In 2024, the global Construction and Real Estate software market grew to $24.2 billion, marking a 12.7% year-over-year increase. The top 10 vendors accounted for 37.2% of the total market. RealPage led the pack with a 5.3% market share, followed by Procore, Oracle, and Autodesk.

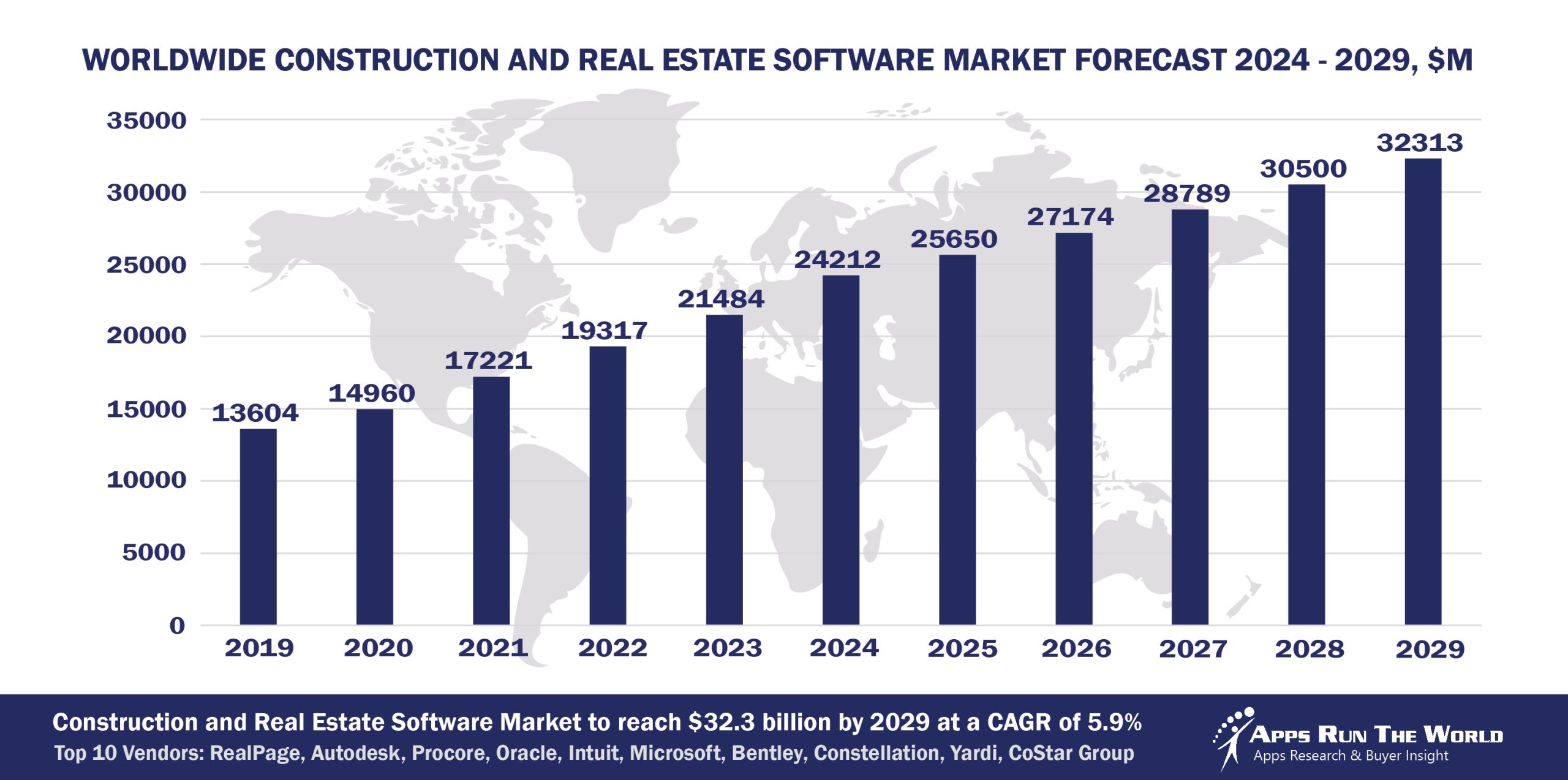

Through our forecast period, the Construction and Real Estate applications market size is expected to reach $32.3 billion by 2029, compared with $24.2 billion in 2024 at a CAGR of 5.9%, as shown in the Apps Top 500 Report – Excel Edition [Preview] .

