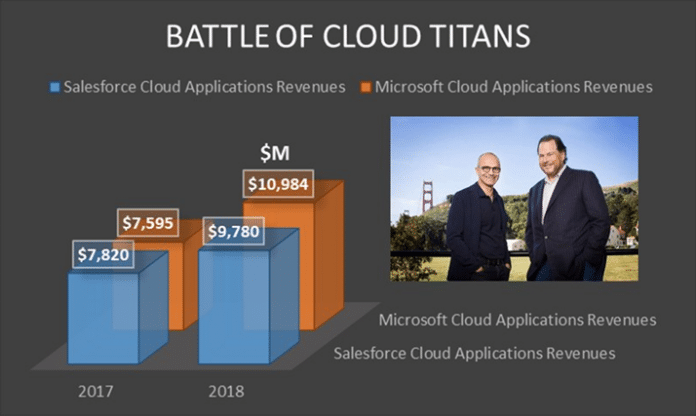

After more than a decade of relentless development efforts and heavy investments including a blockbuster acquisition, Microsoft has surpassed Salesforce for the first time as the No. 1 Cloud applications vendor, a momentous turnaround that underscores its tenacity as much as the power of its platform.

In 2018, Microsoft Cloud applications including Office 365, Dynamics 365 and LinkedIn’s commercial products for sales automation and talent acquisition generated a total of $10.9 billion in Cloud subscription revenues, positioning it as the No. 1 vendor above more than 1,200 Cloud applications providers in our latest annual survey.

By comparison, Salesforce, the perennial Cloud applications favorite and the on-demand pioneer that had dominated the Software As A Service market continuously since it was founded in 1999, dropped to the No. 2 spot with $9.8 billion in Cloud subscription revenues in 2018.

As shown in Exhibit 1, Microsoft ascended to the top position by securing a 10% market share in 2018, compared with Salesforce’s 9% as the Cloud applications market grew faster than we expected to reach $109 billion in Cloud subscription revenues in 2018. Because of rapid adoptions among customers replacing their legacy on-premise implementations with Software As A Service delivery that is considered more easy to use, scale and maintain, our earlier estimate of $84 billion for 2018 was revised upward to $109 billion and now we projected this year’s Cloud applications market to top $124 billion and accelerate to hit $162 billion by 2023 at a compound annual growth rate of 8.3%.

Exhibit 1 – Top 10 Cloud Applications Vendors and Their Market Shares in 2018

By wresting control of the all-important Cloud applications market from Salesforce, Microsoft shows no signs of slowing down in 2019. In October 2018, Microsoft’s LinkedIn acquired Glint for employee engagement applications. The deal, which reportedly was worth more than $400 million, underscores Microsoft’s desire to further grow its presence in the HCM applications market. That was followed by its $7.5 billion purchase of Github, another major source of strength for Microsoft to cement ties with Cloud applications developers. Github, an online coding, learning and collaboration community with 28 million developers, is now part of Microsoft Cloud + AI operations.

The increased momentum is a vindication for Satya Nadella, who headed Microsoft’s Cloud and Enterprise group before becoming its chief executive officer in 2014. Since then, Nadella has successfully steered its transformation from one steeped in the Windows environment to everything revolving around the Cloud. Shortly after Nadella was named to be the third CEO in Microsoft’s history, he rallied the troops by committing to invest more than $10 billion in Azure data centers. The Azure Cloud infrastructure now spans 55 regions and 140 countries, or 72% of the countries recognized by the United Nations. In October 2019, Microsoft won the US Defense Department to become its Cloud infrastructure provider in a deal worth as much as $10 billion over the next 10 years. One significant aspect to the contract is that when different US military branches are migrating their legacy office applications to the Cloud, Microsoft stands to reap tremendous benefit.

To understand Microsoft’s leapfrogging Salesforce in the Cloud applications market, ARTW is providing granular details on the breakdown of Microsoft’s applications revenues based on its SEC filings as well as modeling work that we have been updating continuously over the past 10 years.

One model calls for breaking out Cloud applications vendors and their revenues quarter by quarter since Microsoft’s fiscal year ends on June 30 and Salesforce’s ends on January 31.

Exhibit 2 shows Microsoft’s revenues broken down by its major enterprise applications products under its Productivity and Business Processes operating group for its past three fiscal years.

