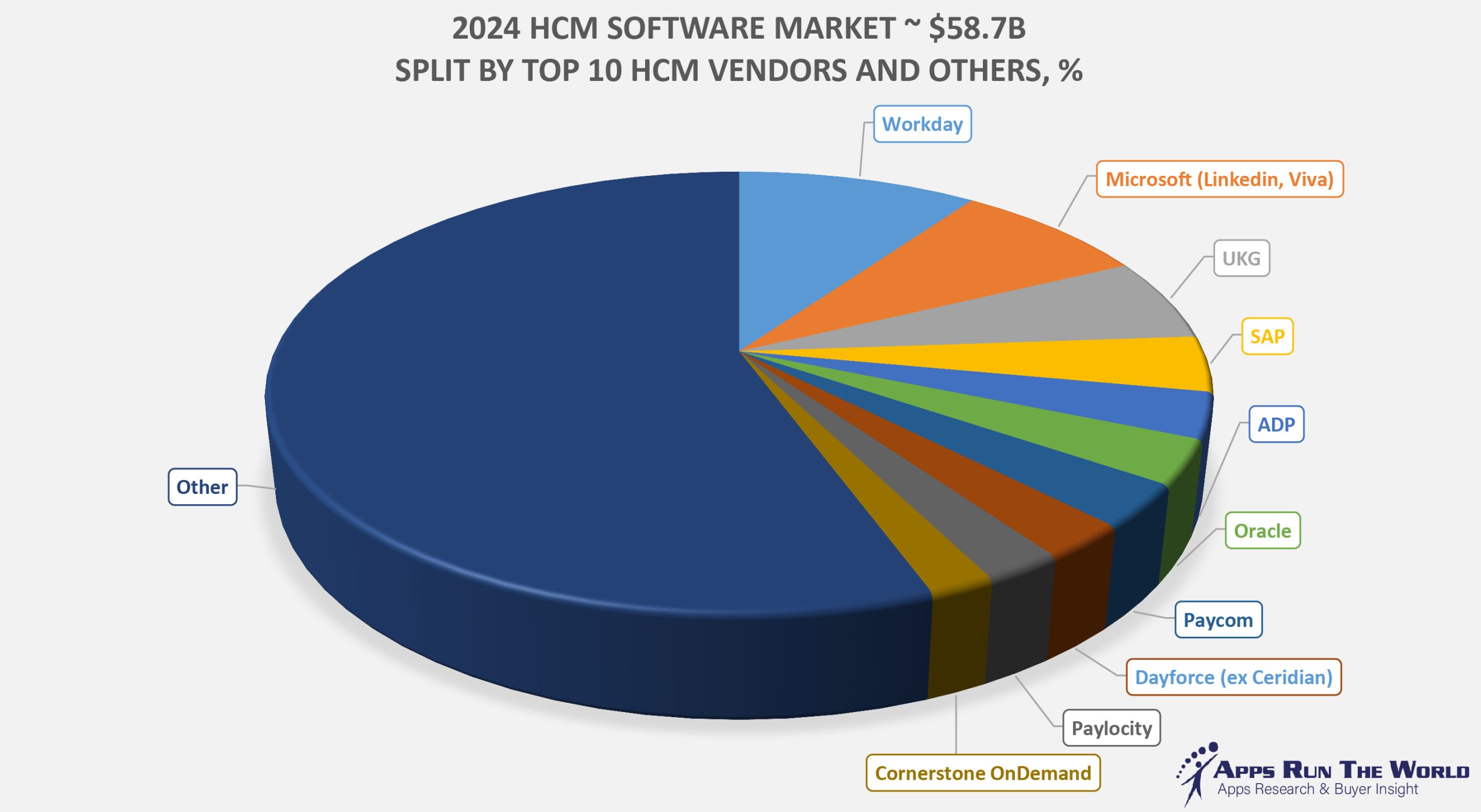

In 2024, the global HCM software market grew to $58.7 billion, marking an 11.7% year-over-year increase. The top 10 vendors accounted for 45.6% of the total market. Workday led the pack with a 9.8% market share, followed by Microsoft, UKG, SAP, and ADP.

