In 2024, Oracle surpassed SAP as the No. 1 ERP applications vendor for the first time, unseating the business software pioneer that has dominated the Enterprise Resource Planning landscape since the early 1980s.

With the help of its fast-growing Oracle Fusion Cloud ERP products for accounting, order management and other mission-critical processes designed to automate industries like healthcare, banking and construction, Oracle posted $8.7 billion in ERP software revenues last year, securing a 6.63% market share in the all-important ERP applications market, compared with SAP’s $8.6 billion in ERP sales and a 6.57% share, according to the latest data from our continuous survey of more than 1,000 ERP applications vendors around the world for the past 15 years, as shown in Exhibit 1.

Exhibit 1 – Worldwide ERP Applications Market and Top 10 Vendors and Their 2019-2024 ERP Software Revenues, $M

| Rank | Vendor | 2019 ERP Revenues, $M | 2020 ERP Revenues, $M | 2021 ERP Revenues, $M | 2022 ERP Revenues, $M | 2023 ERP Revenues, $M | 2024 ERP Revenues, $M | YoY Growth | 2024 ERP Market Share,% |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Oracle | $3,890 | $4,242 | $4,362 | $7,021 | $7,453 | $8,770 | 17.7% | 6.63% |

| 2 | SAP | $6,349 | $6,679 | $6,849 | $7,230 | $7,639 | $8,686 | 13.7% | 6.57% |

| 3 | Intuit | $2,602 | $3,005 | $3,664 | $4,520 | $5,229 | $5,689 | 8.8% | 4.3% |

| 4 | Constellation Software | $2,104 | $2,365 | $3,045 | $3,457 | $4,283 | $5,140 | 20.0% | 3.9% |

| 5 | Microsoft | $2,718 | $3,229 | $2,547 | $3,003 | $3,656 | $4,505 | 23.2% | 3.4% |

| 6 | FIS Global | $2,460 | $2,490 | $2,563 | $2,630 | $2,695 | $2,803 | 4.0% | 2.1% |

| 7 | IQVIA | $2,165 | $2,349 | $2,560 | $2,601 | $2,652 | $2,679 | 1.0% | 2.0% |

| 8 | Roper Technologies | $1,450 | $1,530 | $1,747 | $1,965 | $2,284 | $2,421 | 6.0% | 1.8% |

| 9 | Sage | $1,500 | $1,543 | $1,410 | $1,701 | $2,044 | $2,207 | 8.0% | 1.7% |

| 10 | Infor | $1,625 | $1,558 | $1,565 | $1,696 | $1,777 | $1,866 | 5.0% | 1.4% |

| Subtotal | $26,863 | $28,990 | $30,312 | $35,824 | $39,712 | $44,766 | 12.7% | 33.9% | |

| Others | $67,189 | $66,232 | $73,815 | $78,007 | $84,488 | $87,445 | 3.5% | 66.1% | |

| Total | $94,052 | $95,222 | $104,127 | $113,831 | $124,200 | $132,211 | 6.5% | 100.0% |

Source: APPS RUN THE WORLD, April 2025

*ERP Revenues = License + Support & Maintenance + SaaS

** All revenue figures are estimates based on public records, Cloud and Non-Cloud business models in APPS RUN THE WORLD’s vendor database, and annual survey results including vendor feedback.

The ascent of Oracle has been remarkable given that it did not have a viable ERP product until the early 1990s when its co-founder Larry Ellison decided to invest heavily in applications development, years after forming the company to become the database disrupter to challenge incumbents like Informix, Ingres, Sybase, and IBM.

After winning the relational database market in the late 90s, Ellison on many occasions acknowledged the herculean task of wresting control of the ERP market from SAP because of its outsized influence over some of the biggest organizations in the world by shaping and enhancing their business outcomes through process improvement and efficient IT practices.

Competition between the two intensified in the 2000s when Oracle complemented its E-Business Suite product with a series of acquisitions including PeopleSoft, JD Edwards, and Hyperion. The combination of these products fast-tracked the development of Oracle’s suite of SaaS applications, which are now branded Oracle Fusion Cloud Applications.

