In 2024, the global Recruiting software market grew to $5.3 billion, marking a 10.9% year-over-year increase. The top 10 vendors accounted for 57.3% of the total market. Microsoftled the pack with a 34.3% market share, followed by Checkr, First Advantage, and Workday.

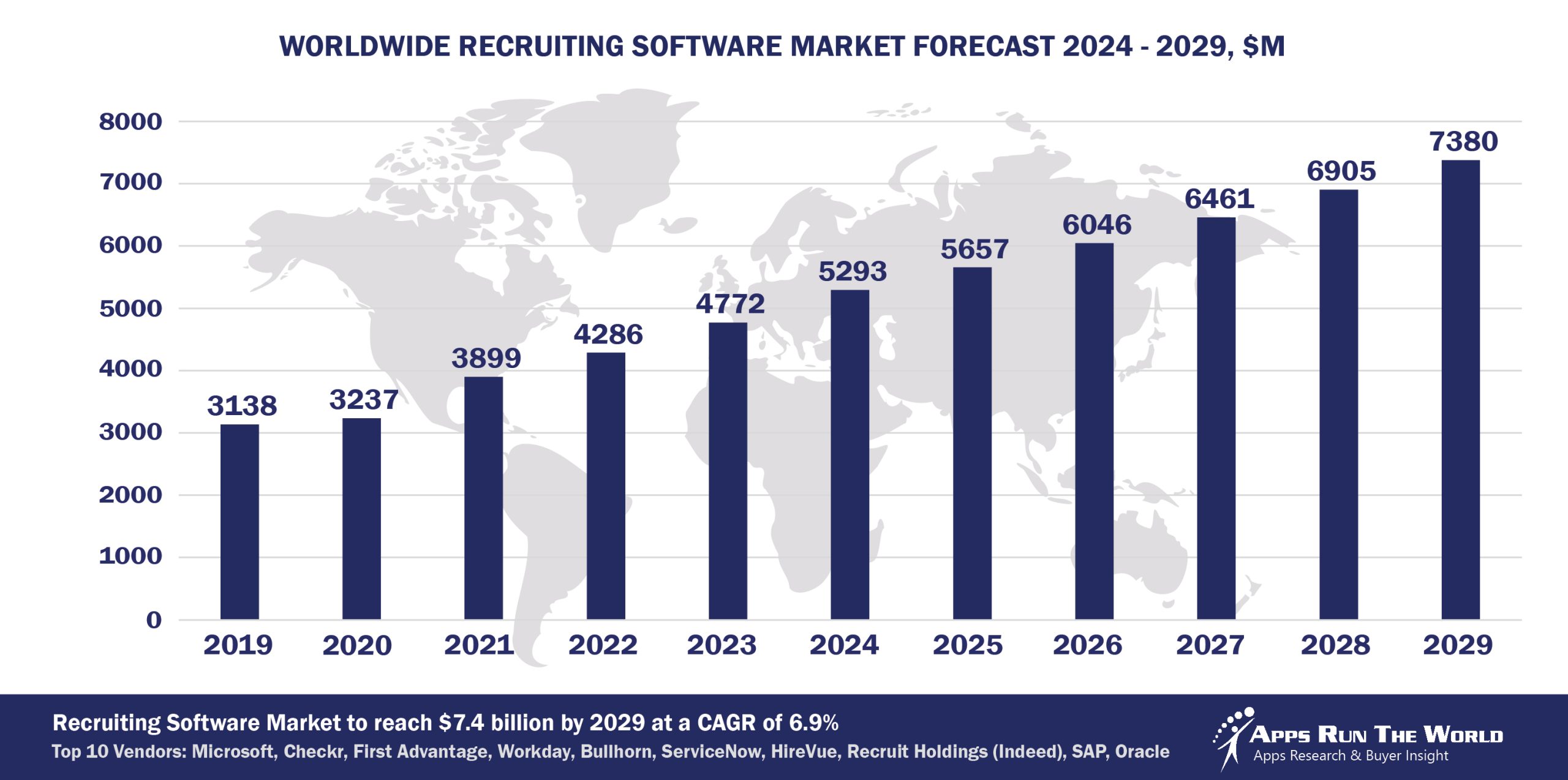

Through our forecast period, the Recruiting applications market size is expected to reach $7.4 billion by 2029, compared with $5.3 billion in 2024 at a CAGR of 6.9%, as shown in the Apps Top 500 Report – Excel Edition [Preview] .

