In 2024, the global Onboarding software market grew to $2 billion, marking a 13.3% year-over-year increase. The top 10 vendors accounted for 50.4% of the total market. ServiceNowled the pack with a 13.5% market share, followed by Workday, SAP (WalkMe), and UKG.

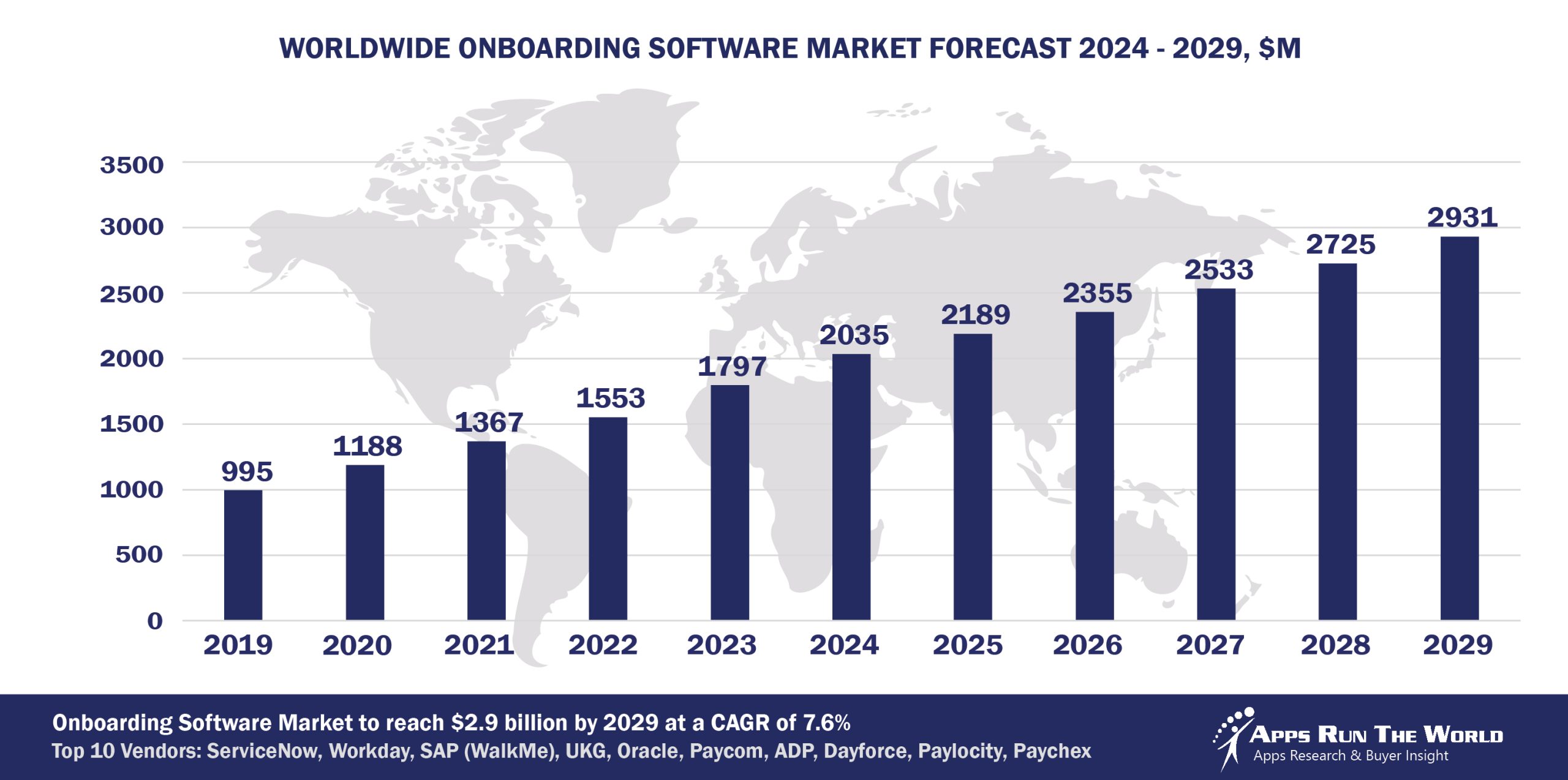

Through our forecast period, the Onboarding applications market size is expected to reach $2.9 billion by 2029, compared with $2 billion in 2024 at a CAGR of 7.6%, as shown in the Apps Top 500 Report – Excel Edition [Preview] .

