In 2024, the global Aerospace and Defense software market grew to $8.5 billion, marking a 10% year-over-year increase. The top 10 vendors accounted for 51.6% of the total market. Dassault Systemes led the pack with a 9% market share, followed by Cadence Design Systems, Synopsys, Microsoft, and Siemens Digital Industries Software.

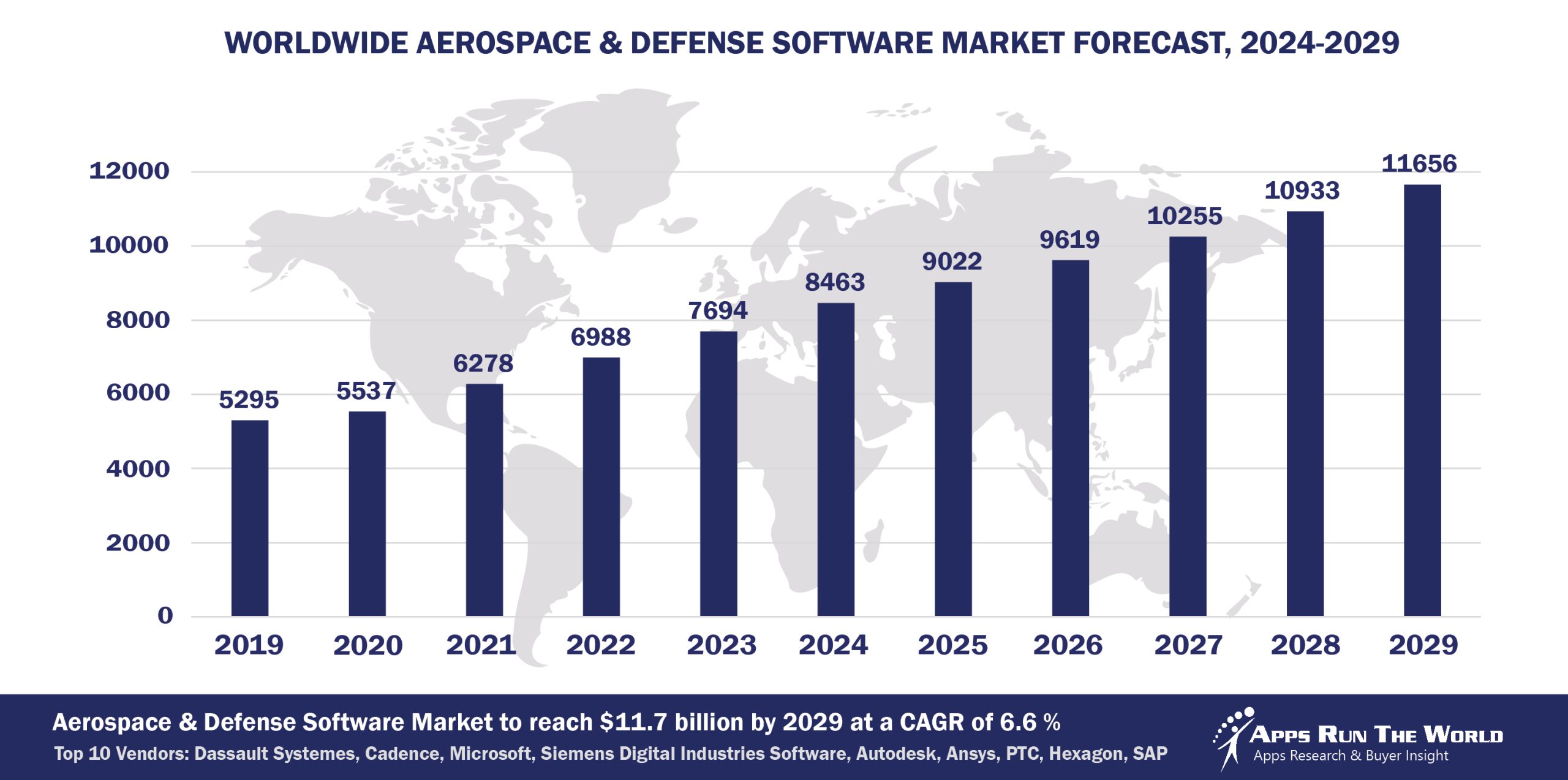

Through our forecast period, the Aerospace and Defense applications market size is expected to reach $11.7 billion by 2029, compared with $8.5 billion in 2024 at a CAGR of 6.6%, as shown in the Apps Top 500 Report – Excel Edition [Preview] .

