Three years after becoming the sole-CEO of SAP, Christian Klein is finally putting the old SAP to bed. The signal to break from the past came loud and clear in the July 2023 earnings call when Klein announced that new innovations will not be available for on-premise or hosted on-premise ERP customers.

A few decibels short of a mandate or forced migration, Klein’s proclamation was unequivocal about the need to upgrade and/or adopt its public cloud ERP apps among tens of thousands of remaining on-premise customers of SAP, including many that have invested billions in SAP ECC and its on-premise successor S/4HANA over the past few decades.

Earlier this year, Klein reiterated the decision not to extend mainstream support for its ECC customers beyond 2027. It also followed the May 2023 election of Punit Renjen to its supervisory board and the designated successor to SAP co-founder Hasso Plattner in 2024 as its next chairman, a position that Plattner has held since 2003.

A consummate consultant, Renjen spent more than three decades at Deloitte including a seven-year stint as its CEO until his retirement in 2022. Suffice it to say that Plattner’s decision to hand over the supervisory control to an outsider underscores the wholesale transformation of SAP is finally happening.

On the call, Klein said SAP reached over 20,000 live Business Technology Platform implementations, the evolving solution that aims to connect all assets of SAP by mitigating expensive integration costs for such capabilities as embedded business intelligence/data warehouse, process orchestration and low-code development with new products like Datasphere, Signavio and SAP Build.

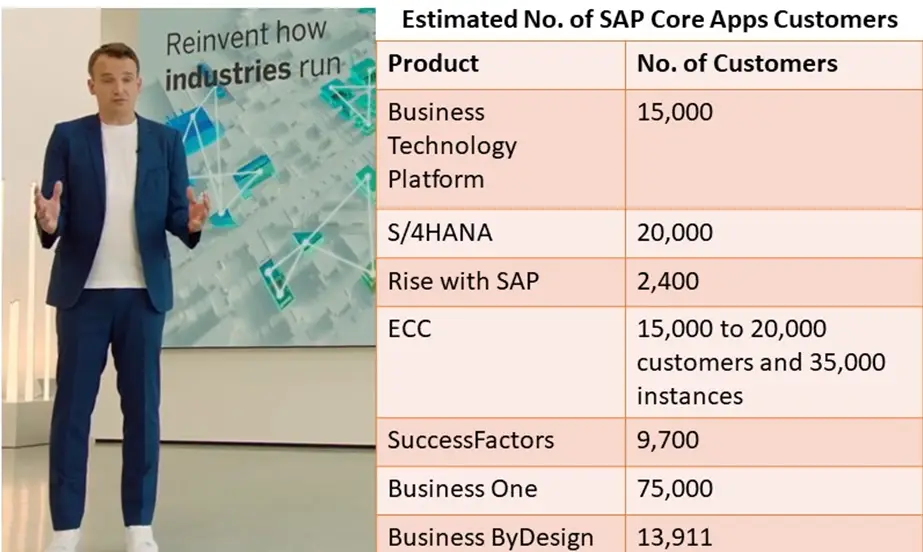

The customer count estimates in this report are based on ARTW Buyer Insight Technographics Database with sources from SAP executives, partners, customers and our continuous research on the SAP ecosystem since 2010.

In a separate briefing with the vendor’s Cloud Success Services operations in February 2023, SAP executives said there were customers rolling out 200 to 300 BTP projects simultaneously within their organizations, suggesting that many of them are aligning themselves with SAP’s direction on a massive scale, a development that could have major ramifications for the SAP ecosystem.

Then there is the $1 billion in new investment that SAP-backed Sapphire Ventures is showering upon multiple AI startups including Aleph Alpha for search and document management, Anthropic for mitigating brand risks through safe AI practices and Cohere for conversational AI implementations, especially for healthcare and life sciences.

With the exception of Heidelberg, Germany-based Aleph Alpha, which seeks to become an alternative to Microsoft-backed Open AI, SAP’s ability to leverage Anthropic and Cohere is not clear because both entities have received significant investments from Google and Oracle, respectively. What SAP’s AI All-In stance in automation suggests is that the vendor realizes that it really doesn’t matter who prevails in the current AI paradigm shift.

