Cornerstone has been in constant motion three years after the HCM applications vendor went private, triggering a series of moves that have shaken up its executive team, product strategies as well as its core offerings for learning and development.

Under its latest Galaxy branding that is always on the move, Cornerstone is taking the new corporate messaging both literally and figuratively through acquisitions, product extensions and workforce agility innovations in order to align with the continuous and perpetual demands of learners and HR leaders for quickly bridging the gaps between the skillsets that are prerequisites for today’s employees and what they shape out to be for tomorrow.

In the midst of a calendar full of global customer events in 2024, Himanshu Palsule, who was named CEO of Cornerstone in February 2023, considers Cornerstone Galaxy the first holistic solution for workforce agility encompassing everything from learning systems to content as well as supporting components from skills library for talent framework to virtual reality tools for training, not to mention the underlying Core HR, payroll and onboarding applications.

Since early 2023, Palsule, who for years had been instrumental in remaking ERP vendors such as Sage and Epicor prior to joining Cornerstone, has overhauled the leadership team by adding software veterans from GE Digital, IBM, Walmart, and others. He has also been rationalizing its pandemic-period purchases of Saba, SumTotal, and Edcast, while adding reinforcements by acquiring in 2024 SkyHive to scale out its skills library and Talespin for immersive corporate learning technology.

For starters, SkyHive, leveraging its AI capabilities, now crunches through terabytes of global workforce, labor market and economic data daily. Talespin, on the other hand, is partnering with Meta to leverage its Virtual Reality headsets to extend easy to deploy content authoring tool, designer, generative AI immersive learning labs services to a range of industries like manufacturing, healthcare, finance, and retail.

Cornerstone’s sky high ambitions have begun to rub its competitors the wrong way. For example, its acquisition of Skyhive has resulted in the product, which touts itself of having billions of anonymized profiles and job descriptions and trillions of skill graph combinations, being booted off the Workday Skills Cloud months after Workday Ventures made an investment in Skyhive.

Still, underscoring the Galaxy vision is the fact that Cornerstone aims to be the one-stop shop that enables its users easily to interoperate with whatever backend systems from ERP to Core HR they happen to be running, while layering its learning and performance management systems on top of curated content to accelerate customer needs’ for addressing the skills gaps.

Karthik Suri, Chief Product Officer of Cornerstone, said the level of seamless integration is nothing to sneeze at, citing 44% of its learning management systems are already running its content as well.

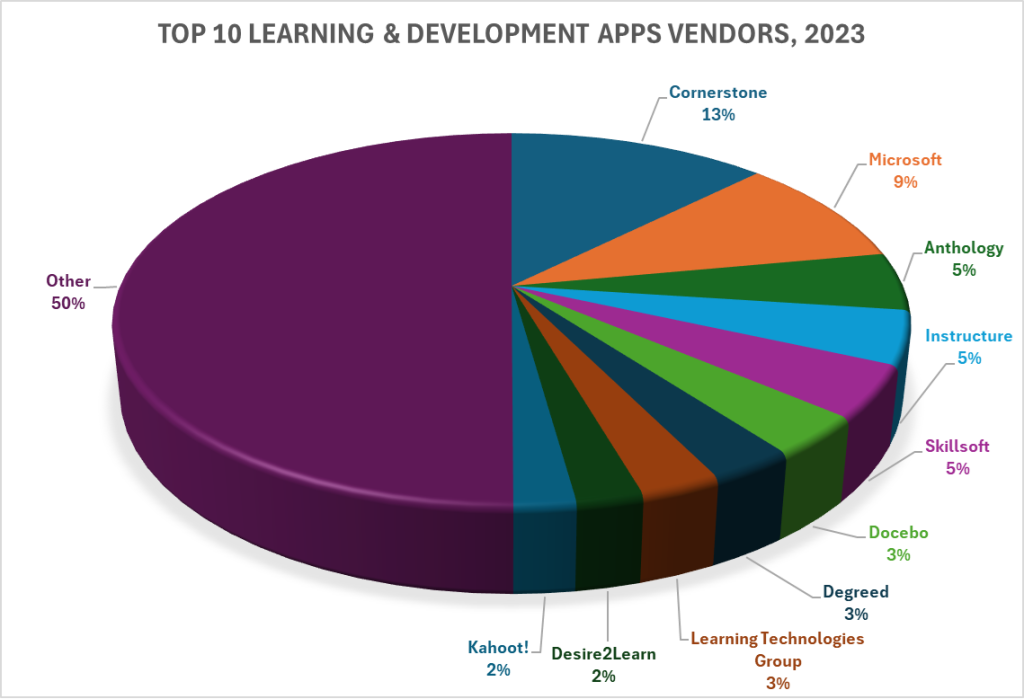

With more than $1.1 billion in annual recurring revenues, Cornerstone is among the top 10 HCM applications vendors in the world, while continuing its dominance as the No. 1 provider of learning and development applications, as shown in below exhibit.

