As many ERP applications vendors are banking on cloud delivery with round-the-clock Web selling strategies and relentless acquisitions, Sage is trying something more subtle.

At its recent Sage Summit, the vendor aimed to deliver a different user experience for its six million small and medium sized business customers including tens of thousands of core ERP accounts in North America.

Featuring less tech talks and more SMB-focused keynotes, Sage Summit marked a new way to drive vendor differentiation through the lenses of like-minded individuals. One of the reasons behind Sage’s gambit to reinvent Sage Summit had to do with its relatively small share in the North American ERP applications market where longtime rivals from intuit to Microsoft Dynamics remained entrenched both with their customers and channel partners intact. The rise of cloud-only vendors like Intacct, NetSuite and more recently Xero has raised questions about Sage’s ability to boost its cloud subscription revenues in a compressed timeframe. In other words, Sage needs to do something radical in order to rise above the noise level.

By illustrating the trials and tribulations of successful startups, entrepreneurs and partners, Sage is positioning itself as the SMB advocate – as opposed to just selling software – in the context of shared experiences and open exchanges of ideas and conversation pieces that ultimately could lead to system upgrades, business referrals, and cross-sell opportunities.

Pascal Houillon, president and chief executive officer of Sage North America, is unequivocal about its new identity as the customer experience company because of its experiences dealing with millions of SMBs and Sage Summit is a manifestation of its deep understanding of not just the SMB software marketplace but also the attributes that could help SMBs become more successful.

In fact, Sage is turning Sage Summit into an always-on virtual community where SMBs can mingle, swap stories and ultimately pick up practical advices from other business owners as well as accountant professionals to help them run their companies more effectively on a continuous basis.

The four-day event attracted 5,000 attendees – more than twice the size of previous events – thanks to Sage’s decision of shifting the costs from customers to exhibitors, some of which were footing a much larger bill than before under the assumption that they would be getting heavier show-floor traffic.

There were big-name speakers like presidential advisor Karl Rove, Twitter co-founder Biz Stone and celebs-turned-entrepreneurs Jessica Alba and Magic Johnson. (Don’t be afraid to be unique, different or vulnerable. Keep your overhead as low as possible. Always surround yourself with people smarter than you were some of the advices from these speakers.)

Conversation pieces on and off the show floor revolved around choice as Sage’s key value proposition, coupled with its SMB reach and the ability to transform its customers through hybrid Cloud, mobility and Big Data. For that matter, Sage’s own transformation has meant a wholesale change at the vendor from top to bottom.

In 2013 Sage spun off its CRM and nonprofit products after jettisoning its healthcare unit in 2011. Over the past two years, executives with backgrounds in consumer Internet services and networking equipment have been brought in to reshape how it approached product management and marketing.

R&D functions have been centralized to rally behind a single brand, compared with the old way of keeping small development teams for niche products. For example, more than 100 developers are working as a team responsible for globalizing its X3 ERP product line. The same applies to its mobile products, which are being developed for the global audience, rather than for each local market.

A week after the Sage Summit, the vendor announced that Stephen Kelly, former CEO of Chordiant Software and Micro Focus with plenty of experience in the UK SMB marketplace, will succeed Guy Berruyer as the new group CEO of Sage in November 2014. Since his appointment to the group CEO position in 2010, Berruyer presided over much of the transformation of Sage by bringing more cohesion to the sprawling organization stitched together after three decades of nonstop acquisitions and vertical selling efforts.

While Sage has scaled back its buying spree, it remains to be seen whether it has any plans to reignite its vertical strategies. At the event, Sage announced Sage 100 Contractor and Sage 300 Construction and Real Estate integration with Sage Payment Solutions in another move to drive more payment transactions through its customers. Currently its payment users are not well represented among its core ERP customers. Meanwhile the recent consolidation wave among construction ERP vendors including Viewpoint buying Maxwell as well as the emergence of cloud-only vendors like Textura and e-Builder could leave Sage Timberline business at a disadvantage.