Top 10 Recruiting Software Vendors in 2024 and their Market Shares

Source: Apps Run The World, July 2025

Other vendors included in the report are: ADP, Agile-1, Accurate Background, Appcast, Inc, Asure Software, Avionte Staffing Software, BambooHR, CareerArc, CareerBuilder, Cegid, Cisive, Community Brands, Cornerstone OnDemand, Dayforce, Ellucian, ELMO Talent Management Software, Epicor, Fountain HR Software, Frontier Software, Gloat, Gupy, Gloat, Greenhouse Software, HarQen, Haufe, HealthStream Inc., Harver, Hilan, HireVue, iCIMS, Infor, Kingdee, Muse, Monjin Interviews Pvt. Ltd, mroads, NEOGOV, Oracle, P&I Personal & Informatik AG, Paychex, Paycom, Paycor, Paylocity, Phenom People, Randstad Sourceright, Recruit Holdings, SHL, ServiceNow, SilkRoad, SmartRecruiters, Symphony Talent, Talentia Software, Textkernel, UKG, VidCruiter, Visma, Work4, Workable, Zoominfo, and many others.

Vendor Snapshot: Recruiting Market Leaders

Microsoft

Microsoft

Microsoft’s LinkedIn Talent Solutions has expanded its AI-driven recruiting features, including Recruiter 2025, which leverages generative AI to automate candidate matching and outreach. LinkedIn has invested heavily in machine learning to refine job recommendations, skills assessments, and predictive hiring analytics. Recent updates emphasize integrating LinkedIn’s recruiting tools with Microsoft’s cloud and productivity platforms to streamline sourcing and hiring workflows.

Checkr

In 2024, Checkr surpassed 100,000 enterprise users and generated over $700 million in revenue, while maintaining a Net Promoter Score of +60 and leadership status on G2. That year it launched Checkr Trust, an instant risk‑evaluation tool leveraging AI to enhance trust and safety in high‑volume marketplaces, and enabled direct-to-consumer personal background checks for transparency. In April 2025, Checkr announced its acquisition of Truework, expanding into income and employment verification and positioning itself as a comprehensive workforce data platform. These developments, combined with its AI-powered core, enterprise integrations, and large funding rounds, underscore Checkr’s strategic move toward embedding automation and risk intelligence in hiring and verification workflows.

First Advantage

First Advantage has modernized its background screening and identity verification services with automation that cut turnaround times in 2024 while ensuring compliance. Its digital identity verification tools are now widely used in markets like the UK, where more than half of applicants rely on digital validation. The 2024 acquisition of Sterling Check significantly expanded its global footprint and advanced its AI-driven screening capabilities. These developments contributed to strong revenue growth in early 2025 and reinforced its position as a leading provider of compliance and risk-mitigation solutions in global hiring.

Workday

Workday Recruiting processed 19 million job requisitions and 173 million applications in the first half of 2024, showing strong growth in hiring activity. The company integrated HiredScore’s AI engine to boost recruiter productivity and launched its “Recruiter Agent” to automate sourcing, job descriptions, and scheduling. These innovations, along with a focus on internal mobility and efficiency, have helped reduce time-to-fill and improve sourcing accuracy across its customer base.

Bullhorn

Bullhorn has expanded its recruitment cloud with AI tools that automate candidate sourcing, CRM workflows, and placement tracking. Its acquisition of Cube19 strengthened analytics and reporting capabilities for staffing firms, while the Herefish integration improved recruitment marketing automation. Ongoing investments in machine learning aim to enhance candidate matching and reduce time-to-hire for staffing agencies.

