In 2024, the global PLM & Engineering software market grew to $31.1 billion, marking a 9.7% year-over-year increase. The top 10 vendors accounted for 84.8% of the total market. Dassault Systèmes led the pack with a 16.5% market share, followed by Autodesk, Synopsys, Siemens Digital Industries Software, and Cadence Design Systems.

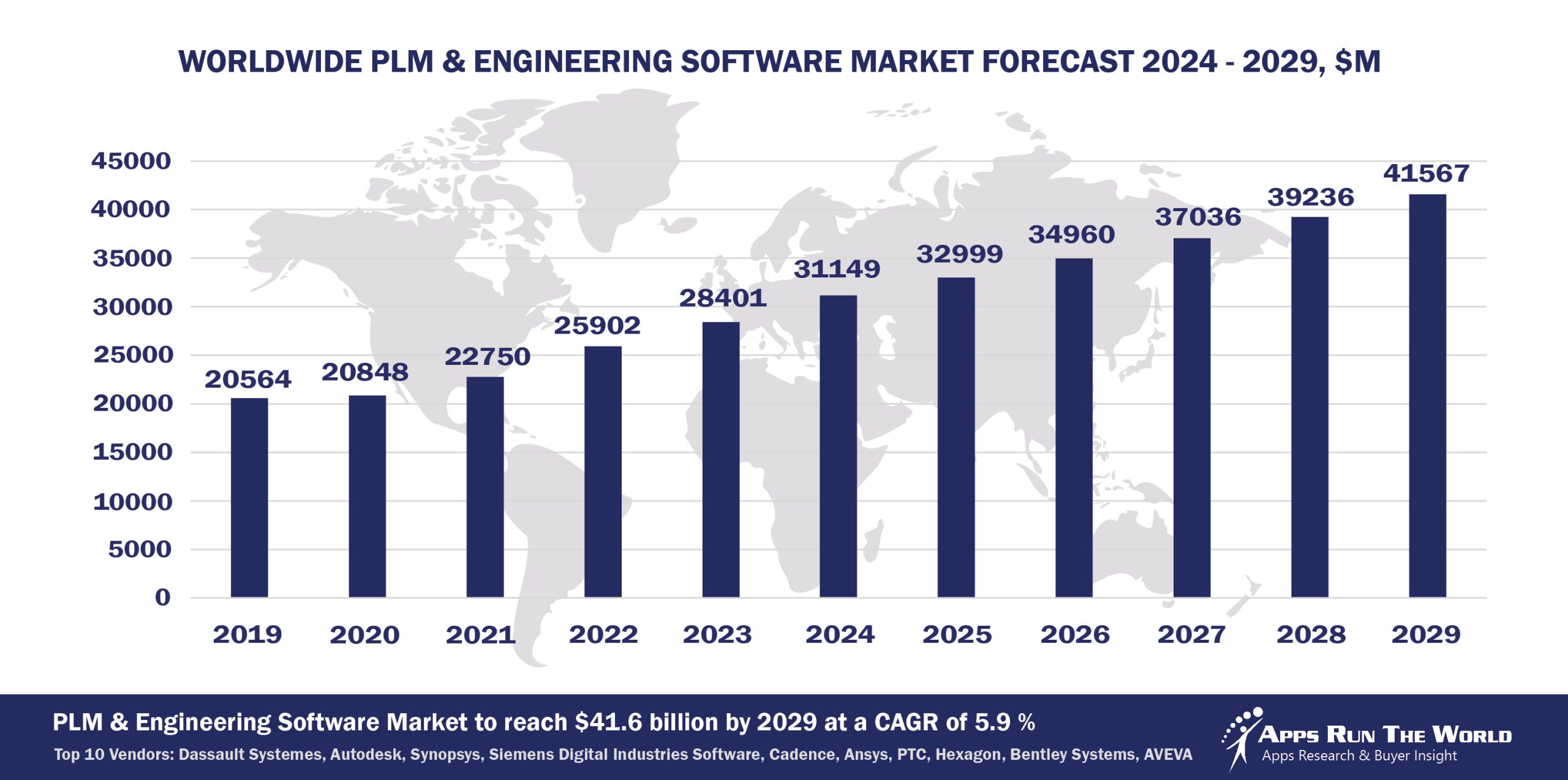

Through our forecast period, the PLM & Engineering applications market size is expected to reach $41.6 billion by 2029, compared with $31.1 billion in 2024 at a CAGR of 5.9%, as shown in the Apps Top 500 Report – Excel Edition [Preview] .

Product Lifecycle Management applications enable key stakeholders including designers, engineers and OEMs to gain and optimize visibility into the entire product life cycle from idea generation to collaboration and from product data management to iterative development efforts. PLM applications are considered a derivative market with revenue contribution to functional areas such as Project and Portfolio Management, Enterprise Resource Planning and Manufacturing.