Aerospace and Defense (Aircraft and parts, defense contractors) – Aviation Maintenance Management, Air Traffic Management applications, Flight operations software, Quality management system, Financials, HR, Procurement

Top 10 Aerospace and Defense Software Vendors in 2024 and their Market Shares

Source: Apps Run The World, July 2025

Other Aerospace and Defense software providers included in the report are: ADP, Adobe, AerData B.V., Altair Engineering, Inc., Amadeus, Atlassian, AVEVA Group, Bentley Systems Inc., Blue Yonder, Boeing Jeppesen, Cegid, Constellation Software Inc., Cisco Systems, Citrix, CoStar Group, DocuSign, Inc., E2open LLC, GE Digital, GFI Informatique, Google, Hitit Bilgisayar, HubSpot, Honeywell International, IBM, IBS Software Services, IFS, Infor, Intuit Inc., Kinaxis Inc., Landmark, a Halliburton business line, Open Text Corporation, Oracle, Palantir Technologies, RingCentral, Rockwell Automation, Roper Technologies, Inc., Saab Sensis, SAP, Sage, Salesforce, SAS Institute, ServiceNow, Shopify, SITA, SupplyOn, Sopra Steria Group SA, Trimble, UKG, Verizon Connect, Workday, Zoom Video Communications and many others.

Vendor Snapshot: Aerospace and Defense Market Leaders

Dassault Systemes

Dassault Systemes

Dassault Systemes introduced its 3D UNIV+RSES capability on the 3DEXPERIENCE platform, blending AI-generated content, modeling, and data science to enhance engineering workflows in aerospace and defense. The company continues to expand virtual twin and digital manufacturing capabilities via DELMIA, enabling complex system modeling, lean operations, and sustainable production planning. Ongoing R&D investments are increasingly focused on high-growth sectors such as space, defense, energy, and sovereign cloud infrastructure to support secure, digital-first engineering environments.

Cadence Design Systems

Cadence is expanding its aerospace and defense portfolio with enhancements to the Allegro and Virtuoso platforms, including AI-driven layout optimization and thermal-aware simulation for mission-critical systems. The company’s investment in generative AI models and cloud-native EDA workflows strengthens support for secure, high-performance chip design in aerospace applications. Through joint innovation programs with defense contractors and expanded digital twin support, Cadence continues to evolve its position in complex system simulation.

Synopsys

Synopsys continues to expand its AI-driven EDA solutions with tools like Synopsys DSO.ai, which automate chip layout for A&D applications demanding security and performance. The Synopsys Platform Architect and Virtualizer help aerospace OEMs model and test embedded software in virtual environments before hardware integration. Its DesignWare IP offerings support specialized hardware requirements, including radiation tolerance and ultra-low power.

Microsoft

Microsoft integrates Dynamics 365 with Azure’s high-security cloud and Microsoft 365 collaboration tools to support digital transformation in aerospace manufacturing and supply chains. Its AI-enabled Copilot and Power Platform tools streamline operations, compliance, and frontline productivity. Microsoft focuses on secure cloud environments and data sovereignty, including government-grade infrastructure for defense customers.

Siemens Digital Industries Software

Siemens Digital Industries Software has embedded AI across NX, Simcenter, and Teamcenter to optimize design, thermal simulation and lifecycle analytics for aerospace platforms. Its Xcelerator portfolio supports closed-loop digital twins, enabling predictive maintenance and manufacturing resilience. Siemens leverages its strength in industrial automation to address the convergence of IT and OT in aerospace production environments.

Autodesk

Autodesk is expanding Fusion 360 with AI-assisted generative design, simulation, and machining tailored to aerospace suppliers and prototyping use cases. AutoCAD and Inventor now integrate tightly with cloud-based product lifecycle data and advanced simulation. Autodesk emphasizes accessibility and cloud-native collaboration for SMBs in the A&D supply chain.

Ansys Inc

Ansys Inc. continues to evolve its Discovery and HFSS platforms with AI-assisted simulation workflows for electromagnetic, optical, and structural integrity design in space and defense systems. SPEOS and Granta MI are integrated to support material modeling and digital mission validation. Ansys tools are increasingly used to meet stringent testing and certification requirements across complex A&D systems.

PTC

PTC leverages Creo and Windchill with embedded AI and simulation tools to support agile product development and real-time engineering collaboration. Its partnership with AWS and investments in model-based systems engineering expand its digital thread capabilities. PTC emphasizes connected product development workflows critical for defense-grade configuration and compliance management.

Hexagon

Hexagon has advanced its Odyssee CAE and HxGN Virtual Manufacturing suites with machine learning to accelerate predictive simulation and manufacturing automation in aerospace. Its focus includes closed-loop process control, quality analytics and sensor fusion within high-tolerance production. Hexagon combines metrology and simulation to optimize aerospace design-to-production processes.