Top 10 Onboarding Software Vendors in 2024 and their Market Shares

Source: Apps Run The World, July 2025

Other vendors included in the market report are: Agile-1, Alvaria, Inc., Alight Solutions, AppVault, Arcoro, Avature, Avionte Staffing Software, BambooHR, Bullhorn, Calabrio, Inc., Capita Software, CareerArc, CatalystOne Solutions, Cegid, ClearCompany, Cornerstone OnDemand, Dayforce, ELMO Talent Management Software, Empxtrack Inc, Epicor, Exact Holding BV, ExactHire, Equifax, Exela Technologies, Inc., Fourth Ltd, Freshworks (formerly Freshdesk), gr8 People Inc., Greenhouse Software, Gloat, Harri US LLC, Haufe, HealthStream Inc., Hilan, HR Cloud, Infor, Infinite Computer Solutions, Insperity, Inc., iCIMS, IBM, iSolved Human Capital Management, KNOLSKAPE, LG lugar de gente, MHR International Ltd, Namely, NEOGOV, Netchex, P&I Personal & Informatik AG, PageUp, Paychex, Paycom, Paycor, Pilat HR, PlanSource, Paylocity, Randstad Sourceright, Rippling, Seismic Software, Inc., SilkRoad, SmartERP, Talentia Software, Tanda, Tyler Technologies, Userlane, Zellis (ex NGA Human Resources UK & Ireland), ZingHR, Zoho Corp., and others.

Vendor Snapshot: Onboarding Market Leaders

ServiceNow

ServiceNow

ServiceNow Onboarding automates employee lifecycle events such as onboarding, offboarding, and relocations by coordinating tasks across HR and related departments. The platform uses AI-driven automation to optimize workflows, ensure compliance, and enhance the overall employee experience.

Workday

Workday Onboarding streamlines HR onboarding by automating tasks and personalizing new hire experiences with AI-driven job recommendations and learning paths. Its AI framework centralizes governance of onboarding workflows to improve efficiency and engagement.

SAP (WalkMe)

SAP SuccessFactors Onboarding has integrated AI-driven features to enhance the onboarding experience. These include AI-assisted writing tools for personalized communication, translation capabilities, and improved content organization, streamlining the process for HR teams and new hires.

UKG

UKG’s onboarding solutions, including UKG Pro Onboarding and UKG Ready Onboarding, leverage AI to automate and personalize the employee onboarding process. These platforms utilize AI-driven features such as automated document management, personalized task assignments, and predictive analytics to enhance the onboarding experience for new hires and streamline HR workflows.

Oracle

Oracle’s Onboarding automates and customizes the employee onboarding process using AI-powered capabilities. This includes AI agents such as the New Hire Onboarding Assistant, which delivers real-time support on company policies, culture, and essential resources to facilitate smoother integration.

Paycom

Paycom Onboarding offers a step-by-step, paperless experience for completing forms and checklists within a single-database system, shortening onboarding time significantly. In July 2025, Paycom introduced IWant, a command-driven AI engine that allows employees and managers to access HR data.

ADP

ADP Onboarding automates new-hire workflows like I-9 and W-4 within its single-database HCM platform, featuring customizable templates, mobile access, and manager task tracking. AI capabilities support workflow simplification and data-driven insights across the HCM platform.

Dayforce

Ceridian Dayforce Onboarding automates new-hire tasks by transferring recruiting data and reducing administrative work. In October 2023, Ceridian launched Dayforce Co-Pilot, using NLP and generative AI to automate job descriptions and performance reviews, boosting HR productivity.

Paylocity

Paylocity’s Onboarding solution digitizes and automates new-hire processes, including tax form completion, I-9 verification, and policy acknowledgments, all within a unified HCM platform. In October 2024, Paylocity introduced the AI Assistant, a generative AI tool that provides real-time, contextual support across the platform.

Paychex

In 2024, Paychex introduced the AI Assistant, a generative AI tool designed to provide real-time, contextual support across the platform, enhancing self-service capabilities and streamlining HR processes. This assistant offers personalized prompts and responses, improving the onboarding experience for both HR professionals and new hires.

ARTW Technographics Platform: Onboarding customer wins

Since 2010, our research team has been studying the patterns of Onboarding software purchases, analyzing customer behavior and vendor performance through continuous win/loss analysis. Updated quarterly, the ARTW Technographics Platform provides deep insights into thousands of Onboarding customer wins and losses, helping users monitor competitive shifts, evaluate vendor momentum, and make informed go-to-market decisions.

