In 2024, the global Special Cause Nonprofit software market grew to $2.1 billion, marking a 10.5% year-over-year increase. The top 10 vendors accounted for 46.6% of the total market. Microsoft led the pack with a 12.6% market share, followed by Blackbaud, Momentive Software (ex Community Brands), and Global Payments.

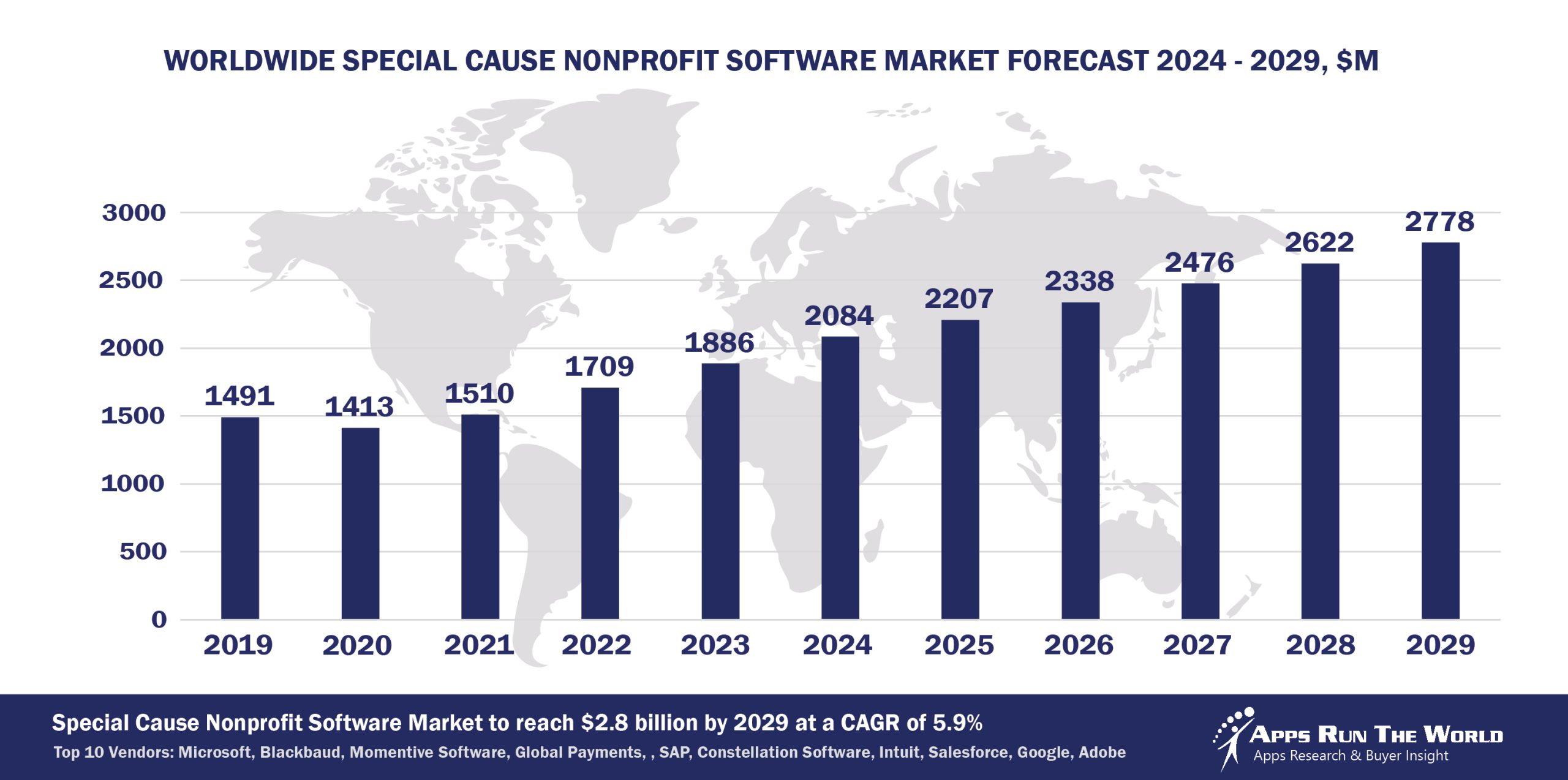

Through our forecast period, the Special Cause Non-Profit applications market size is expected to reach $2.8 billion by 2029, compared with $2.1 billion in 2024 at a CAGR of 5.9%, as shown in the Apps Top 500 Report – Excel Edition [Preview] .

Special Cause Non-Profit organizations are not-for-profit entities that direct their funding and revenues to achieve their stated mission. Applications designed for these organizations include donor and grant management, fundraising and accounting, constituent relationship management, as well as a range of back-office, association and event management, and community-building functions

As online fundraising enters the mainstream, new operating models will emerge as nonprofits experiment with different out-reach programs to attract, retain and strengthen ties with donors, volunteers and their key constituents.

