With a laser focus on automating the operations of manufacturers and asset-intensive industries, IFS is turning Generative AI into an asset both literally and figuratively.

Even though the Gen AI craze is seizing the world’s imagination on its potential to change human civilization, IFS is aiming for something less grandiose as the purveyor of industrial AI software infused with domain expertise in asset maintenance and uptime performance.

The vision was evident at its recent Unleashed user conference in Orlando with more than 3,000 attendees, including many key stakeholders who represent world-class manufacturers struggling to meet the most demanding asset maintenance requirements.

The event followed its $720-million acquisition of Copperleaf Technologies Inc. in August 2024 for advanced analytics software that delivers capital investment planning, culminating in end-to-end asset lifecycle management capabilities for the IFS installed base of more than 20,000 customers and users.

The Copperleaf addition is expected to add hundreds of customers and about $100 million in incremental revenues over the next 12 months, boosting IFS’ top line to exceed $1.5 billion in 2025. A month before it completed the deal with Copperleaf, IFS picked up EmpowerMX as well for its maintenance, repair and overhaul software for the aviation industry. In 2022, EQT, its private equity parent, also bought P2 Energy with more than 1,500 oil and gas customers and more than $100 million in estimated sales, folding the developer of oil and gas accounting and land management applications into IFS.

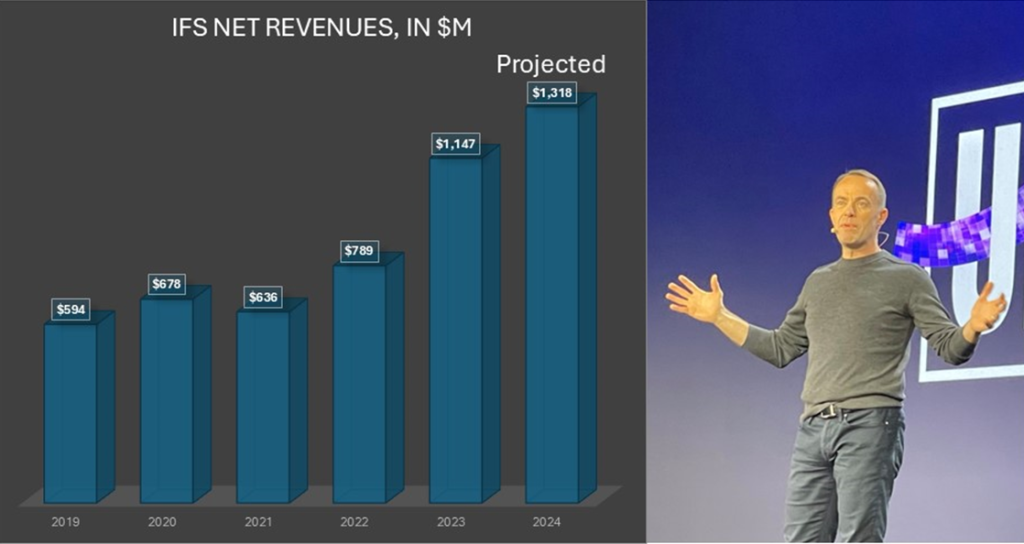

| IFS Revenue Breakdown, in USD$M | ||||||

|---|---|---|---|---|---|---|

| 2024 Projected | 2023 | 2022 | 2021 | 2020 | 2019 | |

| Recurring Revenues | 1026 | 875 | 573 | 382 | 383 | 247 |

| License | 43 | 46 | 47 | 81 | 95 | 143 |

| Consulting | 248 | 226 | 169 | 173 | 199 | 204 |

| Total | 1318 | 1147 | 789 | 636 | 678 | 594 |

Source: Apps Run The World, Buyer Insight Master Database, October 2024

All these will expand IFS’ addressable space in the $124 billion market for ERP Financial Management and ERP Services and Operations with the former attributable to its roots in accounting software and the latter deriving from an extensive collection of industry-specific solutions for Enterprise Asset Management and planning and scheduling functions that touch everything from production to facility maintenance and from material planning to service dispatching.