List of Onboarding customers

Source: ARTW Buyer Insights Technographic Database

Custom data cuts related to the Onboarding Applications market are available:

- Top 200+ Onboarding Applications Vendors and Market Forecast 2024-2029

- 2024 Onboarding Applications Market By Vertical Market (21 Industry)

- 2024 Onboarding Applications Market By Country (USA + 45 countries)

- 2024 Onboarding Applications Market By Region (Americas, EMEA, APAC)

- 2024 Onboarding Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2024 Onboarding Applications Market By Customer Size (revenue, employee count, asset)

- 2024 Onboarding Applications Market By Channel (Direct vs Direct)

- 2024 Onboarding Applications Market By Product

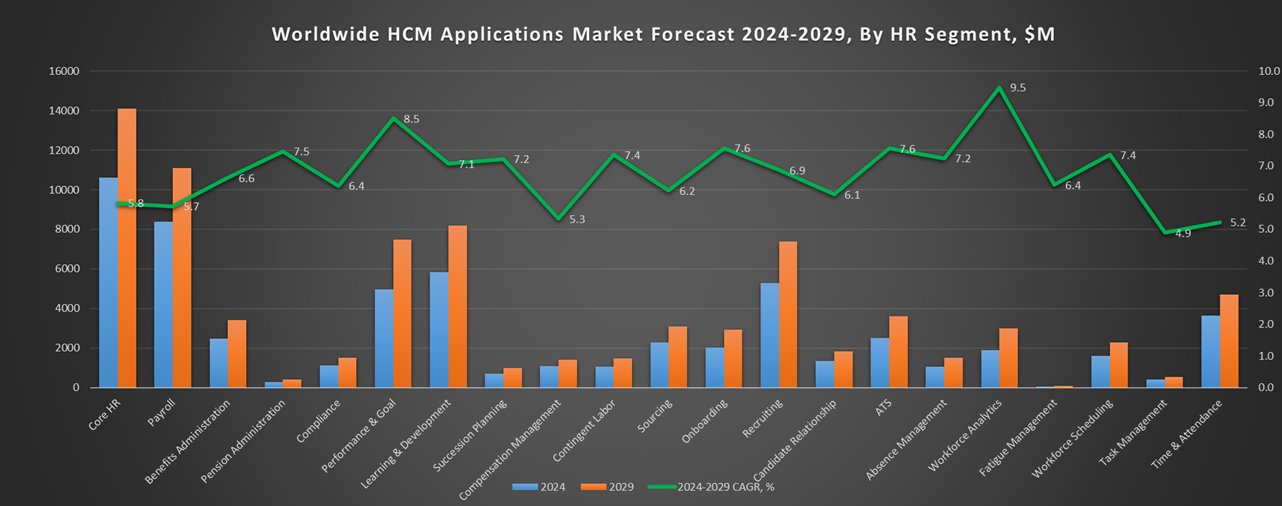

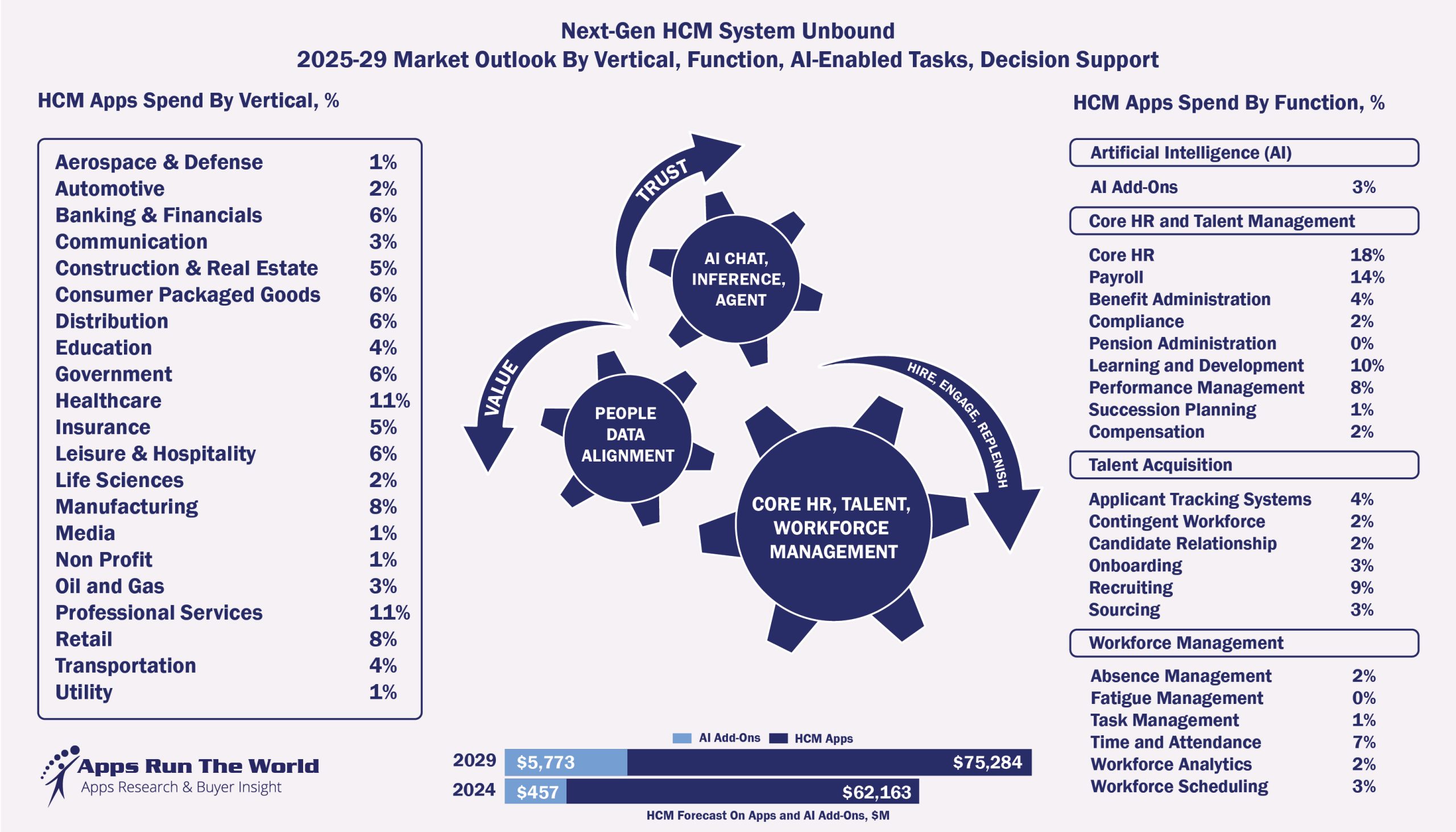

Through our forecast period, the HCM applications market is expected to reach $81.1 billion by 2029, compared with $58.7 billion in 2024 at a compound annual growth rate of 11.7%.

Through our forecast period, the Core HR and Talent Management applications market, which is comprised of nine subsegments, is expected to reach $48.6 billion by 2029, compared with $35.5 billion in 2024 expanding at a compound annual growth rate of 11.6%. For the Top 10 vendors in each of the nine subsegments, please check their own index page by following the link below.