Construction and Real Estate (Contracting and building of commercial, public, and residential structures, real estate management) – Bidding, cost estimates, Time Tracking, Homebuilder Software, Quantity Takeoff Software, Property Management, Financials, HR, Procurement

Top 10 Construction and Real Estate Software Vendors in 2024 and their Market Shares

Source: Apps Run The World, July 2025

Other Construction and Real Estate software providers included in the report are: Adobe, ADP, Ansys Inc., AppFolio, Arcoro, Atlassian, Autodesk, AVEVA Group, Buildertrend, Cisco Systems, Citrix, Computer Methods International Corp., CoStar Group, Dassault Systemes, Dropbox, ECi Software Solutions, Entrata, Eque2, eSUB Construction Software, FINALCAD, Foundation Software, Google, HCSS, Hemlane, Hexagon, IBM, iLease Management LLC, Infor, JDM Technology Group, Lease Harbor, LeaseCalcs, Inc., MRI Software LLC, Nemetschek Group, Newforma, Nice Systems, Open Text Corporation, Paycom, PayProp, Pegasystems, PlanData Systems Corp, Procore, Property Matrix, Raken, RedTeam Software, LLC, Re-Leased Software Company Ltd, RemoteLandlord, Rent Manager by London Computer Systems, RIB Software SE, Rockwell Automation, Roper Technologies, Inc., Salesforce, ServiceNow, Siemens Digital Industries Software, SolarWinds, Sopra Steria Group SA, TenantCloud, Teradata Corporation, The Innovation Group, Twilio, Verint Systems Inc., Visma, VTS (ex Hightower), Workday, Yonyou, Zego(formerly PayLease), and others.

Vendor Snapshot: Construction and Real Estate Market Leaders

RealPage

RealPage

RealPage has enhanced its OneSite and Accounting platforms with AI-powered revenue management and predictive analytics to optimize occupancy and asset performance. The company has also integrated smart building data and ESG tracking into its roadmap to support sustainability and operational efficiency. Recent acquisitions, Livble for flexible rent payment solutions and Rexera for agentic AI workforce capabilities, further expand RealPage’s innovation in resident experience and AI-driven operations.

Procore

Procore has evolved its platform into an agent-enabled intelligence ecosystem, with Helix AI agents automating RFIs, scheduling, submittals, and customizable workflows via a low-code Agent Builder. Machine-learning modules analyze progress images to flag safety or quality issues, while real-time cost-to-complete analytics forecast budget and material risks before they arise. The acquisition of Infocubed further strengthens Procore’s analytics and reporting, aligning data insights with on-site execution.

Oracle

Oracle’s construction suite, including Primavera P6, Aconex, the Smart Construction Platform, and Textura, now embeds AI-powered schedule risk analysis and automated document control to accelerate project delivery and compliance. By integrating Aconex for contract and field collaboration and Textura for payment automation, Oracle has created a unified, cloud-native environment for planning, execution, and financial management. Ongoing investment in digital-twin technologies and microservices supports scalable construction operations.

Autodesk

Autodesk Construction Cloud introduces generative design for buildable models and AI-assisted quantity takeoffs that automate clause recognition and cost estimation. Its Forge APIs enable seamless integration between BIM data, field capture, and project analytics, enhancing collaboration from design through construction. In early 2024, Autodesk acquired Payapps to bring automated payment and compliance workflows into its platform, further streamlining progress billing and financial management.

Intuit Inc.

Intuit’s QuickBooks lineup, Online, Enterprise, Desktop, and its Field Service Management solution now feature AI-driven expense categorization, cash-flow forecasting, and technician dispatch optimization to serve small to mid-market contractors and property managers. The 2025 acquisition of GoCo expands HCM and benefits administration capabilities, integrating workforce lifecycle management directly into QuickBooks Payroll. Intuit’s Mailchimp addition continues to bolster its marketing automation reach for service-based and real estate businesses.

Microsoft

Microsoft’s Project Online, Dynamics 365 for Finance and Operations, and Business Central offerings support construction firms with end-to-end project and financial management. Copilot AI assistants automate reporting, change-order risk detection, and stakeholder communication across tools like Teams, SharePoint, and Microsoft 365. Microsoft is also advancing connected jobsite capabilities through Azure IoT, Power Platform low-code apps, and the Construction Data Model to unify BIM, field data, and operational workflows.

Constellation Software

Through its CSI divisions, NEWSTAR Homebuilder, Jonas Enterprise, Jonas Premier, and BuildTopia, Constellation Software delivers niche construction and homebuilding solutions with deep compliance automation and integrated CRM for sales and customer management. Recent product work has prioritized cloud migration, API extensibility, and mobile-first interfaces to streamline estimating, scheduling, and finance workflows. Constellation’s ongoing acquisition of specialized vertical software firms continues to enrich its portfolio with targeted construction-tech innovations.

Bentley Systems

Bentley’s ProjectWise 365 and SYNCHRO 4D platforms now incorporate machine-learning-based schedule risk forecasting and advanced clash avoidance to support complex infrastructure delivery. MicroStation’s generative design tools accelerate the creation of modular components, reducing design iterations and improving constructability. Recent development has focused on integrating AI-powered analytics across the asset lifecycle to improve decision-making from design through construction.

