The wisdom of Epicor shines through as it preps to parlay its successes in ERP midmarket into the AI bonanza. By focusing on such key attributes as performance, predictability and platform readiness, Epicor is making a compelling case why it is well positioned to help a swath of distribution and manufacturing companies succeed in their migration toward Cognitive ERP, its version of back-office applications made more valuable with the use of AI.

Central to that vision is its 2022 acquisition of Grow, its low-code business intelligence tool that enables users to generate dashboards and interactive visualizations without any training. That way, it puts easy dissemination of mission critical data from popular Epicor ERP systems such as Prophet 21 for distributors and Kinetic for manufacturers into the hands of more professional and casual users, allowing for quicker decision making.

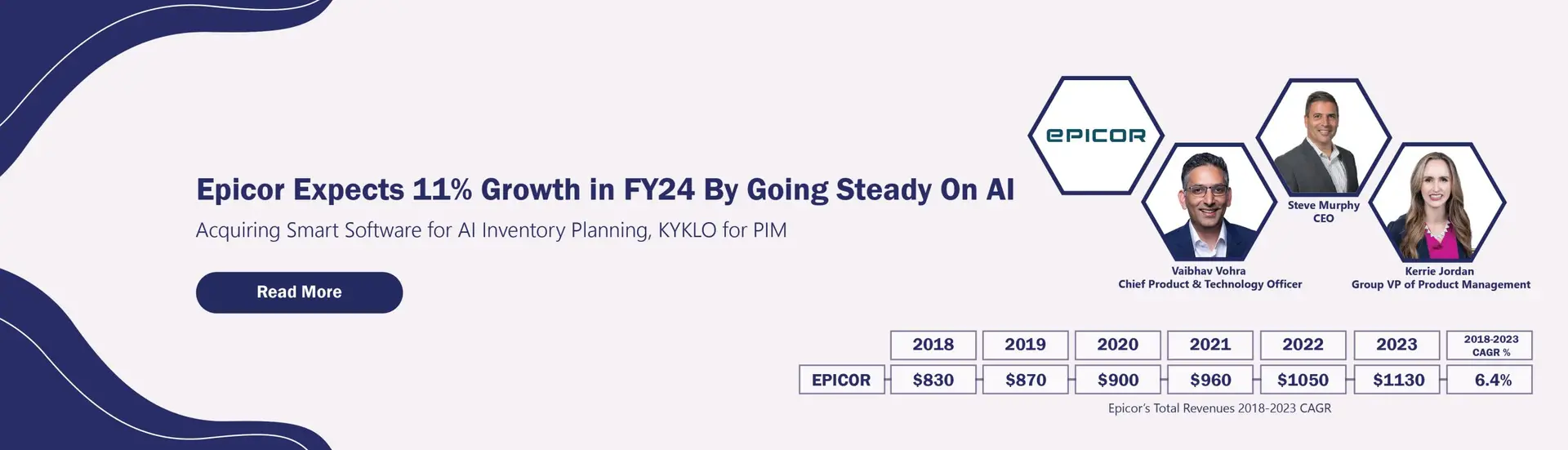

In 2024, Epicor upped the ante by purchasing Smart Software for AI-driven inventory planning and optimization applications, and KYKLO for Product Information Management. Such moves will improve business processes fueled by democratic use of industry-specific data and workflows, especially for key stakeholders within distributors and manufacturers.

Steve Murphy, CEO of Epicor, expects the results will manifest themselves with the use of the Grow data platform, coupled with digital assistants made available from Epicor and its partners. That could reshape how these industries manage their operations from AP/AR/GL to supplier relationship management.

In its current fiscal year, Murphy estimates the vendor to post 11% rise in total revenues reaching $1.25 billion, the biggest increase since 2017. In fact, Epicor’s revenues have been rising steadily resulting in a compound annual growth rate of 6.4% between 2018 and 2023, higher than that of its closest peers, as shown in the below exhibit. While others decry the fact that the vendor is nothing but a collection of dozens of disparate ERP systems, Epicor executives said the collective strength has only helped it become more entrenched in its strategic verticals.

Comparing Epicor’s Total Revenues in USD$M With Those of Peers and Their 2018-2023 CAGR

| Vendor | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2018-2023 CAGR, % |

|---|---|---|---|---|---|---|---|

| Epicor | $830 | $870 | $900 | $960 | $1,050 | $1,130 | 6.4% |

| Sage | $2,252 | $2,583 | $2,539 | $2,307 | $2,531 | $3,040 | 6.2% |

| SAP | $27,178 | $31,685 | $30,071 | $30,626 | $32,471 | $34,327 | 4.8% |

| Infor | $3,117 | $3,173 | $3,250 | $3,367 | $3,510 | $3,668 | 3.3% |

Source: ARTW Buyer Insight Master Database, June 2024

- University Of Saarland, a Germany based Education organization with 375 Employees

- Jefferies Group, a United States based Banking and Financial Services company with 7745 Employees

- Goldman Sachs, a United States based Banking and Financial Services organization with 46500 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

Currently, many of the 23,000 Epicor customers including more than two million cloud users have already taken advantage of such data velocity, leading to more cross-selling and upselling opportunities for the vendor, according to Epicor executives. The growth of Epicor cloud ERP utilization has resulted in a 40% spike in SaaS revenues in fiscal 2023 and 70% of new bookings in fiscal 2023 were derived from Cloud recurring revenues, adding credence to his bullish forecast for 2024, Murphy added.