Through our forecast period, the Talent Acquisition applications market, which is comprised of six subsegments, is expected to reach $20.3 billion by 2029, compared with $14.5 billion in 2024 expanding at a compound annual growth rate of 11.7%. For the Top 10 vendors in each of the six subsegments, please check their own index page by following the link below.

Through our forecast period, the Workforce Management applications market, which is comprised of six subsegments, is expected to reach $12.1 billion by 2029, compared with $8.7 billion in 2024 expanding at a compound annual growth rate of 12.1%. For the Top 10 vendors in each of the six subsegments, please check their own index page by following the link below.

Our HCM Top 500 research team also tracks Time Clock Hardware vendors separately by zeroing in on their embedded software as well as their extensive use of OEM and distribution partners.

Exhibit 3: Worldwide HCM Software Market 2024-2029 Forecast, $M

Source: Apps Run The World, July 2025

Exhibit 4 shows our projections for the HCM enterprise applications market by HCM sub-segment, based on the buying preferences and the customer propensity to invest in new software within those industries as they continue to upgrade and replace many legacy industry-specific applications that have been identified and tracked in our Buyer Insight Database.

FAQ – APPS RUN THE WORLD Top 10 Onboarding Software Vendors, Market Size & Forecast

Q1. What is the global Onboarding software market size in 2024?

