In 2024, the global TRM software market grew to $6.9 billion, marking a 10.2% year-over-year increase. The top 10 vendors accounted for 42.4% of the total market. ION Group led the pack with an 8.5% market share, followed by Murex, Nasdaq Financial Technology (formerly Adenza, AxiomSL and Calypso), SAP, and Finastra.

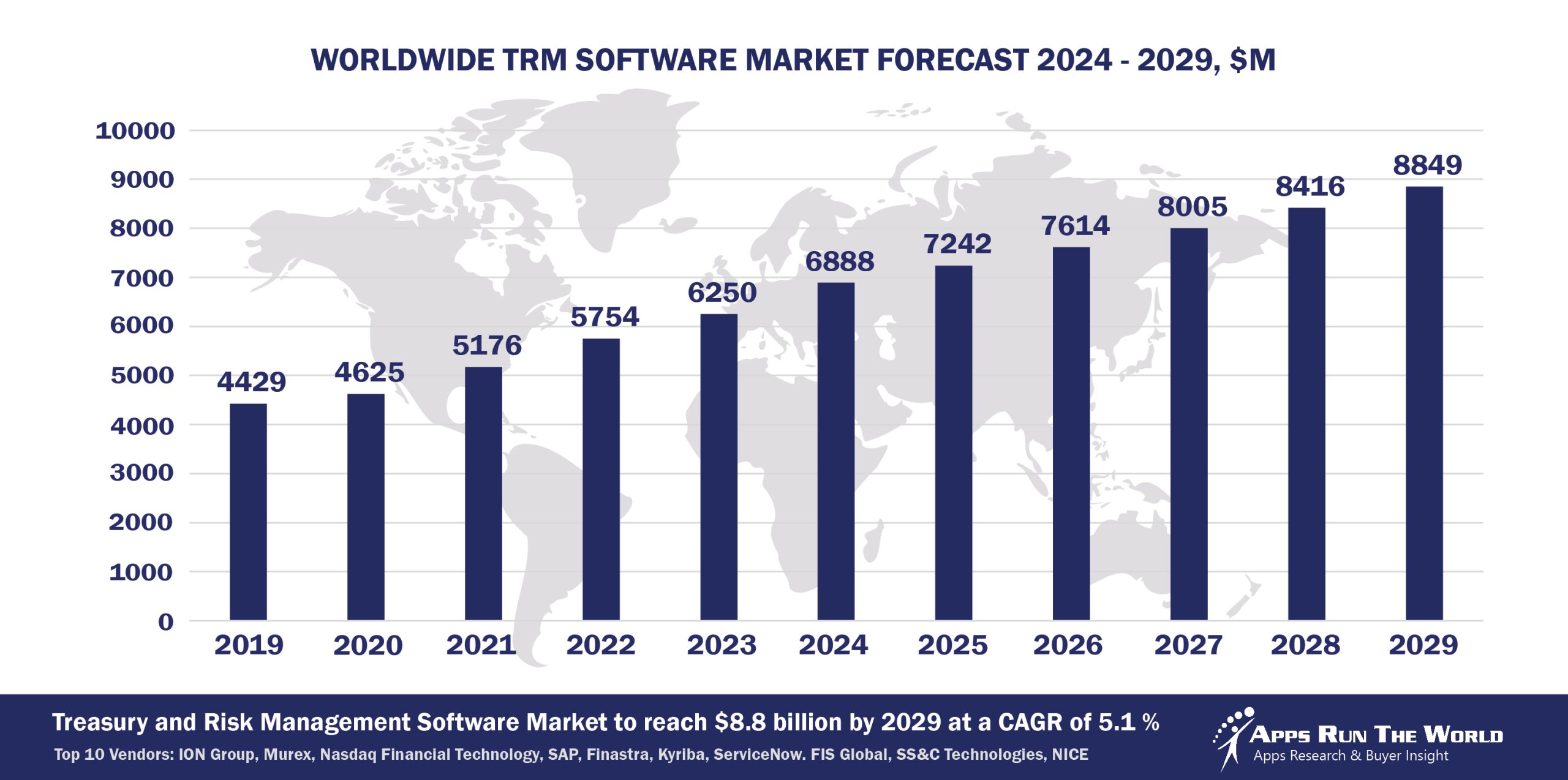

Through our forecast period, the TRM applications market size is expected to reach $8.8 billion by 2029, compared with $6.9 billion in 2024 at a CAGR of 5.1%, as shown in the Apps Top 500 Report – Excel Edition [Preview] .

