In 2024, the global Professional Services software market grew to $51.1 billion, marking an 11.9% year-over-year increase. The top 10 vendors accounted for 43.7% of the total market. Microsoft led the pack with a 13.1% market share, followed by Salesforce, Intuit, and Adobe.

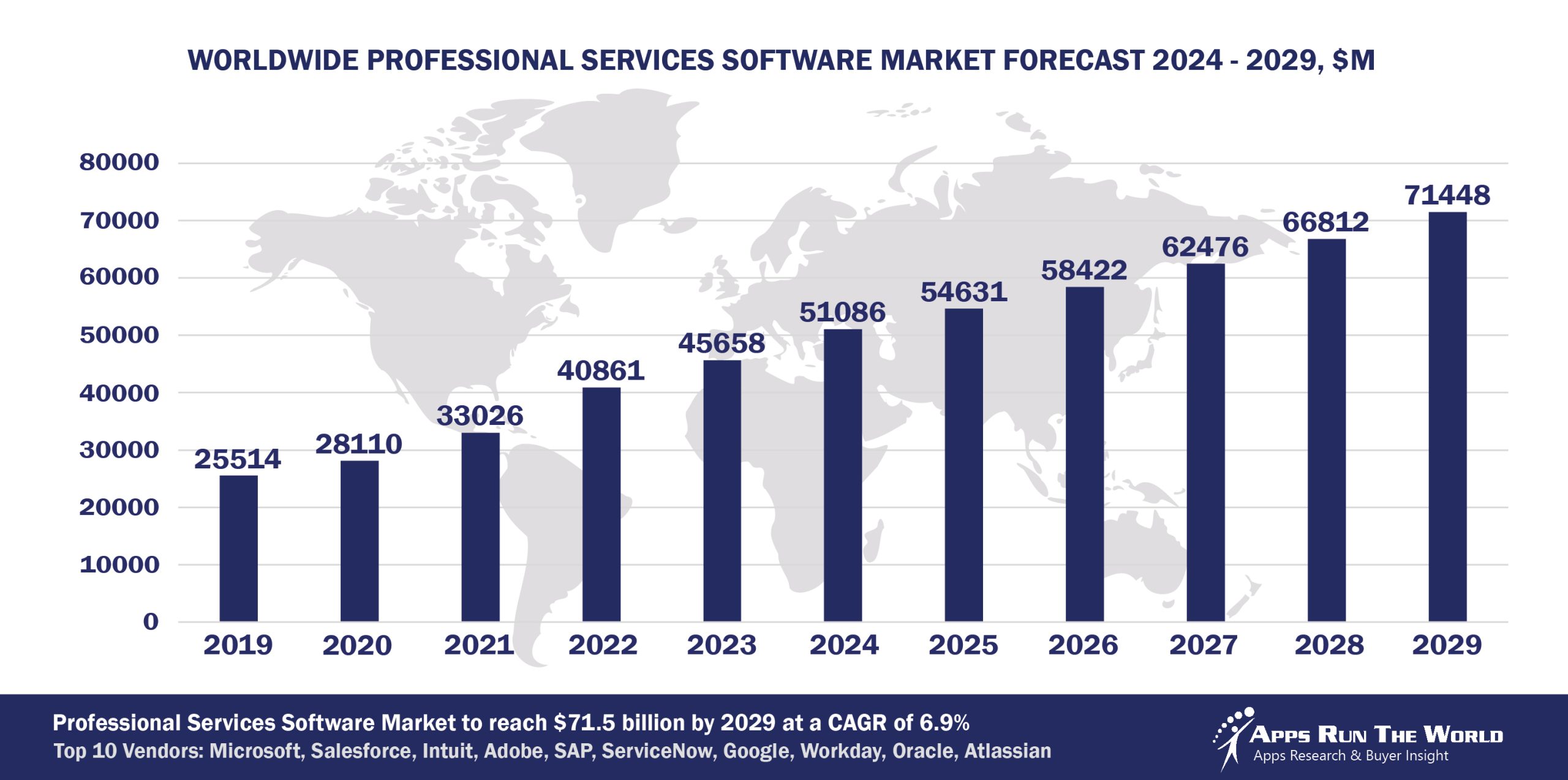

Through our forecast period, the Professional Services applications market size is expected to reach $71.4 billion by 2029, compared with $51.1 billion in 2024 at a CAGR of 6.9%, as shown in the Apps Top 500 Report – Excel Edition [Preview] .

Professional services (Business, Engineering, IT, legal services) – Timesheet and Billing, Legal Practice Management, Project Management, Project Portfolio Management, Field Service Management Software, Professional Services Automation, Financials, HR, Procurement

Professional services firms invest heavily in new tools that boost collaboration, CRM and HR best practices aided by a mix of new entrants from the industrial ERP space namely Roper as well as Cloud startups like FinancialForce, all of which aim to accelerate legacy system replacements across different segments including AEC, business and IT consulting firms.

