On the last day of the huge SAPPHIRENOW conference, a trio of standup comedians appeared on stage lampooning everything under the sun with one suggesting SAP actually stood for Send Another Payment.

The joke drew laughter from the crowd, but it also raised the inconvenient truth that a dramatically different competitive climate had upended the dynamics between SAP and many of its over 250,000 customers that kept the vendor flush with increased revenues for much of the past 42 years. If SAP’s recent license sales drop is of any indication, some customers may not be sending the vendor another payment in the coming years.

The new competitive climate has prompted SAP to embark on a series of restructuring programs recently in order to revive growth to its core products and industries, which have been adversely impacted by the growing threat from thousands of vendors peddling competing applications via Cloud delivery.

Against the backdrop of the climate change, SAP kicked off its biggest annual customer conference hoping that the new management team as well as increased emphasis on simplicity and Cloud adoptions would ease customer concerns.

There were plenty of new product announcements including SAP Simple Finance, a complete Cloud-based finance system highlighting accounting, integrated planning and cash management product; and HANA Cloud Platform, a Platform-As-A-Service offering that extends third-party Cloud applications to SAP core products from SAP Business Suite for ERP to SuccessFactors for HCM all being supported by the in-memory database SAP HANA.

SAP received a big boost by touting more than 1,000 organizations including many net new clients have chosen to run SAP Business Suite powered by SAP HANA. The current customer count of SAP HANA has reached 3,376, compared with 3,200 in the first quarter of 2014 and 1,300 a year earlier.

SAP’s Cloud applications business also saw increased momentum hitting 37 million users, compared with 35 million it reached in early 2014. The May 2014 acquisition of Fieldglass for contingent workforce management added over 250 customers and more than two million Cloud users.

Run Simple Is New Mantra

Bill McDermott, who became the company’s sole chief executive after Jim Hagemann Snabe relinquished his co-CEO post in May, keynoted on the first day of the three-day conference vowing to revitalize SAP through accelerated innovation and product enhancements by improving usability and simplifying software deployment with the help of Cloud computing.

McDermott affirmed the need to instill the Run Simple message across SAP in order to help customers eliminate time-wasting procedures, forms and even one of the oldest ways for facilitating business transactions – bank checks.

The new positioning of SAP is not unique. Its chief rival Oracle has been jumping onto the simplicity bandwagon for a long time paying heed to customer complaints about its ballooning product portfolio and overlapping sales and marketing coverage.

SAP has done its part to simplify pricing including the move to offer at no extra charge under existing maintenance agreements for Fiori, its new user experience that has gained popularity with a tile look and feel that underscores the simplicity message by minimizing the number of key strokes in order to optimize end-user productivity.

Rob Enslin, president of SAP Customer Operations, added that the company has also simplified its pricing scheme, stopping just short of publicly releasing its price list on its website.

With many of the 25,000 SAPPHIRENOW attendees paying greater attention to Cloud software consumption than ever, SAP faced the delicate challenge of crafting a message that reaffirmed its commitment to the Cloud, while still sustaining interest of its current installed base of largely on-premise customers.

One of the recurring themes of this year’s SAPPHIRENOW was SAP Business Suite and how well it has been performing with the added power of SAP HANA. In other words, it’s the classic product that has helped put SAP on the map that matters, despite the buzz about Cloud migration, the coming of age of a mobile workforce as well as the extensibility of its ecosystem through partners like Adobe, eBay, HP and OpenText.

Make no mistake about it, SAP is acutely aware of the strategic value of new products such as its latest Cloud applications like SAP Customer Engagement Intelligence(leveraging its recent acquisition of KXEN) as well as Cloud enablers like Fiori that features a rich UX evoking emotion the same way toy-like online consumer services Facebook, Instagram or online games like Candy Crush are turning addictive. As the most successful software company in Europe, SAP proves that it can succeed in the Cloud as well. In 2013 SAP sold more than $1 billion worth of Cloud software subscriptions derived largely from SuccessFactors for talent management to Ariba for eProcurement.

