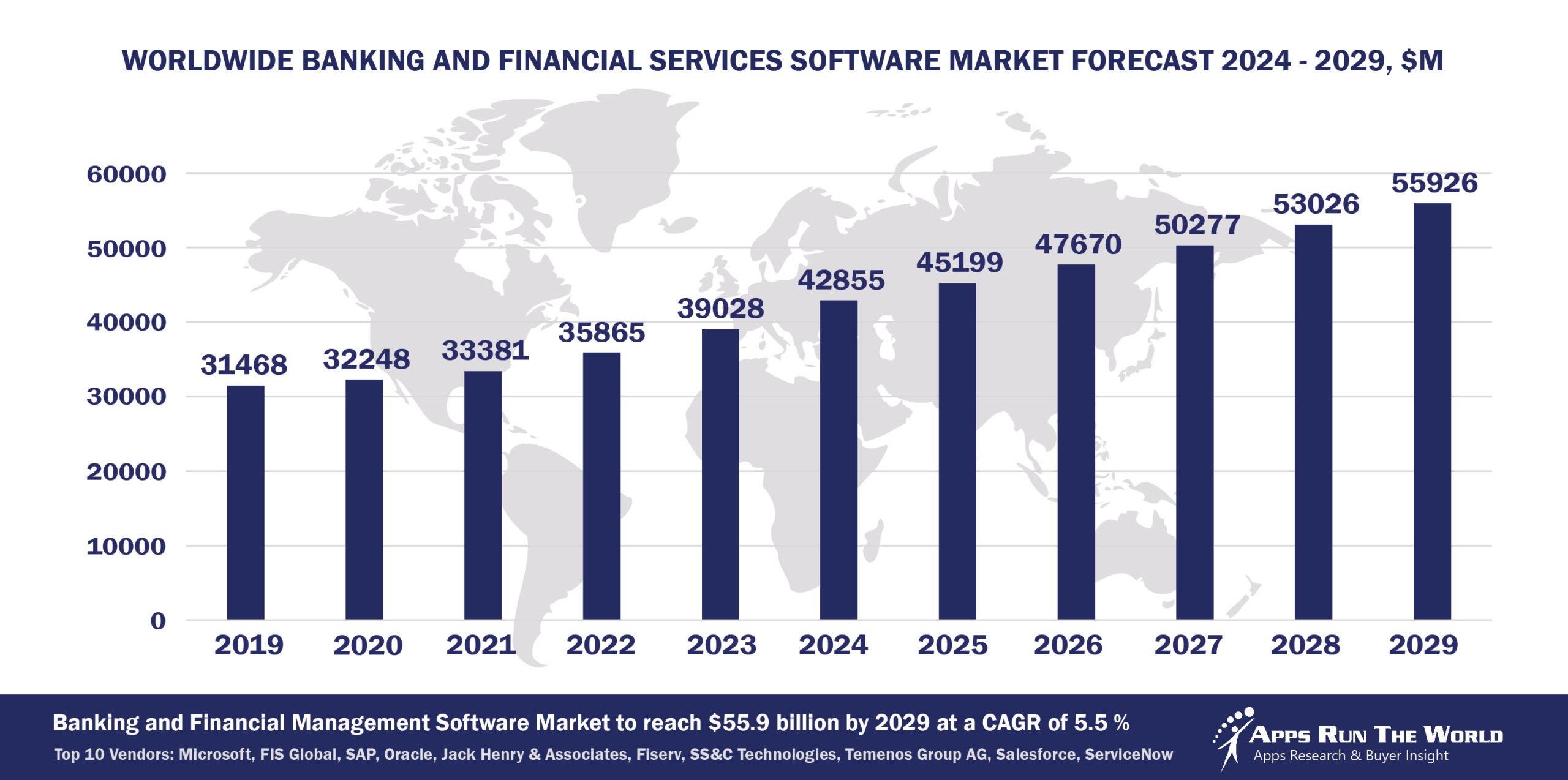

Through our forecast period, the Financial Services applications market size is expected to reach $55.9 billion by 2029, compared with $42.9 billion in 2024 at a CAGR of 5.5%, as shown in the Apps Top 500 Report – Excel Edition [Preview] .

