The Cloud applications market posted another big gain in 2014 as new vendors started ramping up their sales amid surging customer demand for all kinds of online services to augment or replace existing on-premise systems.

DON’T MISS THE LATEST REPORT:

Top 10 HCM Software Vendors and Market Forecast 2016-2021

The market, which covers more than 10 horizontal functional categories as well as 21 verticals, grew 27% to nearly $39 billion in Cloud subscription revenues last year, compared with the 32% jump it achieved in 2013.

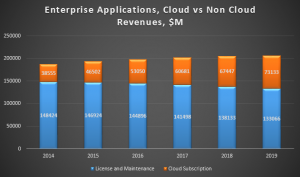

Since 2011, the Cloud applications market has more than doubled from $16 billion to $38.5 billion, now accounting for 20% of the overall enterprise applications space. Four years earlier, it was 10%. By 2019, Cloud applications subscription revenues could make up 35% of the total addressable market opportunity.

Based on written responses from hundreds of vendors and our continuous research on tens of thousands of end-user customers, the Cloud applications market is expected to become the primary reason that sustains the growth of the $200-billion enterprise applications space through the five-year forecast period.

License and maintenance revenues from our database of more than 3,000 enterprise applications vendors are expected to decline 10% from $148 billion in 2014 to as low as $133 billion by 2018. On the other hand, Cloud subscription revenues could almost double from $38 billion to $73 billion during the same period.

Certainly there will be plenty of revenue reclassification that helps juice up the Cloud applications market as a growing number of on-premise start doing away with term-license deals and instead recognizing the underlying revenues as subscriptions, which may include a mix of private Cloud, public Cloud, hosting, applications management subscription fees, along with traditional license and maintenance revenues.

Our methodology calls for the inclusion of subscription fees generated by different vendors through public, private and hybrid Cloud, along with dedicated hosting arrangements, while making sure that traditional license and maintenance revenues are excluded in our Cloud market-sizing calculation based on one-on-one survey work that we have been conducting continuously since 2010 with each of the more than 3,000 enterprise applications vendors in our database.

A growing number of vendors are making their Cloud revenue explicit in their financial statements. SunGard in the financial technology space and Teradata in analytics have started doing that since the beginning of 2015. Both Oracle and SAP have been spelling out their Cloud revenues over the past few years. We believe this trend allows for apples-to-apples comparison, while shedding light on the part of the business that is enjoying the fastest growth.

Of the 500+(See FAQ why) Cloud applications vendors listed on our new Super Site, more than half posted at least 27% growth rate in their Cloud subscription revenues in 2014, suggesting that above-average growth rates are widespread as many are still at an early stage of rapid expansion in terms of new bookings, recurring revenues as well as their own employees.

High-profile startups such as Zenefits for HR Benefits and Slack for team collaboration, along with enterprise applications stalwarts like Sage and Wolters Kluwer have all enjoyed triple-digit growth rates in their Cloud applications revenues last year.

Since its beginning in 2013, Slack has taken the team collaboration market by storm – basically reinventing how team work is communicated, defined and accomplished through constant swapping, searching and making sense of hundreds of millions of messages being sent back and forth. Slack charges these customers anywhere from $8 per user per month to $15. By March 2015, Slack announced that it was picking up $1 million in new annual recurring revenue every 11 days.

Zenefits, which also started offering its Cloud-based HR benefits apps in 2013, has secured more than 10,000 customers primarily small and midsized companies including binpress, Dot&bo, Evo Solution, Inkling, and Twitch.

Such steep growth has prompted major vendors such as Sage to respond aggressively with their Cloud efforts. Stephen Kelly decided to reinvent the accounting software company by striking an alliance with Salesforce.com shortly after he became the group CEO of Sage in November 2014, essentially using much of the intellectual property from Salesforce.com to create a brand new Cloud product called Sage Live in a matter of months using a single database that runs on the Salesforce1 platform.