Since its introduction three years earlier, the SAP HANA in-memory database platform has become an instant hit generating nearly $900 million in software revenues in 2013. More than 3,300 customers, including some that have never been exposed to SAP before, are now running the database platform to crunch massive amounts of data at lightning speed.

Falko Lameter, manager of IT operation of German-based air system manufacturer Kaeser Kompressoren, said with the use of SAP Business Suite primarily for CRM on SAP HANA, system management has become easier while business processes can be handled faster in such cases as the crunching of one million measurements per second during its preventive maintenance procedures.

So SAP should be humming along nicely with two new billion-dollar-plus businesses that have gained rapid adoptions in a short span of time, complementing its well-established business of selling business applications that have captured nearly a quarter million customers since its founding four decades earlier.

The New Competitive Climate

The inconvenient truth is that SAP faces an onslaught of competitors that have every intention to dethrone the vendor in scores of markets from analytics to verticals with Cloud software, open-source alternatives as well as shared services that are as convenient and easy to use as addictive online games. In many cases these apps are free to download gaining a critical mass of millions of users in just a few years. Eager to disrupt the status quo, this new crop of Cloud applications vendors have secured billions of dollars in public and private financial backing as well as a steady recurring revenue stream that makes most investors and software marketers salivate over their long-term potential.

The Cloud applications market has exploded as a result, soaring 85% from $16.4 billion in subscription revenues 2011 to $30.3 billion in 2013. On-premise applications revenues including license and maintenance fees fell 1% to $148.9 billion during the period.

(For additional coverage of SAP’s challenges and their implications for SAP customers, watch interview between ASUG and Apps Run The World’s Albert Pang as they discuss Cloud applications market trends on the show floor of SAPPHIRENOW).

Source: Apps Run The World, June 2014

It’s similar to the raging debate over climate change with extreme weather patterns becoming the new normal replacing predictable weather conditions prescribed by Farmers Almanac. All of a sudden, the traditional way of selling software has gone topsy-turvy. In 2013, both SAP and its long-time competitor Oracle saw dismal results. The former experienced a 3.7% rise in total revenues for 2013, but its license sales dropped 3%, while its lucrative maintenance revenues returned to a single-digit growth of 6%, its slowest increase in a decade.

Oracle, hamstrung by its audacious move to expand into hardware with the acquisition of Sun Microsystems, saw essentially flat sales in its fiscal 2013. For its past three quarters, Oracle was only able to muster a 3% revenue growth, despite spending billions of dollars in multiple acquisitions to shore up its Cloud and industry-specific products last year. It was as if these software stalwarts had fallen out of favor among their customers after years of wooing them successfully to fork over millions of dollars in license and maintenance fees in order to upgrade and replace their on-premise systems. The climate change has changed all that.

In this new competitive climate, SAP responded with a series of restructuring programs including laying off an undisclosed number of employees in May while reshuffling its executives to better meet its revenue target. After SAP’s purchases of SuccessFactors in 2011 and Ariba in 2012, it sought to retain executives such as Lars Dalgaard and Bob Calderoni, former CEOs of the respective Cloud vendors. Both left within the past year.

In May 2014 the revolving door continued with the abrupt departure of Vishal Sikka, the former chief technology officer and one of the key architects of SAP HANA, which underpins its ambitious database strategy to deny Oracle’s ability to collect revenues by supplying SAP customers with the database needed to run their applications.

There were other changes including Rodolpho Cardenuto now becoming the head of SAP Global Partner Operation after leading its Latin America operations. Bernd Leukert, who replaces Sikka, used to be in charge of on-premise application development specifically SAP Business Suite. Rob Enslin, a 22-year SAP veteran who has been promoted a number of times with added sales responsibilities, was appointed to the executive board as president of global customer operations.

While more personnel changes may be in the offing, one thing is clear. The McDermott reign at SAP will require implementing a series of bold and drastic moves in order to extend its leadership into new markets, while safeguarding its core all in the hopes of hitting its publicly-stated revenue target.

