In 2024, the global ERP software market grew to $135.9 billion, marking a 9.4% year-over-year increase. The top 10 vendors accounted for 26.5% of the total market. Oracle led the pack with a 6.5% market share, followed by SAP, Intuit, Constellation Software, and Microsoft.

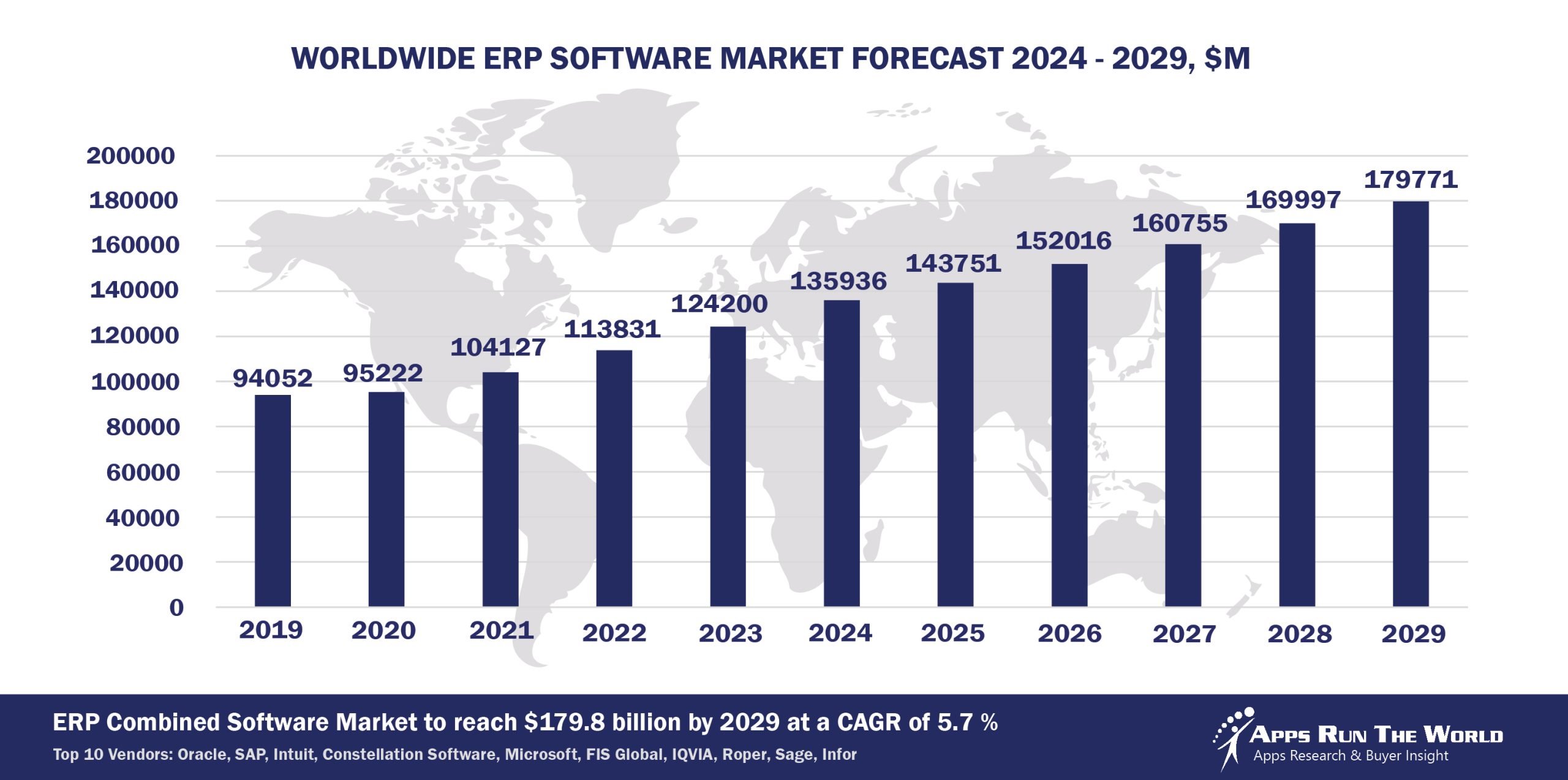

Through our forecast period, the ERP applications market size is expected to reach $179.8 billion by 2029, compared with $135.9 billion in 2024 at a CAGR of 5.7%, as shown in the Apps Top 500 Report – Excel Edition [Preview] .