Though it may take a while for Sage Live to build a critical mass among Sage’s installed base of six million customers worldwide, Kelly is bullish about its Cloud strategy. At its recent Sage Summit event, Kelly touted growing momentum of its broad portfolio of Cloud applications, expecting big-sellers like Sage One to secure one million customers, up from the current level of about 115,000.

Similar to Sage, other on-premise vendors are leveraging their global capabilities to drive Cloud sales. In the first half of 2015, Wolters Kluwer’s division CCH started introducing CCH iFirm, its cloud-based practice management solution, into the United States and India after first selling it in Australia.

Such activities reinforce our forecast assumptions of the overall Cloud applications market by factoring in a combination of supply-side investment in developing Cloud applications to extend and replace their existing systems as well as demand-side adoptions of new and powerful online systems that are proven to be effective in addressing pain points stemming from globalization and information silos.

For example, UK-based media company BBC aimed for better audit quality, cash visibility and overall control of its treasury database as it searched for a solution with those attributes, ultimately deciding on a Cloud TRM application from Kyriba that allowed the public services broadcaster to manage 550 different bank accounts globally and attain those benefits.

When we unveiled the Cloud Top 500 vendors and their ranking last year, our forecast assumptions were pretty straightforward. Vendor push, coupled with robust customer demand, is making more agile, user-friendly applications readily available to a wide range of companies to achieve better outcome for different processes like accounting, procurement and customer service and support.

This year, we believe the shared service capabilities from different Cloud applications are adding a new dimension to our forecast assumptions. Similar to the successes of Uber and AirBnB, which stimulates additional demand by retooling and redirecting excess capacity of drivers and bedrooms to accommodate new consumption, the advent of Cloud applications for improving different business processes from payroll processing to contingent workforce management can lead to the same results.

Network effect and machine learning as well as continuous updates and enhancements common in Cloud applications delivery will collectively make such products easier and more feature rich to use for a diverse audience. In the past it might have taken years for vendors to perfect a piece of on-premise software, Cloud applications providers, working in conjunction with the help of their ISV partners and constant input from their users, could learn from each other’s mistakes and make much faster and more tangible progress.

Though it will be another five to 10 years before Cloud applications become the predominant method for companies to handle their business processes, two other forces are expected to help turn that into reality – globalization and verticalization.

Forecast by region

Across the region, we expect the Cloud applications market to stay the course with perhaps Asia Pacific and EMEA being adversely impacted because of short-term currency effects. While it may take more time for countries like China and Brazil to restore their market momentum, India and Germany as well as popular development hubs in the Netherlands and Eastern European countries from Poland to Macedonia appear to be showing resilient growth.

Cloud Application Market Forecast 2015 – 2019, By Region

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2014 – 2019 CAGR, % |

|---|---|---|---|---|---|---|---|

| Americas | 24920 | 29615 | 33289 | 37700 | 41611 | 45525 | 12.8 |

| EMEA | 9615 | 11808 | 13766 | 15956 | 17884 | 19100 | 14.7 |

| APAC | 4020 | 5079 | 5995 | 7025 | 7952 | 8508 | 16.2 |

| Total | 38555 | 46502 | 53050 | 60681 | 67447 | 73133 | 13.7 |

Source: Apps Run The World, September 2015

In Asia, vendors like Kingdee, Xero, Yonyou, and MYOB all posted sharply higher Cloud applications vendors in 2014 as they directed most of their development and marketing efforts to their online products. ERP vendor Kingdee, which doubled its Cloud subscription revenues in 2014 to $18 million, received a $170 million investment from JD.com, an eCommerce company in China, in return for a 10% stake. After the investment, JD.com will help Kingdee expand in the Cloud by leveraging its data centers.

Xero saw its subscriber base to its Cloud ERP applications almost doubling to over 540,000 from 300,000 a year ago, largely on the strengths of its successes in Australia and New Zealand, which account for three-fourths of its paying customers.

In Europe, the chief beneficiaries are those that have been investing heavily in their own Cloud transformation for an extended period of time.