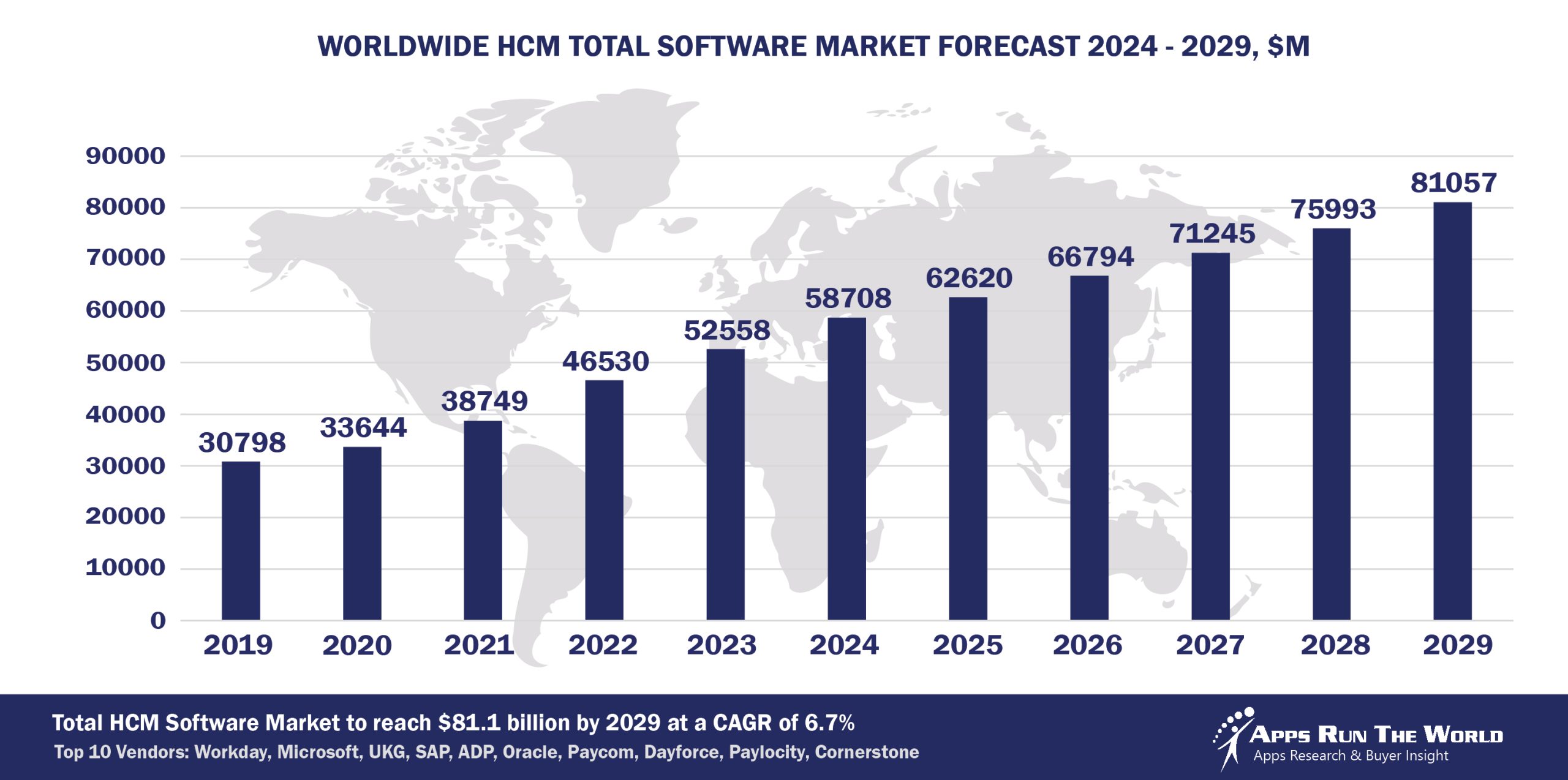

Through our forecast period, the HCM applications market size is expected to reach $81.1 billion by 2029, compared with $58.7 billion in 2024 at a CAGR of 6.7%, as shown in the Apps Top 500 Report – Excel Edition [Preview] .