Treasury and Risk Management applications covers standalone and/or integrated products that automate business processes to support corporate treasury operations (including the treasuries of financial services enterprises) with the corresponding financial institution functionality and optimize related cash management, deal management, and risk management functions

Top 10 TRM Software Vendors in 2024 and their Market Shares

Source: Apps Run The World, July 2025

Other TRM software providers included in the report are: 3i Infotech, 3V Finance (Titan Treasury), ACI Worldwide, Argo Data Resource Corp., Asseco Group, Bloomberg, Bottomline Technologies, Calabrio, Inc., CGI Group Inc., Coupa Software, Clearwater Analytics, COCC, CURA Software Solutions, Deluxe Corporation, Digital River, Edgeverve, an Infosys company, Envestnet, Equifax, Exalog, Exela Technologies, Exigis, Experian, FICO, Fiserv, GTreasury, GBST Holdings Limited, HCL Technologies Ltd., IBM, Imagine Software, Infor, Intelex Technologies, Jack Henry & Associates, KOGER, LexisNexis, Milliman Marc, MSCI, NCR Corporation, Oracle, Resolver Inc., Riskonnect, Roper Technologies, Salmon Software, Sage, Serrala, SimCorp, Silverlake Axis, SAS Institute, SmartStream, Solera Holdings, Temenos Group AG, Thomson Reuters Elite, Trayport, Trintech Group, Verint Systems Inc., Workiva, Yonyou, and others.

Vendor Snapshot: TRM Market Leaders

ION Group

ION Group

ION is transforming its modular TRM platforms—like ION IT2 Treasury and the Reval Cloud Platform—into adaptive, agentic ecosystems. Recent upgrades prioritize domain-specific LLMs and no-code agent composition for cash forecasting, debt decisions, and liquidity stress scenarios. While still emerging publicly, ION’s roadmap positions it as an AI orchestrator in capital-intensive environments, emphasizing human-in-the-loop governance and real-time decisioning agents.

Murex

Murex provides enterprise-wide, cross-asset financial technology solutions to sell-side and buy-side capital markets players. With more than 60,000 daily users in 65 countries, its cross-function platform, MX.3, supports trading, treasury, risk, post-trade operations, as well as end-to-end investment management operations for private and public assets. This helps clients better meet regulatory requirements, manage enterprise-wide risk, and control IT costs.

Nasdaq Financial Technology (formerly Adenza, AxiomSL and Calypso)

Now consolidating Adenza/Calypso and AxiomSL, Nasdaq’s unified TRM platform automates liquidity management, regulatory compliance, and capital constraints through agentic orchestration. Embedded agents reconcile real-time capital positions against risk limits, generating self-regulating workflows. Enhanced explainability and data lineage capabilities make this platform well-suited for treasury teams operating in highly regulated capital markets environments.

SAP

With over 6,000 organizations using SAP’s Treasury and Risk Management (TRM) solutions, SAP is positioning SAP S/4HANA Cloud for Treasury and Risk Management as the standard for real-time treasury management. The platform embeds banks directly into the treasury core, enabling straight-through processing, automated FX exposure capture, hedge accounting aligned to IFRS and US GAAP, and fully integrated debt and investment workflows. Agentic AI within TRM and GRC modules interprets currency, liquidity, and policy inputs to generate adaptive, self-learning workflows, while Joule Studio accelerates low-code agentification of treasury processes. By turning TRM into an autonomous control center embedded in the intelligent ERP, SAP is reshaping treasury management around connectivity, compliance, and continuous real-time decisioning.

Finastra

Finastra’s FusionCapital Kondor and Opics suites now include conversational agents that model risk exposures, simulate yield curve changes, and execute compliance-aware workflows. These agents go beyond forecasting by automatically adapting workflow pipelines when liquidity, collateral, or capital thresholds are breached. Finastra’s open-architecture approach encourages no-code agent customization within its open finance stack, helping clients embed automation deeply into treasury operations.

Kyriba

Kyriba has repositioned its Treasury module as an AI-native command center, with autonomous agents that monitor cash shortfalls, suggest hedging strategies, and execute reconciliations in real time. Its open APIs and low-code agent interface allow treasury teams to plug into ERPs, banking systems, and trading platforms, fostering cross-system orchestration. Kyriba is becoming the go-to AI-first partner for multi-entity financial control.

ServiceNow

ServiceNow is extending its governance-first ethos into treasury and risk through ServiceNow GRC, where embedded agents assist with risk exposures, resilience scenarios, and audit-disclosure workflows. Users can build compliance and treasury bots via low-code interfaces on the Now Platform. Conversational agents guide risk managers on mitigation steps and policy gaps—redefining TRM as a real-time governance ecosystem.

FIS Global

FIS is turbocharging TRM through its Quantum and Integrity Editions of Treasury & Risk Manager, embedding AI agents that handle global cash positioning, liquidity risk orchestration, and treasury continuity planning. Powered by its AI Labs and natural language policy engines, the platform integrates financial digital twins and no-code orchestration tools, pushing toward a future of continuous, self-regulating treasury operations.

SS&C Technologies

SS&C continues to expand its TRM capabilities via strategic acquisitions, including the planned integration of Calastone (a blockchain-based fund network) expected by Q4 2025. Its Treasury Management and Algorithmics platforms now support agents that analyze cross-entity liquidity exposure, embedded in fund trading and claims workflows. While early in agentic deployment, the combined infrastructure suggests a shift toward autonomous intelligence across institutional cash and capital operations.