Source: ARTW Buyer Insight Master Database, July 2024

Palsule minces no words by stating “We are playing offense,’’ adding that the next set of priorities involve building out its emarketplace including reselling Udacity content while delivering a complete talent solution for helping its installed base of 7,000+ customers that strive to reinvent themselves and their more than 125 million employees around the world through workforce agility that covers everything from reskilling to upskilling and from tracking performance to training.

Positioning workforce agility as their North Star, customers such as County of Los Angeles have cut administrative burden from 40 hours to four minutes by using Cornerstone’s learning enhancements for bulk certification approvals, while DHL has generated 10% savings using Cornerstone Skills for recruiting, Palsule said.

During a recent Cornerstone event in Orlando, Barbara Bridgford, Sr. Director of Learning Development and Delivery at McKesson, said the drug distributor is constantly upskilling and reskilling its Gen X employees every 18 to 24 months, expecting many of them to take on different jobs and assignments two to three times in any given year. With the advent of simulation and learning development tools from Cornerstone, coupled with quick and easy learning content, Bridgford said McKesson has been able to yield ROI in less than six months, while lowering its support costs by 10% at the same time.

Such results notwithstanding, Cornerstone now aspires to become something that is easier to use and more importantly more engaging through its revamped advisory services. By expanding its customer success teams, Toya Del Valle, chief customer officer of Cornerstone, said the vendor has realigned itself from a problem solver to a thought partner for a variety of accounts such as Hertz, helping them better compete in a changing world by reskilling their employees to think beyond car rentals, but rather electric vehicles and other mobility solutions.

While the Galaxy vision is admirable, its sometimes imperceptible movement – stemming from either customer inertia or the familiarity of legacy systems – suggests that the real gamechanger for Cornerstone remains its ability to think like its customers through vertical differentiation as well as uninterrupted and perhaps incremental innovation with an ecosystem of partners that can be easily deployed by customers at their own pace.

That’s why it’s important to expand into the future with history in mind. Cornerstone, now banking on the collective strengths of its extensive portfolio, now wants to leave no stones unturned. Case in point: after buying Saba in 2020 and renaming it SBX, the vendor is now bringing back the Saba brand.

Partial List of Cornerstone Customers

| Customer | Industry | Empl. | Revenue | Country | New Product | |

|---|---|---|---|---|---|---|

| A.P. Moller – Maersk | Transportation | 105909 | $81.53B | Denmark | Cornerstone Learning Suite | |

| Alaska Communications | Communications | 569 | $231.0M | United States | Cornerstone Saba Halogen Learning Management | |

| Amazon | Retail | 1525000 | $574.79B | United States | Cornerstone Learning Suite | |

| AmerisourceBergen Corp. | Life Sciences | 39000 | $239.00B | United States | Cornerstone Learning Suite | |

| Applied Materials | Manufacturing | 34800 | $26.52B | United States | Cornerstone Saba Learning Work | |

| AT&T | Communications | 148290 | $122.43B | United States | Cornerstone Learning Suite | |

| Aurecon Group | Construction and Real Estate | 6500 | $674.0M | Australia | Cornerstone Saba Halogen Learning Management | |

| Baker Hughes Company | Oil, Gas and Chemicals | 58000 | $25.51B | United States | Cornerstone Saba Learning Work | |

| Centene | Healthcare | 67700 | $144.55B | United States | Cornerstone Learning Suite | |

| DBS | Banking and Financial Services | 29000 | $10.80B | Singapore | Cornerstone Saba Halogen Learning Management | |

| Eli Lilly and Company | Life Sciences | 43000 | $34.12B | United States | Cornerstone Saba Learning Work | |

| Enbridge | Oil, Gas and Chemicals | 11100 | $45.78B | Canada | Cornerstone Saba Learning Work | |

| Facebook, Inc. | Professional Services | 58604 | $85.97B | United States | Cornerstone Learning Suite | |

| HP | Professional Services | 58000 | $62.98B | United States | Cornerstone Saba Learning Work | |

| Humana | Insurance | 67600 | $106.37B | United States | Cornerstone Learning Suite | |

| McDonald’s Corporation | Leisure and Hospitality | 100000 | $25.49B | United States | Cornerstone Saba Learning Work | |

| McKesson | Professional Services | 75000 | $310.13B | United States | Cornerstone Learning Suite | |

| Salesforce | Professional Services | 56606 | $34.86B | United States | Cornerstone Saba Learning Work | |

| United Parcel Service | Transportation | 500000 | $90.96B | United States | Cornerstone Learning Suite | |

| Walgreens Company | Retail | 330000 | $139.08B | United States | Cornerstone Learning Suite |

Source: ARTW Technographics Database, July 2024

- Cornerstone OnDemand, a United States based Professional Services organization with 3600 Employees

- University Of Saarland, a Germany based Education company with 375 Employees

- Connor, Clark & Lunn Financial Group, a Canada based Banking and Financial Services organization with 400 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|