Human capital management includes such functions as eRecruiting (applicant tracking), Onboarding (employee profile), Performance Management (assessment, goal management, succession planning), Core HR (personnel administration, benefits, compensation management, payroll), Workforce Management (absence management, activity tracking, scheduling, time and attendance), and eLearning (learning management system).

Top 10 HCM Software Vendors in 2024 and their Market Shares

Source: Apps Run The World, July 2025

Other HCM software providers included in the report are: Asure Software, Beeline, Benefitfocus, Blackboard, part of Anthology, Bullhorn, Businessolver, Anthology Inc. (formerly Campus Management), CareerBuilder, Castlight Health, Constellation Software Inc., Epicor, Equifax, Field Nation, First Advantage, Freelancer, Genesys Telecommunications Laboratories, Gusto, HealthStream Inc., Hilan, HireRight, IBM, iCIMS, Infor, Insperity, Inc., Instructure, Inc., Intuit Inc., iSolved, Jobvite, Madison Performance Group, LifeWorks (formerly Morneau Shepell), P&I Personal & Informatik AG, Paychex, Paycor, Paylocity, Roper Technologies, Inc., Sage, ServiceNow, SHL, SmartRecruiters, Snag, Sopra Steria Group SA, Sterling Talent Solutions, Skillsoft, TOTVS, Tricor Group, Trimble, TriNet, Tyler Technologies, UNIT4, Upwork, Visier, Visma, Vitech Systems Group, WalkMe, Wolters Kluwer, WorkForce Software, Xero, Yardi, Yonyou, Zellis (ex NGA Human Resources UK & Ireland), Zoho Corp., and many others.

Vendor Snapshot: HCM Market Leaders

Workday

Workday

Workday is reinforcing its position in enterprise HCM by integrating agentic AI across its core modules—including HCM, Payroll, and Recruiting. Through strategic acquisitions like HiredScore and VNDLY, it has added advanced recruiting and contingent workforce orchestration capabilities. Workday’s agentic roadmap emphasizes embedded skills orchestration and talent lifecycle agents that automate candidate rediscovery, onboarding workflows, compensation simulations, and engagement nudges. Its open ecosystem approach—called “The Workday Economy”—encourages partner-built agents that augment native modules with conversational interfaces and low-code configurability, enabling smarter, faster workforce agility at scale.

Microsoft (LinkedIn, Viva)

Microsoft is merging Dynamics 365 Human Resources with LinkedIn Talent and Viva’s experience insights to build a unified agentic talent ecosystem. Its internal “AI at Scale” initiative supports Copilot integrations that deliver intelligent hiring suggestions, learning prompts, and performance coaching via conversational interfaces. Agents use LinkedIn-driven skills data to guide succession planning and workforce mobility, while Viva-powered feedback agents provide personalized wellbeing nudges and pulse-check analytics. Microsoft’s shift toward agentic HR reflects a broader strategy to weave intelligence and experience data seamlessly into all aspects of the employee lifecycle.

UKG

UKG is reimagining workforce management and HCM via its Pro and Ready products with Bryte AI Agents embedded in scheduling, time tracking, and forecasting. These agents anticipate labor demand, optimize shift assignments, and alert managers to compliance risks. UKG’s AI Hub marketplace enables deployment of modular agentic components for specific operations—such as seasonal hiring and global payroll—powered by recent acquisitions of Great Place to Work, Shiftboard and Immedis. This strategy supports flexible, use-case-driven adoption while offering low-code tools for conversational configurations and adaptive scheduling workflows across large workforces.

SAP

SAP’s SuccessFactors suite—including Employee Central, Recruiting, and Learning—is undergoing a transformation underpinned by Joule, SAP’s intelligent copilot. Joule Studio enables customers to build conversational agents that track skill gaps, auto-schedule training, validate candidate fit, and generate succession pipelines. With the pending SmartRecruiters acquisition, SAP is enhancing high-volume recruitment automation and candidate engagement agents. Meanwhile, SAP Fieldglass extends this agentic vision into external workforce management, with AI-enabled vendor and contingent labor optimization capabilities that complement internal talent strategies. The AI Core and BTP framework unify governance, semantic modeling, and agent orchestration, positioning SAP as a leader in fully embedded, modular AI across both permanent and external workforce ecosystems.