Mark Moffat, CEO of IFS, said rather than overreaching and overpromising, IFS’ key differentiator lies in its focus on only a handful of strategic verticals – namely Aerospace and Defense, Construction, Energy, Manufacturing and Telecom that it believes it can win over by offering an ever-expanding applications portfolio to mitigate the unforeseen risks these asset-intensive organizations are faced with in their digital transformation journey.

Aided by its buying spree, IFS’ core competency in manufacturing, which has served well its long-time customers with many standardizing on its ERP and EAM applications since its founding in 1983, is helping the vendor achieve double-digital growth over the past year. In its first half of FY24, IFS reported a 24% jump in annual recurring revenue to more than $510 million.

With facilities and resources all over the globe, IFS customers now can start off with the decision support engine that plans, budgets and allocates capital expenditures while identifying asset risks and investment benefits. Switching IFS into autopilot, their automation journey will get under way with increased visibility into how best to sustain the assets and maximize their returns with Cloud-based applications for real-time maintenance planning and scheduling, field service management, workforce optimization and finally reporting on their environmental impact.

After hosting the IFS Cloud on Microsoft Azure, its relationship with Microsoft is deepening with the use of Microsoft Copilot that enables IFS customers to take advantage of AI agents capable of summarizing repair manuals to provide on-the-spot assistance to field service technicians anytime and anywhere.

With the proliferation of AI modeling, physical assets are no longer undervalued, misused, or left to their own devices. IFS is aiming to boost their net present value by incorporating the invisible hands of digital agents and copilots into the purchase, support and finally disposal of such assets.

IFS has identified more than 60 Industrial AI scenarios with 300 more in the works as it harnesses its ecosystem led by systems integrators like PWC and Tech Mahindra to make Gen AI and Predictive AI recommendations and ad-hoc reports readily available to forecast asset behaviors and detect anomalies that could trigger proactive quality control and monitoring.

For example, Noble Corp., a $2.5-billion offshore drilling contractor for the oil and gas industry, plans to eliminate the guesswork by using IFS Industrial AI to pinpoint the servicing and replacing of specific components within 80% of its predicted failure time or lifetime.

Tomra, a $1.4-billion equipment maker for the circular economy with more than 105,000 vending machine installations worldwide that collect used bottles, is expanding its use of IFS Industrial AI to help maintain those sorting units packed with sensors and compactors. Its reliance on IFS will help ensure Tomra equipment’s uptime performance as part of its goal of collecting 500 billion drink containers for recycling around the world by 2030, up from 130 billion currently.

Not only are these customers counting on IFS to help them outperform their peers by running a tight ship when handling a raft of onerous tasks associated with asset maintenance, service and repair, but also profit from them.

BAE Systems, for example, uses IFS Maintenix when the aerospace company cross-sells a support contract alongside a new aircraft to not just gain customer intimacy but also better insights on how to optimize the equipment costs, essentially rendering redundant maintenance work obsolete. Its extensive requirement in enterprise asset management has prompted BAE to launch a new unit called Prophesea after purchasing Eurostep in 2023 for its digital asset management software for collaboration and to lower the costs of managing physical assets.

Framing the Gen AI craze to its advantage, IFS is hitting the sweet spot of identifying the pain points of its asset-intensive customers and it may end up scoring the jackpot by providing Industrial AI tools they need for synthesizing mission-critical information and eventually connecting disparate functional areas and system silos, which has already become far too common after decades of IT investments.

Although IFS’ penchant for acquisitions could exacerbate the situation, it is also addressing the fragmentation issue by turning to scores of technology partners including Microsoft Azure and Power BI for unified platform and visualization support as well as Boomi for API integration.

In practice, Industrial AI from IFS will not change the world overnight, or for that matter enterprise automation, but its central premise is not too different from the prevention is better than cure principle, enabling manufacturers to use safe and practical AI models to extend the lifespan of their assets through careful investment planning, prescriptive and scheduled maintenance that minimize costly repairs, and ultimately balanced and sustainable growth that hopefully leaves little or no carbon footprint for all the parties involved.

List of IFS Customers

Source: Apps Run The World, October 2024

- East West Bank, a United States based Banking and Financial Services organization with 3155 Employees

- University Of Saarland, a Germany based Education company with 375 Employees

- LyondellBasell, a United States based Oil, Gas and Chemicals organization with 20000 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|