Top 10 PLM & Engineering Software Vendors in 2024 and their Market Shares

Source: Apps Run The World, July 2025

Other PLM and Engineering software providers included in the report are abas, ABB, Adobe, Altair Engineering, Aptos, Aspen Technology, Centric Software, Corel Corporation, HCL Technologies Ltd., Honeywell International, IDBS, IFS, Ignite Technologies, Intelex Technologies, IQVIA, Johnson Controls, Kingdee, Landmark, Microsoft, Nemetschek Group, Oracle, PerkinElmer Informatics, Planon, RIB Software SE, Rockwell Automation, Roper Technologies, SAP, Schlumberger Software, Schrodinger, Sopheon, TopSolid, Trace One, Trimble, VertiGIS, and many others.

Vendor Snapshot: PLM and Engineering Market Leaders

Dassault Systemes

Dassault Systemes

Dassault Systèmes leverages its 3DEXPERIENCE platform and CATIA/Enovia PLM suite to deploy AI agents that autonomously generate design variants, validate via simulation, and synchronize with digital twins. OEMs in aerospace and automotive use low-code AI workflows to optimize manufacturability, compliance, and cross-supplier collaboration. Agents continuously monitor design and production changes across the digital thread, enabling real-time feedback loops. This agent-driven strategy positions Dassault as a leader in multi-domain systems engineering and scalable PLM orchestration.

Autodesk

Autodesk is injecting agentic AI into its design platforms (AutoCAD, Civil 3D) through generative design agents that autonomously explore design spaces, optimize parameters, and validate structural simulations. Conversational AI tools assist engineers in generating CAD models and automating iteration cycles. Integration with the Autodesk Construction Cloud supports agentic coordination across documentation, field changes, and design updates. Autodesk’s roadmap reflects a shift toward cloud-native, agent-enabled engineering workflows that accelerate project delivery and cross-disciplinary collaboration.

Synopsys

Synopsys is extending agentic AI into silicon design with agents embedded in DesignWare IP, RTL synthesis, and chip verification routines. These agents drive automated design space exploration, logic optimization, and bug triage using LLM-powered assistants and user-configurable low-code workflows. Support for analog/digital co-design and IP integration ensures cross-domain collaboration. Synopsys frames agentic automation as a core competitive advantage in semiconductor engineering, reducing cycles and increasing design quality under robust automation governance.

Siemens Digital Industries Software

Siemens enhances Teamcenter, NX, and Simcenter with autonomous agents that manage digital twin lifecycle, simulation orchestration, and manufacturing execution. Its Xcelerator platform includes low-code agent builders that capture engineering rules, validate designs against requirements, and manage change impact. Autonomous agents coordinate simulation feedback and real-world production data, enabling closed-loop validation. Siemens’ strategy centers on enabling faster iterations in complex product development while embedding governance and compliance across the PLM ecosystem.

Cadence Design Systems

Cadence embeds AI agents across its EDA tools including Virtuoso, Allegro, and BETA CAE, using reinforcement learning and predictive analytics to optimize PCB layouts, manage signal integrity, and preempt thermal issues. Autonomous co-pilots support cross-domain system design by making data-driven decisions during layout and simulation. Cadence positions these agentic assistants as essential collaborators in high-frequency, high-complexity workflows—boosting design velocity and quality.

Ansys

Ansys integrates agentic intelligence into simulation-centric platforms like Discovery, SpaceClaim, and Fluent, where AI agents run design-of-experiments automatically, detect anomalies in simulation results, and generate interpretation insights in real time. Agents also dynamically suggest mesh adjustments or solver settings based on predictive analysis. The result is an engineering platform that learns from simulation history, promotes early detection of design flaws, and accelerates validation cycles across disciplines.

PTC

PTC extends agentic capabilities across its PLM and IoT platforms, including Windchill, Creo, and FlexPLM. Its low-code agent framework allows teams to automate rule-based engineering logic, manage configuration changes, and orchestrate service-readiness workflows. Autonomous agents handle part updates, IoT-driven maintenance alerts, and design change propagation. By embedding agents into the digital thread, PTC enables agile product lifecycles while maintaining enterprise governance across CAD, AR, and manufacturing interfaces.

Hexagon

Hexagon leverages AI automation in CADWorx and metrology-focused platforms to process scanned inspection data, validate design compliance, and generate automated feedback loops for quality teams. Although fewer explicit agentic references are made, its platform supports low-code workflows that turn quality data into actionable design adjustments. This emphasis on integrating metrology with design validation through automation positions Hexagon as a key player in continuous improvement workflows for industrial environments.

Bentley Systems

Bentley Systems embeds AI-driven analytics within infrastructure design tools such as MicroStation and OpenRoads, enabling adaptive asset performance modeling and scenario planning across project lifecycles. Autonomous agents monitor digital twin performance, compliance status, and cost metrics, enabling engineers to simulate infrastructure outcomes in real time. While agentic terminology is less explicit, Bentley’s infrastructure digital thread and twin-based optimization reflect a strategic convergence of analytics, automation, and engineering intelligence.