Banking and Financial Services (Credit, lending, securities institutions) – Hedge fund administration, Core Banking, Cash, treasury, payment, risk management and supply chain finance solutions, Investment management system, Securities transaction and online trading technology, Mortgage, Loan origination and processing solutions, Teller transaction and loan processing, automated loan decisioning, analytical science analysis, workflow management, and sales and service solutions, Financials, HR, Procurement

Top 10 Banking and Financial Services Software Vendors in 2024 and their Market Shares

Source: Apps Run The World, July 2025

Other Banking and Financial Services software providers included in the report are: ACI Worldwide, Inc., Adobe, ADP, AdviseSoft, Alfa Financial Software Holdings plc, Argo Data Resource Corp., Asseco Group, Atlassian, Backbase, Banqsoft AS, BIS – Business Integration Services, Bloomberg, Calyx, Capita Software, Cisco Systems, Citrix, Clarifire, Clearwater Analytics, COCC, Constellation Financing Systems Corp, CoStar Group, DATEV, Deloitte, DocuSign, Dropbox, Edgeverve, an Infosys company, Envestnet, Equifax, ERI Bancaire, Exela Technologies, Inc., FICO, Finastra, GBST Holdings Limited, Genesys Telecommunications Laboratories, Google, Hexagon, HubSpot, IBM, Imagine Software, Intellect Design Arena Limited, Jack Henry & Associates, Laserfiche, Linedata Services S.A., LoanLogics, LRS Retirement Solutions, LTi Technology Solutions, Milliman Marc, MSCI, Murex, NetSol Technologies Inc., Newgen Software, Nice Systems, nCino, Inc., Odessa Technologies, Oleeo, Open Text Corporation, Paycom, Pegasystems, Quantrix, Salesforce, Serrala, ServiceNow, SimCorp, SmartStream, SAS Institute, Sopra Steria Group SA, TalentMap, Teradata Corporation, Thomson Reuters Elite, Tieto (Ex EMRIC AB), TotalSoft, Tungsten Automation (formerly Kofax), Verint Systems Inc., Wolters Kluwer, Workday, Workiva, ZenTreasury, Zoom Video Communications, and many others.

Vendor Snapshot: Banking and Financial Services Market Leaders

Microsoft

Microsoft

Microsoft is embedding agentic AI deeply into its financial systems by integrating autonomous agents within its finance and operations workflows. Recent platform enhancements introduce a suite of autonomous agents, such as account reconciliation, time-and-expense review, case management, and scheduling that dramatically shorten financial close cycles and support compliance‑driven automation on top of Dynamics 365 and the Power Platform. These agents are configurable through low‑code Copilot Studio tools, enabling financial teams to build conversational assistants that interact with data, systems, and users without needing developer involvement. This agent-first roadmap tightly aligns with Microsoft’s broader enterprise AI and analytics strategy, positioning banking workflows as orchestrated, autonomous processes driven by composable agent pipelines and embedded conversational interfaces.

FIS Global

FIS is enhancing its financial services portfolio by integrating agentic AI across treasury, collections, and client service workflows within its Digital One and Atelio platforms. Digital One now features a mobile-first business banking interface and streamlined digital account opening, improving onboarding and customer experience, while Atelio enables banks and intermediaries to embed payments, card issuance, fraud detection, and cash-flow services into their products. Recent innovations include the Revenue Insight solution, which uses predictive analytics agents to optimize receivables management, and Treasury GPT, a generative AI–driven support agent embedded in treasury operations. These capabilities are delivered through low-code dashboards and conversational interfaces, enabling natural-language interactions for policy validation, risk analysis, and configuration, with a roadmap focused on building integrated agent networks that provide autopilot-like analytics and automation under strict governance.

