In 2024, the global Life Sciences software market grew to $20.6 billion, marking an 8.9% year-over-year increase. The top 10 vendors accounted for 56.5% of the total market. IQVIA led the pack with a 16.3% market share, followed by Microsoft, Veeva Systems, and Salesforce.

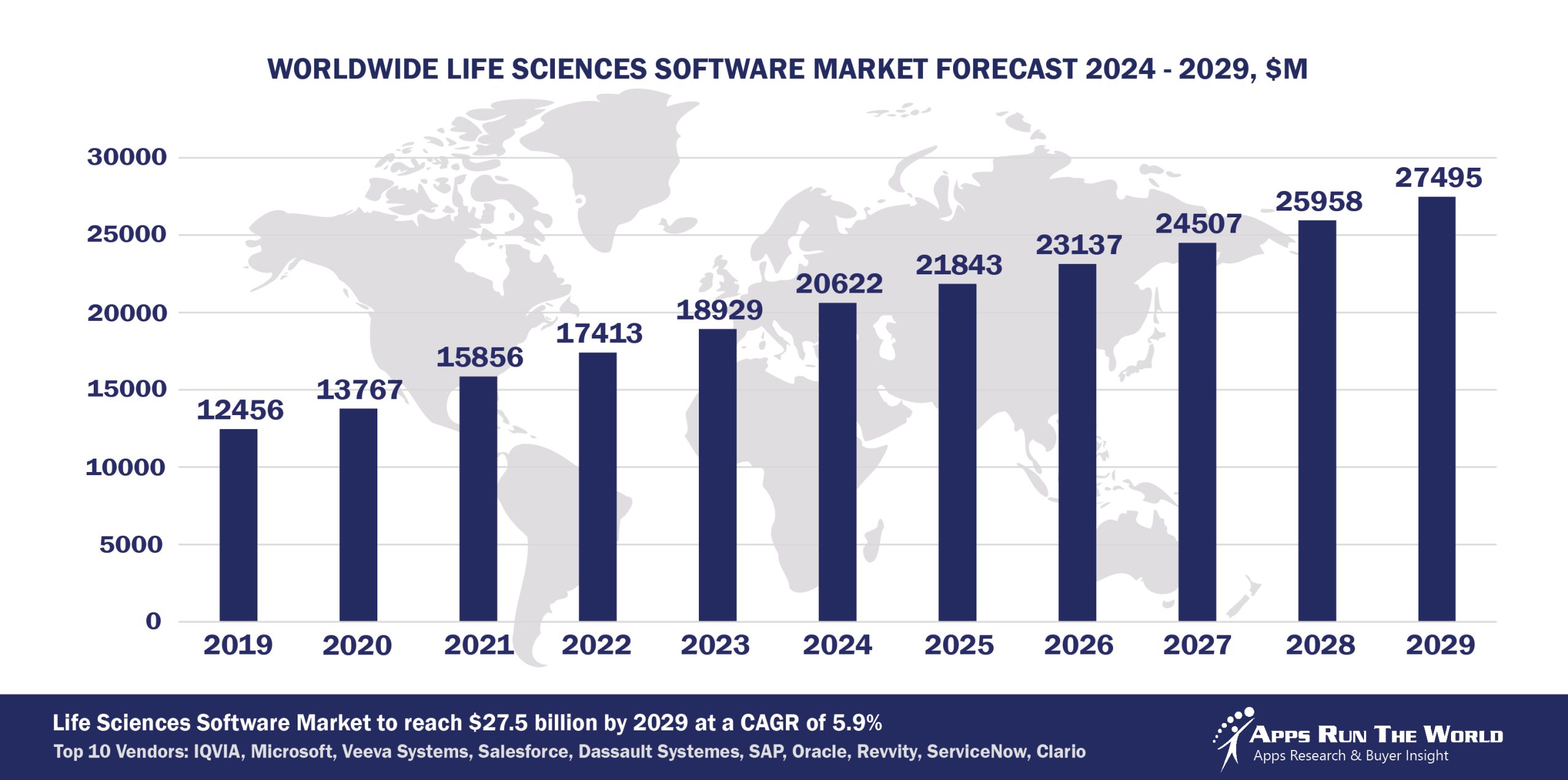

Through our forecast period, the Life Sciences applications market size is expected to reach $27.5 billion by 2029, compared with $20.6 billion in 2024 at a CAGR of 5.9%, as shown in the Apps Top 500 Report – Excel Edition [Preview] .

