Oracle posted a modest 4% rise in constant currency quarterly revenues for its last three-month period of fiscal 2025, ending the year with only a 6% increase in USD and constant currency but more importantly a loud and thunderous chorus that could reverberate for years to come because of significant contributions from Generative AI customers including Open AI and Google using its cloud services.

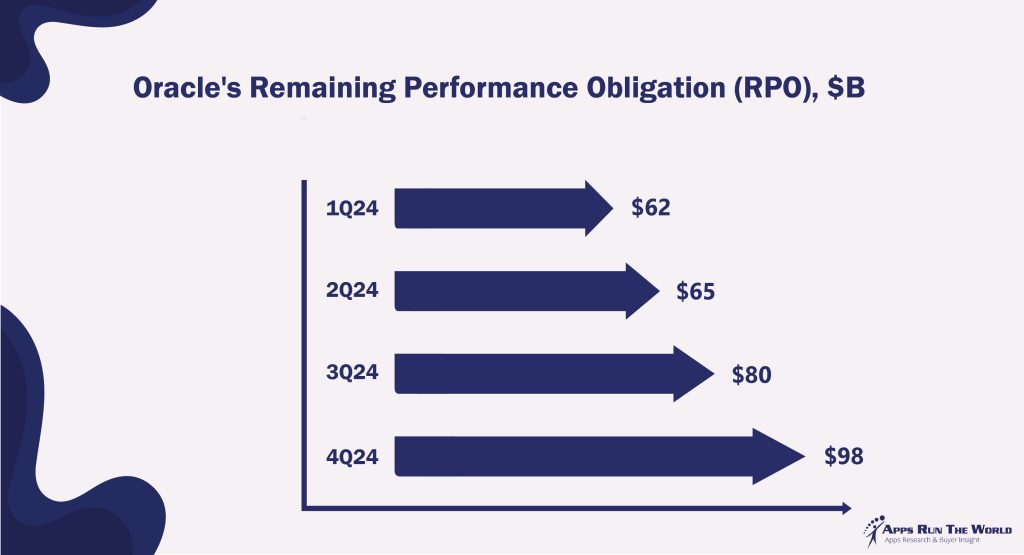

Safra Catz, CEO of Oracle, remarked that in the last quarter alone it had signed 30 AI contracts amounting to more than $12.5 billion, resulting in a 44% jump to $98 billion in remaining performance obligations over the next few years.

Oracle’s RPO, or the expected revenues to be recognized over the next three years or more, reached $98 billion, or 1.75 times of its current run rate of $56 billion, in May 2024, compared with $80 billion in February, $65 billion in November and about $65 billion a year earlier.

About 39% of these RPOs will be recognized over the next 12 months, adding at least $38 billion to its top line in fiscal 2025. With the latest signings of these AI contracts, Oracle – armed with its quicker and more efficient ways to deliver Gen AI results and expand Cloud infrastructure services at scale using technologies like RDMA network that moves data faster – could emerge as one of the biggest beneficiaries of the Gen AI craze.

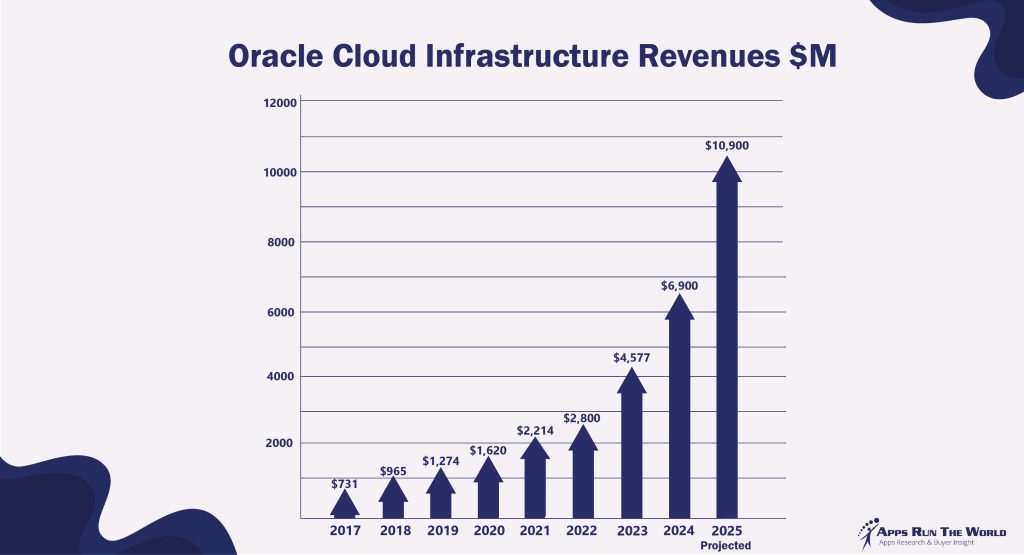

The partnerships with Open AI and Google – on top of similar deals with the likes of Microsoft Azure, Nvidia, Cohere, xAI and Palantir – could help boost the projected sales of Oracle Cloud Infrastructure to as much as $11 billion in fiscal 2025, up 58% from $6.9 billion in FY24, as shown in the following exhibit. The latter figure had already exceeded its earlier forecast of $5.9 billion for FY24.

Larry Ellison, Oracle CTO and co-founder, said all these pacts will only help strengthen further use of Oracle database as the common building block of any calculation and management of the staggering datasets stemming from any GenAI development among Microsoft and Open AI customers and soon to be coming from Google Cloud customers by the end of 2024.