ServiceNow

ServiceNow introduced Intella in 2024, an AI-powered talent engagement platform that uses machine learning to match candidates with roles and streamline recruiting workflows. Its recruiting approach builds on ServiceNow’s existing HR service delivery capabilities, integrating recruiting with broader workforce management. Strategic investments in AI and automation reflect its push into the recruiting market alongside its established ITSM and HR solutions.

HireVue

HireVue has expanded its video interviewing and assessment platform with AI-driven candidate scoring and conversational interview preparation tools. The 2023 acquisition of Modern Hire strengthened its assessment science and broadened its recruiting portfolio. Recent updates have focused on ethical AI, with HireVue developing bias-reduction models to make hiring more equitable while maintaining efficiency.

Recruit Holdings (Indeed)

Recruit Holdings continues to enhance Indeed with Smart Sourcing tools that apply AI to connect recruiters with relevant candidates at scale. Recent innovations include automation for job ad placement, resume parsing, and candidate outreach. Strategic acquisitions in HR tech startups, along with integration of Glassdoor into its portfolio, have expanded Recruit Holdings’ influence in the global recruiting ecosystem.

SAP

SAP SuccessFactors Recruiting has incorporated AI-driven recommendations to match candidates with open roles and automate job requisition workflows. The company has invested in natural-language processing for resume parsing and conversational candidate engagement. SAP’s broader acquisitions in customer experience and analytics also complement its recruiting suite, creating deeper integration with workforce and business systems.

Oracle

Oracle Recruiting Cloud has enhanced its platform with generative AI capabilities in 2024, introducing features for candidate-job fit evaluation and automated application summarization to streamline hiring processes. The company is investing heavily in AI and cloud infrastructure across Europe to support the growth and scalability of its recruitment and talent management solutions. These efforts reflect Oracle’s ongoing focus on integrating advanced technologies to improve efficiency in recruitment workflows.

ARTW Technographics Platform: Recruiting customer wins

Since 2010, our research team has been studying the patterns of Recruiting software purchases, analyzing customer behavior and vendor performance through continuous win/loss analysis. Updated quarterly, the ARTW Technographics Platform provides deep insights into thousands of Recruiting customer wins and losses, helping users monitor competitive shifts, evaluate vendor momentum, and make informed go-to-market decisions.

List of Recruiting customers

Source: ARTW Buyer Insights Technographic Database

Custom data cuts related to the Recruiting Applications market are available:

- Top 250+ Recruiting Applications Vendors and Market Forecast 2024-2029

- 2024 Recruiting Applications Market By Vertical Market (21 Industry)

- 2024 Recruiting Applications Market By Country (USA + 45 countries)

- 2024 Recruiting Applications Market By Region (Americas, EMEA, APAC)

- 2024 Recruiting Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2024 Recruiting Applications Market By Customer Size (revenue, employee count, asset)

- 2024 Recruiting Applications Market By Channel (Direct vs Indirect)