Yardi

Yardi’s Voyager and Breeze platforms integrate AI-enabled lease abstraction and virtual assistants to streamline tenant communications and automate onboarding tasks. Recent enhancements emphasize ESG analytics, utility benchmarking, and portfolio-level forecasting to help property managers meet sustainability goals and optimize asset performance. Expanded integration with IoT and smart building technologies supports real-time visibility into energy use, maintenance, and occupancy trends.

CoStar Group

CoStar Real Estate Manager embeds machine-learning analytics for lease administration, space utilization forecasting, and portfolio benchmarking to inform capital planning decisions. The platform’s expanding data network, bolstered by the 2023 acquisition of STR for hospitality insights, now offers a unified view of market rents, occupancy trends, and competitive performance. CoStar continues to enhance transaction management and marketplace services to meet the needs of corporate real estate teams.

ARTW Technographics Platform: Construction and Real Estate customer wins

Since 2010, our research team has been studying the patterns of Construction and Real Estate software purchases, analyzing customer behavior and vendor performance through continuous win/loss analysis. Updated quarterly, the ARTW Technographics Platform provides deep insights into thousands of Construction and Real Estate customer wins and losses, helping users monitor competitive shifts, evaluate vendor momentum, and make informed go-to-market decisions.

List of Construction and Real Estate customers

Source: ARTW Buyer Insights Technographic Database

Custom data cuts related to the Construction and Real Estate Applications market are available:

- Top 1000+ Construction and Real Estate Applications Vendors and Market Forecast 2024-2029

- 2024 Construction and Real Estate Applications Market By Functional Market (16 Markets)

- 2024 Construction and Real Estate Applications Market By Country (USA + 45 countries)

- 2024 Construction and Real Estate Applications Market By Region (Americas, EMEA, APAC)

- 2024 Construction and Real Estate Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2024 Construction and Real Estate Applications Market By Customer Size (revenue, employee count, asset)

- 2024 Construction and Real Estate Applications Market By Channel (Direct vs Indirect)

- 2024 Construction and Real Estate Applications Market By Product

Worldwide Enterprise Applications by Vertical Market

Exhibit 3 provides a forecast of the worldwide enterprise applications by vertical market from 2024 to 2029, highlighting market sizes, year-over-year growth, and compound annual growth rates across different industry sectors from Aerospace and Defense to Utilities.

Exhibit 3: Worldwide Enterprise Applications by Vertical Market Forecast 2024-2029 by Functional Market ($M)

Source: Apps Run The World, July 2025

Exhibit 4 shows our projections for the enterprise applications market by vertical segment, based on the buying preferences and the customer propensity to invest in new software within those industries as they continue to upgrade and replace many legacy industry-specific applications that have been identified and tracked in our Buyer Insight Database.

FAQ – APPS RUN THE WORLD Top 10 Construction & Real Estate Software Vendors, Market Size & Forecast

Q1. What is the global Construction & Real Estate software market size in 2024?

A: The global Construction & Real Estate software market grew to $24.2 billion in 2024, with a 12.7% year-over‑year increase.

Q2. Who are the top 10 Construction & Real Estate software vendors in 2024 and their combined share?

A: The top 10 vendors are RealPage, Procore, Oracle, Autodesk, Trimble, Bentley Systems, SAP, Microsoft, IBM, and Bluebeam, together accounting for around 37.2% of the market.

Q3. Which vendor leads the Construction & Real Estate software market in 2024?

A: RealPage leads the market in 2024 with a 5.3% share.

Q4. What is the forecast for the Construction & Real Estate software market through 2029?

A: The market is projected to reach $32.3 billion by 2029, growing at a CAGR of 5.9%.

Q5. What applications are included in the scope of the Construction & Real Estate software market?

A: The scope includes bidding, cost estimating, time tracking, homebuilder software, quantity takeoff, property management, financials, HR, and procurement.

Q6. Which other Construction & Real Estate software vendors are covered beyond the top 10?

A: The report also profiles vendors such as Yardi, CoStar Group, AppFolio, and others offering specialized property and real estate management solutions.

Q7. When was this report published and by whom?

A: The Top 10 Construction & Real Estate Software Vendors, Market Size & Forecast 2024‑2029 report was published July 2025 by APPS RUN THE WORLD analysts Albert Pang, Misho Markovski, and Aleksandra Markovska, as part of the APPS TOP 500 research program, which benchmarks the revenues and market share of the world’s 1,500+ largest enterprise application vendors.

More Enterprise Applications Research Findings

Based on the latest annual survey of 10,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 1,500 largest Enterprise Applications Vendors ranked by their 2024 product revenues. Their 2024 results are being broken down, sorted and ranked across 16 functional areas (from Analytics and BI to Treasury and Risk Management) and by 21 vertical industries (from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year our global team of researchers conduct an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market.

We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 2 million organizations around the world.

The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.

- Affordable Housing Concepts, a United States based Construction and Real Estate organization with 30 Employees

- Bharti Tele Ventures, a India based Communications company with 100 Employees

- Wipfli, a United States based Professional Services organization with 2200 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

RealPage

RealPage