Among the largest Cloud applications vendors in Europe, Unit4 grew the most in 2014 by posting $112 million in Cloud subscription revenues, a nearly 35% jump from 2013. Its Cloud applications have been growing at a rapid clip with SaaS bookings clocking in a 72% jump in 2014. Unit4’s recent alliance with Microsoft to embrace Azure, which entails generous market-development incentives from the creator of Windows, is expected to help drive more Cloud adoptions among those that favor on-demand delivery because of ease of adoption and lower total cost of ownership. The prevailing trend at Unit4 is that more orders are Cloud-based than those from on-premise license sales.

What’s unclear is whether the current consolidation wave is going to derail the growth plans of some of the well-established Cloud applications vendors in Europe, which places greater premium on data sovereignty than other regions. In June 2015, US-based Perfect Commerce acquired Hubwoo SA, a Cloud supplier relationship management vendor in France. At the same time, Japanese ad agency Dentsu acquired eCommera, an eCommerce apps vendor in the UK, while Advanced Computer Software Group, a UK-based ERP vendor, was taken private by Vista Equity Partners for $1.1 billion in March 2015.

The future favors those that are taking the international market opportunities early enough to establish a beachhead first and then extend their Cloud delivery to additional countries by striking infrastructure deals with experienced and well-connected platform providers and hosting partners.