- 2024 Recruiting Applications Market By Product

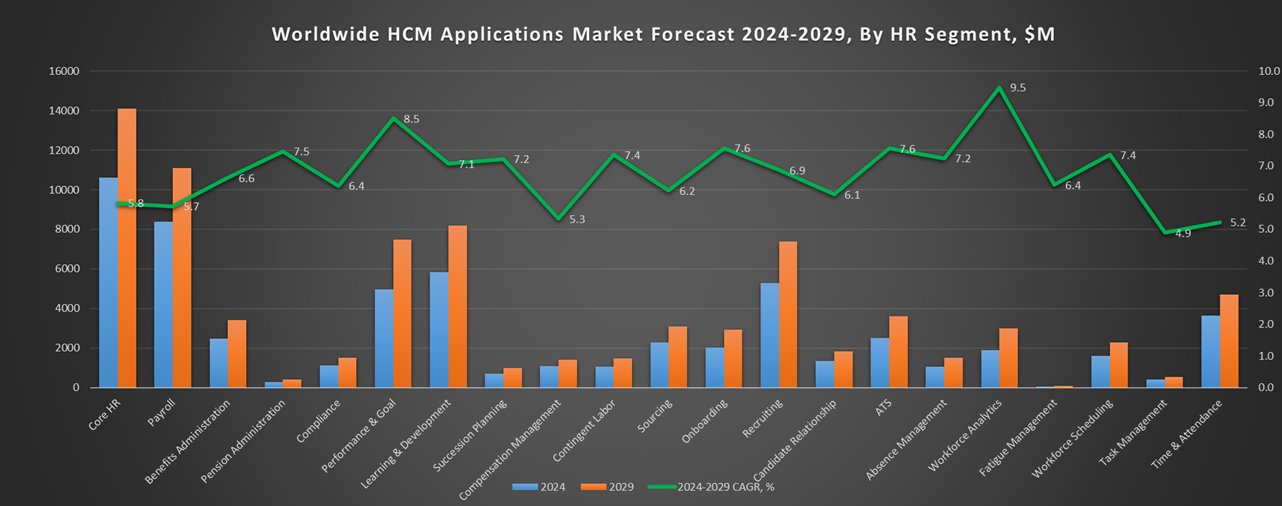

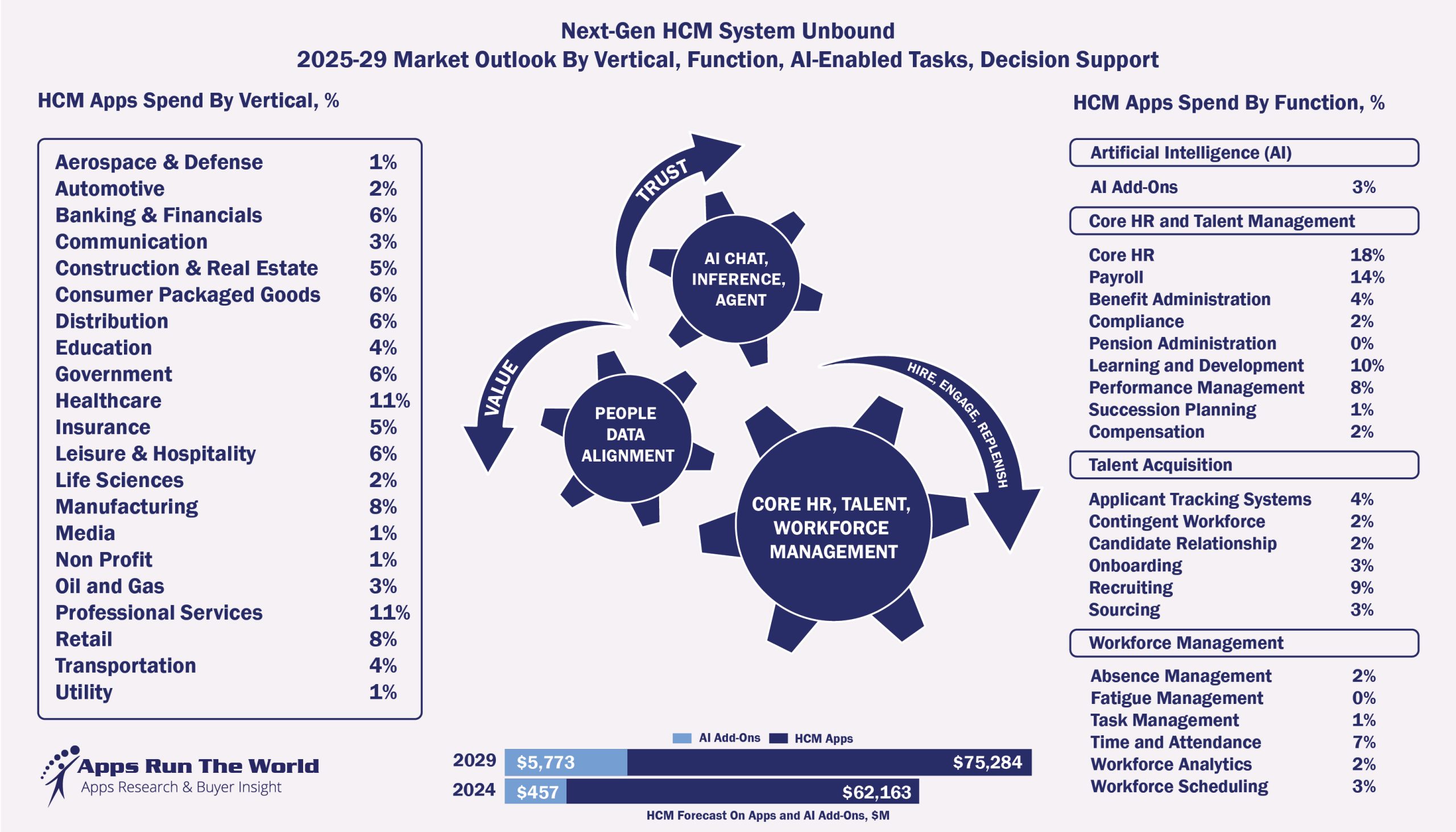

Through our forecast period, the HCM applications market is expected to reach $81.1 billion by 2029, compared with $58.7 billion in 2024 at a compound annual growth rate of 11.7%.

Through our forecast period, the Core HR and Talent Management applications market, which is comprised of nine subsegments, is expected to reach $48.6 billion by 2029, compared with $35.5 billion in 2024 expanding at a compound annual growth rate of 11.6%. For the Top 10 vendors in each of the nine subsegments, please check their own index page by following the link below.

Through our forecast period, the Talent Acquisition applications market, which is comprised of six subsegments, is expected to reach $20.3 billion by 2029, compared with $14.5 billion in 2024 expanding at a compound annual growth rate of 11.7%. For the Top 10 vendors in each of the six subsegments, please check their own index page by following the link below.

Through our forecast period, the Workforce Management applications market, which is comprised of six subsegments, is expected to reach $12.1 billion by 2029, compared with $8.7 billion in 2024 expanding at a compound annual growth rate of 12.1%. For the Top 10 vendors in each of the six subsegments, please check their own index page by following the link below.

Our HCM Top 500 research team also tracks Time Clock Hardware vendors separately by zeroing in on their embedded software as well as their extensive use of OEM and distribution partners.

