Oracle posted better than expected results in its final quarter of fiscal 2025, signaling even stronger performance in the future and its intentions to disrupt the current Cloud order.

For the first time in 11 years, Oracle also posted straight increases across all of its product segments with Cloud Services marking the largest gain at 27% to reach $6.7 billion in revenue for 4QFY25.

Fueled by its cloud database products, the vendor saw a 9% jump in its cloud license and on-premise license sales for the quarter to exceed $2 billion, the first time above that level in two years.

In total, Oracle’s three-month revenues soared 11% to hit $15.9 billion, ending the year with $57.4 billion in total sales, an 8% rise. Its $3.4 billion in net income grew a respectable 9% for the quarter, contributing to a 19% expansion in earnings to $12.4 billion for the year.

CEO of Oracle Safra Catz said better days are yet to come, stating that its total cloud revenues (including applications and infrastructure) would see growth topping 40% in its current fiscal year, up from 24% in FY25 as Oracle Cloud Infrastructure, in a tight race against Google Cloud for the No. 3 IaaS provider spot, starts to take off further with a north of 70% jump to surpass $17 billion in projected sales in FY26, up from $10 billion in FY25.

“Oracle is well on its way to being not only the world’s largest cloud application company, but also one of the world’s largest cloud infrastructure companies,’’ Catz said.

Chairman and Chief Technology Officer of Oracle Larry Ellison said demand for OCI is doubling every year. In order to accommodate the skyrocketing growth rates of OCI, Ellison added that it will double the number of Oracle Cloud@Customer dedicated data centers to at least 59 in fiscal 2026.

If that’s any doubt about Oracle’s ambitions, look no further than its capital expenditures, which amounted to $54 billion in its FY25, up nearly 100% from $27.4 billion in FY24, the biggest jump among the top IaaS providers. To see how things have changed at Oracle, its CapEx was barely $3.5 billion for the whole year of fiscal 2014.

On the other hand, Microsoft boosted its CapEx by 53% for its latest quarter to $21.4 billion, compared with Oracle’s $9.1 billion with a 226% jump in its 4QFY25. AWS’ CapEx is projected to hit $100 billion in 2025, up 20% from $83 billion last year, while Alphabet expects to spend $75 billion on CapEx this year, up 43% from $52.5 billion in 2024

Based on Catz’s guidance, Oracle’s total Cloud revenues could exceed $34 billion in its current fiscal year, split evenly between its IaaS business and Cloud applications. The latter is attributable to uninterrupted demand for its Fusion ERP applications and NetSuite offerings as Catz emphasized the fact that she saw no impact from the ongoing global trade disputes.

Both Catz and Ellison said on the earnings call that Oracle’s IaaS outlook has not even factored in direct contributions and/or halo effects from the still evolving Stargate initiative, a $500-billion project to build the next-generation AI infrastructure consortium involving Softbank, OpenAI, Oracle, and MGX, an investment fund held by the Abu Dhabi government.

