In 2024, the global Non profit software market grew to $5.5 billion, marking a 10.8% year-over-year increase. The top 10 vendors accounted for 43.3% of the total market. Blackbaud led the pack with an 11.9% market share, followed byMicrosoft, Global Payments, and Momentive Software (ex Community Brands).

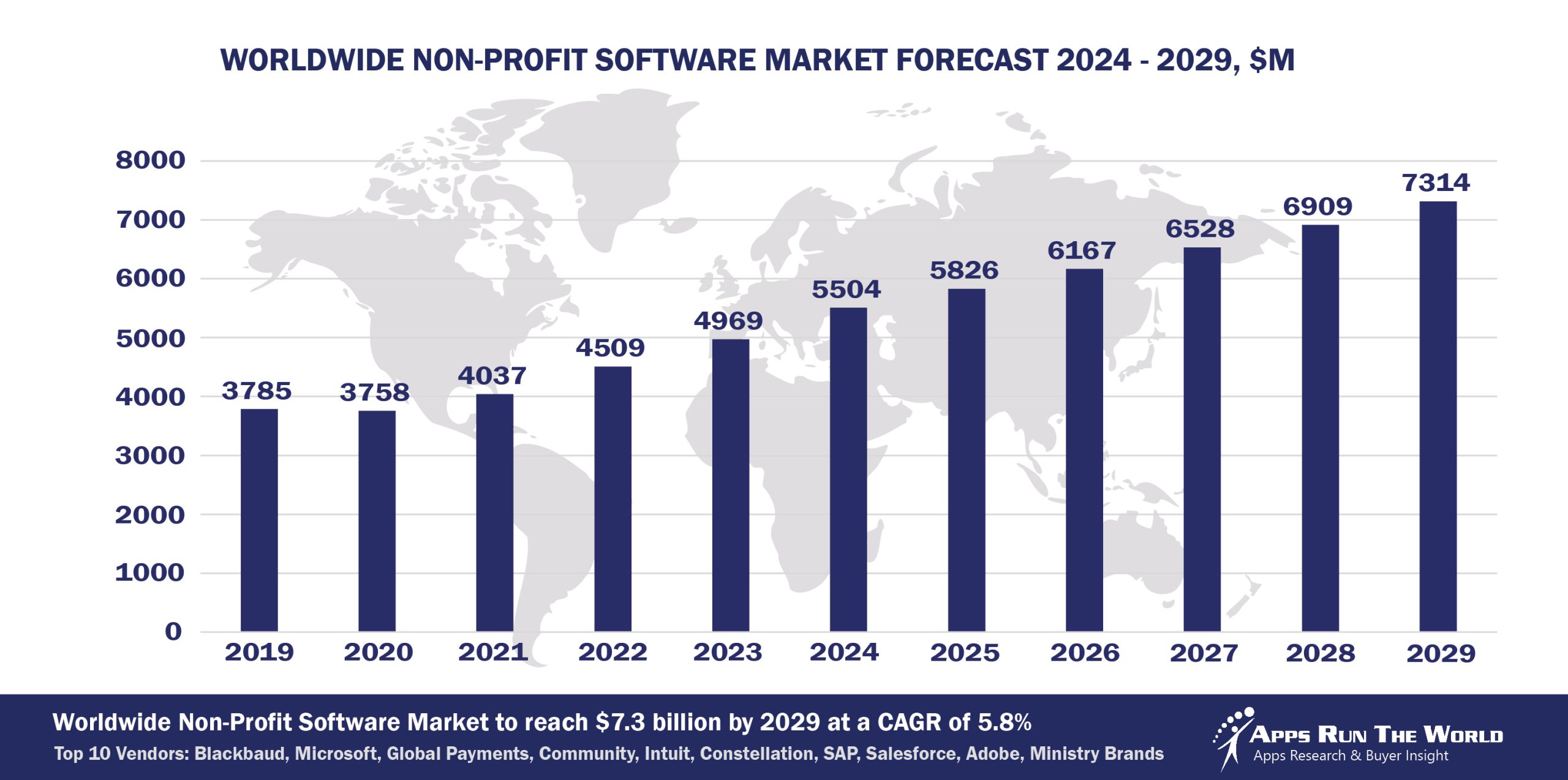

Through our forecast period, the Non-Profit applications market size is expected to reach $7.3 billion by 2029, compared with $5.5 billion in 2024 at a CAGR of 5.8%, as shown in the Apps Top 500 Report – Excel Edition [Preview] .

