In 2024, the global Content Management market grew to $64.3 billion, marking a 11.1% year-over-year increase. The top 10 vendors accounted for 85.7% of the total market. Microsoft led the pack with a 51.1%, followed by Adobe, DocuSign, Dropbox, and Google.

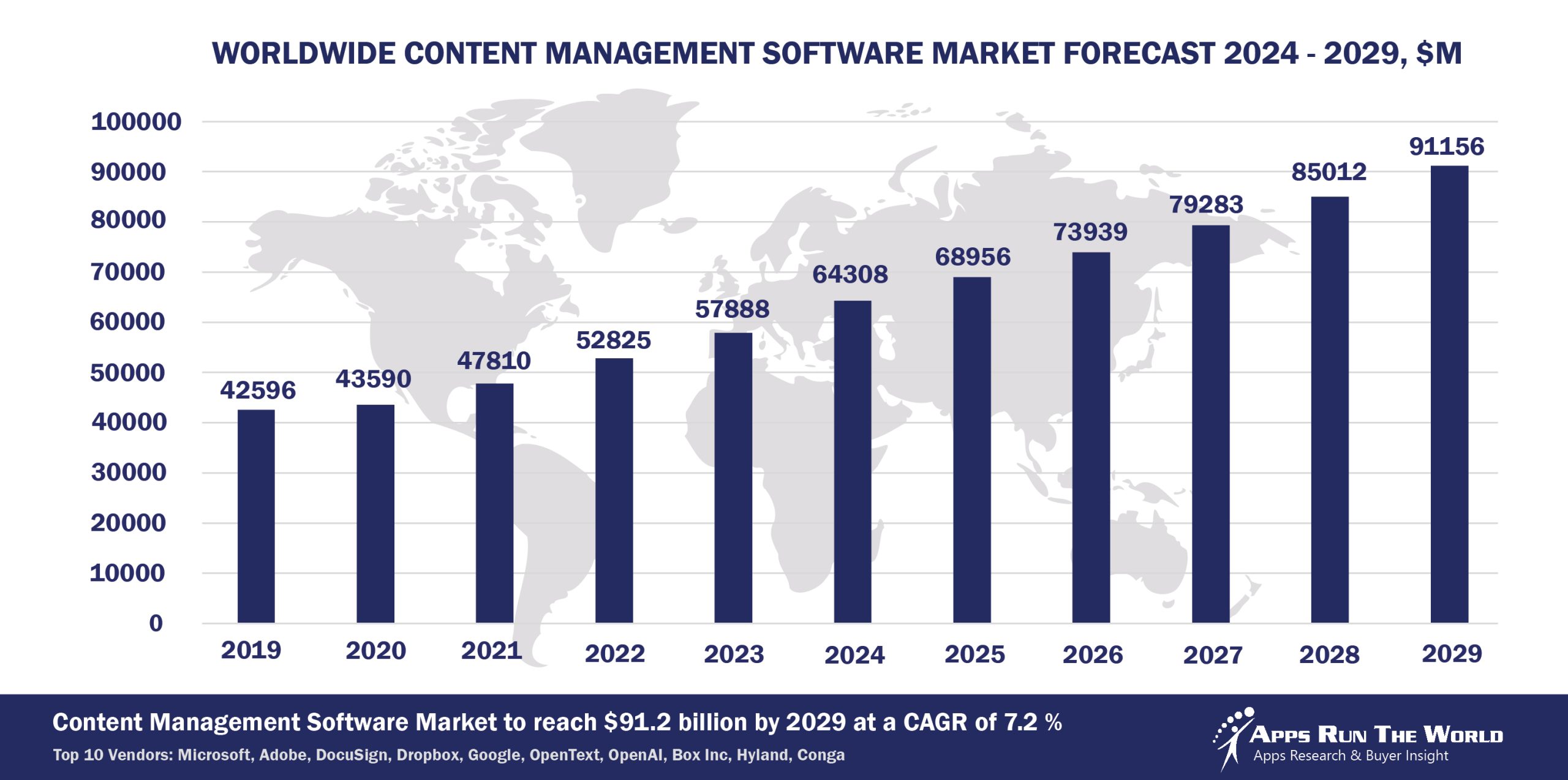

Through our forecast period, the Content applications market size is expected to reach $91.2 billion by 2029, compared with $64.3 billion in 2024 at a CAGR of 7.2%, as shown in the Apps Top 500 Report – Excel Edition [Preview] .

Content applications are software tools designed to create, manage, store, organize, and share digital content and documents across individuals or teams. These applications support both structured and unstructured content, including text files, spreadsheets, presentations, PDFs, and multimedia assets. They provide functionalities such as version control, access permissions, search capabilities, collaboration features, and secure storage—making it easier for users to maintain document integrity and ensure efficient information management.

Here are the rankings of the top 10 Content Management software vendors in 2024 and their market shares.