ERP Financial Management software covers finance-specific business processes such as accounts payable, accounts receivable, general ledger, and fixed asset accounting, as well as online functions such as invoicing, factoring, electronic payments and financial reporting. FM applications revenues represent a major contributor to the Enterprise Resource Planning market as part of our market sizing exercise.

ERP Services and Operations Management covers integrated applications suites designed to automate a range of business processes from back-office operations to financial management and from sales order capture to customer information management. Currently ERP also covers functions not being addressed by other functional markets. Examples include Environment and Health and Safety, Governance, Risk and Compliance, as well as industry-specific applications for 21 verticals.

Top 10 ERP Software Vendors in 2024 and their Market Shares

Source: Apps Run The World, July 2025

Other ERP software providers included in the report are: ACI Worldwide, Acumatica, Adobe, Allscripts, Amadeus, Aptean, Asseco Group, athenahealth, Avalara, Blackbaud, BlackLine, Bottomline Technologies, Capita Software, CDK Global, Cegid, CGI Group Inc., Cision, CompuGroup, CoStar Group, Cox Automotive, CSG Systems International, DATEV, Ellucian, Epic Systems, Epicor, Ericsson, Exact Holding BV, Exela Technologies, FICO, FinancialForce, Finastra, GE Digital, Greenway Health, Guidewire, HealthStream, IBM, IFS, Jack Henry & Associates, Blue Yonder, Kingdee, LexisNexis, MYOB, NextGen Healthcare, OBIC Co. Ltd., RealPage, Reynolds and Reynolds, Roper Technologies, SABRE Corp, Salesforce, Sapiens, Sopra Steria Group, SS&C Technologies, Temenos Group AG, TietoEVRY, TOTVS, Trimble, Tyler Technologies, UNIT4, Visma, Wolters Kluwer, Workday, Xero, Yardi, Yonyou, Zoho Corp., Zuora, and many others.

Vendor Snapshot: ERP Market Leaders

Oracle

Oracle

Oracle is redefining ERP through embedded agentic AI, with over 50 domain-specific agents now available across Oracle Cloud ERP and Oracle NetSuite ERP. These agents execute predictive forecasting, automate sustainability compliance, and streamline content generation, procurement, and close processes—all without additional licensing. New features include Generative AI for business reports, smart invoice matching, and supply chain risk sensing. Oracle’s investment in sovereign cloud and its distributed cloud regions underscores its intent to deliver AI-native ERP at global scale. The go-to-market strategy focuses on embedding autonomous workflows as standard offerings, not bolt-ons, ensuring that AI agents become the operational backbone of enterprise decision-making.

SAP

SAP’s ERP innovation, centered on SAP S/4HANA, Business ByDesign, and Business One, leverages its federated AI Core and Business Technology Platform (BTP) to orchestrate Joule—its enterprise copilot—and a growing ecosystem of modular agents. These agents automate master-data enrichment, supplier onboarding, audit trail validation, and complex scenario modeling across finance and operations. The SAP Build portfolio enables low-code extension of agents across vertical processes, while the AI Foundation governs autonomy thresholds. SAP’s roadmap aligns with making AI an embedded fabric of the Intelligent Enterprise, integrating vertical workflows with agentic execution.

Intuit

Intuit is transforming QuickBooks Online into an intelligent, autonomous finance platform for small and medium businesses while expanding into midmarket ERP through the Intuit Enterprise Suite (IES). Powered by its GenOS foundation and proprietary LLMs, QuickBooks delivers real-time cash flow projections, auto-matches bank transactions, streamlines reconciliation, and enables conversational interactions that autonomously configure tax codes and invoice templates. The Smart Insights upgrade adds agent-driven anomaly detection and budget recommendations, enhancing proactive financial guidance. Building on this, Intuit Enterprise Suite (IES) integrates accounting, payroll, HR, expense management, and compliance into a unified platform, with the July 2025 release introducing multi-entity consolidation, embedded compliance checks, and advanced scenario modeling for CFOs.

