We are thrilled to present the November 2025 edition of the ARTW Buyer Insights Report—a data-driven snapshot of what enterprise application buyers are researching, benchmarking, and shortlisting right now, an extract from the ARTW Cortex.

Enterprise software buyers are constantly evaluating AI and cloud applications to enchance exhsting or replace legacy systems. This edition highlights November’s rip & replace prospects, most active software buyers and the most evaluated enterprise apps, based on observed intent signals across APPS RUN THE WORLD.

In today’s fast-moving digital environment, buyers don’t browse randomly. They compare vendors, applications, validate alternatives, and signal purchase readiness as they move through the buying cycle. This report helps sales, marketing, and competitive intelligence teams prioritize accounts, tailor messaging, and accelerate pipeline using validated buyer intent signals.

ARTW buyer intent signals reflect identified, verified and validated enterprise software buyers engaging with relevant content for benchmarking and evaluation, indicating active interest in specific vendors, applications, categories and system integrators.

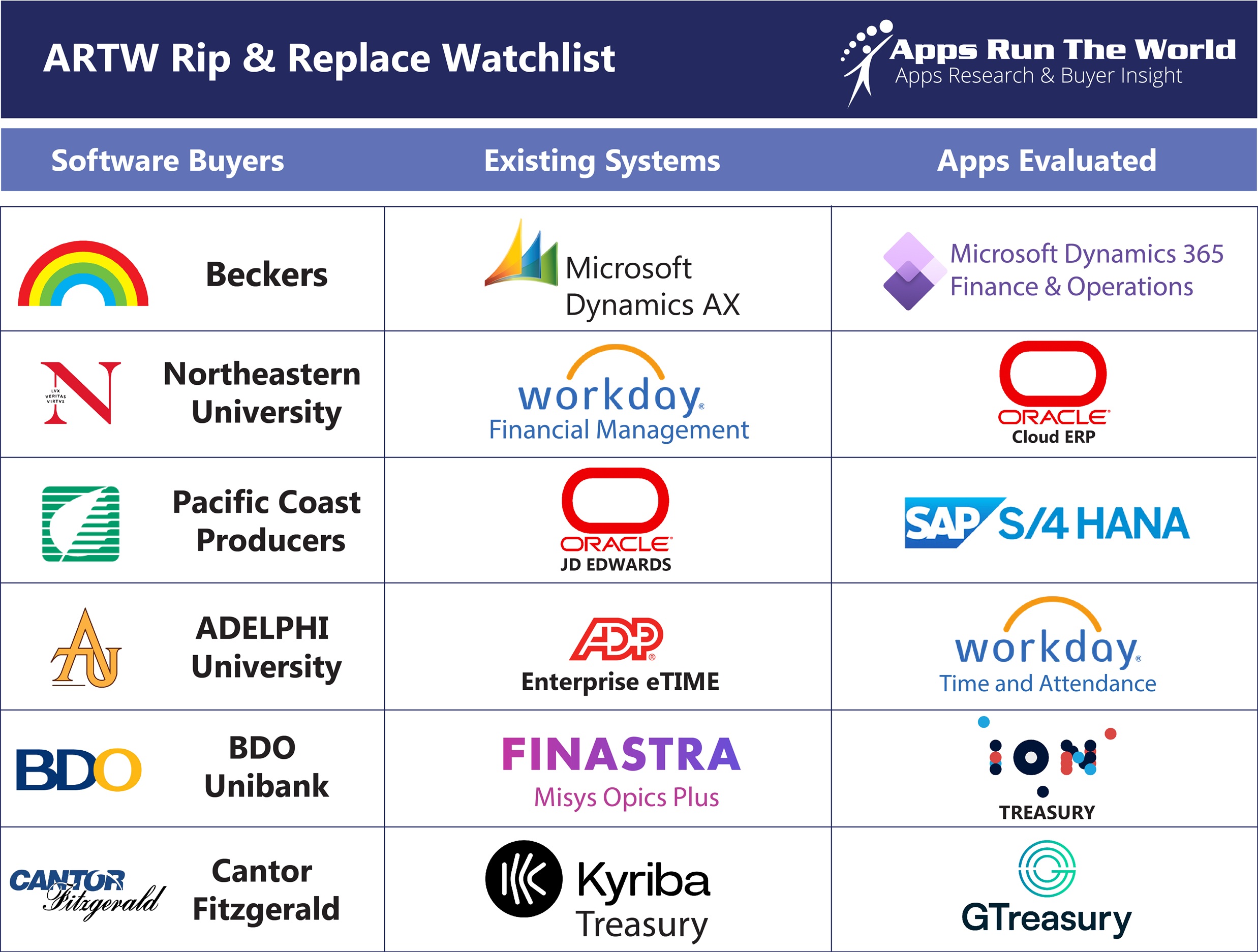

November’s Rip & Replace Watchlist (On Premise → Cloud → Business AI)