Non-profit organizations are not-for-profit entities that direct their funding and revenues to achieve their stated mission. Applications designed for these organizations include donor and grant management, fundraising and accounting, constituent relationship management, as well as a range of back-office, association and event management, and community-building functions

As online fundraising enters the mainstream, new operating models will emerge as nonprofits experiment different out-reach programs to attract, retain and strengthen ties with donors, volunteers and their key constituents.

Top 10 Non-Profit Software Vendors in 2024 and their Market Shares

Source: Apps Run The World, July 2025

Other Non Profit software providers included in the report are: Acquia, Adobe, ADP, Advanced, Altum, Atlassian, Avalara, Berger-Levrault, Brightree, Cisco Systems, Citrix, Constellation Software Inc., Exact Holding BV, First Advantage, Fiserv, Google, Hexagon, IBM, Indra Sistemas, Infor, Kingdee, Logibec, Open Text Corporation, Paycom, Paycor, PDS, Qualtrics, Roper Technologies, Sage, ServiceNow, TalentMap, TeamDynamix, TTEC, Unicorn HRO, UNIT4, Workday, Zendesk, Zoho Corp. and many others.

Vendor Snapshot: Non-Profit Market Leaders

Blackbaud

Blackbaud

Blackbaud has enhanced its Raiser’s Edge NXT and Luminate Online platforms with embedded AI tools for donor prospecting, predictive fundraising, and campaign optimization. Recent product updates focus on cross-channel engagement, grant tracking, and configurable dashboards tailored to nonprofit workflows. Investment in its SKY platform continues to enable scalable cloud innovation across fundraising, CRM, and financial modules.

Microsoft

Microsoft supports nonprofit operations through Dynamics 365 and Microsoft 365, now embedded with Copilot AI features for grant application generation, donor outreach automation, and volunteer scheduling. Integration with Teams and Power Platform enables customized apps and workflows for program delivery and constituent services. Azure-based data governance and compliance tools help nonprofits manage privacy and impact reporting.

Global Payments Inc.

Global Payments’ GreaterGiving solution focuses on streamlining donation management and event fundraising for nonprofits, with recent updates centered on mobile giving, peer-to-peer fundraising, and real-time reporting. AI-driven fraud prevention and donor analytics enhance both security and targeting. Ongoing platform investment has prioritized frictionless digital experiences and unified payment workflows.

Momentive Software (ex Community Brands)

GiveSmart and Abila MIP Fund Accounting have received upgrades to support donor intelligence, auction automation, and integrated fund tracking. AI capabilities are being applied to forecasting donation trends and automating reconciliation workflows. The company continues to expand API access and workflow flexibility to serve mission-driven organizations more effectively.

Constellation Software Inc.

Constellation’s Andar 360 and ProFundo CRM focus on campaign management, donor engagement, and fund allocation within nonprofit and philanthropic institutions. Recent R&D has introduced enhanced donor segmentation, email automation, and KPI tracking through modular updates. The vendor emphasizes long-term product evolution across its decentralized portfolio of nonprofit technologies.

Intuit Inc.

Intuit’s QuickBooks for Nonprofits incorporates AI-assisted categorization, grant tracking, and compliance-ready reporting tailored to nonprofit accounting standards. Mailchimp integration supports multichannel donor engagement, with new templates designed for campaigns and appeals. Recent development emphasizes embedded analytics and secure collaboration across finance and fundraising teams.

SAP

SAP’s nonprofit solutions integrate SAP Business Technology Platform (BTP) with S/4HANA, Business ByDesign, and Concur to streamline program delivery, grant management, and expense tracking. AI-powered scenario modeling and impact assessment tools help nonprofits align budgeting and resource planning with mission outcomes. Cloud-native features support compliance, donor transparency, and agile financial operations across distributed teams.

Salesforce

Salesforce Nonprofit Cloud now features Einstein 1 AI capabilities for donation forecasting, volunteer coordination, and engagement scoring across channels. The platform integrates with Marketing Cloud and Data Cloud to provide 360-degree constituent views and personalized outreach. Ongoing enhancements prioritize interoperability and sector-specific data models through the Nonprofit Success Pack (NPSP).

Adobe

Adobe Experience Cloud supports nonprofit organizations with AI-enabled content personalization, campaign automation, and donor journey optimization. Adobe Firefly generative AI and Sensei services enable rapid asset creation and segmentation for multichannel storytelling. Integration across Creative Cloud and Marketing Cloud strengthens brand consistency and mission-driven outreach.