NiCE Systems

NICE Actimize is applying agentic AI across its NICE Actimize portfolio to unify risk surveillance, behavioral analytics, and treasury fraud detection within a single cognitive layer. These agents monitor liquidity anomalies, exposure volatility, and compliance breaches in real time. Supporting over 1,000 institutions across 70 countries as of early 2025, NICE Actimize positions itself as a strategic partner for global financial firms seeking agent-driven AML.

ARTW Technographics Platform: TRM customer wins

Since 2010, our research team has been studying the patterns of the TRM software purchases, analyzing customer behavior and vendor performance through continuous win/loss analysis. Updated quarterly, the ARTW Technographics Platform provides deep insights into thousands of TRM customer wins and losses, helping users monitor competitive shifts, evaluate vendor momentum, and make informed go-to-market decisions.

List of TRM customers

Source: ARTW Buyer Insights Technographic Database

Custom data cuts related to the Treasury and Risk Management Applications market are available:

- Top 130+ TRM Applications Vendors and Market Forecast 2024-2029

- 2024 TRM Applications Market By Industry (21 Verticals)

- 2024 TRM Applications Market By TRM Segments and Categories

- 2024 TRM Applications Market By Country (USA + 45 countries)

- 2024 TRM Applications Market By Region (Americas, EMEA, APAC)

- 2024 TRM Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2024 TRM Applications Market By Customer Size (revenue, employee count, asset)

- 2024 TRM Applications Market By Channel (Direct vs Indirect)

- 2024 TRM Applications Market By Product

Worldwide Enterprise Application Market

Exhibit 3 provides a forecast of the worldwide enterprise application market from 2024 to 2029, highlighting market sizes, year-over-year growth, and compound annual growth rates across various functional segments. The data shows strong growth in emerging areas like Content Management, eCommerce, Human Capital Management, and IT Service Management, while traditional segments like ERP and CRM continue to dominate in market size.

Exhibit 3: Worldwide Enterprise Application Market Forecast 2024-2029 by Functional Market, $M

Source: Apps Run The World, July 2025

Exhibit 4 shows the enterprise applications market by functional area. The highest growth functional markets revolve around smaller segments like Analytics and BI, eCommerce, Enterprise Performance Management, where first movers remain less established than those that for decades have been entrenched in functional areas like ERP, HCM, CRM and PLM.

FAQ – APPS RUN THE WORLD Top 10 TRM Software Vendors, Market Size & Forecast

Q1. What is the global TRM software market size in 2024?

A: The global TRM software market reached $6.9 billion in 2024, growing 10.2% year-over-year due to increased demand for treasury and risk management solutions.

Q2. Who are the top 10 TRM software vendors in 2024, and what share do they hold?

A: The top 10 vendors are ION Group, Murex, Nasdaq Financial Technology, SAP, Finastra, FIS Global, Kyriba, Wolters Kluwer, Fiserv, and Moody’s Analytics, together accounting for 42.4% of the TRM market.

Q3. Which vendor leads the TRM software market in 2024?

A: ION Group leads the TRM market in 2024 with approximately 8.5% market share, driven by its extensive treasury and risk management platform offerings.

Q4. What is the forecast for the TRM market through 2029?

A: The TRM applications market is expected to grow to $8.8 billion by 2029 from $6.9 billion in 2024, with a 5.1% compound annual growth rate (CAGR) fueled by increasing treasury automation and risk management needs.

Q5. What functionality is covered in the scope of the TRM software in this report?

A: The scope includes corporate treasury operations, cash and liquidity management, risk management, deal processing, and financial institution treasury functions.

Q6. Which other TRM vendors are covered beyond the top 10?

A: The report also covers vendors such as ION Treasury, Calypso Technology, GTreasury, Reval, and Openlink, among others.

Q7. When was this TRM report published and by whom?

A: The Top 10 TRM Software Vendors, Market Size & Forecast 2024–2029 report was published in July 2025 by APPS RUN THE WORLD analysts Albert Pang, Misho Markovski, and Marija Ristik, as part of the APPS TOP 500 research program, which benchmarks the revenues and market share of the world’s 1,500+ largest enterprise application vendors.

More Enterprise Applications Research Findings

Based on the latest annual survey of 10,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 1,500 largest Enterprise Applications Vendors ranked by their 2024 product revenues. Their 2024 results are being broken down, sorted and ranked across 16 functional areas (from Analytics and BI to Treasury and Risk Management) and by 21 vertical industries (from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year our global team of researchers conduct an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market.

We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 2 million organizations around the world.

The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.

- HSBC India, a India based Banking and Financial Services organization with 42000 Employees

- Quintet Luxembourg, a Luxembourg based Banking and Financial Services company with 1650 Employees

- Fujitsu, a Japan based Manufacturing organization with 113000 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

ION Group

ION Group