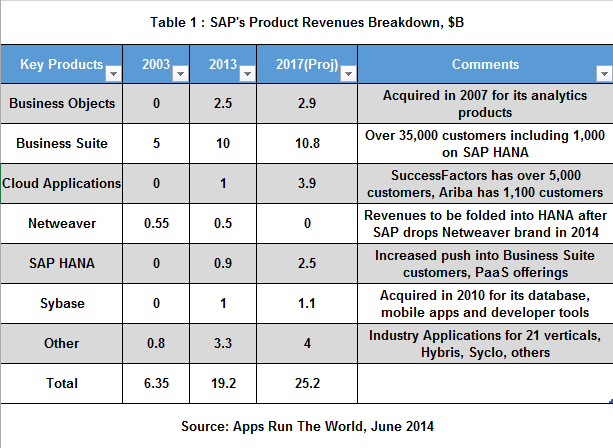

By 2017 SAP aims to secure about $30 billion in total revenues including $4.7 billion in total Cloud sales. Based on the performance of its Cloud division over the past five quarters, the 2017 target would translate into about $25 billion in software revenues including $3.9 billion in Cloud subscription revenues, after stripping out an estimated 16% of revenues in professional services.

As shown in following table, despite the breathtaking growth of its Cloud business and SAP HANA revenues, they accounted for about 10% of SAP product revenues in 2013, while its core SAP Business Suite represented more than half of its product revenues, primarily in the form of maintenance fees.

By 2017, SAP’s Cloud subscription and SAP HANA software revenues could make up as much as 25% of its product revenues, while the core SAP Business Suite could drop to 43%. But that was a far cry from its heyday of selling its Business Suite, which includes ERP, CRM, SCM and PLM applications for a variety of back-office and customer-facing functions, piling up both market and wallet shares by penetrating into some of its biggest accounts in oil and gas, discrete manufacturing verticals.

SAP’s corporate line is that by helping customers innovate around their business models with entirely new processes and services, SAP Business Suite revenues will grow, especially those coming from Suite on HANA regardless of whether they be on premise or in the cloud.

Past Performance

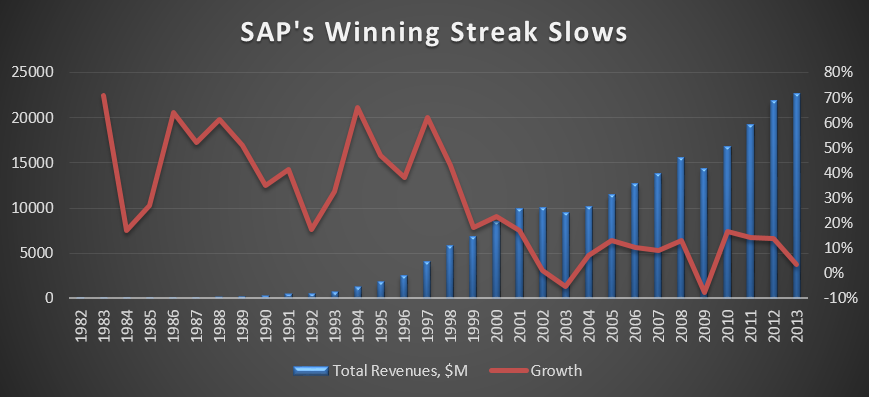

The question is whether SAP can hit the target at a time when its core business is being threatened. To understand the magnitude of the challenge facing McDermott and his lieutenants, one only needs to look at the history of SAP. The world’s largest enterprise software company saw its first decline in total revenues in 2003 following the Dot Com bust. Its subsequent drop in total revenues occurred in 2009 during the recession.

Both times the contraction was largely attributable to macro conditions beyond the control of SAP. After spending more than $13.5 billion to buy Ariba, SuccessFactors and Sybase since 2010, SAP saw a bump in its sales through 2012. Then in 2013 SAP was able to eke out a 3.7% growth, while many of its competitors were cashing in on Cloud migration with growth rates of at least 32% by focusing entirely on the new software delivery model. SAP’s 2013 performance was the third worst performance since 1982 when it entered an uninterrupted period of breakneck growth a little over a decade after its founding. To replicate its previous successes, SAP has vowed to propel its growth back to high single-digit over the next three years.