Life Sciences (Pharmaceuticals, medical devices and life technologies) – Clinical trial management, Enterprise Risk, Compliance and Quality Management, Incentive compensation, sales performance management, Financials, HR, Procurement

Compliance, risk management and PLM apps will continue to play a key role in life sciences vertical with CROs assuming more functions previously held by big pharmaceuticals companies, which are wrestling with revenue model changes as drug prices could fluctuate widely with the advent of smart medications in small dosages.

Top 10 Life Sciences Software Vendors in 2024 and their Market Shares

Source: Apps Run The World, July 2025

Other Life Sciences software providers included in the report are: Adobe, Atlassian, ArisGlobal, ADP, Ansys Inc., Aurea, Autodesk, AVEVA Group, Axway, Box Inc., Cegedim, Cisco Systems, Constellation Software Inc., Citrix, Concentra Analytics Ltd, Cornerstone OnDemand, Dropbox, DocuSign, Inc., Edgeverve, Fiserv, Flex Databases, Genesys Telecommunications Laboratories, Google, IBM, IDBS, Infor, Intuit Inc., Jaggaer, Koerber Group, LabWare, McKesson, Model N, Nakisa, NeoGrid, ON24, Open Text Corporation, Optalert Limited, Optymyze, PerkinElmer, PTC, QAD Inc., Qlik, Randstad Sourceright, Rockwell Automation, Roper Technologies, SAS Institute, SCC Soft Computer, Synopsys, Schrodinger, ServiceNow, Siemens Digital Industries Software, Softworks.com, StayinFront, TELUS Health, UKG, Visma, Workday, Xactly, Zoom Video Communications, and others.

Vendor Snapshot: Life Sciences Market Leaders

IQVIA

IQVIA

IQVIA is expanding its Planning Suite and OneKey platform with AI-enhanced forecasting and data harmonization tools to support evidence-based decision-making across clinical and commercial operations. The company continues to invest in real-world data integration and predictive analytics capabilities tailored to life sciences workflows. Recent efforts emphasize scaling its federated learning models to enable secure AI-driven insights across distributed healthcare datasets.

Microsoft

Microsoft is applying Azure OpenAI and Fabric within its Dynamics 365 and Microsoft 365 platforms to improve clinical productivity, supply chain visibility, and regulatory compliance in life sciences environments. Its AI investments are being directed toward responsible deployment in drug development, patient engagement, and operational analytics. Microsoft’s industry cloud strategy positions it to embed domain-specific intelligence across R&D and manufacturing use cases.

Veeva Systems Inc.

Veeva Systems continues to evolve its Vault and CRM suites with domain-trained AI assistants for clinical documentation, content review, and rep engagement optimization. The company is transitioning customers to Vault CRM, built on its own platform, as part of a broader shift toward vertical SaaS independence. Veeva also emphasizes low-code innovation and clinical data unification to reduce cycle times in drug development.

Salesforce

Salesforce continues to expand its presence in the life sciences sector with the development of Life Sciences Cloud, designed to support medical affairs, field engagement, and compliance workflows. The company is embedding generative AI through its Einstein 1 platform to enable personalized HCP engagement, automated consent management, and predictive analytics for field medical planning. Integrated with Sales, Service, and Marketing Clouds, Salesforce’s industry-specific solutions aim to unify clinical, commercial, and medical data on a compliant platform.

Dassault Systemes

Dassault Systemes advances its Medidata and Biovia portfolios with generative simulation, digital twins, and AI-assisted protocol design for life sciences R&D. The company integrates its virtual twin technology with clinical trial platforms to enhance patient modeling and real-time trial optimization. It is also extending its scientific modeling capabilities into biologics, supporting complex product development across pharma and medtech.

SAP

SAP focuses on compliance-driven digitalization of pharmaceutical supply chains with solutions like Advanced Track and Trace and the Information Collaboration Hub. The company embeds AI into S/4HANA and SAP Analytics Cloud to support production forecasting, batch release, and clinical logistics. Its recent product strategy includes tighter integration of SuccessFactors and industry cloud services for regulated workforce management.

Oracle

Oracle strengthens its life sciences portfolio through the integration of Oracle Clinical One, a unified platform that supports randomization, trial supply management, and data capture across the clinical trial lifecycle. Combined with Oracle Cloud ERP and HCM, as well as Argus for pharmacovigilance, the company is advancing its use of AI in trial design, including digital twins and natural language processing for safety signal detection. Oracle is also leveraging its global cloud infrastructure to support regulatory compliance, real-time data sharing, and scalable trial operations.

Revvity, Inc. (ex Perkinelmer, Inc.)

Revvity is integrating AI-driven lab automation, compound registration, and data visualization tools across its Signals platform to support faster molecule-to-market transitions. The company’s software innovation focuses on unifying informatics environments for preclinical and translational research. Revvity continues to align its Signals portfolio with emerging therapeutic modalities, including cell and gene therapies.