Top 10 Professional Services Software Vendors in 2024 and their Market Shares

Source: Apps Run The World, July 2025

Other Professional Services software providers included in the report are: ADP, Ansys Inc., Atlassian, Autodesk, Avionte Staffing Software, Bentley Systems Inc., Box Inc., BQE Software, Bullhorn, Cisco Systems, Citrix, Clio, Connectwise, Constellation Software Inc., Dassault Systemes, DATEV, Dayforce, DocuSign, Dropbox, Enghouse Interactive Inc., Envestnet, FinancialForce.com, Genesys, Google, HCL Technologies Ltd., Hexagon, Thomson Reuters, Huron, IBM, Impartner Software, Infor, Informatica, SS&C Technologies, Keap, Kingdee, Marin Software, Mavenlink, Nice Systems, OBIC Co. Ltd., Open Text Corporation, Pegasystems, Planview, QAD Inc., Qlik, Relex Solutions, RingCentral, SAS Institute, Siemens Digital Industries Software, Teradata Corporation, Thomson Reuters Elite, TOTVS, UNIT4, Verint Systems Inc., Visma, Workday, and others.

Vendor Snapshot: Professional Services Market Leaders

Microsoft

Microsoft

Microsoft has expanded its enterprise portfolio through continued integration of generative AI across Microsoft 365, Power Platform, and Azure. Investments exceeding $80 billion in AI infrastructure support the deployment of large language models within Microsoft Copilot and Power BI, enabling natural language queries, workflow automation, and data visualization. Updates to Dynamics 365 and Power Platform include embedded AI agents, scenario-based automation, and forecasting tools, aligning with demand for scalable AI applications in knowledge-driven sectors.

Salesforce

Salesforce’s Sales Cloud, Marketing Cloud, and Slack Connect support service-oriented organizations with AI-driven capabilities across client engagement, marketing automation, and team collaboration. In 2024, Salesforce launched Agentforce, an autonomous AI agent platform embedded within its CRM ecosystem, enabling task automation in sales and marketing through low-code workflows. Slack Connect, integrated with ChatGPT, facilitates streamlined communication and document handling, particularly in project-based and client-facing environments.

Intuit Inc.

Since mid-2025, Intuit Assist—Intuit’s agentic AI framework—has deployed task-specific agents across functions such as Accounting, Payments, Finance, Customer, and Payroll to automate processes including bookkeeping, lead qualification, invoice follow-ups, and financial forecasting, with reported time savings of up to 12 hours per month. The platform incorporates predictive analytics, anomaly detection, and AI-generated marketing content through Mailchimp, supporting low-touch operations in project management, client communication, and payroll. These capabilities are delivered across a unified ecosystem serving over 100 million users globally.

Adobe

Adobe Acrobat now includes an AI Assistant with generative contract intelligence, enabling document summarization, version comparison, and citation-based interpretation of legal and financial terms. Adobe has also integrated AI agents through the Experience Platform Agent Orchestrator to support audience segmentation, content automation, and performance diagnostics within Experience Manager and Journey Optimizer. These functions rely on proprietary foundation models, including Firefly, designed for secure enterprise deployment.

SAP

SAP S/4HANA Cloud Public Edition integrates the Joule copilot to provide natural language summarization, smart search, contextual recommendations, and automation of tasks such as employee-project matching and financial closing. SAP Concur Expense leverages generative AI to streamline expense itemization, travel cost estimation, and support query resolution, while SuccessFactors Employee Central embeds AI-driven tools for writing assistance, multilingual translation, and internal opportunity matching. These solutions are built on SAP’s Business Technology Platform (BTP), which offers a unified foundation for scalable AI deployment across its enterprise customer base.

ServiceNow

ServiceNow’s AI platform automates tasks like ticket classification, issue resolution, and employee inquiries, achieving up to a 52% reduction in resolution times. In 2025, ServiceNow enhanced its AI portfolio by acquiring Moveworks, an AI startup focused on employee support, for $2.85 billion. This acquisition is intended to strengthen ServiceNow’s AI capabilities, especially in customer service management, and improve service delivery for mutual clients.

Google’s AI, Gemini, is embedded across core productivity tools to automate tasks such as summarization, content creation, and translation. Its analytics platform improves multi-property management through synced custom metrics, while its cloud data warehouse advances with autonomous machine learning capabilities to streamline data analysis. Additionally, the business intelligence solution incorporates AI-powered conversational analytics and natural language querying, enabling faster, more efficient insights for service-oriented organizations.

Workday

Workday Illuminate, the company’s next-generation AI platform, powers features such as anomaly detection, auto-filling, and document scanning across its applications. In Financial Management, AI automates core financial transactions, reducing errors and costs. HCM utilizes AI for intelligent talent management, including skills categorization and personalized recommendations. Adaptive Planning leverages AI for predictive forecasting and conversational analytics, enabling more agile financial planning. These AI-driven enhancements support organizations in streamlining operations and making data-informed decisions.