Source: Company Reports

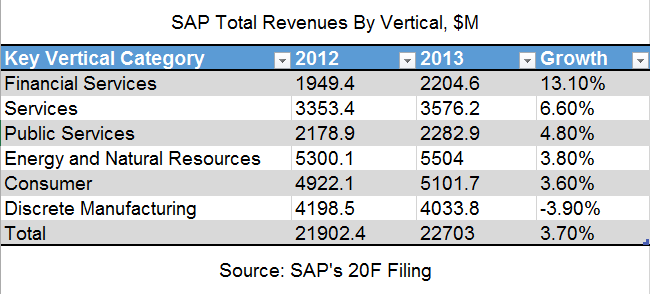

In addition to the Cloud migration, SAP also faces the structural changes to its business, which has traditionally been relying on automating the back-office functions of a large number of discrete and process manufacturing companies. However there are signs that SAP’s reliable source of revenue from those industries appears to be shifting as well.

In 2013 SAP saw a 4% drop in sales to discrete manufacturing vertical, according to its 20F filing. Again it was the first contraction since 2009 and again in 2003 when SAP was dealt a blow by the weakening economy. SAP attributed the decline to weak performance in Asia Pacific and the Americas. In addition sales into process manufacturing appeared to be softening. Even after SAP consolidated process manufacturing into an enlarged group called Energy and Natural Resources, its sales only rose 3.8%, the second smallest gain since 2003 behind the 15% drop in 2008 due to the recession.

Industry Cloud Comes To Rescue

At the conference, SAP announced the Industry Cloud strategy with the goal of accelerating its momentum in the Cloud applications market. New Cloud products include the SAP Circular Authority for Insurance application, a cloud-based solution for tracking, interpreting and analyzing Insurance Service Office (ISO) circulars. Another is a chemical-company-in-a-box solution that delivers pre-configured ERP applications for chemical makers via the Cloud.

Forthcoming products will include a cloud-based student information system being developed with partners including universities around the world as well as a Cloud-based product registration application for semiconductor companies enabling tighter collaboration among chip makers, original design manufacturers and VARs.

Despite the Cloud push at the industry level, SAP applications being used across its target verticals are mostly on-premise implementations and they are likely to remain so for the time being.

A breakout session highlighted recent successes of SAP Banking solutions with customers deploying and taking the products go-live were mostly limited to on-premise implementations with some of their decisions being made years earlier before the current wave of Cloud adoptions kicked in.

SAP’s dilemma follows the same pattern of other enterprise applications vendors, especially those that focus on asset-intensive industries like discrete and process verticals that have yet to recover from the twin effects of the recession – customers’ reluctance to expand payroll and their aversion to large expenditures.

By contrast, enterprise applications vendors, including many that focus entirely on Cloud delivery, are often those that specialize in services-based industries, perfect candidates for paying software by the month since many of the organizations involved are startups themselves with little inclination to spend on big organizational infrastructure.