ServiceNow

ServiceNow tailors its ITSM and digital workflow capabilities for regulated environments in life sciences, adding automated change controls, audit readiness, and AI-driven incident resolution. The platform’s integration with GxP-aligned tools and low-code compliance modules supports digital transformation in clinical and manufacturing operations. Recent innovations include domain-specific AI agents for lab and quality operations.

Clario

Clario expands its clinical trial technology with AI-enhanced eCOA, CTMS, and imaging platforms to streamline endpoint data capture and protocol adherence. The company focuses on reducing variability in decentralized trials through wearables integration, adaptive design support, and sensor data calibration. Clario’s technology roadmap emphasizes real-time monitoring and operational analytics to improve study timelines and data quality.

ARTW Technographics Platform: Life Sciences customer wins

Since 2010, our research team has been studying the patterns of Life Sciences software purchases, analyzing customer behavior and vendor performance through continuous win/loss analysis. Updated quarterly, the ARTW Technographics Platform provides deep insights into thousands of Life Sciences customer wins and losses, helping users monitor competitive shifts, evaluate vendor momentum, and make informed go-to-market decisions.

List of Life Sciences customers

Source: ARTW Buyer Insights Technographic Database

Custom data cuts related to the Life Sciences Applications market are available:

- Top 950+ Life Sciences Applications Vendors and Market Forecast 2024-2029

- 2024 Life Sciences Applications Market By Functional Market (16 Markets)

- 2024 Life Sciences Applications Market By Country (USA + 45 countries)

- 2024 Life Sciences Applications Market By Region (Americas, EMEA, APAC)

- 2024 Life Sciences Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2024 Life Sciences Applications Market By Customer Size (revenue, employee count, asset)

- 2024 Life Sciences Applications Market By Channel (Direct vs Direct)

- 2024 Life Sciences Applications Market By Product

Worldwide Enterprise Applications by Vertical Market

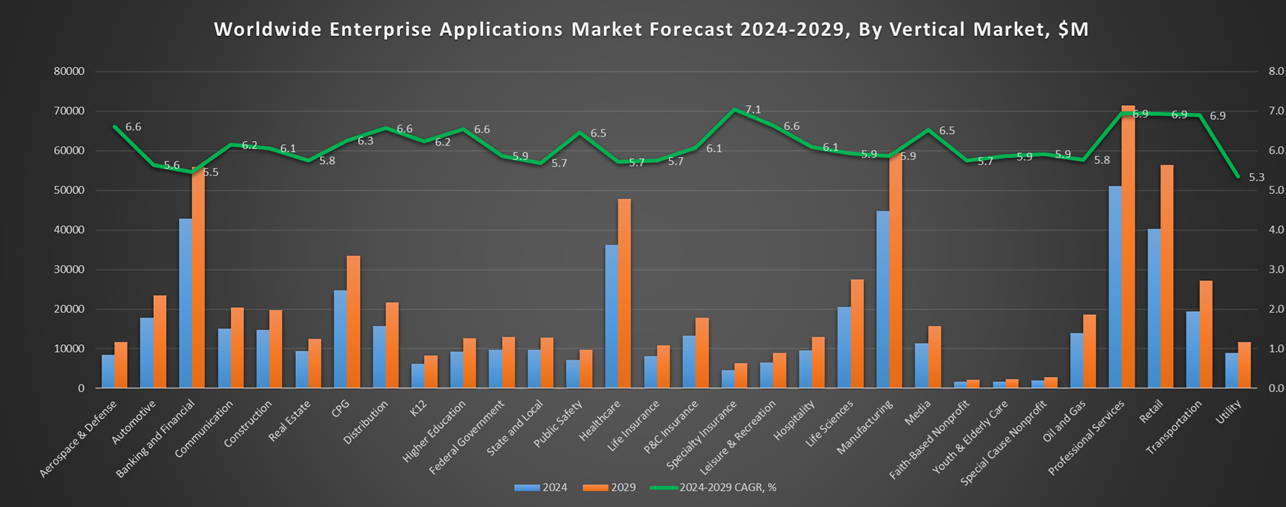

Exhibit 3 provides a forecast of the worldwide enterprise applications by vertical market from 2024 to 2029, highlighting market sizes, year-over-year growth, and compound annual growth rates across different industry sectors from Aerospace and Defense to Utilities.

Exhibit 3: Worldwide Enterprise Applications by Vertical Market Forecast 2024-2029 by Functional Market ($M)

Source: Apps Run The World, July 2025

Exhibit 4 shows our projections for the enterprise applications market by vertical segment, based on the buying preferences and the customer propensity to invest in new software within those industries as they continue to upgrade and replace many legacy industry-specific applications that have been identified and tracked in our Buyer Insight Database.