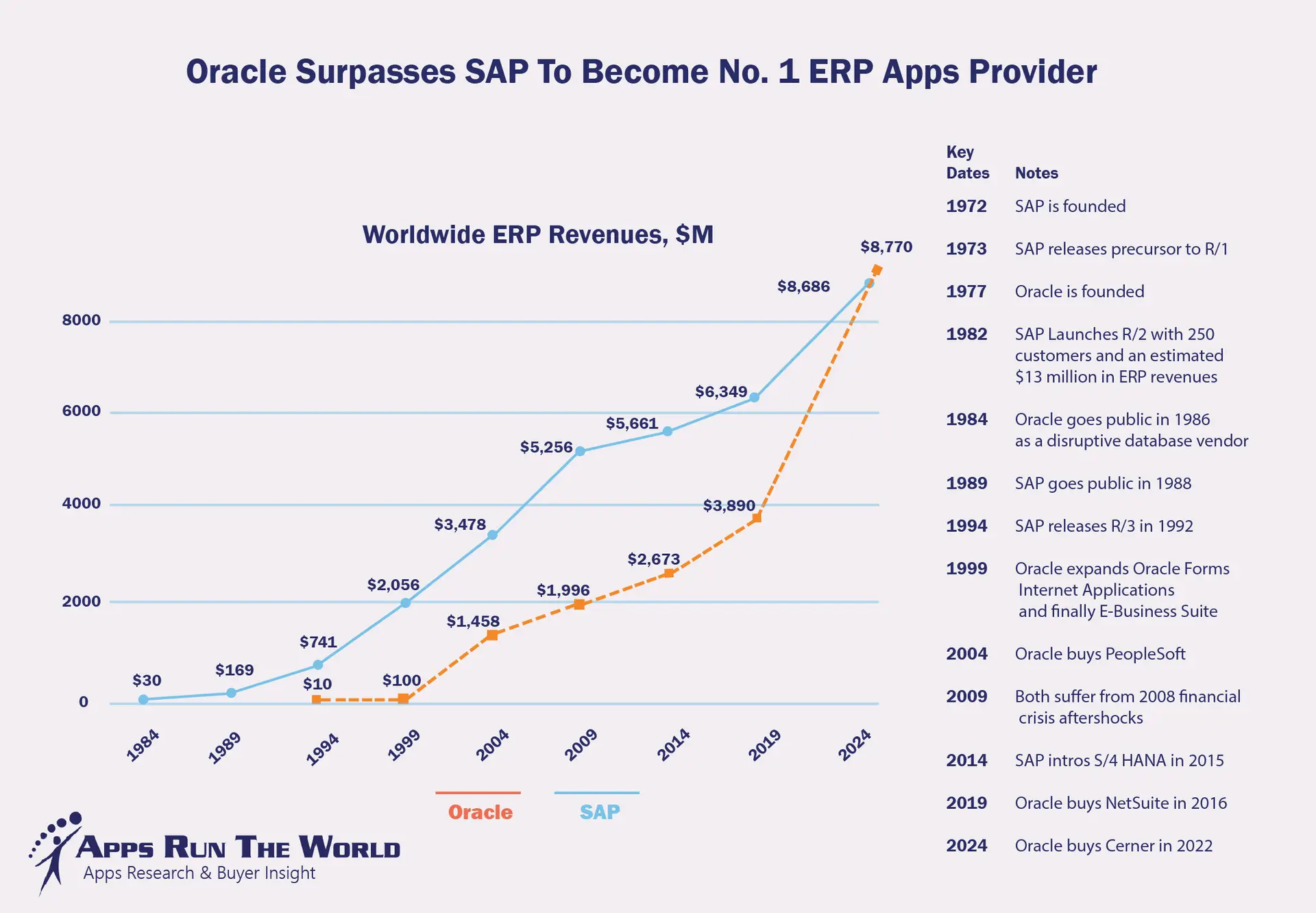

Exhibit 2 summarizes the decades-long battle between the two with increments of five-year milestones showing Oracle more than doubling its ERP software revenues from 2004 to 2019 and finally leapfrogging SAP last year as a result of growing market acceptance and cumulative effects of multiple acquisitions.

Exhibit 2 – Five-Year Milestone Increments of SAP and Oracle ERP Revenues Since 1984, $M

Following the purchase of PeopleSoft that helped usher in Fusion applications, Ellison upped the ante in 2016 in his quest to challenge SAP by buying NetSuite and picking up more than 10,000 unique Cloud ERP customers along the way.