ADP

ADP, the undisputed leader in payroll processing with over one million clients globally, is embedding intelligent automation across its Enterprise HCM and Workforce Now platforms. At the core is ADP Payroll, re-engineered for real-time compliance checks, multi-jurisdictional tax optimization, and autonomous retroactive calculations. Its Lyric architecture supports scalable AI services—like automated compensation modeling and employee sentiment tracking—within a low-code governance framework. The acquisition of WorkForce Software expands global time-tracking and scheduling capabilities, while ADP’s substantial R&D spend fuels development of predictive analytics, no-code workflow tools, and intelligent employee self-service—solidifying its position as the foundational system-of-record for global payroll and intelligent workforce management.

Oracle

Oracle is layering agentic innovation into its Oracle Cloud HCM, Payroll, and Recruiting offerings, with internal GenAI Innovator programs focused on talent matching and natural-language workflow bots. Oracle’s embedded agents help guide compensation cycles, perform workforce forecasting, and support conversational jobs-to-roles matching across employee and candidate data. Recognition for AI-driven talent acquisition capabilities underscores Oracle’s preference for building platform-first agentic features rather than relying on acquisitions. Its roadmap supports modular deployment of HR copilots into any core HCM process, reinforcing a unified, strategically AI-enhanced talent foundation.

Paycom

Paycom’s unified architecture now includes conversational assistants powered by its IWant AI engine, automating tasks such as HR query resolution and time-off approvals. These agents use real-time business rules to accelerate decision-making and reduce administrative workload. Latest UX improvements support voice-based employee interaction and intuitive forecasting guidance for payroll and benefits. Paycom emphasizes organic growth and operational excellence, deploying agentic functionality incrementally across modules to improve usability and drive adoption in mid-market enterprises.

Dayforce

Dayforce is evolving its real-time HCM platform by embedding agentic AI across payroll, workforce scheduling, and talent-management workflows. With continuous calculation at its core, Dayforce enables instantaneous payroll insights and real-time compliance monitoring—capabilities essential for large, complex enterprises. Recent M&A includes the acquisition of eloomi, enhancing the platform’s learning and development tools with adaptive content delivery, and Ideal, whose talent-intelligence tech now powers automated candidate screening and workforce analytics. In August 2025, Thoma Bravo agreed to acquire Dayforce for US$12.3 billion take-private transaction, a move intended to accelerate the company’s AI investments and growth.

Paylocity

Paylocity’s HCM suite is augmented by Paylocity AI: intelligent agents that automate benefits recommendations, predictive staffing alerts, and performance cycle nudges. Its standalone conversational AI Assistant assists employees with onboarding, scheduling, and HR policy queries. Embedded across payroll and HR modules, these agents deliver proactive insights and streamline routine tasks. With integrated analytics connectors and machine learning-powered retention modeling, Paylocity is positioning itself as an accessible, agent-driven platform for mid-market talent management.

Cornerstone OnDemand

Cornerstone is advancing its talent suite with predictive skills frameworks, personalized learning pathways, and automated succession planning to foster continuous employee growth. Its recent acquisition of Talespin introduced immersive XR learning and AI-powered content authoring, while the integration of the Galaxy talent experience platform enhances employee engagement through AI-driven career mobility and personalized development journeys. Deep embedding of machine learning for content recommendations and performance analytics underscores Cornerstone’s commitment to evolving beyond transactional HR processes toward a holistic talent development ecosystem fueled by agentic AI and autonomous learning experiences.

ARTW Technographics Platform: HCM customer wins

Since 2010, our research team has been studying the patterns of the HCM software purchases, analyzing customer behavior and vendor performance through continuous win/loss analysis. Updated quarterly, the ARTW Technographics Platform provides deep insights into thousands of HCM customer wins and losses, helping users monitor competitive shifts, evaluate vendor momentum, and make informed go-to-market decisions.