Source: Apps Run The World, July 2025

Other Content Management software providers included in the report are: Acquia, Amazon Web Services (AWS), Avid Technology, Automattic, Axway, Capital ID, Cisco Systems, Cision, Citrix, Constellation Software Inc., Corel, Cox Automotive, Crownpeak, CTERA Networks, Dalet, Docuware, Egnyte, Episerver, Esker SA, Eventbrite, Evernote, Everteam, FIS Global, HCL Technologies, IBM, icertis, IQVIA, Kentico Software, Laserfiche, LexisNexis, M-Files, NCR Corporation, Newgen Software, Objective Corporation, PandaDoc, Pitney Bowes, PTC, Revinate, SAP, SER Group, Squiz, TIBCO, Unilog, Veeva Systems, Vonage, Zoho and many others.

Vendor Snapshot: Content Management Market Leaders

Microsoft

Microsoft

Microsoft is reshaping enterprise content management by embedding agentic AI into every layer of its productivity stack. Its Graph-driven agents now handle document summarization, versioning, access control, and metadata tagging across SharePoint and OneDrive. With Copilot Studio, content administrators can build low-code agents that enforce governance and lifecycle rules at scale. Microsoft’s roadmap is centered on turning Microsoft 365 into a unified, AI-native content platform—where agents act autonomously to route, secure, and surface insights from enterprise documents in highly regulated environments.

Adobe

Adobe is redefining content creation and management by embedding generative and agentic AI into its Experience and Creative Clouds. Firefly and Sensei agents auto-generate personalized content variants, automate metadata tagging, and orchestrate omnichannel distribution through intelligent workflows. By enabling conversational UI design and low-code automation across content operations, Adobe is turning traditional content repositories into adaptive digital experience hubs, where agents personalize delivery and enforce brand and compliance standards in real time.

DocuSign

DocuSign is transitioning beyond e-signature into intelligent document lifecycle automation. AI agents embedded within its agreement workflows now autonomously extract clauses, recommend redlines, and trigger compliance workflows after execution. These agents function across CLM systems and integrate via APIs with document repositories, enabling seamless risk-aware automation. DocuSign’s approach positions content agreements as live, self-regulating assets—where agents maintain compliance, visibility, and version control without manual intervention.

Dropbox

Dropbox is evolving into an AI-powered content workspace by layering agentic automation on top of its file management infrastructure. Its Dash assistant uses retrieval-augmented AI to summarize documents, recommend actions, and accelerate file discovery across silos. The platform’s no-code automation builder allows teams to create autonomous document workflows—from tagging to approval—without external orchestration tools. Dropbox is strategically shifting toward an intelligent content layer where files are no longer passive storage units, but dynamic elements in agent-managed knowledge systems.

Google is transforming content collaboration through the integration of Gemini agents within Google Drive and Workspace. These agents co-author documents, manage access permissions, translate content, and summarize data—all through natural language interactions. By connecting Vertex AI, enterprises can deploy custom agents trained on their own document corpora with fine-tuned governance. Google’s content management evolution lies in conversational orchestration, where intelligent agents proactively manage content quality, compliance, and collaboration across distributed work environments.

OpenText

OpenText is accelerating the convergence of content services and AI through its Aviator strategy, embedding autonomous agents in Documentum, Extended ECM, and Core Content platforms. These agents dynamically classify content, apply retention rules, and redact sensitive data—ensuring real-time policy compliance. Low-code tools allow enterprises to adapt agent behavior to industry-specific mandates. OpenText’s strategy is focused on content intelligence at scale—enabling agentic automation across every stage of the document lifecycle while maintaining regulatory alignment.

OpenAI

OpenAI serves as the AI backbone for many content platforms, enabling intelligent document understanding through custom GPT-based agents. These agents summarize large document sets, auto-generate policy drafts, and conduct compliance reviews with high contextual precision. Its emphasis on retrieval-augmented generation (RAG) supports nuanced reasoning over proprietary content. OpenAI’s approach is not to replace content platforms, but to supercharge them—empowering organizations to embed autonomous reasoning into any stage of the content workflow via secure, scalable LLM infrastructure.

Box Inc.

Box is integrating agentic AI into every aspect of enterprise content operations. With Box AI and Hubs, agents now automate metadata extraction, document summarization, and cross-departmental content curation. APIs and no-code design tools allow organizations to embed policy-enforcing agents into secure content workflows. Box’s vision is a content cloud where files are discoverable, explainable, and immediately actionable—bridging collaboration and compliance through agents that manage content interactions intelligently and autonomously.

Hyland

Hyland is embedding intelligent agents into OnBase, Alfresco and its new Content Innovation Cloud (CIC) to to transform traditional ECM systems into smart content automation platforms. These agents perform automated classification, data extraction, and compliance-driven routing, tailored to government and healthcare sectors. No-code tools enable non-technical users to design AI-powered workflows with full traceability. Hyland’s roadmap emphasizes AI agents that adapt to content complexity and organizational rules—supporting real-time document decisioning and continuous content governance across hybrid architectures.

