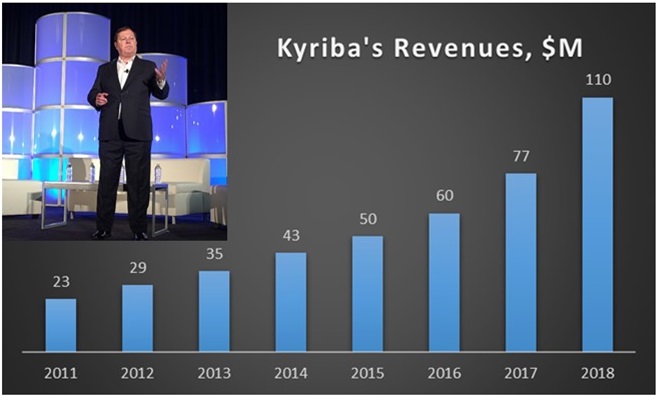

The rise of Kyriba validates the upside potential of the Cloud applications market, especially for nimble players that can outrun their competition.

In 2018, Kyriba signed 229 new clients and achieved a 43% jump to top $110 million in revenues, outpacing a host of Treasury and Risk Management vendors that have eked out single-digit or low double-digit growth largely from their on-premise applications. After securing a customer count of over 2,000 including many global brands like Amazon, Peloton, Spotify and WeWork, Kyriba has received a new round of funding totaling $160 million from investors including Bridgepoint – now the majority stakeholder.

At its recent Kyriba Live event, executives, partners and customers outlined the latest TRM implementations that could drive significant improvement to how the corporate treasury function is run at the global level.

For example, Costco, which operates in 10 countries, is now running Kyriba to help manage its global cash position on a daily basis, handling as many as 2.5 million transactions – about 10% of which are in cash. Centralizing payments and preparing for the proliferation of virtual cashiers are among the priorities that Costco would turn to Kyriba for meeting next-generation treasury imperatives.

Brighthouse Financial, an insurance spinoff from MetLife, completed a 13-month implementation of Kyriba in June 2018 to manage its cash and payments functions. Today, Kyriba is being used to generate some 400,000 payment transactions at Brighthouse, or one-fifth of its volume. The rest is either imported files or blind-routed ACH payments, which are mostly pre-approved and pre-formatted from its back-end ERP systems. Brighthouse expects to use Kyriba to handle the rest as well in order to achieve full payment automation while securing the lowest possible cost in bank fees.

Kyriba said it currently processes more than 83 million bank transactions, 30 million payments and 530 million ERP transactions on behalf of its clients each month through its global connectivity hub. A new API integration with the help of Citi can help improve the velocity of those transactions for its global customers.

Other customers are less sanguine about the cost-saving aspect of running Cloud applications like Kyriba. At the event, a finance executive of a $2-billion furniture manufacturer that is in the process of implementing Kyriba, said he was skeptical how much he would be able to save by running Kyriba given the considerable amount of automation that his company has already invested in to improve its business processes.

Still, Kyriba will help solve one nagging problem he faces every day, eliminating the need to carry around a bulging collection of two-factor authentication tokens that he needs to access bank portals and approve payments. That in itself would address one of the most common gripes of online banking for finance and treasury professionals.

In fact, Jean-Luc Robert, CEO of Kyriba, said of the more than 600 corporates that are SWIFT members, Kyriba supports over 300 by managing SWIFT connectivity and improving their TRM function. While other TRM vendors are focused on migrating to the Cloud or figuring out better ways to work well with their ERP systems, best-of-breed providers like Kyriba can simply offer the intrinsic value proposition of addressing user pain points.

In addition to cash and risk management capabilities, Kyriba is shoring up its liquidity platform with new features and products like working capital management, lease accounting as well as foreign currency exposure management with its recent acquisition of FiREapps.

The latter two developments could fuel momentum for Kyriba in the coming years. The lease accounting applications market is expected to see rapid adoptions by almost every publicly-traded company in the United States to add software tools in order to meet new accounting rules and regulations. Recent changes to accounting rules such as IFRS 16 and ASC 842 are making lease accounting a strategic imperative for lessors to measure the financial implications of the amount and timing of cashflows stemming from leases. More importantly, lessees, which apply to many companies that lease real-estate, heavy and office equipment to run their operations, now require a better tool to track existing assets or contracts.

The acquisition of FiREapps, which brings Kyriba’s current headcount to 700, is rounding out its risk management offerings especially in the areas of currency exposure management and analytics. The new risk management offering from Kyriba is one of the most robust solutions for managing global foreign exchange (FX) risk, enabling finance chiefs to mitigate the impact of currency fluctuations on earnings per share (EPS), according to a recent company announcement.

Kevin Bryla, executive vice president and chief marketing officer of Kyriba, said the shared customers between FiREapps and Kyriba will serve as the blueprint to drive further upselling and cross-selling opportunities across its total installed base of more than 2,000 customers and 65,000 users.

Over the past few years, rampant consolidation in the TRM market has created a number of aggregators including ION Group (Aspect Enterprise Solutions, Fidessa, Openlink, Reval, and TriplePoint are among its recent acquisitions), FIS (SunGard and Worldpay), and Finastra (Misys and D+H), posing challenges and opportunities for best-of-breed vendors like Kyriba.

Based on our continuous survey of more than 10,000 TRM customers, end users remain mixed about the implications of the consolidation wave. Some suggested that the consolidation wave will help ease their Cloud migration efforts given the streamlining and standardization of the underlying platforms.

Possible R&D cuts from aggregators, a claim that is disputed by the likes of ION and FIS, are being raised by affected customers.