Top 10 Special Cause Non-Profit Software Vendors in 2024 and their Market Shares

Source: Apps Run The World, July 2025

Other Special Cause Non-Profit software providers included in the report are: Acquia, Adobe, Aircall, ADP, Advanced, Altum, Atlassian, Access Group, Avalara, Berger-Levrault, Box Inc., Brightree, Resmed Company, Cisco Systems, Cornerstone OnDemand, Citrix, Constellation Software Inc., DocuSign, Inc., Dropbox, Exact Holding BV, First Advantage, Fiserv, Google, Hexagon, IBM, Indra Sistemas, Infor, Kingdee, Logibec, Meltwater Group, Open Text Corporation, Paycom, Paylocity, Paycor, PDS, Roper Technologies, Sage, SofterWare, Inc., ServiceNow, TalentMap, TeamDynamix, TTEC, Unicorn HRO, Upland Software, UNIT4, UKG, Visma, Workday, Xero, Zendesk, Zoho Corp., Zoom Video Communications, and many others.

Vendor Snapshot: Special Cause Non-Profit Market Leaders

Microsoft

Microsoft

Microsoft is embedding AI-first automation across Microsoft 365 and Dynamics 365, with Copilot features in Sales and Customer Service that streamline donor engagement, automate case handling, and improve operational efficiency for nonprofits. The Nonprofit Common Data Model and Nonprofit Accelerator have standardized donor, volunteer, and program data management.

Blackbaud

Blackbaud continues to reinforce its leadership in nonprofit fundraising and CRM platforms, focusing on incremental product enhancements. Edge NXT remains the primary fundraising engine, enhanced by integrations (like Constant Contact) and recurring-donor optimization features. Luminate Online retains prominence for digital campaign-heavy nonprofits, while Blackbaud CRM addresses larger-scale constituent management needs. Collectively, these platforms underpin donor engagement and campaign effectiveness across a broad range of nonprofit sectors, with deep integration across data, payments, and marketing workflows.

Momentive Software (ex Community Brands)

GiveSmart leverages AI-powered tools to enhance its comprehensive fundraising and donor management platform, streamlining event ticketing, auctions, peer-to-peer campaigns, and text-to-give outreach. Its AI-driven analytics and automation improve donor engagement and optimize fundraising workflows, supporting nonprofits, schools, and foundations in raising over $8 billion. Together, GiveSmart and Abila MIP Fund Accounting offer nonprofits an AI-enhanced, end-to-end solution for fundraising and financial management.

Global Payments Inc.

The platform is deployed by over 10,000 nonprofit organizations and schools across the U.S. and Canada, managing 100,000+ fundraising events and processing over $6 billion in donations since 2002.

SAP

SAP delivers a broad, enterprise-grade ecosystem for nonprofits by combining ERP, CRM, and spend management anchored in AI and compliance automation. While Business ByDesign targets midsize organizations with integrated fund accounting, S/4HANA scales for larger institutions using mission accounting and grant reporting. Sales Cloud supports donor-focused interactions, and Concur ensures auditability and cost control. Together, they offer nonprofits a unified, scalable, and AI-enhanced financial and engagement backbone.

Constellation Software Inc.

Andar/360, used by over 400 nonprofits including United Ways and community foundations, is an AI-enhanced donor-centric CRM that unifies giving, volunteer engagement, events, marketing, and grants into a single platform. Its 2025.01 release introduced features like Tribute Giving, new dashboard apps, Tomcat performance boosts, and self-installing modules, with AI-driven analytics improving fundraising forecasts, donor segmentation, and engagement personalization. ProFundo CRM, part of Constellation Software’s nonprofit suite, focuses on European membership and cause-driven organizations, leveraging AI-powered data enrichment and automation to optimize campaigns, member retention, and payment workflows.

Intuit Inc.

Intuit’s suite of products, QuickBooks Online, Mailchimp, and QuickBooks Payroll, offers a comprehensive solution for nonprofit organizations seeking to streamline their financial management, marketing, and payroll processes. The integration across these platforms provides nonprofits with a unified system to manage donations, engage with supporters, and handle administrative tasks efficiently.

Salesforce

In mid‑2024, Salesforce introduced generative AI capabilities like Gift Proposal Generator, Program & Grant Summaries, and unified Data Cloud for Nonprofits, enabling teams to generate donor communications, summarize program impact, and harmonize constituent data in one view. Salesforce’s nonprofit stack is now grounded in its foundational CRM but significantly enhanced with industry-specific AI and data orchestration layers, ushering in a new era for nonprofit software. Nonprofit Cloud, Sales Cloud, and Marketing Cloud collectively provide a unified, AI-enabled platform for donor engagement, program delivery, and impact reporting.