Exhibit 3: Worldwide HCM Software Market 2024-2029 Forecast, $M

Source: Apps Run The World, July 2025

Exhibit 4 shows our projections for the HCM enterprise applications market by HCM sub-segment, based on the buying preferences and the customer propensity to invest in new software within those industries as they continue to upgrade and replace many legacy industry-specific applications that have been identified and tracked in our Buyer Insight Database.

FAQ – APPS RUN THE WORLD Top 10 Recruiting Software Vendors, Market Size & Forecast

Q1. What is the global Recruiting software market size in 2024?

A: The global Recruiting software market reached $5.3 billion in 2024, growing 10.9% year-over-year.

Q2. Who are the top 10 Recruiting software vendors in 2024 and their combined share?

A: The top 10 vendors in 2024 are Microsoft, Checkr, First Advantage, Workday, Bullhorn, ServiceNow, HireVue, Recruit Holdings (Indeed), SAP, and Oracle, collectively accounting for 57.3% of the global Recruiting software market.

Q3. Which vendor leads the Recruiting software market in 2024?

A: Microsoft leads the Recruiting software market in 2024 with a 34.3% market share.

Q4. How does this report define the Recruiting software market scope?

A: The Recruiting software market includes solutions for applicant tracking, candidate sourcing, recruitment marketing, background screening, and AI-driven hiring workflows.

Q5. What is the Recruiting software market outlook through 2029?