Exhibit 2 – Microsoft Cloud and Non-Cloud Applications Revenues As Part of Productivity and Business Processes Group, Fiscal 2017 To Fiscal 2019, $M

| Products | Fiscal 2017 | Fiscal 2018 | Fiscal 2019 | FY19 over FY18 Growth, % | Notes |

|---|---|---|---|---|---|

| Microsoft Office 365 | $5,625 | $7,545 | $9,608 | 27% | Modeling based on historical data |

| Microsoft Office OnPremise | $19,000 | $19,861 | $21,133 | 6% | Modeling based on historical data |

| Microsoft Office Subtotal | $24,625 | $27,406 | $30,741 | 12% | Modeling based on historical data |

| Microsoft Dynamics 365 | $1,025 | $1,690 | $2,476 | 47% | As reported in Microsoft 10K |

| Microsoft Dynamics OnPremise | $1,245 | $870 | $460 | -47% | Modeling based on historical data |

| Microsoft Dynamics Subtotal | $2,270 | $2,560 | $2,936 | 15% | As reported in Microsoft 10K |

| Microsoft LinkedIn Commercial Components | $1,035 | $2,385 | $3,060 | 28% | Modeling based on historical data |

| Microsoft LinkedIn Consumer Components | $1,265 | $2,915 | $3,740 | 28% | Modeling based on historical data |

| Microsoft LinkedIn Subtotal | $2,300 | $5,300 | $6,800 | 28% | As reported in Microsoft 10K |

| Other Products(Sharepoint, UCC, etc.) | $675 | $599 | $683 | 14% | Modeling based on historical data |

| Productivity and Business Processes Total | $29,870 | $35,865 | $41,160 | 15% | As reported in Microsoft 10K |

| Other Microsoft Revenues | $66,701 | $74,495 | $84,683 | 14% | As reported in Microsoft 10K |

| Total Revenues of Microsoft | $96,571 | $110,360 | $125,843 | 14% | As reported in Microsoft 10K |

Source: Apps Run The World, December 2019

Exhibit 3 shows the breakdown of Microsoft Cloud and OnPremise Applications covering Office and Dynamics. The Office umbrella includes all the productivity tools like Word, Excel as well as newer ones like Teams for Collaboration. Dynamics includes its Dynamics CRM, ERP and other back-office and customer-facing functions from accounting to sales force automation.

Exhibit 3 – Breakdown of Microsoft Office And Dynamics Applications Revenues, $M

| Products | Fiscal 2017 | Fiscal 2018 | Fiscal 2019 | FY19 over FY18 Growth, % | Notes |

|---|---|---|---|---|---|

| Microsoft Office Commercial | $21,201 | $23,600 | $26,668 | 13% | As reported in Microsoft 10K |

| Microsoft Office Consumer | $3,424 | $3,807 | $4,073 | 7% | As reported in Microsoft 10K |

| Microsoft Office Total | $24,625 | $27,407 | $30,741 | 12% | Modeling based on historical data |

| Microsoft Office 365 Commercial | $3,938 | $5,552 | $7,383 | 33% | As reported in Microsoft 10K |

| Microsoft Office 365 Consumer | $1,687 | $1,994 | $2,225 | 12% | As reported in Microsoft 10K |

| Microsoft Office 365 SubTotal | $5,625 | $7,546 | $9,608 | 27% | Modeling based on historical data |

| Microsoft Office OnPremise Commercial | $17,263 | $18,048 | $19,285 | 7% | Modeling based on historical data |

| Microsoft Office OnPremise Consumer | $1,737 | $1,813 | $1,848 | 2% | Modeling based on historical data |

| Microsoft Office Total | $24,625 | $27,407 | $30,741 | 12% | Modeling based on historical data |

| Microsoft Dynamics 365 | $1,025 | $1,690 | $2,476 | 47% | As reported in Microsoft 10K |

| Microsoft Dynamics OnPremise | $1,245 | $870 | $460 | -47% | Modeling based on historical data |

| Microsoft Dynamics Total | $2,270 | $2,560 | $2,936 | 15% | As reported in Microsoft 10K |

Source: Apps Run The World, December 2019

Exhibit 4 outlines Microsoft Cloud Applications revenues by its products between fiscal 2017 and 2019.