List of HCM customers

Source: ARTW Buyer Insights Technographic Database

Custom data cuts related to the HCM Applications market are available:

- Top 700+ HCM Applications Vendors and Market Forecast 2024-2029

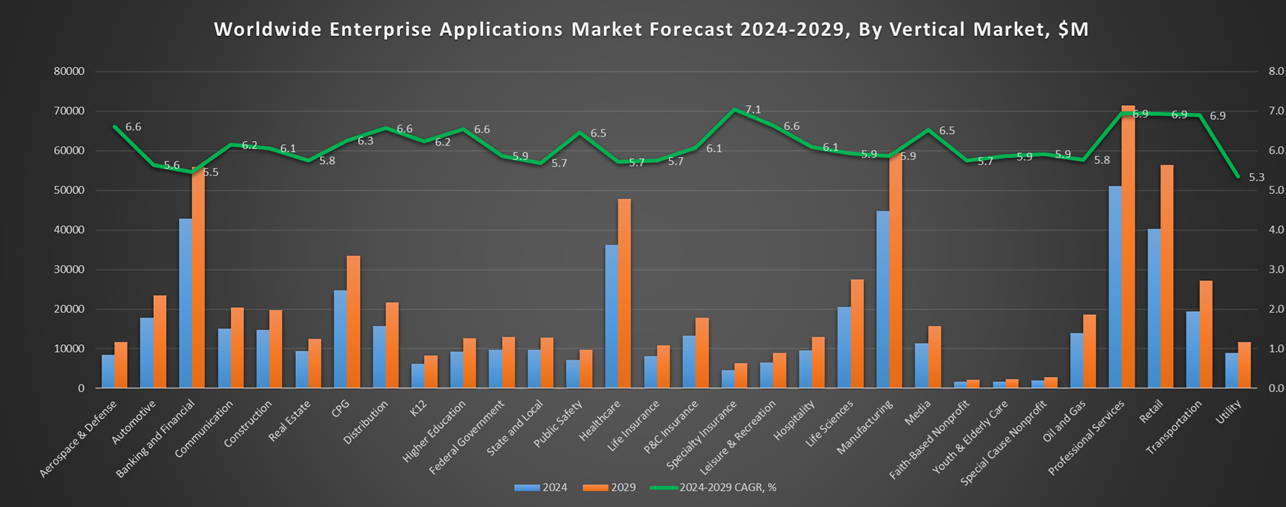

- 2024 HCM Applications Market By Industry (21 Verticals)

- 2024 HCM Applications Market By HCM Segments and Categories

- 2024 HCM Applications Market By Country (USA + 45 countries)

- 2024 HCM Applications Market By Region (Americas, EMEA, APAC)

- 2024 HCM Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2024 HCM Applications Market By Customer Size (revenue, employee count, asset)

- 2024 HCM Applications Market By Channel (Direct vs Indirect)