A: The Recruiting software market is projected to grow to $7.4 billion by 2029, at a 6.9% compound annual growth rate.

Q6. Which other Recruiting software vendors are covered beyond the top 10?

A: The report also profiles vendors such as Lever, SmartRecruiters, Greenhouse, and BambooHR, among others, offering recruiting solutions.

Q7. When was this report published and by whom?

A: The Top 10 Recruiting Software Vendors, Market Size and Forecast 2024–2029 was published July 29, 2025, by APPS RUN THE WORLD analysts Albert Pang, Misho Markovski, and Marija Markovska, as part of the APPS TOP 500 research program, which benchmarks the revenues and market share of the world’s 1,500+ largest enterprise application vendors.

Methodology

Similar to any of the hundreds of reports that we have published since 2010, HCM Top 500 is a labor of love. Since 2013, our team of researchers have been conducting rigorous research on thousands of HCM vendors, surveying them quarterly, reviewing their products at even shorter intervals because of the compressed Cloud release cycle, and discussing HR vision with their customers to better understand user needs as well as different paths to upgrade and replace their existing systems.

Each year we also attend many industry-wide and vendor-specific user conferences – HR Tech, Dreamforce, SAPPHIRENOW, Oracle Open World, just to name a few, to gauge what customers are looking for.

Throughout this process comes a rich database of more than 2,000 HCM vendors as well as over 50,000 HCM customers that have been touched one form or another through regular surveys, phone and in-person interviews, email exchanges, and social media interactions, etc.

On a proactively basis, we contact the vendors directly to tabulate their latest quarterly and annual revenues by HCM segment, vertical market, revenue type, region, country and customer size.

We supplement their written responses with our own primary research to determine quarterly and yearly growth rates in each of the 22 segments and 21 verticals, in addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our quantitative research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 100,000 organizations around the world.

The database provides customer insight and contextual information on what types of HCM, enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall HCM and IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the HCM marketplace for years to come.

HCM Market Taxonomy

Definition of Human Capital Management (HCM) Applications

Core HR and Performance Management

| Core HR and Performance Management | Description |

|---|---|

| Personnel and Organization Management | Core human resource management system, personnel records, HR master file, accruals, organizational development, org chart visualization |

| Payroll | Payroll processing, tax filing, language support, country-level updates, payslip calculations, automatic deductions and other government requirements for proper disbursement of employee compensation. |

| Benefits Administration | Benefits and health administration. Plan and design benefits lifecycle, billing and payment. Carrier solutions are also included for integration purposes. |

| Pension Administration | Pension and retirement fund(401K) administration as well as software that helps manage profit sharing plan, defined benefit plan, or cash balance plan. |

| Compliance | Compliance, regulatory updates and reporting including such laws as Affordable Care Act, Overtime Regulations, Fair Labor Standards Act |

| Performance and Goal Management | HR performance management applications are designed to automate the aggregation and delivery of information pertinent to the linking of job roles and the mission and goals of the organization. More specifically, the system allows users to automate the performance review process by using mechanisms such as training and key performance indicators to continuously track and monitor the progress of an individual employee, work team, and division. Some of the key features include: Assessment of individual career objectives and organizational skills gaps that impede performance and job advancement. Continuous reviews and establishing milestones. 360-degree evaluation and real-time feedback. Performance appraisal automation. Goal setting and tracking. Employee surveys. Alignment of human assets to corporate objectives. Fast tracks for top performers. |

| Learning and Development | Learning management systems refer to applications that automate the administration, tracking, and reporting of training events. Other tools may include courseware and other delivery, management, tracking, or integrated solutions whose focus is on the learning environment, including learning content management systems. Career development tools include apps for coaching, mentoring, employee development planning, and diagnosing of development needs. |

| Succession and Leadership Planning | Identify and address current and potential talent gaps to create succession management reporting. Develop and maintain a continuous supply of internal talent to fill critical job roles. Improve employee engagement through digital tools to advance career path development opportunities. |