Exhibit 4 – Microsoft Cloud Applications Revenues Between Fiscal 2017 And 2019, $M

| Products | Fiscal 2017 | Fiscal 2018 | Fiscal 2019 | FY19 over FY18 Growth, % | Notes |

|---|---|---|---|---|---|

| Microsoft Office 365 Commercial | $3,938 | $5,552 | $7,383 | 33% | As reported in Microsoft 10K |

| Microsoft Dynamics 365 | $1,025 | $1,690 | $2,476 | 47% | As reported in Microsoft 10K |

| Commercial portion of Microsoft LinkedIn | $1,035 | $2,385 | $3,060 | 28% | Modeling based on historical data |

| Total | $5,998 | $9,627 | $12,919 | 34% |

Source: Apps Run The World, December 2019

Exhibit 5 details Salesforce’s Cloud Applications revenues by its products between fiscal 2017 and 2019.

Exhibit 5 – Salesforce Cloud Applications Revenues Between Fiscal 2017 And 2019, $M

| Products | Fiscal 2017 | Fiscal 2018 | Fiscal 2019 | FY19 over FY18 Growth, % | Notes |

|---|---|---|---|---|---|

| Salesfore Sales Cloud | $3,076 | $3,588 | $4,040 | 13% | As reported in Salesforce 10K |

| Salesforce Service Cloud | $2,343 | $2,883 | $3,621 | 26% | As reported in Salesforce 10K |

| Salesforce Marketing and Commerce Cloud | $947 | $1,382 | $1,898 | 37% | As reported in Salesforce 10K |

| Subtotal | $6,315 | $7,853 | $9,559 | 22% | As reported in Salesforce 10K |

| Portion of Salesforce Platform Attributable To Its Analytics Offerings | $0 | $104 | $387 | 272% | Modeling based on historical data |

| Salesforce Total Cloud Applications Revenues | $6,315 | $7,957 | $9,946 | 25% | As reported in Salesforce 10K |

| Other Salesforce Product Revenues | $1,484 | $1,809 | $2,467 | 36% | Modeling based on historical data |

| Salesforce Professional Services Revenues | $638 | $774 | $869 | 12% | As reported in Salesforce 10K |

| Salesforce Total Revenues | $8,437 | $10,540 | $13,282 | 26% | As reported in Salesforce 10K |

Source: Apps Run The World, December 2019

Exhibit 6 reorganizes Microsoft’s Cloud Applications revenues by aligning them to calendar years 2017 and 2018, essentially pushing its quarterly revenues ahead by six months.

Exhibit 6 – Microsoft Cloud Applications Revenues In Calendar Years 2017 And 2018, $M.

| Microsoft Cloud Applications | CY2017 | CY2018 | Growth, % |

|---|---|---|---|

| Microsoft Office 365 Commercial | $4,540 | $6,268 | 38% |

| Microsoft Dynamics 365 | $1,254 | $1,981 | 58% |

| Commercial portion of Microsoft LinkedIn | $1,800 | $2,735 | 52% |

| Total | $7,595 | $10,984 | 45% |

Source: Apps Run The World, December 2019

Exhibit 7 reorganizes Salesforce’s Cloud Applications revenues by aligning them to calendar years 2017 and 2018, essentially averaging its revenues into 12-month increments over the past three fiscal years and backtracking them by one month.

Exhibit 7 – Salesforce Cloud Applications Revenues In Calendar Years 2017 And 2018, $M.

| Salesforce Cloud Applications | CY2017 | CY2018 | Growth, % |

|---|---|---|---|

| All | $7,820 | $9,780 | 25% |

Source: Apps Run The World, December 2019

Once you become an ARTW subscriber, you can access the full Excel table that contains the quarter to quarter revenues of Microsoft and Salesforce for fiscal years 2017-2019 and calendar years. In addition, the file also details Microsoft’s revenues of its Intelligent Cloud and Azure revenues for fiscal years 2017-2019.

Cloud Applications Market Outlook

What the above exhibits demonstrate is that Microsoft has managed to drive more Cloud applications revenues by successfully converting many of its on-premise customers to its Cloud releases of Office 365, and Dynamics 365. That was further compounded by the continuous growth of LinkedIn, which led a number of HCM market segments including Sourcing, Recruiting, Candidate Relationship Management, as well as the overall Talent Acquisition category. With the $26-billion purchase of LinkedIn, its largest in its history, Microsoft now owns more than a quarter of the talent acquisition market, which topped nearly $7 billion in 2018.