SAP

SAP continues to evolve S/4HANA for Manufacturing with embedded AI, analytics and digital twin capabilities that support production visibility and materials traceability in aerospace programs. SAP Business Network and Industry Cloud solutions integrate procurement, compliance and supplier collaboration for defense-grade manufacturing. The company’s R&D investments support end-to-end transformation across regulated A&D supply chains.

ARTW Technographics Platform: Aerospace and Defense customer wins

Since 2010, our research team has been studying the patterns of the Aerospace and Defense software purchases, analyzing customer behavior and vendor performance through continuous win/loss analysis. Updated quarterly, the ARTW Technographics Platform provides deep insights into thousands of Aerospace and Defense customer wins and losses, helping users monitor competitive shifts, evaluate vendor momentum, and make informed go-to-market decisions.

List of Aerospace and Defense customers

Source: ARTW Buyer Insights Technographic Database

Custom data cuts related to the Aerospace and Defense Applications market are available:

- Top 700+ Aerospace and Defense Applications Vendors and Market Forecast 2024-2029

- 2024 Aerospace and Defense Applications Market By Functional Market (16 Markets)

- 2024 Aerospace and Defense Applications Market By Country (USA + 45 countries)

- 2024 Aerospace and Defense Applications Market By Region (Americas, EMEA, APAC)

- 2024 Aerospace and Defense Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2024 Aerospace and Defense Applications Market By Customer Size (revenue, employee count, asset)

- 2024 Aerospace and Defense Applications Market By Channel (Direct vs Indirect)

- 2024 Aerospace and Defense Applications Market By Product

Worldwide Enterprise Applications by Vertical Market

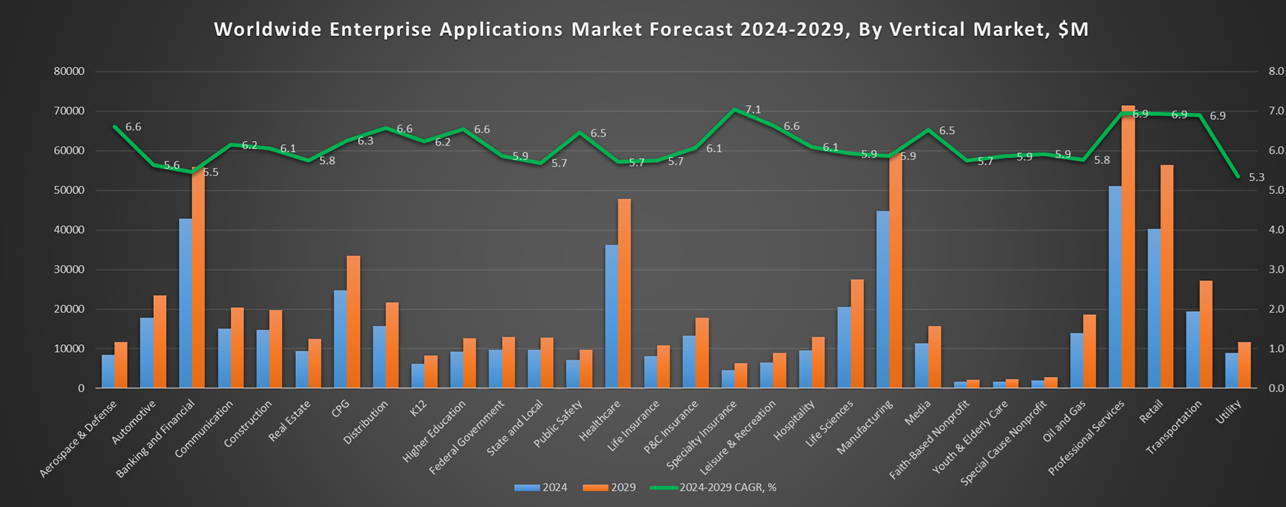

Exhibit 3 provides a forecast of the worldwide enterprise applications by vertical market from 2024 to 2029, highlighting market sizes, year-over-year growth, and compound annual growth rates across different industry sectors from Aerospace and Defense to Utilities.

Exhibit 3: Worldwide Enterprise Applications by Vertical Market Forecast 2023-2028 by Functional Market ($M)

Source: Apps Run The World, July 2025

Exhibit 4 shows our projections for the enterprise applications market by vertical segment, based on the buying preferences and the customer propensity to invest in new software within those industries as they continue to upgrade and replace many legacy industry-specific applications that have been identified and tracked in our Buyer Insight Database.