Google continues to evolve Workspace by embedding AI into Gmail, Docs, Meet, and Chat through Duet AI. While Google’s AI agents are not fully autonomous, Workspace developers now have access to Vertex AI Agent Builder and AppSheet to create tailored collaborative experiences. The platform is increasingly allowing agents to summarize meetings, generate documents, and facilitate decisions through real-time content synthesis—bridging asynchronous and live collaboration seamlessly.

Adobe

Adobe provides a comprehensive suite combining Experience Cloud’s marketing and analytics, Marketing Cloud’s automation capabilities, and Creative Cloud’s storytelling toolset—all tailored to nonprofit needs. With investment in generative AI, behavior-based journey orchestration, and discounted access programs, Adobe supports nonprofits in creating compelling, data-driven engagement strategies.

ARTW Technographics Platform: Special Cause Non-Profit customer wins

Since 2010, our research team has been studying the patterns of Special Cause Non-Profit software purchases, analyzing customer behavior and vendor performance through continuous win/loss analysis. Updated quarterly, the ARTW Technographics Platform provides deep insights into thousands of Special Cause Non-Profit customer wins and losses, helping users monitor competitive shifts, evaluate vendor momentum, and make informed go-to-market decisions.

List of Special Cause Non-Profit customers

Source: ARTW Buyer Insights Technographic Database

Custom data cuts related to the Special Cause Non-Profit market are available:

- Top 550+ Non Profit Applications Vendors and Market Forecast 2024-2029

- 2024 Special Cause Non-Profit Applications Market By Functional Market (16 Markets)

- 2024 Special Cause Non-Profit Applications Market By Country (USA + 45 countries)

- 2024 Special Cause Non-Profit Applications Market By Region (Americas, EMEA, APAC)

- 2024 Special Cause Non-Profit Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2024 Special Cause Non-Profit Applications Market By Customer Size (revenue, employee count, asset)

- 2024 Special Cause Non-Profit Applications Market By Channel (Direct vs Indirect)

- 2024 Special Cause Non-Profit Applications Market By Product

Worldwide Enterprise Applications by Vertical Market

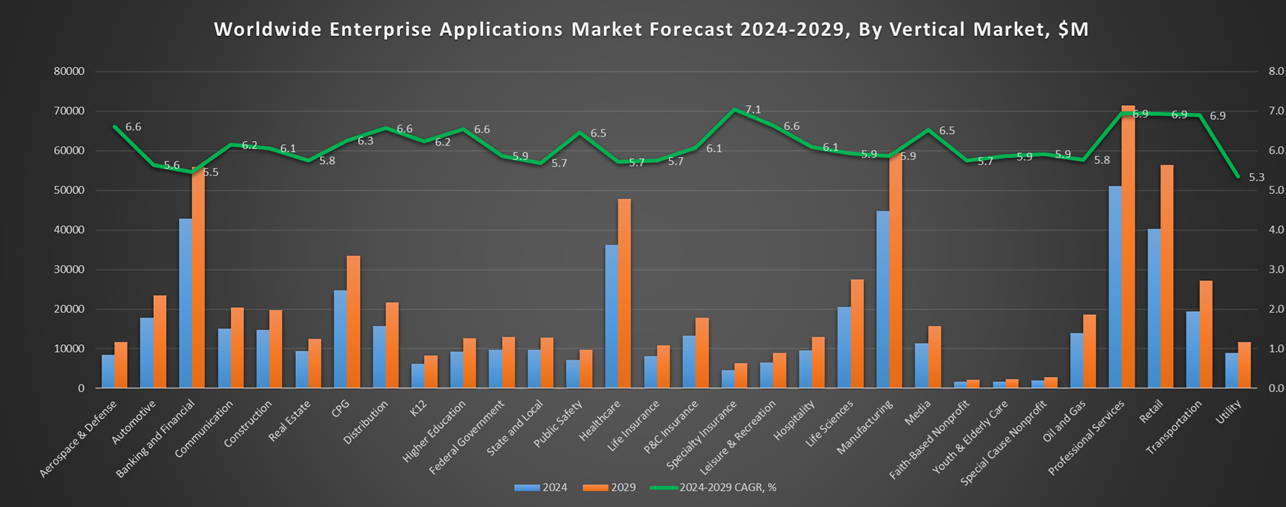

Exhibit 3 provides a forecast of the worldwide enterprise applications by vertical market from 2024 to 2029, highlighting market sizes, year-over-year growth, and compound annual growth rates across different industry sectors from Aerospace and Defense to Utilities.