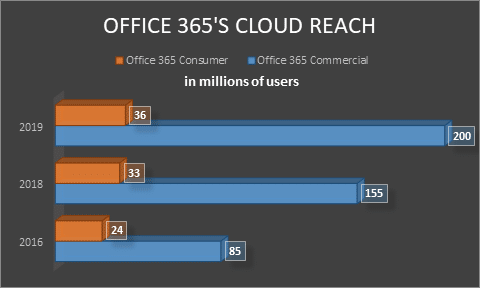

Microsoft’s outlook looks favorable. If one simply compares the fiscal year revenues of Microsoft and Salesforce, the delta between the two widens, resulting in a 23% advantage for the former. That does not even take into account the Cloud Applications revenues from its Office 365 Consumer product, which derives revenues from small businesses as well as individuals. In October 2019, Microsoft announced that Office 365 Commercial now has more than 200 million monthly active users and Office 365 Consumer has 36 million, compared with 155 million and 33 million a year ago, respectively. In 2016, Microsoft had 85 million subscribers for Office 365 Commercial and 24 million subscribers for Office 365 Consumer.

The implication is that Salesforce finds itself a formidable competitor in Microsoft that now has the moving parts of its extensive Cloud applications portfolio firing on all cylinders.

Despite Microsoft’s on-again and off-again relationship with Salesforce through the years, it could deal a major blow to Salesforce’s announced plans to double its revenues to $35 billion by fiscal 2024, a mere 48 months away.

Sensing the impending danger, Salesforce has bulked up its Cloud and non-Cloud offerings by acquiring Mulesoft, which competes with Microsoft Azure in API management for cloud integration, and Tableau, which locks horns with Microsoft Power BI in analytics and visualization. The $24 billion that Salesforce has spent on deals since 2016 – not including a number of tucked-in acquisitions – is a direct response to Microsoft’s growing threat in the Cloud applications market. Salesforce now counts on Quip, its Cloud productivity tools, to chip away at the ubiquity of Microsoft Office and more recently Microsoft Teams now being used by 20 million users daily, two and a half years since the introduction of the chat-based Cloud collaboration applications.

It’s that kind of explosive growth that has prompted us to revise our Cloud applications market forecast, as shown in Exhibit 8.

Exhibit 9 – Cloud Applications Market Forecast, 2018-2023, $M, and CAGR, %

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2018-2023 CAGR, % | |

|---|---|---|---|---|---|---|---|---|

| Cloud Applications Forecast 2018 | $77,679 | $84,155 | $89,524 | $94,287 | $98,224 | $101,295 | ||

| Revised Cloud Applications Forecast 2019 | $86,263 | $108,843 | $124,081 | $136,489 | $146,808 | $155,367 | $161,970 | 8.3% |

Source: Apps Run The World, December 2019

The future of the Cloud applications market is fraught with uncertainty as leading vendors are engaged in a delicate dance that could turn any cordiality into an ugly spat.

Collectively the top 10 Cloud applications vendors, as shown in Exhibit 1, hold only 40% of the market, while the rest is splintered into hundreds of vertical and functional segments. Despite Microsoft’s ability to retain control of the content management applications market with its Office franchise, growing use of artificial intelligence, machine learning and other innovative technologies could change that. Case in point – it would be hard for Microsoft to continue charging for use of Word or Excel on a per-user basis when a machine alone can process on its own(read/edit/act on) mountains of documents in a split second.

It’s even possible for Box, Slack and Salesforce Quip to beat Microsoft at its own game in office productivity tools given their ability to attract a new generation of users who may be less unencumbered by legacy Office assets for continuous knowledge discovery and management. However, Google has been trying to win that battle for years with G Suite, barely making a dent in the Office franchise. Our latest vendor survey shows Microsoft leading the Content Management and Collaboration markets by a factor of six over the No. 2 player Adobe, and at least 15 over a smattering others like OpenText, Dropbox, Cisco, and Google. The question is whether there’s a limit to growth of Office 365 – or for that matter the lock of Office in the enterprise – over the next five to 10 years when user behavior changes.