FAQ – APPS RUN THE WORLD Top 10 Life Sciences Software Vendors, Market Size & Forecast

Q1. What is the global Life Sciences software market size in 2024?

A: The global Life Sciences software market reached $20.6 billion in 2024, growing 8.9% year‑over‑year.

Q2. Who are the top 10 Life Sciences software vendors in 2024 and their combined share?

A: The top 10 vendors are IQVIA, Microsoft, Veeva Systems, Salesforce, Dassault Systèmes, SAP, Oracle, Revvity, ServiceNow, and Clario, together accounting for 56.5% of the Life Sciences software market.

Q3. Which vendor leads the Life Sciences software market in 2024?

A: IQVIA leads with a 16.3% market share in 2024.

Q4. What is the forecast for the Life Sciences software market through 2029?

A: The market is projected to reach $27.5 billion by 2029, growing at a compound annual growth rate (CAGR) of 5.9% from 2024 to 2029.

Q5. What applications are included in the scope of the Life Sciences software market?

A: It includes software for clinical trial management, enterprise risk & quality management, regulatory compliance, incentive compensation, sales performance management, financials, HR, and procurement across pharmaceuticals, medical devices, and life technologies.

Q6. Which other Life Sciences software vendors are covered beyond the top 10?

A: The report also profiles other vendors such as Medidata (now part of Dassault), Certara, LabWare, and several specialized informatics and regulatory technology providers.

Q7. When was this Life Sciences software report published and by whom?

A: The Top 10 Life Sciences Software Vendors, Market Size & Forecast 2024‑2029 was published in July 2025 by APPS RUN THE WORLD analysts Albert Pang, Misho Markovski, and Marija Ristik, as part of the APPS TOP 500 research program, which benchmarks the revenues and market share of the world’s 1,500+ largest enterprise application vendors.

More Enterprise Applications Research Findings

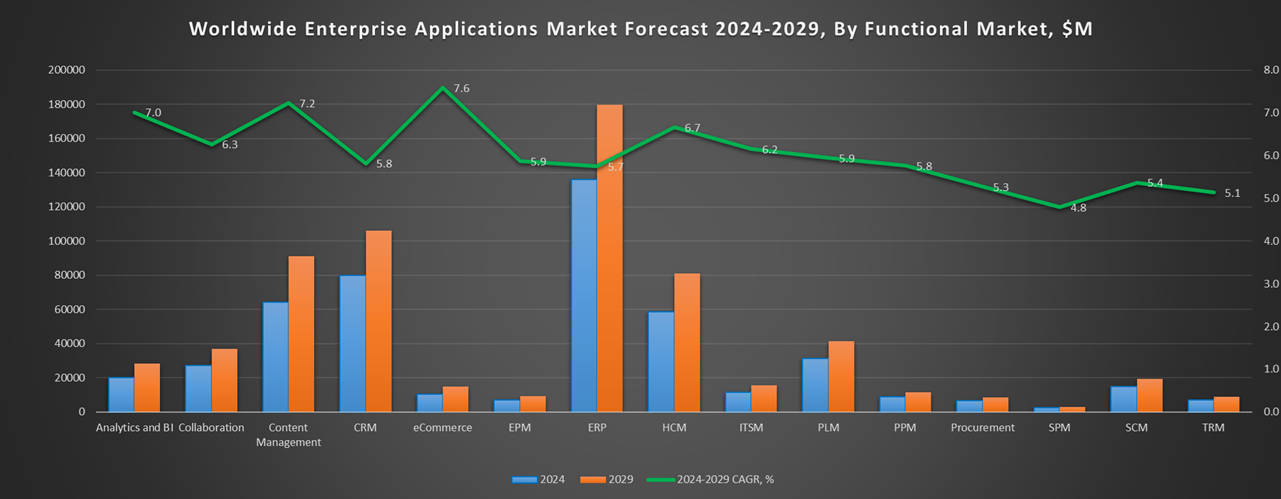

Based on the latest annual survey of 10,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 1,500 largest Enterprise Applications Vendors ranked by their 2024 product revenues. Their 2024 results are being broken down, sorted and ranked across 16 functional areas (from Analytics and BI to Treasury and Risk Management) and by 21 vertical industries (from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year our global team of researchers conduct an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market.

We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 2 million organizations around the world.

The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.

- LEO Pharma, a Denmark based Life Sciences organization with 6000 Employees

- The University of British Columbia, a Canada based Education company with 17778 Employees

- Florida Department of Children and Families, a United States based Government organization with 12000 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

IQVIA

IQVIA