Oracle

Oracle’s cloud portfolio integrates AI across its HCM, ERP, Marketing, and Analytics solutions to enhance operational efficiency and decision-making. Its HCM platform uses generative AI for job description creation, personalized career path recommendations, and skills management to streamline HR processes. The ERP system automates financial reconciliations, project change orders, and procurement workflows, reducing manual effort. Oracle’s Marketing Cloud, including Eloqua, leverages generative AI to optimize content creation for campaigns, while the Analytics Cloud provides AI-driven insights, natural language querying, and predictive analytics to support data-driven strategies. These AI capabilities work together to address the evolving needs of service-based industries.

Atlassian

Jira Service Management leverages Atlassian Intelligence to automate ticket triage, summarize communications, and facilitate agent responses, thereby accelerating issue resolution and improving service delivery. Confluence utilizes AI to assist in content creation, summarization, and task generation, enhancing collaboration and knowledge management. Jira Software incorporates AI features such as natural language search, content generation, and automated work item creation, facilitating agile project management. Statuspage provides real-time incident communication and status updates, enabling organizations to keep stakeholders informed and maintain transparency during service disruptions.

ARTW Technographics Platform: Professional Services customer wins

Since 2010, our research team has been studying the patterns of Professional Services software purchases, analyzing customer behavior and vendor performance through continuous win/loss analysis. Updated quarterly, the ARTW Technographics Platform provides deep insights into thousands of Professional Services customer wins and losses, helping users monitor competitive shifts, evaluate vendor momentum, and make informed go-to-market decisions.

List of Professional Services customers

Source: ARTW Buyer Insights Technographic Database

Custom data cuts related to the Professional Services Applications market are available:

- Top 1100+ Professional Services Applications Vendors and Market Forecast 2024-2029

- 2024 Professional Services Applications Market By Functional Market (16 Markets)

- 2024 Professional Services Applications Market By Country (USA + 45 countries)

- 2024 Professional Services Applications Market By Region (Americas, EMEA, APAC)

- 2024 Professional Services Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2024 Professional Services Applications Market By Customer Size (revenue, employee count, asset)

- 2024 Professional Services Applications Market By Channel (Direct vs Indirect)

- 2024 Professional Services Applications Market By Product

Worldwide Enterprise Applications by Vertical Market

Exhibit 3 provides a forecast of the worldwide enterprise applications by vertical market from 2024 to 2029, highlighting market sizes, year-over-year growth, and compound annual growth rates across different industry sectors from Aerospace and Defense to Utilities.

Exhibit 3: Worldwide Enterprise Applications by Vertical Market Forecast 2024-2029 by Functional Market ($M)

Source: Apps Run The World, July 2025

Exhibit 4 shows our projections for the enterprise applications market by vertical segment, based on the buying preferences and the customer propensity to invest in new software within those industries as they continue to upgrade and replace many legacy industry-specific applications that have been identified and tracked in our Buyer Insight Database.

FAQ – APPS RUN THE WORLD Top 10 Professional Services Software Vendors, Market Size & Forecast

Q1. What is the global Professional Services software market size in 2024?

A: The market reached $51.1 billion in 2024, with an 11.9% year‑over‑year increase driven by demand for project, financial, and HR systems.

Q2. Who are the top 10 Professional Services software vendors in 2024 and their combined share?

A: The top 10 vendors are Microsoft, Salesforce, Intuit, Adobe, SAP, ServiceNow, Google, Workday, Oracle, and Atlassian, together accounting for 43.7% of the market.

Q3. Which vendor leads the Professional Services software market in 2024?

A: Microsoft leads with approximately 13.1% market share.

Q4. What is the forecast for the Professional Services software market through 2029?

A: The market is projected to reach $71.4 billion by 2029, growing at a compound annual growth rate (CAGR) of 6.9%.

Q5. What applications are included in the scope of the Professional Services software market?

A: It includes Timesheet & Billing, Project and Portfolio Management, Legal Practice Management, Field Service Management, Professional Services Automation, plus Financials, HR, and Procurement.

Q6. Which other Professional Services software vendors are covered beyond the top 10?

A: Other vendors profiled include FinancialForce, Deltek, Kimble (UK), Mavenlink, and Projector PSA, among others.

Q7. When was this report published and by whom?

A: The report was published in July 2025 by APPS RUN THE WORLD analysts, as part of the APPS TOP 500 research program, benchmarking the revenues and market share of the world’s 1,500+ largest enterprise application vendors.

More Enterprise Applications Research Findings

Based on the latest annual survey of 10,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 1,500 largest Enterprise Applications Vendors ranked by their 2024 product revenues. Their 2024 results are being broken down, sorted and ranked across 16 functional areas (from Analytics and BI to Treasury and Risk Management) and by 21 vertical industries (from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year our global team of researchers conduct an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market.

We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 2 million organizations around the world.

The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.

- Uber, a United States based Transportation organization with 31100 Employees

- Uber, a United States based Transportation company with 31100 Employees

- PSG Equity, a United States based Banking and Financial Services organization with 150 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

Microsoft

Microsoft