Forecast by Functional Area

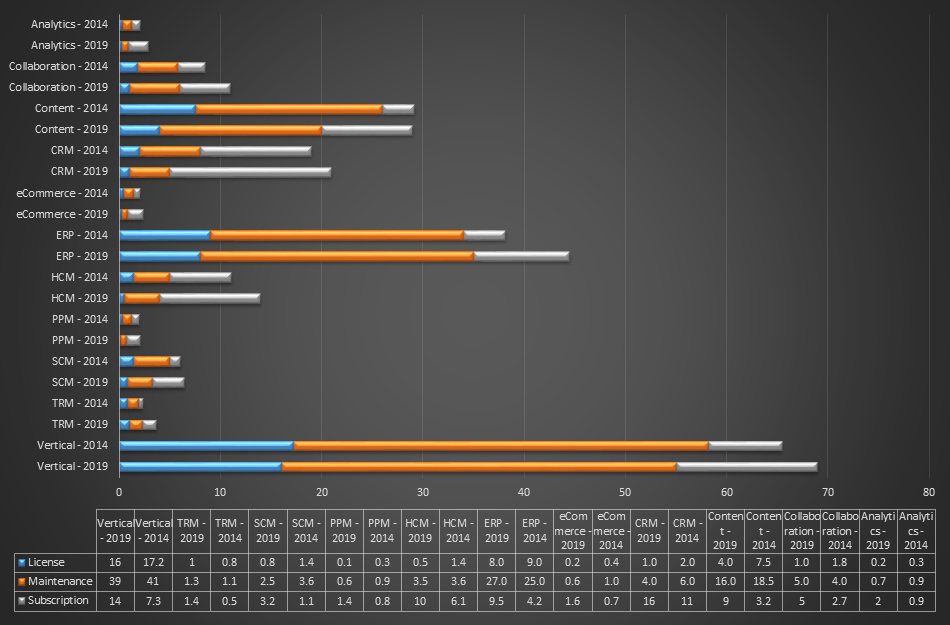

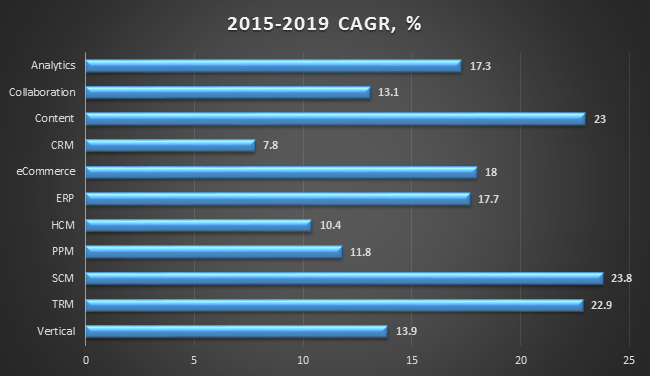

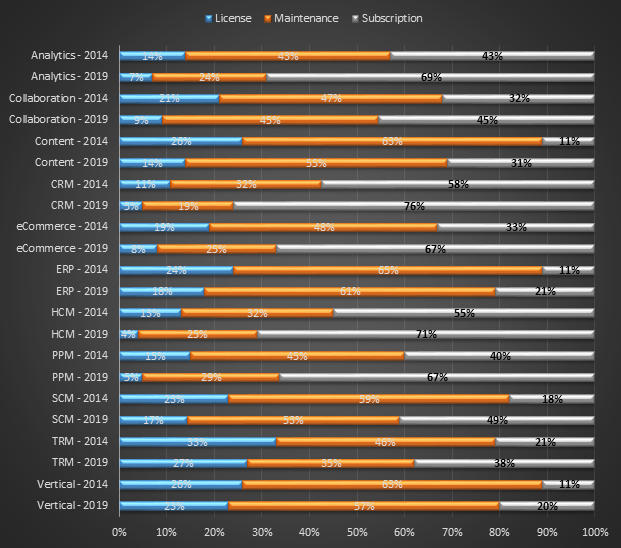

Our forecast calls for splitting the total enterprise applications market into 10 horizontal and the Verticals segments. The former runs the gamut from analytics to treasury and risk management. The latter in itself is comprised of 21 vertical industries from aerospace and defense to utilities.

Analytics, Collaboration and Content Management applications are expected to be staying within the range of projections that we proffered last year. For analytics, we expect the pent-up demand to increase as more analytics tools to be embedded into different Cloud applications, thus boosting the overall addressable market for Cloud analytics.

In addition, startup vendors such as 1010data, Birst, Domo, GoodData, Rosslyn Analytics, along with incumbents like Microstrategy, SAS and Tibco continue to post healthy double-digit gains in their Cloud business, eclipsing their non-Cloud sales. In the case of SAS, Cloud Analytics revenues jumped 24% in 2014, compared with the 2% rise in its total revenues.

Collaboration will be the segment to watch as Slack, which just completed a new round of funding with $340 million raised to date, flexes its muscles to compete directly with other team collaboration tools. Meanwhile, Box Inc. and Dropbox have been staking their claim on different parts of the collaboration market, rendering access control, file sharing, digital asset management much more transparent and ubiquitous in the post email era.

In fact, the gain for collaboration could come at the expense of conventional content management tools like Office and its Cloud derivative Office 365. Every time a user sends a text message over Slack, it could mean that person is spending less time on an Office document.

It may take a while before these new Cloud tools can undermine the Office world of some 1.2 billion users. Still the modern metaphor and the classic client-server collaboration/content management environment are beginning to blur.

A few data points are worth considering. Microsoft said Office 365 is gaining the critical mass in the Cloud with some 50 million active commercial users every month. By contrast, Slack has over 135,000 paid accounts and more than half a million daily active users. On a monthly basis, Slack users collectively spend over 100 million hours connected to Slack and send over 300 million messages. In other words, the hold that Microsoft Office 365 has on its army of information workers could erode once Slack’s volume of messages increases exponentially with new users being added daily.

CRM and eCommerce

One is tempted to ask whether the world of Cloud applications is turning into a zero sum game. If someone gains a market-share point in the Cloud, does it automatically mean a reduction of a few points for somebody else?

In the CRM and eCommerce segments, that has already been happening. Salesforce.com’s rapid growth with its Service Cloud offerings as well as Marketing Cloud through the 2013 acquisition of ExactTarget has created a grab bag of products from email marketing to call center automation with rising quarterly revenues exceeding $600 million, almost as big as its flagship product Sales Cloud for salesforce automation. Because of that, other email marketing vendors have been trudging along hoping to find other patches of green that still elude Salesforce.com.

The same applies to Amazon.com displacing eBay as the favorite online shopping site, essentially rendering GSI Commerce(now eBay Enterprise) and Magento(also owned by eBay) to a secondary role for eCommerce fulfillment and transaction processing platform. The more merchants are using Amazon for their eCommerce activities, the less need they have for other eCommerce engines or order management applications.