Pushpay

Pushpay has advanced its ChurchStaq and Giving platforms with AI tools for donor engagement scoring, mobile-first donation journeys, and predictive churn detection. The platform now includes customizable workflows for member communications, volunteer coordination, and financial stewardship. Continuous investment in scalability and API extensibility supports large congregational and faith-based nonprofits.

ARTW Technographics Platform: Non-Profit customer wins

Since 2010, our research team has been studying the patterns of Non-Profit software purchases, analyzing customer behavior and vendor performance through continuous win/loss analysis. Updated quarterly, the ARTW Technographics Platform provides deep insights into thousands of Non-Profit customer wins and losses, helping users monitor competitive shifts, evaluate vendor momentum, and make informed go-to-market decisions.

List of Non-Profit customers

Source: ARTW Buyer Insights Technographic Database

Custom data cuts related to the Special Cause Non-Profit market are available:

- Top 550+ Non Profit Applications Vendors and Market Forecast 2024-2029

- 2024 Special Cause Non-Profit Applications Market By Functional Market (16 Markets)

- 2024 Special Cause Non-Profit Applications Market By Country (USA + 45 countries)

- 2024 Special Cause Non-Profit Applications Market By Region (Americas, EMEA, APAC)

- 2024 Special Cause Non-Profit Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2024 Special Cause Non-Profit Applications Market By Customer Size (revenue, employee count, asset)

- 2024 Special Cause Non-Profit Applications Market By Channel (Direct vs Indirect)

- 2024 Special Cause Non-Profit Applications Market By Product

Worldwide Enterprise Applications by Vertical Market

Exhibit 3 provides a forecast of the worldwide enterprise applications by vertical market from 2024 to 2029, highlighting market sizes, year-over-year growth, and compound annual growth rates across different industry sectors from Aerospace and Defense to Utilities.

Exhibit 3: Worldwide Enterprise Applications by Vertical Market Forecast 2024-2029 by Functional Market ($M)

Source: Apps Run The World, July 2025

Exhibit 4 shows our projections for the enterprise applications market by vertical segment, based on the buying preferences and the customer propensity to invest in new software within those industries as they continue to upgrade and replace many legacy industry-specific applications that have been identified and tracked in our Buyer Insight Database.

FAQ – APPS RUN THE WORLD Top 10 Non‑Profit Software Vendors, Market Size & Forecast

Q1. What is the global non‑profit software market size in 2024?

A: The global non‑profit software market reached $5.5 billion in 2024, growing 10.8% year‑over‑year.

Q2. Who are the top 10 non‑profit software vendors in 2024 and their combined share?

A: The top 10 vendors are Blackbaud, Microsoft, Global Payments, Momentive Software (ex Community Brands), Constellation Software, Intuit, SAP, Salesforce, Adobe, and Pushpay, together capturing 43.3% of the total non‑profit software market.

Q3. Which vendor leads the non‑profit software market in 2024?

A: Blackbaud leads the non‑profit software market in 2024 with an 11.9% market share.

Q4. What is the forecast for the non‑profit software market through 2029?

A: The market is projected to reach $7.3 billion by 2029, growing at a compound annual growth rate (CAGR) of 5.8%.

Q5. What applications are included in the scope of non‑profit software solutions?

A: It includes donor and grant management, fundraising, constituent relationship management (CRM), back‑office accounting, event & association management, and volunteer coordination tools.

Q6. Which other non‑profit software vendors are covered beyond the top 10?

A: The report also profiles vendors such as Community Brands, Bloomerang, Neon One, and Virtuous among the additional players in non‑profit tech.

Q7. When was this non‑profit software report published and by whom?

A: The Top 10 Non‑Profit Software Vendors, Market Size & Forecast 2024‑2029 was published in July 2025 by APPS RUN THE WORLD analysts as part of the APPS TOP 500 research program, which benchmarks the revenues and market share of the world’s 1,500+ largest enterprise application vendors.

More Enterprise Applications Research Findings

Based on the latest annual survey of 10,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 1,500 largest Enterprise Applications Vendors ranked by their 2024 product revenues. Their 2024 results are being broken down, sorted and ranked across 16 functional areas (from Analytics and BI to Treasury and Risk Management) and by 21 vertical industries (from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year our global team of researchers conduct an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market.

We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 2 million organizations around the world.

The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.

- TriNet, a United States based Professional Services organization with 343025 Employees

- Wingate University, a United States based Education company with 670 Employees

- Inovia Capital (Us), a United States based Banking and Financial Services organization with 10 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

Blackbaud

Blackbaud