| Compensation Management | Compensation management applications are designed to automate the process of providing cash, noncash, variable and nonvariable compensation to employees through advanced modeling, reporting, and built-in interfacing to payroll processing systems. Other key features include seamlessly manage compensation budgets and allocation in a single, shared tool. Streamline pay recommendation workflows and approvals. Support multiple pay and incentive practices. Ensure budget compliance and adherence to compensation guidelines. Quota and territory management. Calculation and distribution of commissions, spiffs, royalties, incentives to employees, and channel and business partners. Compensation analysis using internal and external data for retention risk analysis. Linking salary, commission and incentives — cash and noncash — to business objectives. Payroll and payment engine interfaces. Account payables integration. |

Talent Acquisition

| Talent Acquisition | Description |

|---|---|

| Applicant Tracking | Applicant tracking software automates such functions as management of resumes, applicant information, scoring, workflow, matching, search, interview scheduling, job descriptions, EEOC reporting, job postings and notifications |

| Recruiting | Recruiting applications are designed to automate the recruitment process of salaried and hourly employees through screening and skills assessment, as well as automated selection processes to improve hiring pipeline by identifying talent inside or outside the organization. Other key features include: Manage skills inventories. Create and manage job requisitions. Coordinate team collaboration within hiring processes. Video Interviewing, team building and digital coaching. |

| Candidate Relationship Management | Applications designed to attract and engage candidates and employees. Other tasks automate functions such as candidate relationship management apps, career site technology, social recruiting, employee referrals, branding, video engagement, campus recruiting and internal hiring |

| Contingent Labor Management | Processing of hiring of contingent labor, search, skills matching, assessment, interview scheduling, negotiation of rates, approvals, project milestone payments, project completion tracking, performance ratings |

| Sourcing | Facilitate resource planning for staffing firms as well as vendor managed system, allowing for front office integration for employment agencies as well as talent acquisition apps designed for staffing firms. |

| Onboarding | Applications designed to deploy workers to appropriate jobs, projects, or teams for accelerated on-boarding. |

Workforce Management

| Workforce Management | Description |

|---|---|

| Absence and Leave Management | Absence management applications offer automated features to support employee leave management, employer authorized leave, Short-Term-Disability/Workers’ Comp coordination, federal and state compliance, customized leave correspondence, medical certification processing, insurance premium payment tracking as well as employee self-service capabilities. Leave Management supports compliance activities related to government regulations such as the Family and Medical Leave Act in the United States and other local leave laws in different countries. |

| Workforce analytics | Workforce analytics are used to analyze compensation, benefits, and other employee variables. These applications can also be used to analyze and optimize labor allocation for particular projects. |

| Fatigue Management | Fatigue Management apps help automate key facets of fatigue risk mitigation, enforcing employee work-hour limits and aligning with fitness for duty best practices. Similar apps may act as electronic work diaries for real-time reporting and compliance with transportation laws. |

| Hardware (Time Clock) | Time capture is the hardware platform that provides authentication features for clock-in and clock-out times, meal and rest breaks, as well as timesheet and payroll reporting and compliance. |

| Scheduling | Products are designed to Increase forecasting accuracy by factoring in a variety of methods and historical patterns. Create optimal schedules to meet customer demands, while reducing costs and maximizing resources |

| Task Management | Task Management offers labor management capabilities such as task-based and project-based activity tracking as well as measurement and reporting functions against performance standards like engineered labor standards, team standards and reflective standards. |

| Time & Attendance | Time and Attendance applications are designed to automate employee time tracking in different locations, help reduce overtime expenses, improve payroll accuracy, eliminate pay errors and adjustments, along with the need to simplify and optimize administrative tasks and complex rate calculations by making available accurate and current labor data and full audit trail of payroll data. |

- Reichman University, a Israel based Education organization with 1000 Employees

- Virtek Vision, a Canada based Manufacturing company with 10 Employees

- Digital Alliance Holdings Japan, a Japan based Retail organization with 304 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

Microsoft

Microsoft