Conga

Conga is redefining contract and content operations by infusing AI agents into its CLM and document generation stack. These agents handle negotiation support, clause management, and post-signature compliance, creating intelligent feedback loops between documents and enterprise systems. Through low-code orchestration and CRM integration, Conga enables business users to automate and audit document workflows across legal, sales, and finance. Its content strategy is centered on treating contracts as intelligent, evolving content assets governed by autonomous logic.

ARTW Technographics Platform: Content customer wins

Since 2010, our research team has been studying the patterns of the Content software purchases, analyzing customer behavior and vendor performance through continuous win/loss analysis. Updated quarterly, the ARTW Technographics Platform provides deep insights into thousands of Content customer wins and losses, helping users monitor competitive shifts, evaluate vendor momentum, and make informed go-to-market decisions.

List of Content customers

Source: ARTW Buyer Insights Technographic Database

Custom data cuts related to the Content Management Applications market are available:

- Top 200+ Content Management Applications Vendors and Market Forecast 2024-2029

- 2024 Content Management Applications Market By Industry (21 Verticals)

- 2024 Content Management Applications Market By Content Management Segments and Categories

- 2024 Content Management Applications Market By Country (USA + 45 countries)

- 2024 Content Management Applications Market By Region (Americas, EMEA, APAC)

- 2024 Content Management Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2024 Content Management Applications Market By Customer Size (revenue, employee count, asset)

- 2024 Content Management Applications Market By Channel (Direct vs Indirect)

- 2024 Content Management Applications Market By Product

Worldwide Enterprise Application Market

Exhibit 3 provides a forecast of the worldwide enterprise application market from 2024 to 2029, highlighting market sizes, year-over-year growth, and compound annual growth rates across various functional segments. The data shows strong growth in emerging areas like eCommerce, Human Capital Management, and IT Service Management, while traditional segments like ERP and CRM continue to dominate in market size.

Exhibit 3: Worldwide Enterprise Application Market Forecast 2024-2024 by Functional Market ($M)

Source: Apps Run The World, July 2025

Exhibit 4 shows the enterprise applications market by functional area. The highest growth functional markets revolve around smaller segments like eCommerce, Enterprise Performance Management, Sales Performance Management and Treasury and Risk, where first movers remain less established than those that for decades have been entrenched in functional areas like ERP, CRM and PLM.

FAQ – APPS RUN THE WORLD Top 10 Content Management Software Vendors, Market Size & Forecast

Q1. What is the global Content Management software market size in 2024?

A: The global Content Management software market reached $64.3 billion in 2024, growing 11.1% year-over-year as enterprises expanded digital content workflows and cloud collaboration.

Q2. Who are the leading vendors in the Content Management market in 2024, and what share do the top 10 hold?

A: The top 10 vendors include Microsoft, Adobe, DocuSign, Dropbox, Google, OpenText, OpenAI, Box, Hyland, and Conga, together capturing 85.7% of the global market.

Q3. Which vendor has the largest share of the Content Management market in 2024?

A: Microsoft leads the Content Management market with a 51.1% share in 2024, driven by the widespread adoption of Microsoft 365, SharePoint, and Teams.

Q4. What is the forecast for the Content Management market through 2029?

A: The Content Management market is projected to reach $91.2 billion by 2029, growing at a 7.2% CAGR fueled by AI-powered automation and hybrid work trends.

Q5. How is Content Management defined in this report?

A: Content Management includes software that helps organizations create, manage, store, organize, and securely share structured and unstructured digital content.

Q6. Which other Content Management vendors are covered beyond the top 10?

A: The report also covers vendors such as Egnyte, Laserfiche, M‑Files, MediaValet, Boxever, and KnowledgeLake, among many others.

Q7. When was this Content Management report published and by whom?

A: The Top 10 Content Management Software Vendors, Market Size & Forecast 2024–2029 was published in July 2025 by APPS RUN THE WORLD analysts as part of the APPS TOP 500 research program, which benchmarks the revenues and market share of the world’s 1,500+ largest enterprise application vendors.

More Enterprise Applications Research Findings

Based on the latest annual survey of 3,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 500 largest Enterprise Applications Vendors (Apps Top 500) ranked by their 2019-2024 product revenues.

Their 2024 results are being broken down, sorted and ranked across 16 functional areas (from Analytics to Treasury and Risk Management) and by 21 vertical industries(from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year our global team of researchers conducts an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market. We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 100,000 organizations around the world. The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.

- Beasley Construction Services, a United States based Construction and Real Estate organization with 10 Employees

- Bank of America, a United States based Banking and Financial Services company with 213000 Employees

- Mecca, a Australia based Retail organization with 7000 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

Microsoft

Microsoft