Exhibit 3: Worldwide Enterprise Applications by Vertical Market Forecast 2024-2029 by Functional Market ($M)

Source: Apps Run The World, July 2025

Exhibit 4 shows our projections for the enterprise applications market by vertical segment, based on the buying preferences and the customer propensity to invest in new software within those industries as they continue to upgrade and replace many legacy industry-specific applications that have been identified and tracked in our Buyer Insight Database.

FAQ – APPS RUN THE WORLD Top 10 Special Cause Nonprofit Software Vendors, Market Size & Forecast

Q1. What is the global Special Cause Nonprofit software market size in 2024?

A: The market reached $2.1 billion in 2024, growing 10.5% year‑over‑year.

Q2. Who are the top 10 Special Cause Nonprofit software vendors in 2024 and their combined share?

A: The top 10 vendors are Microsoft, Blackbaud, Momentive Software (ex Community Brands), Global Payments, SAP, Constellation Software, Intuit, Salesforce, Google, and Adobe, collectively holding about 46.6% of the market.

Q3. Which vendor leads the Special Cause Nonprofit software market in 2024?

A: Microsoft leads with approximately 12.6% market share.

Q4. What is the forecast for the Special Cause Nonprofit software market through 2029?

A: The market is projected to grow to $2.8 billion by 2029 at a compound annual growth rate (CAGR) of 5.9%.

Q5. What applications are included in the scope of the Special Cause Nonprofit software market?

A: It includes donor and grant management, fundraising, accounting, constituent relationship management (CRM), back‑office operations, association & event management, and community engagement tools.

Q6. Which other Special Cause Nonprofit software vendors are covered beyond the top 10?

A: Additional vendors profiled include GiveSmart, Abila, Blackbaud’s Luminate, and greater‑giving or similar specialized tools for events, campaigns, and donor workflows.

Q7. When was this Special Cause Nonprofit software report published, and by whom?

A: It was published in July 2025 by APPS RUN THE WORLD analysts as part of the APPS TOP 500 research program, which benchmarks the revenues and market share of the world’s 1,500+ largest enterprise application vendors.

More Enterprise Applications Research Findings

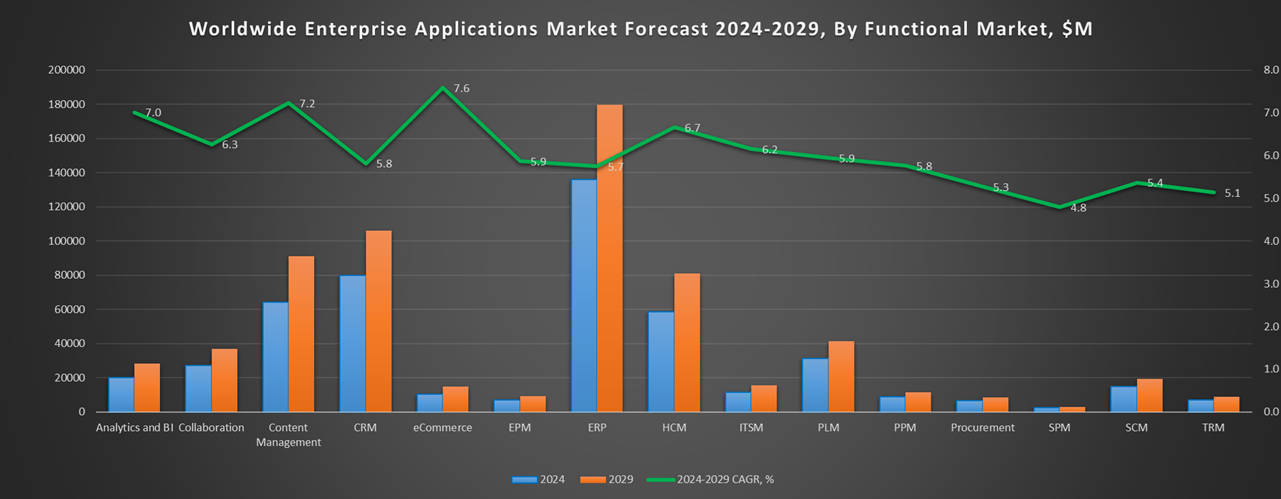

Based on the latest annual survey of 10,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 1,500 largest Enterprise Applications Vendors ranked by their 2024 product revenues. Their 2024 results are being broken down, sorted and ranked across 16 functional areas (from Analytics and BI to Treasury and Risk Management) and by 21 vertical industries (from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year our global team of researchers conduct an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market.

We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 2 million organizations around the world.

The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.

- Vesuvius, a United Kingdom based Manufacturing organization with 11280 Employees

- Mobius Knowledge Services India, a India based Professional Services company with 1100 Employees

- Tamiami Airport Business Association United States, a United States based Non Profit organization with 10 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

Microsoft

Microsoft