In recent years, Oracle Fusion Applications and NetSuite have experienced rapid customer adoption. The former now counts 14,000+ large enterprises among its installed base, while NetSuite has grown to serve more than 41,000 customers.

Six years later Oracle signed a $28.3 billion pact to absorb Cerner, which offers a range of patient accounting, revenue cycle management and electronic health records deemed essential for over 20,000 healthcare and public-sector organizations.

As recent as early 2020, Christian Klein, who was co-CEO at the time until he was named the sole chief executive of SAP in April of that year, saw little threat from Oracle ever becoming the No. 1 ERP vendor despite the fact some of its customers were entertaining the idea of containing their spend with SAP because of structural changes to the economy with more emphasis on services than goods and their move to the Cloud.

Soon a storm of controversy erupted over customer defection in dueling earnings calls from the two vendors with some citing SAP ERP customers migrating to Oracle while others reporting Oracle database workloads being moved to SAP HANA. According to our Buyer Insight Technographics Database, there have been cases where a number of SAP customers have replaced their ERP systems with Oracle products either at the divisional level or wholesale changes following an extended period of running old versions of SAP. However, these are exceptions rather than the rule, meaning that SAP’s account control remains firmly in place.

The real catalyst behind the latest turn of events is simple math. SAP’s installed base now covers no more than 400,000 customers, compared with about 400,000 for Oracle.

In its latest fiscal year, SAP was able to fetch on average $91,800 in revenue per customer for a total turnover of $37 billion, compared with $132,500 for Oracle for a total turnover of $53 billion, handing Oracle a 31% wallet-share advantage. That means Oracle is capable of selling more products to its customers, many of whom are willing to pay more for their end-to-end Oracle products and services including the mission-critical ERP systems.

In the total ERP market(covering both financial management and industry-specific back-office solutions), Oracle has more than 100,000 customers that on average contributed $87,700 each last year, compared with $61,429 for each of SAP’s 141,399 ERP customers. Again, Oracle achieved a 30% advantage over SAP in its ability to drive greater wallet share among its customers.

The same applies to Oracle’s edge over SAP across its ERP financial management applications for enterprise accounts and SMB, as shown in Exhibit 3 below.

Exhibit 3 – Estimated ERP Software Revenues Per Customer On Average in 2024

| Brand | Estimated Sales Per Customer on Average in 2024, $ |

|---|---|

| Oracle Fusion Cloud ERP | $257,286 |

| SAP S/4HANA Cloud | $253,100 |

| NetSuite ERP | $91,463 |

| SAP Business ByDesign | $8,276 |

| SAP Business One | $5,175 |

Source: APPS RUN THE WORLD, April 2025

Oracle also has the added benefit of its fast-growing Oracle Cloud Infrastructure business. Oracle now targets AI companies with its infrastructure as a service and applications offerings, courting at least two million unique entities that operate either io or ai domains.

SAP, on the other hand, scaled back its hosting operations that saw its IaaS revenue slipping from a little under $1 billion in 2022 to $580 million in 2024, in addition to its 2023 decision to spin off customer survey vendor Qualtrics, severing ties with many of its 18,000 brands that could have been cross-selling opportunities for SAP ERP systems.

In the ERP midmarket space, the number of SAP Business One and Business ByDesign customers rose 46% between 2019 and 2024 to 97,399. Revenues for the former went up slightly, while those for the latter rose 10% in 2024.

By contrast, Oracle’s NetSuite saw its installed base of ERP customers soaring to 41,000 in early 2025, more than doubling what it had in 2019 and commanding higher recurring fees from them than what SAP is able to accomplish through its channel partners because of the former’s ability to more easily cross-sell other NetSuite and Oracle products directly. NetSuite’s revenues soared 25% in 2024.

What that means is that Oracle has been able to make bigger inroads into some of these customers by tapping into a wider recurring revenue pipeline. Since its fiscal 2015, Oracle’s recurring revenues other than license and maintenance fees have jumped 845% to $19.7 billion, while SAP’s recurring revenues have grown 650% to $18.5 billion during the same period. The former is on track to post even bigger recurring revenues in excess of $22 billion for the full fiscal year of 2025 when it reports its 4QFY25 results in June.

Outlook for 2025 and Through 2029 Forecast Period

Despite geopolitical uncertainty, the ERP applications market performed better than expected in 2024 with six of the top 10 vendors posting at least 6.5% or more in sales growth, above the market trendline as a whole, even without resorting to making major acquisitions.