- 2024 HCM Applications Market By Product

Worldwide Enterprise Application Market

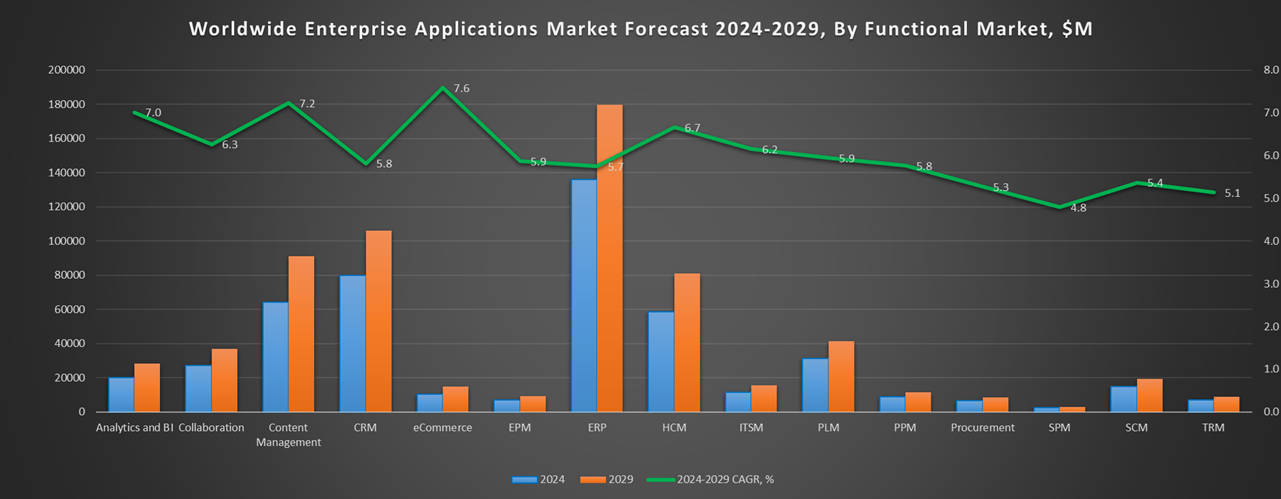

Exhibit 3 provides a forecast of the worldwide enterprise application market from 2024 to 2029, highlighting market sizes, year-over-year growth, and compound annual growth rates across various functional segments. The data shows strong growth in emerging areas like Content Management, eCommerce, Human Capital Management, and IT Service Management, while traditional segments like ERP and CRM continue to dominate in market size.

Exhibit 3: Worldwide Enterprise Application Market Forecast 2024-2029 by Functional Market, $M

Source: Apps Run The World, July 2025

Exhibit 4 shows the enterprise applications market by functional area. The highest growth functional markets revolve around smaller segments like Analytics and BI, eCommerce, Enterprise Performance Management, where first movers remain less established than those that for decades have been entrenched in functional areas like ERP, HCM, CRM and PLM.

FAQ – APPS RUN THE WORLD Top 10 HCM Software Vendors, Market Size & Forecast

Q1. What is the global HCM software market size in 2024?

A: The global Human Capital Management (HCM) software market reached $58.7 billion in 2024, growing 11.7% year-over-year as organizations modernized HR operations through cloud-based and AI-enabled platforms.

Q2. Who are the top 10 HCM software vendors in 2024 and their combined share?

A: The top 10 HCM vendors are Workday, Microsoft, UKG, SAP, ADP, Oracle, Paycom, Ceridian (Dayforce), Paylocity, and Cornerstone OnDemand, together accounting for 45.6% of the total HCM applications market.

Q3. Which vendor leads the HCM software market in 2024?

A: Workday leads the global HCM market in 2024 with a 9.8% share, followed by Microsoft, UKG, SAP, and ADP.

Q4. What is the scope of the HCM market in this report?

A: The HCM market includes core HR, payroll, workforce management, recruiting, onboarding, performance, learning, and talent management applications.

Q5. What is the HCM market outlook through 2029?

A: The HCM software market is expected to grow from $58.7 billion in 2024 to $81.1 billion in 2029, at a 6.7% CAGR driven by digital HR transformation and AI-powered tools.

Q6. Which other HCM vendors are covered beyond the top 10?

A: The report also profiles additional HCM vendors such as BambooHR, HiBob, Gusto, Paycor, Rippling, Darwinbox, Namely, Zoho People, and others serving global and midmarket segments.

Q7. When was this report published and by whom?

A: The Top 10 HCM Software Vendors, Market Size and Forecast 2024–2029 was published July 23, 2025, by APPS RUN THE WORLD analysts Albert Pang, Misho Markovski, and Aleksandra Markovska, as part of the APPS TOP 500 research program, which benchmarks the revenues and market share of the world’s 1,500+ largest enterprise application vendors.

More Enterprise Applications Research Findings

Based on the latest annual survey of 10,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 1,500 largest Enterprise Applications Vendors ranked by their 2024 product revenues. Their 2024 results are being broken down, sorted and ranked across 16 functional areas (from Analytics and BI to Treasury and Risk Management) and by 21 vertical industries (from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year our global team of researchers conduct an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market.

We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 2 million organizations around the world.

The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.

- ICICI Bank, a India based Banking and Financial Services organization with 141009 Employees

- CGI, a Canada based Professional Services company with 90500 Employees

- Rox Resort Hotel, a Turkey based Leisure and Hospitality organization with 350 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

Workday

Workday