SAP

SAP is restructuring its financial services and S/4 HANA platforms around autonomous workflows and agentic orchestration. Its strategy increasingly includes agents that detect credit, liquidity, and regulatory events, trigger financial advisory actions, and automatically align ERP-ledger entries. Empowered by SAP’s low-code process automation tools, business administrators can configure conversational agents for compliance validation, procurement-to-pay orchestration, and real-time data reconciliation. SAP’s roadmap centers on composable automation across finance, treasury, and risk, delivering an agent-enabled enterprise fabric for financial operations that unifies analytics, execution, and governance in self-managing loops.

Oracle

Oracle’s FLEXCUBE banking platform has received updates to support digital account onboarding, multitier branch workflows, and cross-channel integration with Oracle Analytics Cloud dashboards. Enhanced interoperability with Cloud ERP, expense, and planning modules drives unified treasury, finance, and customer insight views. Ongoing investment in AI-driven credit scoring and generative analytics tools aims to streamline decision-making across risk and financial operations workflows.

Jack Henry & Associates

Jack Henry is enhancing its SilverLake core and Banno digital banking platforms with mobile upgrades, fraud visualization, and payment orchestration, while expanding open banking and embedded finance through fintech partnerships and real-time APIs. The company is integrating agentic automation for real-time account management, fraud detection, and customer engagement, with autonomous agents for transaction reconciliation, risk monitoring, and conversational banking. Low-code tools enable banks to design agent workflows across core, digital, and CRM systems, positioning the platforms as innovation-ready solutions for scalable, well-governed automation and analytics.

Fiserv

Fiserv has modernized its DNA and Premier platforms with real-time account servicing APIs, digital self-service account onboarding, and instant card issuance integration. Its acquisition of Finxact provides a cloud-native core architecture that accelerates digital innovation, while CheckFree RXP enhances its analytics and bill-payment resilience. Investment in omnichannel workflows, client experience tools, and embedded payments support its positioning as a platform for modern financial institutions.

SS&C Technologies

SS&C has upgraded Algorithmics risk systems with advanced predictive analytics for liquidity, credit, and market stress testing aligned to regulatory demands. Its Advent Portfolio Exchange platform now includes event-driven triggers and workflow orchestration for real-time rebalancing and compliance alerts. Continuous investment in unified data architecture and analytics reinforces its position in supporting operational efficiency across capital markets and institutional financial services.

Temenos Group

Temenos is redefining banking software by embedding multi-agent orchestration into its core platforms, governing everything from customer onboarding, compliance screening, up-sell journey execution, to financial crime analytics. Its roadmap emphasizes composable agent pipelines, configurable through visual interfaces, for risk modeling, customer segmentation, and fraud detection. Agents engage through conversational banking channels and execute cross-functional workflows across T24, Infinity, and risk modules under embedded governance. This positions Temenos as a provider of intelligent, agent-driven banking ecosystems where analytics, automation, and compliance converge.

Salesforce

Salesforce has integrated Commerce, Sales, and Service Clouds into its Financial Services Cloud, adding industry-specific workflows, real-time client views, automated next-best actions, and omnichannel engagement for wealth management, banking, and insurance. It is embedding agentic workflows across marketing, service, and customer engagement, with autonomous agents handling outreach, segmentation, opportunity scoring, and conversational resolution. Built on the low-code Einstein platform, these agents can be configured through no-code tools and embedded into dashboards, enabling vertical-specific, autonomous customer journey orchestration that blends CRM, analytics, and financial workflows.

ServiceNow

ServiceNow is expanding its Finance Operations Management suite in financial institutions with enhanced invoice automation, exception handling workflows, and ServiceNow ITSM connectivity for IT-finance bridges. Its recent acquisition of Moveworks strengthens conversational agent capabilities for internal service requests. The platform is driving adoption of hyperautomation in financial operations by orchestrating analytics, service, and IT capabilities under a controlled enterprise service framework.

ARTW Technographics Platform: Banking and Financial Services customer wins

Since 2010, our research team has been studying the patterns of the Banking and Financial Services software purchases, analyzing customer behavior and vendor performance through continuous win/loss analysis. Updated quarterly, the ARTW Technographics Platform provides deep insights into thousands of Banking and Financial Services customer wins and losses, helping users monitor competitive shifts, evaluate vendor momentum, and make informed go-to-market decisions.