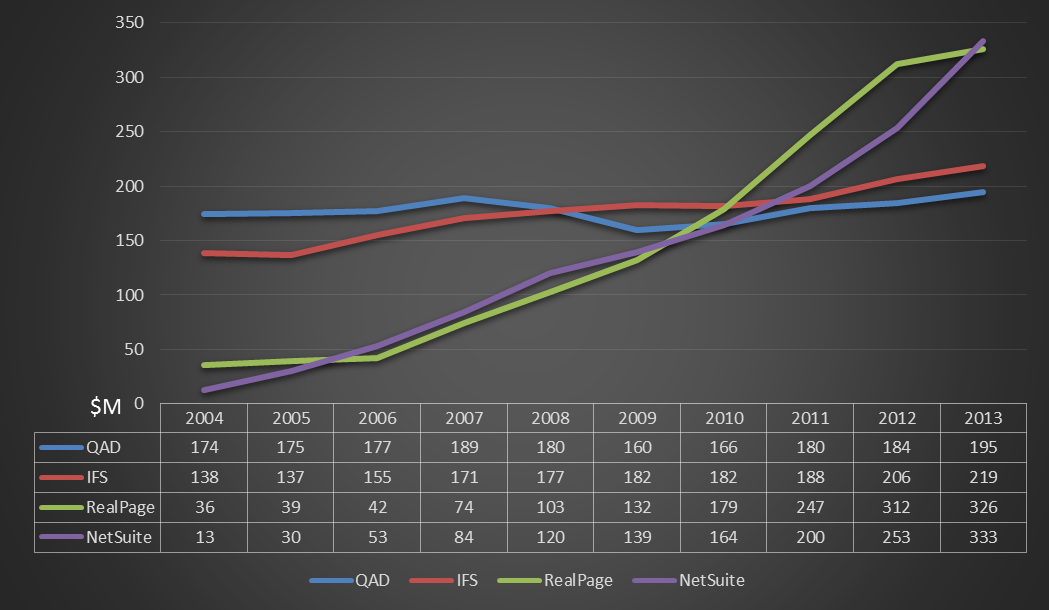

As the following graphic shows, Cloud ERP applications vendors such as NetSuite and RealPage – the former focusing on professional services organizations while the latter on real-estate companies – have grown by leaps and bounds. By comparison, vendors such as QAD and IFS, which focus on asset-intensive industries such as automotive and aerospace and defense, fared much worse over the past 10 years. ERP Vendors For Professional Services Grew Faster Than Those For Manufacturing

Source: Apps Run The World, June 2014

SAP may have already taken considerable measures to stem the decline in its core manufacturing installed base, but the long-term implications could be detrimental to SAP, or for that matter any vendor that is heavily exposed to the manufacturing vertical.

At the conference, SAP executives insisted that manufacturers in emerging markets in China, Latin America and Africa would continue to invest in on-premise applications that have been widely adopted around the world, potentially blunting the momentum of Cloud applications.

While it may take years before the manufacturing sector in North America and many parts of Western Europe restores their software spending to their pre-recession levels if it happens at all, the current situation underscores the fact that the climate of selling software may have already changed irrevocably.

The old way of selling enterprise applications was not too different from the age-old practice of hunting and gathering. After a vendor developed a killer app, it scaled out by hiring a full team of direct salespeople capable of slaughtering big animals – meaning that they were particularly effective in identifying and bagging big deals – which typically would entail millions of dollars in license fees. The herd mentality that permeated many industries would amplify the sales effects as IT executives started bragging about the benefits of their software projects to their peers at industry events, thus convincing others that similar results could be achieved if they followed such best practices.

After bagging such big deals, the vendor began to feast on the maintenance fees, which were universally applied but their benefits were rarely distributed evenly since some companies would require more hand-holding than others. In some cases, companies would sign enterprise wide agreements without any inkling on the amount of work involved in rolling out different modules across their organizations, let alone the support they would want at the divisional level. At times, it was difficult to connect the soaring vendor ambitions and the mismatched customer expectations.

Farming and Harvesting In The Cloud

In the new climate, some Cloud applications vendors are offering their products purely by how they are being consumed on a per user basis. The more users subscribing to one’s applications, the more that company has to pay. Others take a more liberal approach. For example, Resumator offers its products a fixed price of $99 for unlimited number of users. Instead of hunting and gathering, Cloud applications vendors are keen on the farming and harvesting technique that allows them to reach a critical mass in a short amount of time. After planting a robust Cloud core, the vendor immediately layers it with different Cloud services for harvesting purposes.

What appears missing in SAP’s recent restructuring programs to reverse the eroding sales is the unwillingness to think outside its traditional core.

While SAP failed to gain traction with its earlier move to position the Cloud-based Business ByDesign as the Business Suite substitute for professional services organizations, the purchases of Ariba and SuccessFactors were designed more as quick fixes to buy Cloud market share.

By going after an audience that is increasingly embracing Cloud applications from top to bottom, SAP needs to establish a robust core Cloud offering first and then layer additional Cloud services on top of that.