Constellation Software

Constellation Software continues to expand through targeted acquisitions across its Harris, Volaris, Vela, and Jonas subsidiaries. These vertical ERP units are integrating lightweight AI agents to optimize billing accuracy, compliance monitoring, and customer onboarding. Though disruptive AI transformation is rare in its model, the steady deployment of pre-trained domain agents within public sector, healthcare, and hospitality software reflects a gradual AI assimilation strategy. Constellation’s focus remains on extending the value of legacy ERP platforms via incremental automation rather than replatforming.

Microsoft

Microsoft’s ERP strategy for Dynamics 365 for Finance & Operations and Business Central now includes Copilot Studio for building and customizing AI agents using natural language. These agents automate journal entries, detect vendor risks, and guide forecasting decisions in real time. Microsoft’s embedded AI is powered by Azure OpenAI and Fabric, allowing seamless cross-solution orchestration and enterprise data lake integration. Its push toward composable ERP positions Dynamics as an intelligent operating layer, with Copilot Agents acting as autonomous co-workers across supply chain, finance, and service operations.

FIS Global

FIS is integrating agentic automation within core offerings like FIS Core Banking and FIS GETPAID. AI agents now handle payment exception resolution, credit scoring, and collections prioritization. The Digital One platform is being rebuilt into a modular, AI-native environment with embedded conversational flows and anomaly detection models. FIS is targeting regulated verticals such as treasury, receivables, and trade finance with pre-configured agents capable of adapting to jurisdiction-specific rules and generating audit trails automatically. Its roadmap merges ERP and core banking into a compliance-first automation platform.

IQVIA

IQVIA is advancing its Clinical Trial Financial Suite with autonomous budgeting agents, protocol deviation analytics, and intelligent variance analysis. Its AI stack merges structured ERP records with unstructured medical and operational data to enable CROs and sponsors to manage financial operations with real-time granularity. Agents are trained on life sciences-specific taxonomies, delivering high accuracy for monitoring clinical burn rates, budgeting mid-trial amendments, and financial reconciliation. IQVIA’s ERP evolution reflects an AI-first redesign of trial finance as a continuously adapting operational layer.

Roper Technologies

Roper’s portfolio companies—Deltek (CostPoint), Aderant (Expert), and Vertafore (AMS360)—are being equipped with modular AI agents that streamline billing approvals, legal compliance, and insurance case handling. Roper’s enterprise data lab centralizes algorithmic training for shared deployment across its independent brands, ensuring standardization in agent behavior. These agents serve as task-level copilots, enabling domain-specific automation without requiring full system migration. Roper’s playbook focuses on accelerating ROI via targeted feature deployment in its mature ERP assets.

Sage

Sage’s AI push is centered on Sage Intacct and Business Cloud X3, where agents now handle ledger reconciliation, payroll auditing, and AP/AR optimization. The latest product cycle introduced interactive scenario modeling tools for CFOs and an embedded cash flow AI advisor. With Sage Copilot, users can ask natural language questions about financial health and trigger actions across modules. Sage emphasizes self-service configuration, aligning its midmarket ERP roadmap around conversational automation and role-based autonomy.

Infor

Infor is embedding automation into Infor CloudSuite and Infor LN with industry-specific agent packs. These pre-built agents optimize material requirements planning, vendor selection, and production line monitoring. Infor’s Nexus and Coleman AI platforms provide the orchestration layer for these agents, enabling real-time analytics, natural language interaction, and predictive workflows. Its manufacturing and distribution customers are adopting AI agents to shrink decision windows and replace static dashboards with dynamic, conversational reporting. Infor’s vision is ERP as a sector-specific, low-latency AI fabric.

ARTW Technographics Platform: ERP customer wins

Since 2010, our research team has been studying the patterns of the ERP software purchases, analyzing customer behavior and vendor performance through continuous win/loss analysis. Updated quarterly, the ARTW Technographics Platform provides deep insights into thousands of ERP customer wins and losses, helping users monitor competitive shifts, evaluate vendor momentum, and make informed go-to-market decisions.