A: The global Onboarding software market reached $2 billion in 2024, growing 13.3% year-over-year.

Q2. Who are the top 10 Onboarding software vendors in 2024 and their combined share?

A: The top 10 vendors in 2024 are ServiceNow, Workday, SAP (WalkMe), UKG, Oracle, Paycom, ADP, Ceridian (Dayforce), Paylocity, and Paychex, collectively accounting for 50.4% of the global Onboarding software market.

Q3. Which vendor leads the Onboarding software market in 2024?

A: ServiceNow leads the Onboarding software market in 2024 with a 13.5% market share.

Q4. How does this report define the Onboarding software market scope?

A: The Onboarding software market includes solutions for automating employee lifecycle events such as onboarding, offboarding, and relocations by coordinating tasks across HR and related departments.

Q5. What is the Onboarding software market outlook through 2029?

A: The Onboarding software market is projected to grow to $2.9 billion by 2029, at a 7.6% compound annual growth rate.

Q6. Which other Onboarding software vendors are covered beyond the top 10?

A: The report also profiles vendors such as BambooHR, Zenefits, and Gusto, among others, offering onboarding solutions.

Q7. When was this report published and by whom?

A: The Top 10 Onboarding Software Vendors, Market Size and Forecast 2024–2029 was published July 29, 2025, by APPS RUN THE WORLD analysts Albert Pang, Misho Markovski, and Natasha Ilievski, as part of the APPS TOP 500 research program, which benchmarks the revenues and market share of the world’s 1,500+ largest enterprise application vendors.

Methodology

Similar to any of the hundreds of reports that we have published since 2010, HCM Top 500 is a labor of love. Since 2013, our team of researchers has been conducting rigorous research on thousands of HCM vendors, surveying them quarterly, reviewing their products at even shorter intervals because of the compressed Cloud release cycle, and discussing HR vision with their customers to better understand user needs as well as different paths to upgrade and replace their existing systems.

Each year, we also attend many industry-wide and vendor-specific user conferences – HR Tech, Dreamforce, SAPPHIRENOW, Oracle Open World, just to name a few, to gauge what customers are looking for.

Throughout this process comes a rich database of more than 2,000 HCM vendors as well as over 50,000 HCM customers that have been touched one form or another through regular surveys, phone and in-person interviews, email exchanges, and social media interactions, etc.

On a proactive basis, we contact the vendors directly to tabulate their latest quarterly and annual revenues by HCM segment, vertical market, revenue type, region, country and customer size.

We supplement their written responses with our own primary research to determine quarterly and yearly growth rates in each of the 22 segments and 21 verticals, in addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our quantitative research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 100,000 organizations around the world.

The database provides customer insight and contextual information on what types of HCM, enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall HCM and IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the HCM marketplace for years to come.

HCM Market Taxonomy

Definition of Human Capital Management (HCM) Applications

Core HR and Performance Management

| Core HR and Performance Management | Description |

|---|---|

| Personnel and Organization Management | Core human resource management system, personnel records, HR master file, accruals, organizational development, org chart visualization |

| Payroll | Payroll processing, tax filing, language support, country-level updates, payslip calculations, automatic deductions and other government requirements for proper disbursement of employee compensation. |

| Benefits Administration | Benefits and health administration. Plan and design benefits lifecycle, billing and payment. Carrier solutions are also included for integration purposes. |

| Pension Administration | Pension and retirement fund(401K) administration as well as software that helps manage profit sharing plan, defined benefit plan, or cash balance plan. |

| Compliance | Compliance, regulatory updates and reporting including such laws as Affordable Care Act, Overtime Regulations, Fair Labor Standards Act |

| Performance and Goal Management | HR performance management applications are designed to automate the aggregation and delivery of information pertinent to the linking of job roles and the mission and goals of the organization. More specifically, the system allows users to automate the performance review process by using mechanisms such as training and key performance indicators to continuously track and monitor the progress of an individual employee, work team, and division. Some of the key features include: Assessment of individual career objectives and organizational skills gaps that impede performance and job advancement. Continuous reviews and establishing milestones. 360-degree evaluation and real-time feedback. Performance appraisal automation. Goal setting and tracking. Employee surveys. Alignment of human assets to corporate objectives. Fast tracks for top performers. |