In the old days, Sage relied heavily on acquisitions and product extensions to drive top-line growth. Now it zeroes in on choice. Instead of selling its own payment services, Sage announced a deal at the event with Moneris because the Toronto-based payment processor could probably do a better job serving its Canadian customers given its base of 350,000 merchant locations.

Again, instead of investing in its own data centers to serve a global base of six million customers, Sage now turns to both Microsoft Azure and Amazon Web Services for hosting Cloud applications such as Sage 300 Online and Sage ERP X3 Online. Instead of buying mobile or cloud-only vendors, Sage simply added mobile extensions such as Sage Mobile Sales and Mobile Service to help its on-premise customers access order management and field service capabilities over their mobile devices by leveraging Sage Data Cloud, a mix of Cloud repository and integration toolbox that the vendor is making it available free for its users. Steep valuation of mobile and cloud startups seemed to have kept Sage on the sidelines. At the event Sage also introduced other Cloud products such as a new release of Sage One Accountant Edition due out later this year.

Sage’s Cloud Transformation

None of these changes suggested that Sage’s transformation is complete or without risks. For a vendor with more than $2 billion in 2013 worldwide revenues mostly from its on-premise products, Sage’s cautious approach to Cloud delivery is consistent with that of most legacy software providers. Suffice it to say that the results are mixed at best. For example, its Cloud-only product Sage One secured 22,400 paying subscriptions in 2013, generating about $2.7 million in annual subscription fees, a small sum compared with that of its other products.

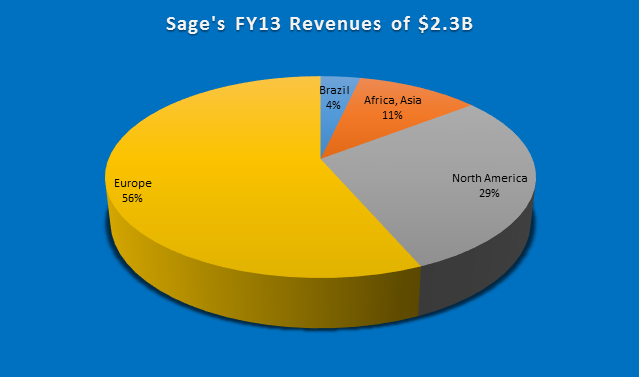

Adoptions of its Cloud products have been on the rise in some countries. Despite its insistence on keeping the hybrid model for its North American customers, other parts of Americas such as Sage Brazil are selling nothing but Cloud apps because of the reduced exposure to legacy and on premise systems in the Latin American country, according to Houillon. Currently, Americas account for one-third of its $2.3-billion annual revenue run-rate with the US contributing the bulk of that $750 million. Sage Brazil posted about $82 million in sales last year. Western Europe represented about 56% of group sales, as shown in the following chart.

And its decision to emphasize choice over an all-in-or-nothing approach could mean an extended period of sluggish growth. In the first nine-month period of its fiscal 2014, Sage reported a 4.7% organic revenue growth including a 4.3% rise in the third quarter. Over the past 18 months, its software product revenues have been mostly flat, compared with a low single-digit contraction for the year-earlier period. For 2015, it projected a 6% organic revenue growth. By comparison, its Cloud-only competitors are expected to be growing faster than Sage by a wide margin because of their smaller base.

Following an extended period of streamlining and restructuring, Sage appears to be entering a new phase of stabilizing its core by deepening relationships with its customers. Perhaps that’s where the Sage Summit strategy will resonate the most.

Still for a vendor with millions of customers from major urban areas to small town USA where Cloud coverage may be less than optimal(a fact validated by a Sage-300 retailer in Hawaii where the geography could make for spotty Cloud service), the choice issue that is at the heart of the Sage’s soft-sell approach appears to be driven more by significant sales through the lowest common denominator, rather than trying to sell into any selective group of users.

To wit, Sage executives are now gearing up to have as many as 10,000 attendees for next year’s Sage Summit in a not-so-subtle sign of its ability to turn small talks and symbolic moves into volume transactions and bigger market shares.