Jennifer Morgan, who became CEO of UKG in 2024, is shaking things up at the No. 1 workforce management apps vendor by taking a proactive stance to rebuild the company while extending its lead as the trusted workforce operating platform for enterprises and frontline workers.

Contrary to the belief that if ain’t broke, don’t fix it, Morgan has been making the preemptive moves by putting her own stamp on UKG with significant new executive hires, shepherding a well-established company that has had significant change since the merger and charting a new course that portends a massive cultural change.

At a recent analyst event in Fort Lauderdale, not far from its Florida headquarters, Morgan said the biggest difference between the new UKG and the old one is that the entire organization should be laser focused on working collaboratively and taking a proactive approach to formulate programs and instill value that matters the most to its customers and other key stakeholders.

“We were addressing symptoms, not the root causes,’’ Morgan said, adding that everyone at UKG is empowered to boost user experience, accelerate go-lives and drive trust and engagement across customers, resellers and implementers as well as its entire partner ecosystem. Today, “we can support better, much more proactively. It’s how we work and the speed at which we work to make sure customer focus is our No. 1 priority,’’ she added.

Since becoming the new CEO in July 2024, Morgan has rewired the inner working of UKG with a dozen or so appointments of seasoned executives from companies such as Adobe, Cisco, Procore and SAP who are now in charge of UKG’s operation, product, sales, marketing and corporate communications.

Examples include Suresh Vittal, who oversaw the development of Adobe Experience Cloud and is now the Chief Product Officer of UKG. In his new role at UKG, Vittal has been given the mandate of building AI-first solutions that not only anticipate and address customers’ evolving business needs. Some of the new features include shift incentives for healthcare customers and opening up its Flex platform to low-code tools. Additional duties involve improving its Data Hub, which is a vast repository of workforce insights covering tens of billions of schedules and punches created and tabulated.

Just a few weeks earlier, UKG struck a deal with ServiceNow to align each other’s work in agentic AI development so that both HR executives who are familiar with the former, and IT heads who are accustomed to dealing with the latter, can easily extract and optimize the cross-functional value of such joint efforts. This can help unlock the true potential of productivity gains for any aspect of its business from the IT side to front line workforce as Morgan envisions.

Vittal aims to turbocharge natural language processing as its near-term AI objective by making conversational UI the lowest common denominator for frontline managers to render repetitive tasks obsolete and touchless payroll possible for all users. “Search and assist becomes AI search and act (in real time),’’ Vittal added.

Rachel Barger, president of Go-to-Market at UKG, said in addition to its emphasis on conversational intelligence, it is banking on digital signals for customer success by using more AI tools for rapid deployment. The naming of Jay Dettling as its first Chief Partner Officer, coupled with its push into carriers, brokers, and prospects affiliated with private equity firms, underscore its desire to be more partner-friendly than ever, Barger said.

On the customer success front, Bob DelPonte, executive vice president and chief customer experience officer of UKG, said the vendor has seen a noticeable increase in customer satisfaction since it took more than 1,500 customers live since last October. His goal is to drive that further by cutting time to live to just a few months for its Ready midmarket customers with AI tools for rapid resolution of any issue relating to knowledge transfer and emergency response.

UKG is also rolling out Emerald Experience with dedicated support for its top-level customers, after hiring Silvio Bessa, one of the key architects of SAP’s premium support offerings.

The 102% recent increase in deals among strategic accounts and Midmarket customers over the past year highlighted the readily available white space that UKG is tapping into as it elevates its brand awareness, Barger added.

Hence, Sarah Hodges, the new chief marketing officer of UKG, vows that any lack of visibility of UKG will be addressed over the next six to 12 months as the company unleashes a slew of new marketing programs to put the UKG brand equity to work through persona narratives and customer outcomes.

UKG has made steady progress over the last five years with its continued dominance of the workforce management market, while gaining ground in the overall HCM applications market.

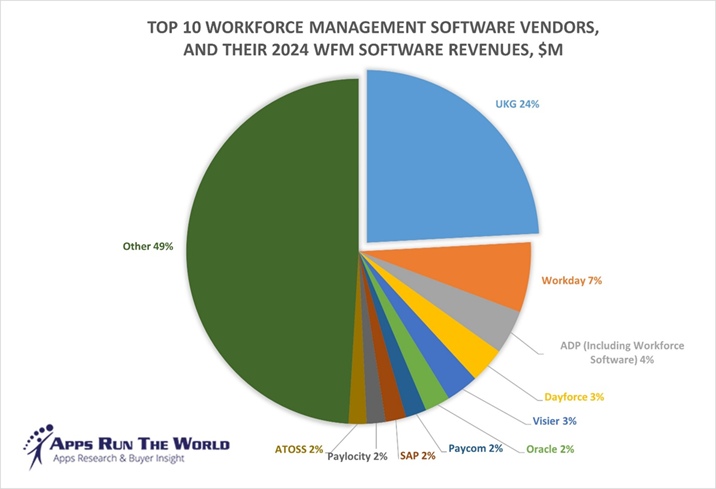

Preliminary data show that UKG’s lead in the worldwide workforce management market stands unchanged at a solid 24% in 2024, while its share in the HCM market is inching upward in 2024:

Preliminary Top 10 Workforce Management Vendors, Market Size and Market Shares, 2019-2024

| Rank | Vendor | 2019 WFM Revenues, $M | 2020 WFM Revenues, $M | 2021 WFM Revenues, $M | 2022 WFM Revenues, $M | 2023 WFM Revenues, $M | 2024 WFM Revenues, $M | YoY Growth | 2024 WFM Market Share, % |

|---|---|---|---|---|---|---|---|---|---|

| 1 | UKG | 1173 | 1300 | 1413 | 1613 | 1772 | 1920 | 8.30% | 24.10% |

| 2 | Workday | 213 | 256 | 312 | 383 | 449 | 522 | 16.30% | 6.60% |

| 3 | ADP (Including Workforce Software) | 143 | 148 | 166 | 177 | 187 | 329 | 76.20% | 4.10% |

| 4 | Dayforce (ex-Ceridian) | 119 | 121 | 149 | 183 | 227 | 265 | 16.60% | 3.30% |

| 5 | Visier | 107 | 135 | 180 | 212 | 228 | 242 | 6.40% | 3.00% |

| 6 | Oracle | 146 | 146 | 153 | 163 | 178 | 189 | 5.90% | 2.40% |

| 7 | Paycom | 53 | 66 | 88 | 115 | 142 | 156 | 10.20% | 2.00% |

| 8 | SAP | 160 | 164 | 160 | 161 | 167 | 153 | -8.20% | 1.90% |

| 9 | Paylocity | 61 | 70 | 84 | 111 | 135 | 141 | 4.60% | 1.80% |

| 10 | ATOSS | 65 | 68 | 72 | 86 | 115 | 133 | 16.20% | 1.70% |

| Subtotal | 2238 | 2473 | 2777 | 3204 | 3599 | 4050 | 12.50% | 50.90% | |

| Other | 2778 | 2945 | 2962 | 3413 | 3734 | 3901 | 4.50% | 49.10% | |

| Total | 5016 | 5418 | 5739 | 6617 | 7333 | 7951 | 8.40% | 100.00% |

Source: ARTW Buyer Insights Technographic Database, June 2025

Preliminary Top 10 HCM Software Vendors, Market Size and Market Shares, 2019-2024

| Rank | Vendor | 2019 HCM Revenues, $M | 2020 HCM Revenues, $M | 2021 HCM Revenues, $M | 2022 HCM Revenues, $M | 2023 HCM Revenues, $M | 2024 HCM Revenues, $M | YoY Growth | 2024 HCM Market Share, % |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Workday | 2427 | 2842 | 3466 | 4203 | 4987 | 5750 | 15.3% | 9.7% |

| 2 | Microsoft (LinkedIn, Viva) | 2481 | 2853 | 3389 | 3604 | 4034 | 4714 | 16.9% | 7.9% |

| 3 | UKG | 2280 | 2385 | 2592 | 2807 | 3193 | 3556 | 11.3% | 6.0% |

| 4 | SAP | 2286 | 2342 | 2423 | 2590 | 2488 | 2388 | -4.0% | 4.0% |

| 5 | ADP (inc. Workforce Software) | 1391 | 1510 | 1675 | 1762 | 1953 | 10.8% | 3.3% | |

| 6 | Oracle | 1077 | 1236 | 1430 | 1605 | 1784 | 1899 | 6.4% | 3.2% |

| 7 | Paycom | 664 | 756 | 1037 | 1352 | 1665 | 1842 | 10.6% | 3.1% |

| 8 | Dayforce (ex Ceridian) | 681 | 690 | 851 | 1069 | 1299 | 1512 | 16.4% | 2.5% |

| 9 | Paylocity | 477 | 543 | 731 | 1022 | 1236 | 1340 | 8.4% | 2.3% |

| 10 | Cornerstone OnDemand | 543 | 705 | 809 | 950 | 1051 | 1119 | 6.5% | 1.9% |

| Subtotal | 14302 | 15743 | 18238 | 20877 | 23499 | 26071 | 10.9% | 43.9% | |

| Other | 16496 | 17901 | 20511 | 25653 | 28638 | 33374 | 16.5% | 56.1% | |

| Total | 30798 | 33644 | 38749 | 46530 | 52137 | 59445 | 14.0% | 100.0% |

Source: ARTW Buyer Insights Technographic Database, June 2025

UKG’s overhaul serves as a wake-up call for any software company that needs to stand out against the backdrop of the global trade war or mitigate the risks of overdoing AI just for the sake of staying buzzword compliant.

As economic and geopolitical chaos reign, one needs to stay true to its core competency and its principles by committing to its key constituents that it is fully accountable to their future and it’s a job that requires no prompt engineering. It must be delivered from within engendering trust, transparency and a 100% commitment to mutual success for all the parties involved with no one being left behind.

It’s a clear mission and Jennifer Morgan, as the new CEO at UKG, is putting all the right pieces together in order to defend its core, while expanding into the next frontier with care, precision and her signature customer focus.