SAP, for one, experienced explosive growth with its S/4HANA Cloud by scoring a 34% jump to more than $5 billion in subscription revenue last year, riding on top of its Rise and Grow selling and packaging strategies.

Other major vendors posted equally impressive double-digit increases for their Cloud ERP applications last year as a result of their successful campaigns to migrate their installed base of customers to take advantage of real-time capabilities of online services.

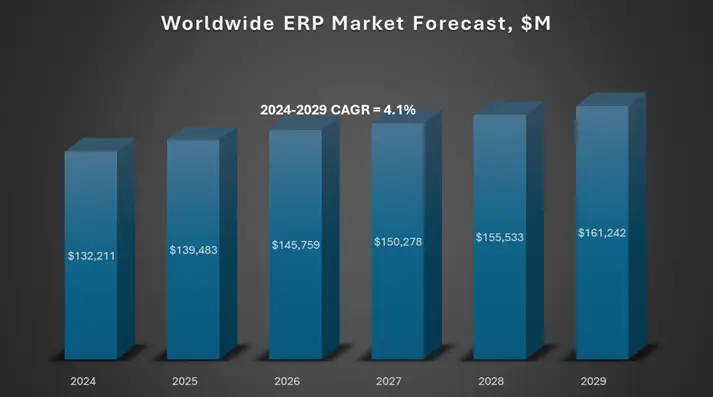

Based on the strong performance, we have revised the forecast through 2029 – as shown in Exhibit 4 – for the ERP applications market from 3.6% to 4.1% for the following reasons:

Exhibit 4 – Worldwide ERP Applications Market Forecast, 2024-2029, $M

- The ascent of Oracle to become the No. 1 ERP vendor will trigger another wave of aggressive marketing campaigns from all ERP brands in order to preempt any talks of displacement activities or competitive upgrades by any of their rivals. That could spur another round of heavy discounts, channel rebates as well as incentives being thrown around to protect one’s installed base.

- Both Intuit and Microsoft will play to their strengths of reaching millions of users to upgrade and replace their existing ERP systems with hefty sign-on incentives and free use of their copilot add-ons to drive rapid adoptions of their digital agents.

- Looming end of life deadlines on a host of ERP systems from SAP ECC 6.0 to Sage 300 CRE for construction will result in a growing number of upgrades and replacement activities, thus sparking new ERP projects across a wide swath of industries.

- Instead of minimizing their IT spend, companies around the world have no choice but to pony up additional budgets for IT and mission-critical ERP projects as the trade war will escalate to the point that some systems might be better off running within a defined geography. The ERP landscape could become more fragmented, but a raft of testing and applications management tools will help mitigate the risks of running multiple systems that do not talk to one another.

- CDK in automotive dealership market and RealPage in real-estate now have to confront with the fallout from the former’s system outage last year and the latter’s protracted disputes with state and federal authorities over rental housing data. Because of their dominance in the two verticals, it will have a lasting impact on their customers and partners while they need to step up efforts to safeguard their installed base of captive accounts.

- In banking and financial services, the low to high single-digit growth experienced by incumbent core banking vendors like Infosys Finacle and Temenos contrasts double-digit increases at providers like nCino and Solaris in recent quarters, giving more reasons for core banking incumbents to accelerate their migration from license and maintenance fees to recurring revenues. Such migration could push out the prospects for the core banking applications market until the end of the forecast period.

- The emergence of ServiceNow as the functional workflow equivalent of widely used ERP and CRM applications has thickened the plot, raising the prospect that ServiceNow and its CEO Bill McDermott, who led SAP for nearly a decade until 2019, rising to the occasion by becoming a viable alternative to those ERP systems that he once championed.

- Going east may well sum up what it takes to succeed by following the money in Asia as our research shows high potential for ERP vendors in areas like Malaysia and Thailand where Odoo has made great strides, while Shiji Group has locked up the hospitality ERP market in China by posting nearly $400 million in revenue over the past few years. Structural changes to the Japanese and Korean economies will open up more opportunities for current and aspiring ERP vendors. The next bonanza could be the one belt one road project that could connect the western part of China through Laos into Thailand, eventually heading south to Malaysia and Singapore by forming a modern high speed rail network over the next five to 10 years for hundreds of millions of people. Once the track has been laid, there is no turning back.