FAQ – APPS RUN THE WORLD Top 10 Aerospace & Defense Software Vendors, Market Size & Forecast

Q1. What is the global Aerospace & Defense software market size in 2024?

The global Aerospace & Defense software market reached $8.5 billion in 2024, growing 10% year-over-year.

Q2. Who are the top 10 Aerospace & Defense software vendors in 2024 and their combined share?

The top 10 vendors in 2024 are Dassault Systèmes, Cadence Design Systems, Synopsys, Microsoft, Siemens Digital Industries Software, Autodesk, Ansys, PTC, Hexagon, and SAP, collectively accounting for 51.6% of the global Aerospace & Defense software market.

Q3. Which vendor leads the Aerospace & Defense software market in 2024?

Dassault Systèmes leads the Aerospace & Defense software market in 2024 with a 9% market share.

Q4. How does this report define the Aerospace & Defense software market scope?

The Aerospace & Defense software market includes applications for aircraft and parts, defense contractors, aviation maintenance management, air traffic management, flight operations, quality management systems, financials, HR, and procurement.

Q5. What is the Aerospace & Defense software market outlook through 2029?

The market is forecast to reach $11.7 billion by 2029, growing from $8.5 billion in 2024 at a 6.6% compound annual growth rate (CAGR).

Q6. What portion of the Aerospace & Defense market is controlled by the top 10 vendors in 2024?

The top 10 vendors control 51.6% of the Aerospace & Defense software market in 2024.

Q7. When was this report published and by whom?

The Top 10 Aerospace & Defense Software Vendors, Market Size & Forecast 2024–2029 report was published in July 2025 by APPS RUN THE WORLD analysts Albert Pang, Misho Markovski, and Marija Ristik, as part of the APPS TOP 500 research program, which benchmarks the revenues and market share of the world’s 1,500+ largest enterprise application vendors.

More Enterprise Applications Research Findings

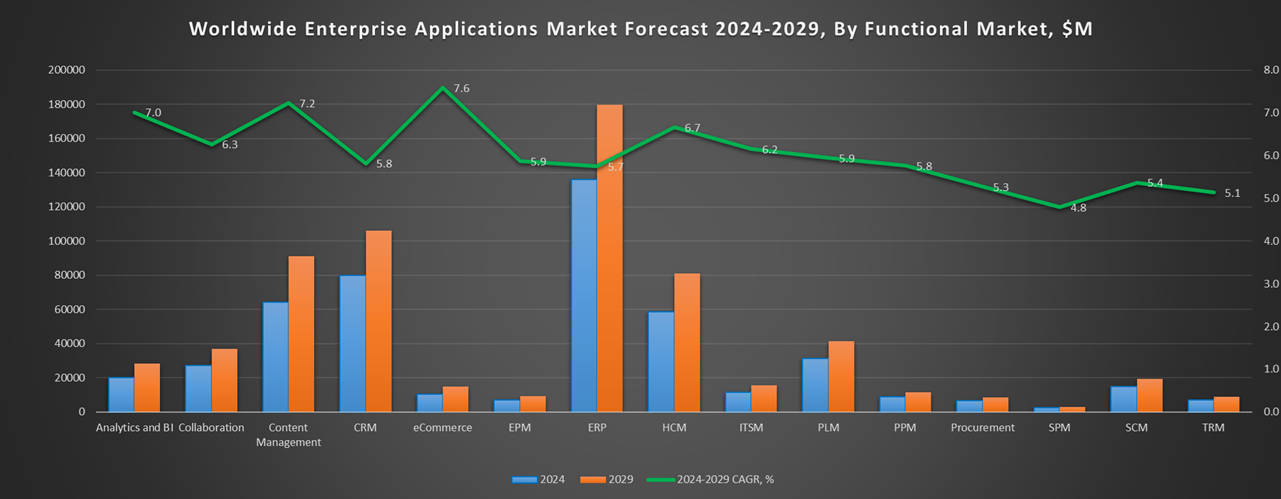

Based on the latest annual survey of 10,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 1,500 largest Enterprise Applications Vendors ranked by their 2024 product revenues. Their 2024 results are being broken down, sorted and ranked across 16 functional areas (from Analytics and BI to Treasury and Risk Management) and by 21 vertical industries (from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year our global team of researchers conduct an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market.

We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 2 million organizations around the world.

The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.

- Alliance University, a India based Education organization with 500 Employees

- Alliance University, a India based Education company with 500 Employees

- PwC, a United Kingdom based Professional Services organization with 370000 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

Dassault Systemes

Dassault Systemes