The allure of the small and midmarket companies for enterprise software vendors is proving to be more irresistible and indispensable than ever, despite economic headwinds that have stalled a number of technology providers catering to the masses.

In October 2023, Oracle announced Oracle HCM Now with an accelerated implementation package designed for midsized organizations up to 15,000 employees, many of which are still struggling to meet today’s complex HR requirements partly because of a lack of a fully automated system.

Speaking at the recent HR Tech Conference, Yvette Cameron, senior vice president of Oracle global product strategy, is confident that these midsized organizations can radically improve their recruiting, Core HR and other people management business processes by adopting Oracle HCM Now. After signing an initial set of six systems integrators in North America, Cameron said an expanding ecosystem will help Oracle HCM Now customers get up and running within six months using a fixed price fixed scope methodology.

At the same time, Oracle NetSuite is partnering with hundreds of private equity firms and trade associations focusing on manufacturing and services industries to help their portfolio companies and members take advantage of NetSuite’s integrated applications for ERP including planning and budgeting, omnichannel commerce, HR, inventory management, customer service and support, and analytics.

Oracle NetSuite, the vendor’s default product for SME, currently supports over 37,000 customers, more than double what it had in 2019, resulting in $2.8 billion in revenue in 2023, up from $1.3 billion four years earlier. Oracle also caters to hundreds of thousands of SMEs through its industry solutions such as Aconex and Primavera for construction and engineering, Micros for leisure, hospitality, and retail, as well as Cerner for healthcare and life sciences.

During its most recent earnings call, SAP announced that it has signed more than 440 customers in over 80 countries with increased traction especially in North America that have purchased its GROW with SAP Cloud ERP offering since its launch in March 2023, according to CEO Christian Klein.

Another advantage lies in the fact that GROW with SAP shares many of the attributes including SAP Business Technology Platform, industry best practice content, as well as a growing array of tools, methodologies, and activation services native to its flagship product S/4 HANA cloud.

In addition to GROW with SAP, the vendor also caters to the SME market with SAP Business One, which has more than 75,000 customers running it either as on-premise or hosted in the cloud, and SAP Business ByDesign, a Cloud ERP suite with about 14,000 customers.

Elsewhere, UKG considers SME a critical component behind its goal of hitting $5 billion in total revenues in the next year or two as it positions UKG Ready applications further up the market to as large as 500-person employers. Having experienced rapid growth among small and midsized enterprises that are increasingly standardizing on UKG Ready for Core HR and strategic workforce management, CEO Chris Todd said UKG Ready has out-performed the company as a whole after the vendor doubled its SME-dedicated sales force over the past year. During the period, UKG indicated that UKG Ready has leapfrogged rivals like Paycom and Paylocity because of a mix of inside sales and channel sell-through.

The ambitions of these vendors differ from those including Bill, Paycom, and Zoominfo that have tempered their enthusiasm in recent weeks citing economic headwinds that could result in less-than-expected growth potential especially from their small and midsized customers. Bill, Paycom, and Zoominfo all have seen sizable drops in their stocks since they dialed back their sales projections for 2024.

The diverging views of the opposing camps underscore two salient facts. First, the SME market remains highly fragmented with plenty of opportunities for bulls like Oracle, SAP and UKG to displace incumbents with smarter use of technology enablers from AI to channel, in addition to actionable signals that zero in on customer purchases and preferences.

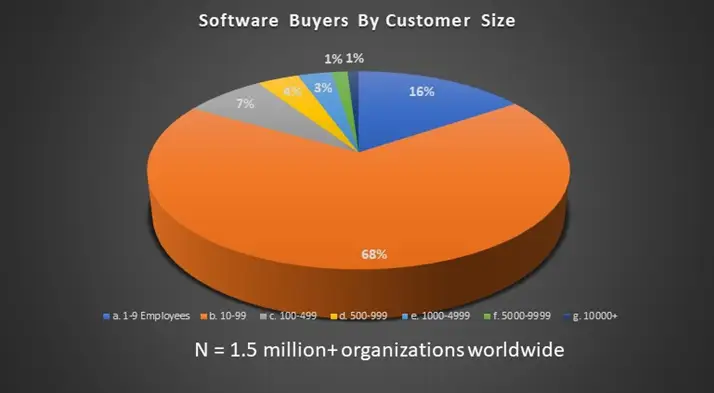

Our Buyer Insight Technographics Database illustrates the first point in stark fashion. Among the more than 1.5 million organizations worldwide that we track and survey continuously, 79% of them have between 10 and 999 employees, as shown in the following exhibit.