AVEVA Group

AVEVA embeds AI tools into its operational and design solutions for process and energy industries—such as E3D Design—providing agents that automate layout validation, simulate operational risk, and synchronize design changes with live asset performance data. Agents auto-identify discrepancies between as-built and as-operated models and propose corrections. AVEVA’s platform strategy emphasizes real-time model fidelity and digital twin integrity as core outcomes of agent-driven PLM workflows.

ARTW Technographics Platform: PLM and Engineering customer wins

Since 2010, our research team has been studying the patterns of the PLM and Engineering software purchases, analyzing customer behavior and vendor performance through continuous win/loss analysis. Updated quarterly, the ARTW Technographics Platform provides deep insights into thousands of PLM and Engineering customer wins and losses, helping users monitor competitive shifts, evaluate vendor momentum, and make informed go-to-market decisions.

List of PLM and Engineering customers

Source: ARTW Buyer Insights Technographic Database

Custom data cuts related to the PLM market are available:

- Top 70+ PLM and Engineering Applications Vendors and Market Forecast 2024-2029

2024 PLM and Engineering Applications Market By Industry (21 Verticals)

2024 PLM and Engineering Applications Market By PLM and Engineering Segments and Categories

2024 PLM and Engineering Applications Market By Country (USA + 45 countries)

2024 PLM and Engineering Applications Market By Region (Americas, EMEA, APAC)

2024 PLM and Engineering Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

2024 PLM Applications Market By Customer Size (revenue, employee count, asset)

2024 PLM and Engineering Applications Market By Channel (Direct vs Indirect)

Worldwide Enterprise Application Market

Exhibit 3 provides a forecast of the worldwide enterprise application market from 2024 to 2029, highlighting market sizes, year-over-year growth, and compound annual growth rates across various functional segments. The data shows strong growth in emerging areas like Content Management, eCommerce, Human Capital Management, and IT Service Management, while traditional segments like ERP and CRM continue to dominate in market size.

Exhibit 3: Worldwide Enterprise Application Market Forecast 2024-2029 by Functional Market, $M

Source: Apps Run The World, July 2025

Exhibit 4 shows the enterprise applications market by functional area. The highest growth functional markets revolve around smaller segments like Analytics and BI, eCommerce, Enterprise Performance Management, where first movers remain less established than those that for decades have been entrenched in functional areas like ERP, HCM, CRM and PLM.

FAQ – APPS RUN THE WORLD Top 10 PLM & Engineering Software Vendors, Market Size & Forecast

Q1. What is the global PLM & Engineering software market size in 2024?

A: The global PLM & Engineering software market was $31.1 billion in 2024, growing 9.7% year-over-year.

Q2. Who are the top 10 PLM & Engineering software vendors in 2024, and what share do they hold?

A: The top 10 vendors are Dassault Systèmes, Autodesk, Synopsys, Siemens Digital Industries Software, Cadence Design Systems, Ansys, PTC, Hexagon, Bentley Systems, and AVEVA Group, together accounting for 84.8% of the market.

Q3. Which vendor leads the PLM & Engineering market in 2024?

A: Dassault Systèmes leads the market with approximately 16.5% market share.

Q4. What is the forecast for the PLM & Engineering market through 2029?

A: The market is projected to reach $41.6 billion by 2029, growing at a 5.9% CAGR.

Q5. What functions are covered under PLM & Engineering in this report?

A: The report covers tools for the full product lifecycle—idea generation, product data management, design, collaboration, simulation, and iterative development across engineering domains.

Q6. Which other PLM & Engineering vendors are covered beyond the top 10?

A: The report also profiles vendors such as Vero Software, Dassault Systèmes, Autodesk, Siemens Digital Industries Software, and others.

Q7. When was this PLM & Engineering report published, and who authored it?

A: The Top 10 PLM & Engineering Software Vendors, Market Size & Forecast 2024–2029 report was published in July 2025 by APPS RUN THE WORLD analysts Albert Pang, Misho Markovski, and Marija Ristik, as part of the APPS TOP 500 research program, which benchmarks the revenues and market share of the world’s 1,500+ largest enterprise application vendors.

More Enterprise Applications Research Findings

Based on the latest annual survey of 10,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 1,500 largest Enterprise Applications Vendors ranked by their 2024 product revenues. Their 2024 results are being broken down, sorted and ranked across 16 functional areas (from Analytics and BI to Treasury and Risk Management) and by 21 vertical industries (from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year our global team of researchers conduct an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market.

We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 2 million organizations around the world.

The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.

- UBS, a Switzerland based Banking and Financial Services organization with 106789 Employees

- RTX Corporation Aerospace, a United States based Aerospace and Defense company with 185000 Employees

- Samsung, a South Korea based Manufacturing organization with 262647 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

Dassault Systemes

Dassault Systemes