Others expect aggregators may opt to boost retention or win bigger wallet shares through aggressive pricing or accelerated migration to any other product within their portfolios. Meanwhile, dozens of former Reval employees have been hired away by the likes of Kyriba, GTreasury, TreasuryXpress and BELLIN, according to their LinkedIn bios.

It is possible that the consolidation wave has contributed to Kyriba’s 43% jump in revenues in 2018 as customers seek a proven solution from a well-funded vendor. Not to be outdone, GTreasury, which has over 750 customers after buying Visual Risk for its risk management applications in 2018, reported a 64% jump in revenues last year. BELLIN also saw a strong double-digit growth in 2018 with an installed base of nearly 500 customers. Customers are also favoring startups. TreasuryXpress, which was launched in 2015, has won more than 130 customers with stepped-up presence in financial centers in Europe.

By comparison, FIS, which in 2015 acquired SunGard, has reported low single-digit growth of its Integrated Financial Solutions division that covers SunGard’s TRM software business over the past few years.

However, competition is stiffening for Kyriba and others. Already, Oracle NetSuite, a longtime partner of Kyriba, has made cash management and lease accounting a focal point of its product direction in 2019. Similarly, SAP and other ERP vendors like Infor and Sage are banking on their TRM offerings as indispensable tools to help drive more ERP bundle sales.

At its recent SuiteWorld event, Oracle NetSuite executives said the decision to bolster its cash management and lease accounting offerings is to meet its evolving customer demands and the company is committed to strengthening relationships with its ecosystem partners like Kyriba.

Table 1: Partial List of Kyriba Treasury Customers

| Customer | Industry | Empl. | Revenue | Country | New Product |

| AmTrust Financial Services | Banking and Financial Services | 9300 | $5.96B | USA | Kyriba Treasury |

| Americana Group | Consumer Packaged Goods | 66000 | $3.20B | Kuwait | Kyriba Treasury |

| Standard Motor Products | Automotive | 4200 | $1.12B | USA | Kyriba Treasury |

| Eastman Kodak Company | Retail | 5800 | $1.53B | USA | Kyriba Treasury |

| Pimkie | Retail | 5500 | $1.20B | France | Kyriba Treasury |

| ECS GROUP | Aerospace and Defense | 1034 | $1.00B | France | Kyriba Treasury |

| ExpressJet Airlines | Aerospace and Defense | 8000 | $7.60B | USA | Kyriba Treasury |

| LISI AEROSPACE | Aerospace and Defense | 7200 | $1.86B | France | Kyriba Treasury |

| Zodiac Aerospace | Aerospace and Defense | 35000 | $6.30B | France | Kyriba Treasury |

| Caribbean Airlines Ltd | Aerospace and Defense | 1700 | $250.0M | Trinidad and Tobago | Kyriba Treasury |

| Bridgestone Corp | Automotive | 139822 | $26.94B | USA | Kyriba Treasury |

| Delphi Automotive | Automotive | 147000 | $12.90B | USA | Kyriba Treasury |

| Faurecia | Automotive | 115686 | $20.18B | France | Kyriba Treasury |

| Oreca | Retail | 200 | $50.0M | France | Kyriba Treasury |

| Visteon | Automotive | 10000 | $3.15B | USA | Kyriba Treasury |

| Tan Chong Motor Holdings | Automotive | 4300 | $4.70B | Malaysia | Kyriba Treasury |

| CFAO Equipment Ghana LTD | Automotive | 1000 | $100.0M | Ghana | Kyriba Treasury |

| IAC Group | Automotive | 22000 | $5.02B | Luxembourg | Kyriba Treasury |

| Inteva Products | Automotive | 12000 | $2.60B | USA | Kyriba Treasury |

| Nidec Motor Corporation | Automotive | 2500 | $500.0M | USA | Kyriba Treasury |

| A. Schulman | Manufacturing | 4900 | $2.50B | USA | Kyriba Treasury |

| ABB Inc | Professional Services | 15000 | $10.00B | USA | Kyriba Treasury |

| Abbott | Healthcare | 91000 | $20.41B | USA | Kyriba Treasury |

| AccorHotels | Leisure and Hospitality | 250000 | $2.20B | France | Kyriba Treasury |

| AccorInvest | Leisure and Hospitality | 30000 | $4.56B | UK | Kyriba Treasury |

| Action Logement | Construction and Real Estate | 800 | $120.0M | France | Kyriba Treasury |

| Actissia Services | Professional Services | 4500 | $682.0M | France | Kyriba Treasury |

| Activision | Media | 4000 | $7.00B | USA | Kyriba Treasury |

| Acuitis France | Consumer Packaged Goods | 650 | $70.0M | France | Kyriba Treasury |

| Adtalem Global Education | Consumer Packaged Goods | 8512 | $1.23B | USA | Kyriba Treasury |

| AECOM | Construction and Real Estate | 100000 | $17.99B | USA | Kyriba Treasury |

| Coface SA | Banking and Financial Services | 4100 | $1.60B | France | Kyriba Treasury |

| Commerzbank | Banking and Financial Services | 48743 | $9.94B | Germany | Kyriba Treasury |

| Alstom | Transportation | 32000 | $6.90B | France | Kyriba Treasury |

| Alstom Power | Oil, Gas and Chemicals | 34500 | $7.95B | France | Kyriba Treasury |

| Altice USA | Communications | 9047 | $9.31B | USA | Kyriba Treasury |

| Alticor | Manufacturing | 14000 | $10.00B | USA | Kyriba Treasury |

| Alvean | Consumer Packaged Goods | 160000 | $4.70B | Switzerland | Kyriba Treasury |

| Amazon | Retail | 566000 | $177.87B | USA | Kyriba Treasury |

Source: Apps Run The World Apps Database, April 2019