several hundred developers.

In addition to these ISVs, enterprise customers like Siemens are also throwing their weight behind HCP because of its fit into their Internet of Things(IoT) strategy. Siemens is expected to leverage HCP as the Cloud platform to help its mining division capture sensor information deployed across trucks and other mine equipment. Other enterprises doing the same include CenterPoint Energy for harnessing HCP to gain asset-management insights from its 2.2 million intelligent meters that form its smart grid, as well as Tennant for enabling 4,000 connected cleaning machines via HCP.

SAP’s Steve Lucas(left) with HCP customers including CenterPoint Energy, Siemens, Tennant

Through scalable execution, HCP, according to some SAP executives, could be a $1-billion business in a matter of years. By comparison, Salesforce.com is on an annual run-rate of more than $800 million after a few years of building out its AppExchange and Salesforce1 platform for ISVs.

If S/4HANA is a manifestation of SAP’s multiple personalities in ERP, HCP is the hydrahead that could propel the vendor to leapfrog Salesforce.com or Microsoft Azure across multiple fronts because of the sheer size of the SAP ecosystem of not just 290,000 customers, but also an army of system integration and ISV partners.

Mocana, for example, is betting its mobile security offerings on the ecosystem by turning a hardware virtual private network appliance into a secure mobile platform for any corporation or ISV that aims to massively deploy SAP enterprise applications across different devices.

Additionally, SAP HANA has attracted more than 2,000 startups that are developing hundreds of market-ready solutions for different lines of business using the in-memory database as the engine. If these developers want to sell into the SAP ecosystem, supporting HCP will become a prerequisite.

Once that happens, HCP could become a pragmatic and sensible way for enterprises to make use of the hybrid Cloud by combining best-of-breed Cloud applications with their existing on-premise systems.

Show Biz vs Software Business

There is no business like show business with the making and flaming out of blockbuster hits from one sequel to the next. Software business is no less brutal and the brand extension that has worked well in the show business has limitations in the tech industry. Salesforce.com still makes most of its money from its Sales Force Automation applications and Oracle’s bread and butter remains its database.

With the advent of the Cloud, SAP’s brand equity could extend easily to platform, database, Business Network and other big opportunities like IoT. Still, SAP executives insist that what needs to happen is its ability to scale out its fledgling ecosystem to the point that matches the scope of something like Android, Microsoft or even Apple. Steve Singh, the former CEO of Concur and now head of SAP Business Network, said it will take at least 12 months before the three networks – Ariba, Concur and Fieldglass – can become integrated and realize certain synergistic benefits. Even when that happens, one has to question just what those benefits will mean for SAP customers.

So the search is on for the next big hit for SAP after halo effects of HANA start buoying the fortunes of products like S/4, HCP as well as other Cloud initiatives. As in show business, fortunes come and go in software(just ask i2, Lotus, or Netscape). SAP’s grip on its installed base – though steady and improving with recent successes like HANA – is not a sure bet given the seismic changes brought on by the Cloud and Mobility.

What remains unchanged is SAP’s uncanny ability to reinvent itself by sustaining the legacy of its ERP past by churning out more new hits – not too different from J. Lo’s constant reincarnation without batting her eyelashes.