The end game is to position SAP as the center of AI Business-Ready ERP framework by helping these partners and customers make the most out of its data, which remain the gold standard in business to business transactions as most of the biggest companies in the world rely heavily on SAP-centric operational systems from factory production to transportation management and financial processes from AP/AR to general accounting and compliance.

For example, Nvidia is a major SAP user with the former emerging as one of the biggest winners of the nascent AI race by achieving $1 trillion in market cap because of the extensive use of its graphics processing unit for training large language models in generative AI implementations. For years, Nvidia has been running multiple SAP systems including S/4HANA, SAP Business Planning and Consolidation, SAP Enterprise Asset Management, SAP Concur among other SAP apps, according to our Buyer Insight Technographics Database.

Klein added that all these developments including the latest innovations in generative AI, sustainability like carbon management and accounting will not be available to its on-premise customers, essentially telling its customers to innovate or die.

SAP may have no choice but to push harder on its legacy customers to upgrade and migrate. In its second quarter of 2023, SAP on-premise license revenues tumbled 26%, compared with a 13% drop in the first quarter of 2023. Maintenance revenues also fell 3% to €2.8 billion in 2Q23 after slipping 1% in 1Q23. Despite that, SAP’s total sales rose 5% to €7.5 billion in 2Q23 after increasing 10% in 1Q23.

By contrast, SAP S/4HANA Cloud revenues jumped 79% to €823 million in 2Q23, accelerating migration among its on-premise customers to cloud ERP delivery. In 1Q23, the increase was 75%. SAP’s overall cloud revenues were up 22% reaching €3.3 billion in constant currency in 2Q23, following another 22% jump to €3.2 billion in constant currency in 1Q23.

What the results indicate is nothing short of a delicate transition from SAP maintenance – still representing more than one-third of its total sales – to Cloud subscriptions, now accounting for 44% of its business to more than half that SAP is undertaking while still needing to sustain a double-digit growth for the whole in order to satisfy its investors.

Situating itself in the middle of the road, SAP does not favor the approach of rivals like Epicor, Infor or Oracle, which has steadfastly voiced perpetual support of its legacy customers. Neither does it want to be someone like Microsoft, which has been force-migrating its legacy ERP customers primarily those running AX, GP and NAV to Dynamics 365 ERP specifically Business Central, much to the dismay of its business partners.

Still, SAP needs to equip itself with sticks as well as carrots to entice the majority of its legacy customers to upgrade and migrate by 2027. One stumbling block is that some of its technology and systems integration partners have already voiced concerns about the high costs of adopting BTP at a time when perhaps only a few companies can afford to do these ambitious projects all at once.

From any vantage point, the vendor may no longer appear to be the company that it used to be and it will definitely require the new SAP and its customers to tango together barring an automatic buy-in, but any sign of a withdrawal from the massive SAP ecosystem is neither beneficial nor practical for any of the parties involved.

While the call to action from the 43-year-old Klein is not totally surprising, his direct message is expected to cause consternation among tens of thousands of customers including many in its Germany home base and the United States that have been relying heavily on a stable ERP platform for decades since the 51-year-old company released R/1 in 1973 that paved its way to eventual dominance of the enterprise resource planning market.

Through the years, SAP proceeded with upgrades including R/2 in 1979, the spectacularly successful R/3 in 1992 and the subsequent ECC Enhancement Packs that fueled its global expansion because of their high performance and standard-setting capabilities for financial analysis, maintenance management, production operation, HR as well as industry-specific features tailored for conglomerates and multinationals.

Even with the release of S/4HANA in 2014, SAP has been working under the mandate of serving the best interest of its customers and their operations counting on receiving periodic enhancements from the vendor that are complementary but never disruptive. Today, most of over 20,000 S/4HANA customers are still running the software in an on-premise mode, according to our Buyer Insight Technographics Database.

With that in mind, long-time SAP customers and partners have been given a clear directive and they are well advised to align themselves with the AI All-In stance of SAP if they want to evolve and gain a competitive advantage.

List of SAP Customers

Source: Apps Run The World, July 2023