- The changing of the guard in the ERP market could usher in a new round of consolidation as incumbents are angling to leapfrog one another through high-stakes mergers and acquisitions. Constellation Software has been the poster child of that strategy as it swallows bigger targets in its race for ERP gold through unrelenting M&As as the Toronto-headquartered vendor ended 2024 with more than $10 billion in sales for the first time. In 2014, its revenues were $1.1 billion, translating into an almost 10-fold increase.

- One thing is certain about the ERP market as competition intensifies in the coming months, forcing anyone that wants to prevail with the new base line of mastering three intrinsic ingredients: solid product, complete visibility into one’s accounts and exceptional customer experience. Anything else is just gravy.

Some of the largest Oracle Fusion Cloud ERP and SAP S/4HANA Customers

| Customer | Industry | Empl. | Revenue | Country | New Product |

|---|---|---|---|---|---|

| Accenture | Professional Services | 774000 | $64.9B | Ireland | SAP S/4 HANA |

| Albertsons | Retail | 108300 | $79.2B | United States | Oracle Cloud ERP |

| AT&T | Communications | 140990 | $122.3B | United States | Oracle Cloud ERP |

| Bank of America | Banking and Financial Services | 213000 | $101.9B | United States | Oracle Cloud ERP |

| Bosch Group | Manufacturing | 429417 | $102.8B | Germany | SAP S/4 HANA |

| Carrefour | Retail | 305309 | $102.5B | France | SAP S/4 HANA |

| Costco Wholesale | Retail | 316000 | $242.3B | United States | SAP S/4 HANA |

| Department for Work and Pensions (DWP) | Government | 90000 | $212.5B | United Kingdom | Oracle Cloud ERP |

| FedEx Corp | Transportation | 306000 | $87.8B | United States | Oracle Cloud ERP |

| Grupo Bimbo | Consumer Packaged Goods | 146910 | $23.9B | Mexico | Oracle Cloud ERP |

| Hearst Communications | Media | 22000 | $12.0B | United States | Oracle Cloud ERP |

| Humana | Insurance | 65680 | $117.8B | United States | Oracle Cloud ERP |

| IBM | Professional Services | 282200 | $61.9B | United States | SAP S/4HANA Cloud |

| Kroger | Retail | 414000 | $150.0B | United States | Oracle Cloud ERP |

| Lidl | Retail | 376000 | $134.2B | Germany | SAP S/4 HANA |

| Lowe’s | Retail | 300000 | $86.4B | United States | Oracle Cloud ERP |

| Meta | Professional Services | 72404 | $134.9B | United States | Oracle Cloud ERP |

| Microsoft | Professional Services | 228000 | $245.1B | United States | SAP S/4HANA Cloud |

| National Health Service (NHS) | Healthcare | 1297455 | $200.0B | United Kingdom | Oracle Cloud ERP |

| County of Orange, CA | Government | 19000 | $9.5B | United Kingdom | Oracle Cloud ERP |

| PepsiCo | Consumer Packaged Goods | 318000 | $91.5B | United States | SAP S/4 HANA |

| Schwarz Group | Retail | 550000 | $129.0B | Germany | SAP S/4 HANA |

| Securitas | Professional Services | 358000 | $3.7B | Sweden | Oracle Cloud ERP |

| Siemens | Manufacturing | 321000 | $84.3B | Germany | SAP S/4 HANA |

| Tesco | Retail | 354744 | $77.6B | United Kingdom | Oracle Cloud ERP |

| The Coca-Cola Company | Consumer Packaged Goods | 700000 | $45.8B | United States | SAP S/4 HANA |

| Toyota Motor | Automotive | 380793 | $410.9B | Japan | SAP S/4 HANA |

| United Nations | Non Profit | 37000 | $53.0B | United States | Oracle Cloud ERP |

| United Parcel Service (UPS) | Transportation | 500000 | $91.0B | United States | Oracle Cloud ERP |

| Volkswagen Group | Automotive | 684300 | $257.0B | Germany | SAP S/4 HANA |

| Walgreens Boots Alliance | Retail | 330000 | $139.1B | United States | SAP S/4 HANA |

| Walmart | Retail | 2100000 | $648.1B | United States | SAP S/4 HANA |

Source: Apps Run The World, April 2025