An above-average performance is only half of the story. Unlike other enterprise applications vendors that have either placed a premium pricing on their AI offerings(Microsoft Co-Pilots come to mind) or others going full throttle on digital assistants(Intuit Assist is one of its big bets), Epicor remains cautious.

At its recent Insights conference in Nashville, Murphy urged his customers not to be afraid or embarrassed if they were skeptical about AI, considering the hype might actually be too good to be true for the audience more accustomed to taking a no-nonsense approach to making, moving and selling hard goods around the world.

It’s one thing that robotic manufacturing is emerging, it is something else altogether if anyone suggests that AI would soon replace the complex business processes deriving from a full spectrum of proprietary and hard-to-replicate domain expertise and tribal knowledge commonly found among those running a metal fabrication plant.

Vaibhav Vohra, Chief Product & Technology Officer of Epicor, said customers would be better off if they prioritize the integrity of their industry-specific data over everything else, while leveraging AI tools for quick returns such as real-time notifications, forecasting and planning or even necessary reporting requirements such as carbon emissions management. In other words, AI should be applied carefully to complement one’s core operations, not replacing them.

Another way to mitigate the abuse of AI is Epicor’s use of retrieval augmented generation, a generative AI framework for improving the accuracy and reliability of large language models, using relevant data from company sources. The objective is to prevent it from undermining the decision-making process because of Generative AI hallucinations, said Kerrie Jordan, its group vice president of product management.

Predictability is the key, Jordan said, as Epicor starts promoting Cognitive ERP use cases for scenarios such as product recommendations, predictive fleet management and skills assistant.

At the platform level, in order for Epicor to leapfrog its bigger rivals it must rely on others to backfill areas that it may not be able to address in full capacity. Years earlier, Epicor was relying heavily on Microsoft and others for tools like reporting. Now Epicor Grow is making significant contributions as a robust data lake.

Along the way, Epicor has built a robust ecosystem made up of over 250 VARs and global Sis including Cognizant, as well as 119 ISV partners including Workato to deliver Automation Studio for creation of industry templates, Climatiq for sustainability management and Salesforce for CRM integration for Prophet 21 and Kinetic customers.

The net effect is that its ecosystem of VARs and partners have contributed to high double-digit growth in overall channel sales, while registering triple-digit increases in partner-led revenues in places like Australia, New Zealand and Europe over the past year.

List of Epicor Customers

| Customer | Industry | Empl. | Revenue | Country | New Product |

|---|---|---|---|---|---|

| American Packaging | Distribution | 1200 | $350.0M | United States | Epicor Prophet 21 |

| Ann Joo Resources Berhad | Manufacturing | 2100 | $564.0M | Malaysia | Epicor ERP 10 |

| ARCH Medical Solutions | Manufacturing | 1000 | $350.0M | United States | Epicor Kinetic |

| Ashcroft | Manufacturing | 1000 | $300.0M | United States | Epicor Kinetic |

| BlackHawk Industrial | Distribution | 710 | $400.0M | United States | Epicor Prophet 21 |

| Carpenter Contractors of America | Construction and Real Estate | 1000 | $300.0M | United States | Epicor BisTrack |

| Colony Hardware | Distribution | 1200 | $180.0M | United States | Epicor Prophet 21 |

| Ducommun | Manufacturing | 2465 | $712.0M | United States | Epicor Kinetic |

| Erickson Companies | Distribution | 1000 | $150.0M | United States | Epicor BisTrack |

| Gulfeagle Supply | Distribution | 1100 | $120.0M | United States | Epicor BisTrack |

| Jones Plastic & Engineering | Manufacturing | 2700 | $700.0M | United States | Epicor ERP 10 |

| Parr Lumber | Distribution | 1250 | $320.0M | United States | Epicor BisTrack |

| Radwell International | Distribution | 2000 | $1.70B | United States | Epicor Prophet 21 |

| Singer Industrial | Distribution | 1200 | $500.0M | United States | Epicor Prophet 21 |

| Standex International | Manufacturing | 3800 | $741.0M | United States | Epicor ERP 10 |

| Sunroc Construction & Materials | Construction and Real Estate | 1000 | $200.0M | United States | Epicor BisTrack |

| Tecomet | Manufacturing | 2500 | $600.0M | United States | Epicor Kinetic |

| TireHub | Distribution | 1000 | $240.0M | United States | Epicor Prophet 21 |

| Triumph Group | Aerospace and Defense | 4937 | $1.38B | United States | Epicor ERP 10 |

| Twin City Fan & Blower | Manufacturing | 2700 | $500.0M | United States | Epicor Kinetic |

| UFP Technologies | Manufacturing | 2665 | $389.0M | United States | Epicor ERP 10 |

| UFP Technologies | Manufacturing | 2665 | $389.0M | United States | Epicor Kinetic |

| US Tool Group | Distribution | 800 | $120.0M | United States | Epicor Prophet 21 |

| Voyant Beauty | Manufacturing | 4000 | $1.50B | United States | Epicor ERP 10 |

| Wastequip | Manufacturing | 900 | $100.0M | United States | Epicor Prophet 21 |

Source: ARTW Buyer Insight Master Database, June 2024