| Learning and Development | Learning management systems refer to applications that automate the administration, tracking, and reporting of training events. Other tools may include courseware and other delivery, management, tracking, or integrated solutions whose focus is on the learning environment, including learning content management systems. Career development tools include apps for coaching, mentoring, employee development planning, and diagnosing of development needs. |

| Succession and Leadership Planning | Identify and address current and potential talent gaps to create succession management reporting. Develop and maintain a continuous supply of internal talent to fill critical job roles. Improve employee engagement through digital tools to advance career path development opportunities. |

| Compensation Management | Compensation management applications are designed to automate the process of providing cash, noncash, variable and nonvariable compensation to employees through advanced modeling, reporting, and built-in interfacing to payroll processing systems. Other key features include seamlessly manage compensation budgets and allocation in a single, shared tool. Streamline pay recommendation workflows and approvals. Support multiple pay and incentive practices. Ensure budget compliance and adherence to compensation guidelines. Quota and territory management. Calculation and distribution of commissions, spiffs, royalties, incentives to employees, and channel and business partners. Compensation analysis using internal and external data for retention risk analysis. Linking salary, commission and incentives — cash and noncash — to business objectives. Payroll and payment engine interfaces. Account payables integration. |

Talent Acquisition

| Talent Acquisition | Description |

|---|---|

| Applicant Tracking | Applicant tracking software automates such functions as management of resumes, applicant information, scoring, workflow, matching, search, interview scheduling, job descriptions, EEOC reporting, job postings and notifications |

| Recruiting | Recruiting applications are designed to automate the recruitment process of salaried and hourly employees through screening and skills assessment, as well as automated selection processes to improve hiring pipeline by identifying talent inside or outside the organization. Other key features include: Manage skills inventories. Create and manage job requisitions. Coordinate team collaboration within hiring processes. Video Interviewing, team building and digital coaching. |

| Candidate Relationship Management | Applications designed to attract and engage candidates and employees. Other tasks automate functions such as candidate relationship management apps, career site technology, social recruiting, employee referrals, branding, video engagement, campus recruiting and internal hiring |

| Contingent Labor Management | Processing of hiring of contingent labor, search, skills matching, assessment, interview scheduling, negotiation of rates, approvals, project milestone payments, project completion tracking, performance ratings |

| Sourcing | Facilitate resource planning for staffing firms as well as vendor managed system, allowing for front office integration for employment agencies as well as talent acquisition apps designed for staffing firms. |

| Onboarding | Applications designed to deploy workers to appropriate jobs, projects, or teams for accelerated on-boarding. |

Workforce Management

| Workforce Management | Description |

|---|---|

| Absence and Leave Management | Absence management applications offer automated features to support employee leave management, employer authorized leave, Short-Term-Disability/Workers’ Comp coordination, federal and state compliance, customized leave correspondence, medical certification processing, insurance premium payment tracking as well as employee self-service capabilities. Leave Management supports compliance activities related to government regulations such as the Family and Medical Leave Act in the United States and other local leave laws in different countries. |

| Workforce analytics | Workforce analytics are used to analyze compensation, benefits, and other employee variables. These applications can also be used to analyze and optimize labor allocation for particular projects. |

| Fatigue Management | Fatigue Management apps help automate key facets of fatigue risk mitigation, enforcing employee work-hour limits and aligning with fitness for duty best practices. Similar apps may act as electronic work diaries for real-time reporting and compliance with transportation laws. |

| Hardware (Time Clock) | Time capture is the hardware platform that provides authentication features for clock-in and clock-out times, meal and rest breaks, as well as timesheet and payroll reporting and compliance. |

| Scheduling | Products are designed to Increase forecasting accuracy by factoring in a variety of methods and historical patterns. Create optimal schedules to meet customer demands, while reducing costs and maximizing resources |

| Task Management | Task Management offers labor management capabilities such as task-based and project-based activity tracking as well as measurement and reporting functions against performance standards like engineered labor standards, team standards and reflective standards. |

| Time & Attendance | Time and Attendance applications are designed to automate employee time tracking in different locations, help reduce overtime expenses, improve payroll accuracy, eliminate pay errors and adjustments, along with the need to simplify and optimize administrative tasks and complex rate calculations by making available accurate and current labor data and full audit trail of payroll data. |

- Air Net United Kingdom, a United Kingdom based Communications organization with 25 Employees

- Newport Financial Group, a United States based Banking and Financial Services company with 40 Employees

- HG Insights, a United States based Professional Services organization with 560 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

ServiceNow

ServiceNow