That’s why the future of Microsoft’s Cloud applications strategy will be linked to LinkedIn, which remains popular among professionals, and Dynamics 365, which still trails behind many ERP and CRM vendors in different markets.

The conundrum for Microsoft is not to treat its Cloud applications business distinct and separate from its Azure infrastructure, which requires support from other parts of Microsoft as much as it gets from third-party vendors like Salesforce and Oracle. For Microsoft, growing its Cloud applications business and Azure in tandem will inevitably bruise some egos along the way.

In November 2019, Microsoft and Salesforce reaffirmed their strategic partnership by using Azure as the Cloud infrastructure provider for Salesforce Marketing Cloud, the product set that delivers the smallest revenues. In addition, Salesforce will build integration into Microsoft Teams starting late 2020. For a long time, Salesforce has been offering Salesforce app for Slack, which will compete with Salesforce for Microsoft Teams once it becomes available.

Unlike its announcements with Microsoft in 2014 and 2015, Salesforce is keeping a distance between its platform and Office 365.

By contrast, Salesforce announced during the same week that it will start reselling to its customers Amazon Connect, the Contact As A Service product that has been used internally by the eCommerce giant and is now being marketed to a broader audience through OEM partners like Salesforce. Additionally Salesforce will integrate Amazon Connect with its Service Cloud Voice, while finding ways to be compatible with Amazon Alexa with its Einstein Voice Skills. Apparently, Salesforce is not concerned about Amazon’s growing portfolio of Cloud apps like Connect, Forecast or even Digital Workplace. And it’s willing to lend a helping hand to make sure some of these Amazon Cloud applications are being adopted by its customers, along with the need to host many Salesforce apps on AWS. That’s on top of its deepening partnership with Google by building integration into Google G Suite and Analytics 360 since 2017. To Salesforce, AWS and Google appear to be less threatening than Microsoft.

The rivalry between Microsoft and Salesforce in the Cloud applications market will intensify given their trajectory with both wanting to make people more productive, whether they are knowledge workers or customers. The remaining question is whether Microsoft needs Salesforce more or the other way around as the former aims to loosen the stranglehold of Amazon and Google in Cloud infrastructure and search, respectively.

These days, the truism in tech is that buying friendship in one is mutually exclusive from competing with the same party. But Microsoft and Salesforce really can’t separate one from the other when they go after the same set of customers in more ways than one. At one point, Microsoft would hire trucks loaded with billboards hawking its Dynamics CRM applications by circling around San Francisco’s Moscone Center where Salesforce Dreamforce was being held.

The relationship turned less frosty with the appointment of Nadella as Microsoft CEO who appeared on stage at Dreamforce 2015. The truce was short-lived and Salesforce’s recent acquisitions have made it a bigger threat to Microsoft, not less.

Meanwhile, on separate occasions in recent months, Microsoft has announced strategic partnerships with Oracle and SAP as if the Windows developer now consider them better partners than, say Salesforce.

Despite Salesforce’s recent efforts to diversify through acquisitions(mostly buying vendors that derive majority of revenues from onpremise software, not Cloud), its room to maneuver is pretty limited given its huge exposure to a single market – CRM. And Microsoft realizes that its new leadership role in the Cloud applications market is a prelude to something bigger than all of these vendors combined. And if Salesforce happens to stand in its way, Microsoft would not be the one to yield.

List of Microsoft Customers

Source: Apps Run The World, December 2019

List of Salesforce Customers

| Product | Market |

| Salesforce CRM | Customer Relationship Management |

| Service Cloud | Customer Service and Support |

| Salesforce Commerce Cloud | eCommerce |

| Salesforce Marketing Cloud | Marketing Automation |

| Salesforce Sales Cloud | Customer Relationship Management |

| Salesforce Service Cloud | Customer Service Software |

| Salesforce Einstein Analytics | AI Platform |

| Salesforce Pardot | Marketing Automation |

| Salesforce Chatter | Enterprise Social Network and Collaboration Software |

| Salesforce Community Cloud | Customer Community Collaboration |

| Salesforce Radian6 | Social Media Monitoring, Analysis and Engagement Platform. |

| Salesforce Financial Service Cloud | Customer Relationship Management |

Source: Apps Run The World, December 2019