List of ERP customers

Source: ARTW Buyer Insights Technographic Database

Custom data cuts related to the ERP Applications market are available:

- Top 900+ ERP Applications Vendors and Market Forecast 2024-2029

- 2024 ERP Applications Market By Industry (21 Verticals)

- 2024 ERP Applications Market By ERP Segments and Categories

- 2024 ERP Applications Market By Country (USA + 45 countries)

- 2024 ERP Applications Market By Region (Americas, EMEA, APAC)

- 2024 ERP Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2024 ERP Applications Market By Customer Size (revenue, employee count, asset)

- 2024 ERP Applications Market By Channel (Direct vs Indirect)

- 2024 ERP Applications Market By Product

Worldwide Enterprise Application Market

Exhibit 3 provides a forecast of the worldwide enterprise application market from 2024 to 2029, highlighting market sizes, year-over-year growth, and compound annual growth rates across various functional segments. The data shows strong growth in emerging areas like Content Management, eCommerce, Human Capital Management, and IT Service Management, while traditional segments like ERP and CRM continue to dominate in market size.

Exhibit 3: Worldwide Enterprise Application Market Forecast 2024-2029 by Functional Market, $M

Source: Apps Run The World, July 2025

Exhibit 4 shows the enterprise applications market by functional area. The highest growth functional markets revolve around smaller segments like Analytics and BI, eCommerce, Enterprise Performance Management, where first movers remain less established than those that for decades have been entrenched in functional areas like ERP, HCM, CRM and PLM.

FAQ – APPS RUN THE WORLD Top 10 ERP Software Vendors, Market Size & Forecast

Q1. What is the global ERP software market size in 2024?

A: The global ERP software market reached $135.9 billion in 2024, growing 9.4% year-over-year as enterprises accelerated cloud ERP adoption and AI-driven automation.

Q2. Who are the top 10 ERP software vendors in 2024 and their combined share?

A: The top 10 ERP vendors are Oracle, SAP, Intuit, Constellation Software, Microsoft, FIS Global, IQVIA, Roper Technologies, Sage, and Infor, together capturing 26.5% of the worldwide market.

Q3. Which vendor leads the ERP software market in 2024?

A: Oracle leads the global ERP market in 2024 with a 6.5% share, powered by Oracle Fusion Cloud ERP, NetSuite ERP, and its Cerner-driven healthcare expansion.

Q4. How does this report define the ERP market scope?

A: The ERP market covers financial management (AP/AR, GL, assets, invoicing, payments, reporting), operations management (back-office, order, customer info), plus EHS, GRC, and industry-specific ERP applications.

Q5. What is the ERP market outlook through 2029?

A: The ERP software market is projected to grow to $179.8 billion by 2029, up from $135.9 billion in 2024, at a 5.7% CAGR, driven by AI-native ERP, SaaS models, and vertical solutions.

Q6. Which other ERP vendors are covered beyond the top 10?

A: The report also profiles Workday, Unit4, Epicor, IFS, Acumatica, Zoho, Xero, Salesforce, Temenos, Visma, Wolters Kluwer, Tyler Technologies, TOTVS, Kingdee, Yonyou, Zuora, Aptean, and many others.

Q7. When was this report published and by whom?

A: The Top 10 ERP Software Vendors, Market Size and Forecast 2024–2029 was published July 23, 2025 by APPS RUN THE WORLD analysts Albert Pang, Misho Markovski, and Marija Ristik, as part of the APPS TOP 500 research program, which benchmarks the revenues and market share of the world’s 1,500+ largest enterprise application vendors.

More Enterprise Applications Research Findings

Based on the latest annual survey of 10,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 1,500 largest Enterprise Applications Vendors ranked by their 2024 product revenues. Their 2024 results are being broken down, sorted and ranked across 16 functional areas (from Analytics and BI to Treasury and Risk Management) and by 21 vertical industries (from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year our global team of researchers conduct an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market.

We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 2 million organizations around the world.

The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.

- NHS, a United Kingdom based Healthcare organization with 1297455 Employees

- Taft, Stettinius & Hollister, LLP, a United States based Professional Services company with 1400 Employees

- GEP Worldwide, a United States based Professional Services organization with 6000 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

Oracle

Oracle