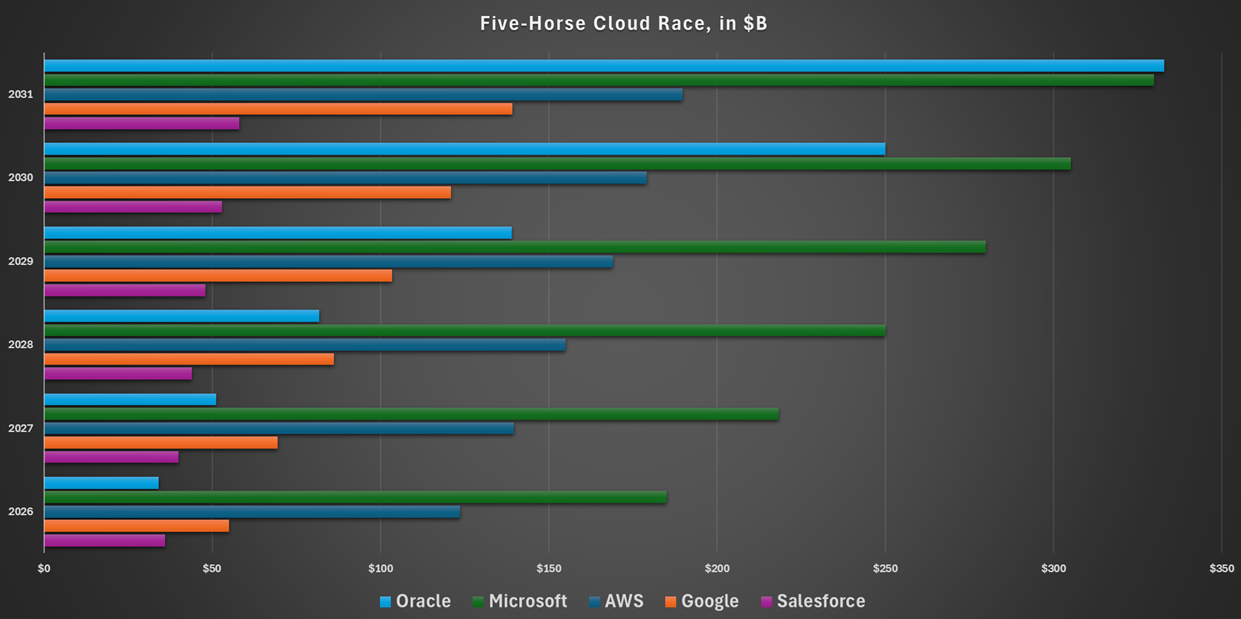

If things pan out as Oracle envisions, we estimate its total Cloud revenues could zoom past $330 billion by 2031 as shown in the following modeling.

Per Oracle’s announcement on June 30 that zeroes in on a $30 billion cloud contract that comes into effect in its Fiscal 2028 that runs from June 2027 to May 2028, our model has been updated to reflect doubling of its projected Cloud revenues to exceed $100 billion in calendar year 2028. Because of that, Oracle’s projected Cloud revenues could top $175 billion by 2029 and add at least $75 billion each year in incremental cloud revenues through 2031 chalking up as much as $333 billion in total cloud revenues by that time.

Exhibit 1 – Modeling of Projected Cloud Revenues of Top Five Providers

| Top Cloud Vendors | Projected Cloud Revenues, $B, 2026 | Projected Cloud Revenues, $B, 2031 | 2026-2031 CAGR, % |

|---|---|---|---|

| AWS | $124 | $190 | 9% |

| $55 | $139 | 20.4% | |

| Microsoft | $185 | $330 | 12.3% |

| Oracle | $34 | $333 | 57.7% |

| Salesforce | $36 | $58 | 10.0% |

What is likely to happen is the emergence of a five-horse race through 2031 for the crown to become the No. 1 Cloud applications and infrastructure provider capitalizing on the enormous appetite for Generative AI build-out activities around the world, as shown in the following exhibit:

Exhibit 2 – Projected Sales of Cloud Applications and Infrastructure Services Through 2031, in $billions

Another reason for optimism behind the Oracle’s Cloud trajectory is the breadth of its products.

In the business software space, not even Microsoft can match Oracle’s breadth of horizontal and vertical software offerings. The former may be able to rely on Windows and its Office 365 juggernauts to continue, but one can argue that these two could see eroding demand given that they are being sustained as mostly replacement business, similar to the hardware sales of Oracle.

In our Buyer Insight Technographics Database, Microsoft, Oracle and SAP are among the top vendors with extensive listings of their products and buyer intent signals that are being updated continuously. Currently, Microsoft, Oracle and SAP are listed in our Directory as having 432, 599 and 561 unique products, respectively, at the stock keeping unit level.

However, when it comes to buyer intent signals from thousands of visitors accessing our proprietary content every day, Oracle garners the most attention picking up 3,356 active buyers evaluating 297 different products over the past 90 days, more than that of any other vendor and their products in our continuous tracking of these signals. Over the past 12 months, we have identified more than one million such signals by making regular updates available to our subscribers.

Exhibit 3 – ARTW’s Software Product Database and ARTW Buyer Intent Signals

| Microsoft | Oracle | SAP | |

|---|---|---|---|

| Number of Products Listed on ARTW Database | 561 | 599 | 432 |

| Number of Buyer Intent Signals Identified Over the Past 90 Days | 2,977 | 3,356 | 2,918 |

| Buyer Intent Target Products | 87 | 297 | 253 |

Because of the breadth of Oracle’s offerings, it appears that buyers are paying more attention to its product mix than that of other vendors. That could bode well for Oracle in the long run as it continues to expand its reach through migration of its onpremise customers, internal development of new products, and alliances like those with Stargate.

If it succeeds in migrating to the Cloud by 2031 most of its onpremise customers, which accounted for about $20 billion in sales alone to Oracle in FY25, Oracle could chalk up tens of billions of dollars in incremental Cloud revenues every year through the forecast period.

List of Oracle 4QFY25 Customer Wins

Source: APPS RUN THE WORLD Technographics Platform, June 2025