This table highlights pre-validated software buyers showing clear rip & replacement behavior in November. All of them are at risk accounts with legacy or incumbent systems, that are actively evaluating AI-enabled cloud alternatives fostering Business AI adoption, often a signal of modernization, consolidation, compliance or cost-driven transformation.

Source: APPS RUN THE WORLD Technographics Platform, December 2025

Top 25 Most Active Software Buyers in November

These are the most active enterprise application buyers in November, organizations evaluating a broad range of applications across multiple categories. High activity typically indicates a live digital transformation initiative rather than a single-point purchase.

| Software Buyers | Industry | Employee | Revenue | Country | # of Intents |

|---|---|---|---|---|---|

| Telstra | Communications | 31876 | $14.6B | Australia | 10 |

| Government of India | Government | 4700000 | $358.7B | India | 7 |

| Royal Bank of Canada | Banking and Financial Services | 94369 | $45.5B | Canada | 7 |

| University of Washington | Education | 35331 | $7.1B | United States | 7 |

| American Express | Banking and Financial Services | 75100 | $65.9B | United States | 6 |

| Bank of America | Banking and Financial Services | 213000 | $101.9B | United States | 6 |

| Abacus.Ai | Professional Services | 160 | $15M | United States | 6 |

| SOCOMEC Group S.A. | Manufacturing | 3100 | $654M | France | 5 |

| National University | Education | 4000 | $100M | United States | 5 |

| Marriott International | Leisure and Hospitality | 418000 | $25.1B | United States | 5 |

| Morgan Stanley | Banking and Financial Services | 82000 | $57.6B | United States | 5 |

| UBS | Banking and Financial Services | 106789 | $57.1B | Switzerland | 5 |

| Sohu.com Limited | Professional Services | 4900 | $836M | China | 5 |

| Boost Mobile | Communications | 700 | $100M | United States | 5 |

| Horizon Forest Products | Distribution | 200 | $30M | United States | 5 |

| University of Queensland | Education | 7500 | $1.5B | Australia | 4 |

| General Beverage Sales Co. | Distribution | 1000 | $114M | United States | 4 |

| National Science Foundation | Government | 1483 | $9.1B | United States | 4 |

| IBMC | Professional Services | 570 | $70M | France | 4 |

| Direct Connect Logistix | Transportation | 180 | $35M | United States | 4 |

| The Home Depot | Retail | 470000 | $159.5B | United States | 4 |

| University of Georgia | Education | 10856 | $1.9B | United States | 4 |

| Deutsche Bank | Banking and Financial Services | 89753 | $34.9B | Germany | 4 |

| Northeastern University | Education | 2000 | $500M | United States | 4 |

| VmWare, a Broadcom Company | Professional Services | 38300 | $14.1B | United States | 3 |

Source: APPS RUN THE WORLD Technographics Platform, December 2025

Top 25 Most Watched Enterprise Applications in November

This ranking shows which enterprise applications received the highest buyer attention in November. Both, software suppliers and software buyers can utilize it to spot category momentum, competitive pressure, category heat and emerging “must-shortlist” platforms.

Source: APPS RUN THE WORLD Technographics Platform, December 2025

ARTW Cortex – AI Buyer Insights Dashboard (Premium Subscription)

Premium subscribers can access the full interactive ARTW Buyer Insights Dashboard to pinpoint prospects most likely to replace existing systems within the next 3–6 months, and can opt in to weekly Buyer Intent notifications to ensure no opportunity is missed.

November’s buyer activity underscores how quickly enterprise teams are moving from curiosity → comparison → replacement. The organizations and applications highlighted above reflect where budgets, platform strategies, and competitive evaluations are shifting right now.

- Shoprite Nigeria, a Nigeria based Retail organization with 2000 Employees

- Ludia Consulting, a United States based Professional Services company with 30 Employees

- Sapot Systems, a United States based Professional Services organization with 80 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|