In other words, even if these GenAI construction projects hit any snags, they still need the Oracle framework to support the data structure as well as cloud service delivery. It’s the classic case of heads Oracle wins and tails Oracle wins too.

Ellison commented on the earnings call this way, “This AI race is going to go on for a long time. It’s not a matter of getting ahead — just simply getting ahead in AI, but you also have to keep your model current, and that’s going to take larger and larger data centers.’’

While there are echoes from the Dot Com boom and the subsequent bust in early 2000 when Oracle did the same by mastering the art of gaining a foothold in any paradigm shift, conditions are starkly different these days.

Even though Catz said the company would double its capital expenditures in its current fiscal year in order to build out its OCI and the associated costs of running such Large Language Models, she was quick to point out during the earning call that Oracle has been able to bag other big deals as well including a $600 million deal on Fusion applications from a tech firm in the fourth quarter. In order to fully actualize the heads Oracle wins and tails Oracle wins scenario, Oracle understands that it must prevail in areas other than Gen AI.

Also, Oracle is much more diversified following the Dot Com bust when it followed the downturn by embarking on a round of applications acquisitions, allowing it to spread its bets by investing in more enduring businesses like banking, utilities and healthcare.

Its Fusion Cloud ERP and NetSuite applications revenues totaled $1.6 billion in its latest quarter, growing at a healthy double-digit rate, accounting for half of its SaaS sales, despite the fact that the overall applications business posted a 6% rise in 4QFY24 and a 9% growth for the year, a deceleration from the last two years because of inclusion of Cerner.

Its ongoing integration of Cerner will help Oracle broaden its reach into one of the most strategic areas in global IT spend as many developed and emerging countries are vying to improve living standards by automating population health and other advanced systems from accelerated clinical trial development to digital assistants for patient scheduling.

The same applies to Oracle’s other investments in costing and project management for construction, billing for communications and utilities and better dispatching and smart policing for public safety agencies and first responders.

In summary, Oracle’s latest financial performance underscores the company is well positioned to capture the upside benefits of Gen AI, but remains vigilant in its ability to prevent itself from becoming a roadkill in the worst possible scenario.

Oracle faces the same paradox that has dogged other platform providers that have been struggling to determine what to invest and what to ditch in the Gen AI paradigm shift.

During the quarter, Oracle exited the advertising business that it acquired for billions over the past decade.

It follows similar moves by Meta citing the need to reallocate its resources to AI projects by recently killing its Workplace by Facebook product after trying to make a go at delivering Facebook features to thousands of enterprise customers. Similarly, after paying $8.5 billion for Skype in 2011 Microsoft has been gradually relegating it to noncore as it finally pulled the plugs on Skype for Business Server in favor of Teams.

If history proves to be of any guide, Oracle is determined that its staying power will drone on longer than Gen AI, or for that matter any of its peers that fail to learn from their mistakes decades earlier.

List of Oracle Cloud Infrastructure (OCI) Customers

| Customer | Industry | Empl. | Revenue | Country | New Product | |

|---|---|---|---|---|---|---|

| 7-Eleven | Retail | 138808 | $87.60B | United States | Oracle Cloud Infrastructure | |

| Albertsons | Retail | 290000 | $72.00B | United States | Oracle Cloud Infrastructure | |

| AT&T | Communications | 148290 | $122.43B | United States | Oracle Cloud Infrastructure | |

| Cummins | Manufacturing | 75500 | $34.07B | United States | Oracle Cloud Infrastructure | |

| Electronic Arts | Professional Services | 13400 | $7.43B | United States | Oracle Cloud Infrastructure | |

| Experian | Professional Services | 22400 | $8.66B | Ireland | Oracle Cloud Infrastructure | |

| FedEx | Transportation | 328000 | $90.16B | United States | Oracle Cloud Infrastructure | |

| Genuine Parts Company | Distribution | 60000 | $23.09B | United States | Oracle Cloud Infrastructure | |

| Grupo Bimbo | Consumer Packaged Goods | 146910 | $23.86B | Mexico | Oracle Cloud Infrastructure | |

| Humana | Insurance | 67600 | $106.37B | United States | Oracle Cloud Infrastructure | |

| LVMH | Retail | 192287 | $93.46B | France | Oracle Cloud Infrastructure | |

| Marriott International | Leisure and Hospitality | 411000 | $23.71B | United States | Oracle Cloud Infrastructure | |

| Mazda Motor Corporation | Manufacturing | 50749 | $29.39B | Japan | Oracle Cloud Infrastructure | |

| McDonald’s Corporation | Leisure and Hospitality | 100000 | $25.49B | United States | Oracle Cloud Infrastructure | |

| Nissan | Automotive | 131719 | $10.60B | Japan | Oracle Cloud Infrastructure | |

| NTT Group | Communications | 338651 | $142.52B | Japan | Oracle Cloud Infrastructure | |

| Schneider Electric | Manufacturing | 162339 | $36.00B | France | Oracle Cloud Infrastructure | |

| TJX Companies | Retail | 329000 | $30.55B | United States | Oracle Cloud Infrastructure | |

| Toyota | Manufacturing | 380737 | $245.51B | Japan | Oracle Cloud Infrastructure |

Source: ARTW Technographics Database, July 2024

- Oracle, a United States based Professional Services organization with 160000 Employees

- Zurich Insurance, a Switzerland based Insurance company with 60000 Employees

- Oracle, a United States based Professional Services organization with 160000 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|