Source: Buyer Insight Technographics Database, October 2023

Updated daily, the ARTW database showcases 7.5 million enterprise software purchases that have been made by 1.5 million companies – more than three quarters of which are small and mid-sized organizations from 195 countries – as they rely on 27,000 different applications from 10,000 Independent Software Vendors(ISVs) to run their mission critical business processes.

Any ISV that fails to articulate and execute a coherent SME strategy is missing out on a big chunk of the market. Consider Zoho, which started out as a provider of network management and ITSM tools namely ManageEngine in the 1990s, has now signed up more than 100 million users worldwide, up from 30 million in 2018, by supporting them with a complete suite of over 55 applications from CRM to email and from financial management to collaboration. In total, Zoho said it reached $1 billion in annual revenue in 2022.

By comparison, Intuit, which aims to exceed $16 billion in total sales with 11% growth in fiscal 2024, now touts more than 10 million businesses running its accounting, online payment, payroll and CRM applications, in addition to 90 million consumers that run its tax management and other services like Credit Karma for personal finance with 42 million monthly active users.

Like many that have perfected the art of selling into SMEs, they have reckoned that less is more, or the smaller the customer, the bigger the reward if one can win them over repeatedly.

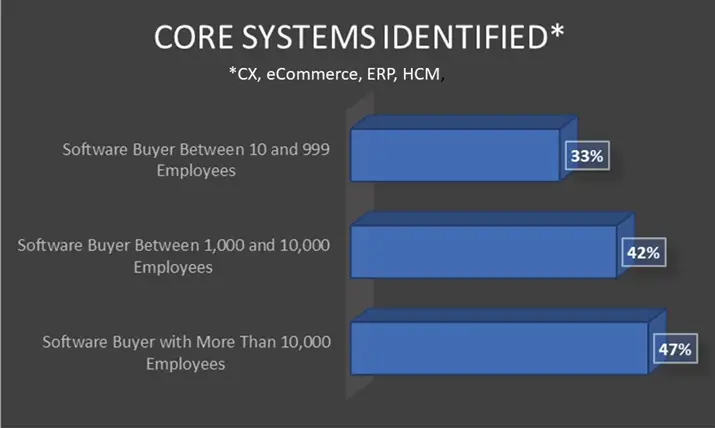

That is because the use of core systems for CX, eCommerce, Financial Management, and HR is more pronounced among organizations with more than 10,000 employees, a full 14 percentage point over those that have fewer than 999 employees, as shown in the following exhibit.

Source: Buyer Insight Technographics Database, October 2023

- LG CNS, a South Korea based Professional Services organization with 7000 Employees

- LG CNS, a South Korea based Professional Services company with 7000 Employees

- Covenant University, a Nigeria based Education organization with 1100 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

The bigger the organization the more likely that they have already established their direction in the above core systems, suggesting that there is less of an opportunity to displace incumbents. On the other hand, the smaller the organization the less likely that these core systems have been set in stone and many of them are still using a hodgepodge of legacy, best-of-breed, home grown and other sub-core systems from email to web hosting. For the time being, core-system penetration appears to be higher among big enterprises than small and midsized organizations.

The second point is that the bearish camp led by Bill, Paycom, Zoominfo and the likes needs to reset their expectations as high interest rates are here to stay perhaps through the end of the decade following the cessation of government subsidies in the post-pandemic era. Though SMEs may have less to spend, they still represent a much larger buying bloc as they turn selective by favoring those vendors that have successfully modified their approach by becoming more downturn-ready through customer-centricity and product and service diversifications.

The performance of other broad-based vendors has been more consistent. GoDaddy, which has been expanding from a pure-play hosting provider to one with multiple applications and eCommerce offerings, has continued to fare well among SMEs. Despite the economic headwinds, GoDaddy saw uninterrupted growth in low single-digit for the past three quarters this year. Its applications and eCommerce revenues – now one-third of its $4-billion run rate – rose 11.4% in the third quarter, compared with 10.9% in the second quarter and 11.5% in the first quarter.

Another example is Constellation Software, which chalks up over $8 billion in sales this year from hundreds of thousands of SME customers, reported a 6% organic growth rate in the third quarter, up from 5% in the second and 5% in the first. Since the 1990s, CSI Software has emerged as one of the largest and most diversified enterprise software vendors by sticking to a low-cost model with multiple decentralized operating subsidiaries that zero in specific verticals and subverticals from public transportation to gym management through the addition of dozens of acquisitions worldwide every year.

No doubt the SME market in 2024 is going to be hotly contested and survival of the fittest matters more than ever.

List of SAP, Oracle, and UKG SME Customers

Source: Buyer Insight Technographics Database, November 2023