In both cases, CRM and eCommerce apps growth projections have been revised downward. On the other hand, ERP and HCM applications in the Cloud are expected to continue to post solid growth rates through 2019 because of a large amount of on-premise replacement opportunities that are becoming more evident than ever.

For example, Workday, which recently signed over 1,000 customers, compared with 850 in early 2015, 600 in early 2014 and 400 in early 2013, still has plenty of room to grow before it reaches the 6,500 customer-count mark that PeopleSoft had crossed before its purchase by Oracle a decade ago. Founders of Workday used to run PeopleSoft.

We are holding steady on our forecast for Project Portfolio Management and Supply Chain Management as both categories are still at an early stage of Cloud adoption.

Treasury and Risk Management

Much of what’s to come in Treasury and Risk Management will depend on how upstarts including Reval and Kyriba are going to wrest control of the Cloud agenda from on-premise incumbents such as SunGard, which is in the process of being acquired by FIS Global, another heavy weight in the financial technology space for core banking and transaction processing, in a $5.1 billion deal.

SunGard will be instrumental in helping restore organic growth for FIS Global, which has seen steady increases in its transaction and processing revenues primarily through acquisitions of other payment processors and core banking vendors for the past several years. SunGard, which broke out its Cloud applications revenues for the first time in March 2015, saw a slight uptake of its Cloud revenues in 2014 while its traditional software revenues were sluggish due to reductions in its legacy products.

By contrast, Reval saw its bookings doubling in the last quarter of 2014 as it expanded its distribution channel and Cloud options for different market segments, while Kyriba recently reached an important milestone of signing 1,000 customers, up from 200 in 2008.

Vertical Applications

If there is a pot of gold for Cloud applications vendors, vertical industries are where the action should be focused. Because of the huge fragmentation of enterprise applications being used for the 21 verticals that we track, the opportunities are expected to grow richer through the forecast period.

Our forecast calls for Cloud subscription revenues for different verticals – ranging from aerospace to utilities – to reach as much as $14 billion, or one-fifth of the overall vertical-industry applications market by 2019. That amounts to anywhere from $500 million to a billion dollar plus in Cloud subscription revenues for each of the 21 verticals. By comparison, the onslaught of startups with many offering similar products for email marketing or configuration price quote could either result in a price war or a shakeout.

Increasingly, smart money is pouring into verticals. In September 2015, Salesforce.com entered the fray by announcing Health Cloud for healthcare providers to drive better outcomes as well as patient care.

The Cloud applications vendors for verticals to watch are a trio of companies Actua, Aurea and Ignite, all of which have launched aggressive plans to gain an upper hand in different verticals.

Actua caters to insurance, egovernment and environmental, health and safety (EH&S) markets, while Aurea focuses on selling CRM applications into energy, life sciences, retail and insurance verticals. Ignite, on the other hand, has been making inroads into healthcare, finance, construction, manufacturing, and biotechnology with recently acquired applications for human capital management and profitability and cost management.

All three vendors are likely to help transform different verticals by stitching together an extensive product portfolio and a scalable platform capable of addressing domain-specific requirements of multiple industries, while enriching their Cloud applications to eliminate feature gaps that are common in horizontal software packages.

Last year, we ended our forecast by highlighting the successes of Q2ebanking, a Cloud-based applications vendor that caters to regional banks and credit unions since its founding in 2005. Despite a spate of bank closures during the past few years, Q2ebanking has been growing nicely with Cloud subscription revenues climbing 35% to reach $69 million in 2014, following a 38% rise in 2013. Currently it has over 361 customers, up from 334 in 2013. In July 2015, Q2ebanking acquired Centrix Solutions for its fraud detection and risk management applications. Two months later, it kicked off a secondary offering that could net the vendor $25 million to help fund its growth.

For most Cloud applications vendors that recognize their subscription revenues ratably, the stable and almost unremarkable performance of Q2ebanking is what makes the future of the Cloud so alluring.