List of Banking and Financial Services customers

Source: ARTW Buyer Insights Technographic Database

Custom data cuts related to the Banking and Financial Services Applications market are available:

- Top 1000 Banking and Financial Services Applications Vendors and Market Forecast 2024-2029

- 2024 Banking and Financial Services Applications Market By Functional Market (16 Markets)

- 2024 Banking and Financial Services Applications Market By Country (USA + 45 countries)

- 2024 Banking and Financial Services Applications Market By Region (Americas, EMEA, APAC)

- 2024 Banking and Financial Services Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2024 Banking and Financial Services Applications Market By Customer Size (revenue, employee count, asset)

- 2024 Banking and Financial Services Applications Market By Channel (Direct vs Indirect)

- 2024 Banking and Financial Services Applications Market By Product

Worldwide Enterprise Applications by Vertical Market

Exhibit 3 provides a forecast of the worldwide enterprise applications by vertical market from 2024 to 2029, highlighting market sizes, year-over-year growth, and compound annual growth rates across different industry sectors from Aerospace and Defense to Utilities.

Exhibit 3: Worldwide Enterprise Applications by Vertical Market Forecast 2024-2029 by Functional Market ($M)

Source: Apps Run The World, July 2025

Exhibit 4 shows our projections for the enterprise applications market by vertical segment, based on the buying preferences and the customer propensity to invest in new software within those industries as they continue to upgrade and replace many legacy industry-specific applications that have been identified and tracked in our Buyer Insight Database.

FAQ – APPS RUN THE WORLD Top 10 Banking & Financial Services Software Vendors, Market Size & Forecast

Q1. What is the global Banking & Financial Services software market size in 2024?

A: The global Banking & Financial Services software market reached $42.9 billion in 2024, growing 9.8% year-over-year as financial institutions accelerated cloud adoption and digital transformation.

Q2. Who are the top 10 Banking & Financial Services software vendors in 2024 and their combined share?

A: The top 10 vendors are Microsoft, FIS Global, SAP, Oracle, Temenos, Fiserv, Jack Henry & Associates, NCR, SS&C Technologies, and ICE Mortgage Technology, collectively capturing 41.1% of the market.

Q3. Which vendor leads the Banking & Financial Services software market in 2024?

A: Microsoft leads the Banking & Financial Services software market in 2024 with approximately 14.7% market share across key applications.

Q4. What is the forecast for the Banking & Financial Services software market through 2029?

A: The market is projected to grow from $42.9 billion in 2024 to $55.9 billion in 2029, at a compound annual growth rate (CAGR) of 5.5%.

Q5. What applications are included in the scope of the Banking & Financial Services software market?

A: The market scope includes core banking, payments, compliance, loan origination, investment and wealth management, treasury, and integrated back-office solutions.

Q6. Which other Banking & Financial Services software vendors are covered beyond the top 10?

A: The report also profiles Salesforce, ServiceNow, Infosys, nCino, and Finastra, along with dozens of other vendors offering specialized banking and fintech solutions.

Q7. When was the Banking & Financial Services report published and by whom?

A: The Top 10 Banking & Financial Services Software Vendors, Market Size and Forecast 2024–2029 was published July 23, 2025 by APPS RUN THE WORLD analysts Albert Pang, Misho Markovski, and Marija Ristik, as part of the APPS TOP 500 research program, which benchmarks the revenues and market share of the world’s 1,500+ largest enterprise application vendors.

More Enterprise Applications Research Findings

Based on the latest annual survey of 10,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 1,500 largest Enterprise Applications Vendors ranked by their 2024 product revenues. Their 2024 results are being broken down, sorted and ranked across 16 functional areas (from Analytics and BI to Treasury and Risk Management) and by 21 vertical industries (from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year our global team of researchers conduct an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market.

We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 2 million organizations around the world.

The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.

- PwC Australia, a Australia based Professional Services organization with 6750 Employees

- Cross River, a United States based Banking and Financial Services company with 500 Employees

- OP Financial Group, a Finland based Banking and Financial Services organization with 14000 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

Microsoft

Microsoft