The end game for SAP in the Cloud may be finding a new service automation offering that is extensible enough for different industries allowing customers to drive greater utilization through a host of cloud services from HR to order management and from ecommerce to eProcurement.

Fast-growing Cloud applications vendors such as ServiceNow are doing just that by positioning themselves as the provider of Enterprise Service Management, extending beyond its core competence in IT Service Management and Portfolio Product Management to HR, procurement, and CRM.

For SAP, its long-term Cloud applications strategy appears to revolve around the Simple Suite approach, which encompasses CRM, ERP and PLM-equivalent of SAP Simple Finance, offering conventional integrated enterprise applications functionality over the Cloud. For starters, SAP Simple Finance focuses on delivering accounting and cash management functionality in the Cloud. It’s not clear whether the subsequent releases to SAP Simple Finance such as PLM will follow the same pattern of delivering a narrow scope of features via the Cloud. Additionally, the new product chief Leukert was not prepared to declare if SAP Simple Suite would eventually replace SAP Business Suite.

One reason behind SAP’s noncommittal stance has to do with its ambivalence toward multi-tenant deployment of Cloud applications, an approach that has been widely adopted by fast-growing companies such as Workday, Zendesk as well as SAP’s own SuccessFactors to scale out massively in a compressed time frame.

For instance, Zendesk, which specializes in Cloud-based customer service applications, has been able to achieve a critical mass of nearly 39,000 customers by successfully leveraging a scalable multi-tenant platform in the first seven years of its history since its founding in 2007. That is a steeper ramp than Cloud pioneer Salesforce.com, which saw the growth of its customer count to 13,900 in its first seven years. For incumbents such as SAP and Oracle, these Cloud upstarts pose greater threat to their market and mind shares on a larger scale.

Multi-Tenancy Debate

During a Q&A session, SAP chairman Hasso Plattner dismissed the benefits of multi-tenant delivery of its enterprise applications, primarily those that deal with mission-critical functions like supply chain and financials. Plattner recalled a heated debate over the merits of multi-tenancy with Lars Dalgaard of SuccessFactors after it was bought by SAP in 2012. To this date, Plattner’s position, though not unique, remains that SAP’s biggest customers – fearing unnecessary business disruption – would still prefer deploying their applications either in a private cloud setting or as managed services, all without the intrusion of continuous updates commonly found in other Cloud applications.

Despite SAP’s new simplicity messaging, there may well be a convoluted environment within a hybrid applications landscape among its customers – meaning that some customers may run multi-tenant applications like SuccessFactors, while leaving the use of SAP Business Suite either behind their firewall or in a single-tenant mode that does not get updated continuously by SAP.

What that suggests is that as thousands of Cloud applications vendors are flooding the market with simplified products that could be enhanced, updated and delivered to users all without the involvement of their IT department, SAP has chosen the safe path of afflicting the least amount of disruption to its customers.

There is nothing wrong with the SAP approach since it considers system downtime something that has to be avoided at all costs. Vendors such as Salesforce.com, on the other hand, have seen nary difference to their revenues after periodic system outages including one that lasted for hours around the world just a few days before its biggest customer conference in November 2013.

The new climate change appears to have shifted customer expectations as well at a time when major airlines would see their entire reservation system and passenger management applications completely inaccessible if their website goes down. Still one could hardly imagine airlines not spending heavily on their own Websites. The irreplaceable value of Cloud ubiquity now takes precedence over system integrity, especially at the back-end.

The old joke of everybody wants to go to heaven, but nobody wants to die perhaps encapsulates the rationale behind SAP’s reluctance to remove the shackles of its legacy applications. For SAP and its customers to go 100% Cloud perhaps in a flexible and scalable multi-tenant environment, it could entail shared sacrifices that neither side is willing to make.

Another irony is that at a time when SAP has endeavored to challenge and perhaps overturn its long-held beliefs that its 400 million lines of code are sacrosanct all in the name of disruptive innovation, its willingness to avert itself under the new competitive climate is a different matter altogether and that may well be the gap that the new SAP needs to bridge.