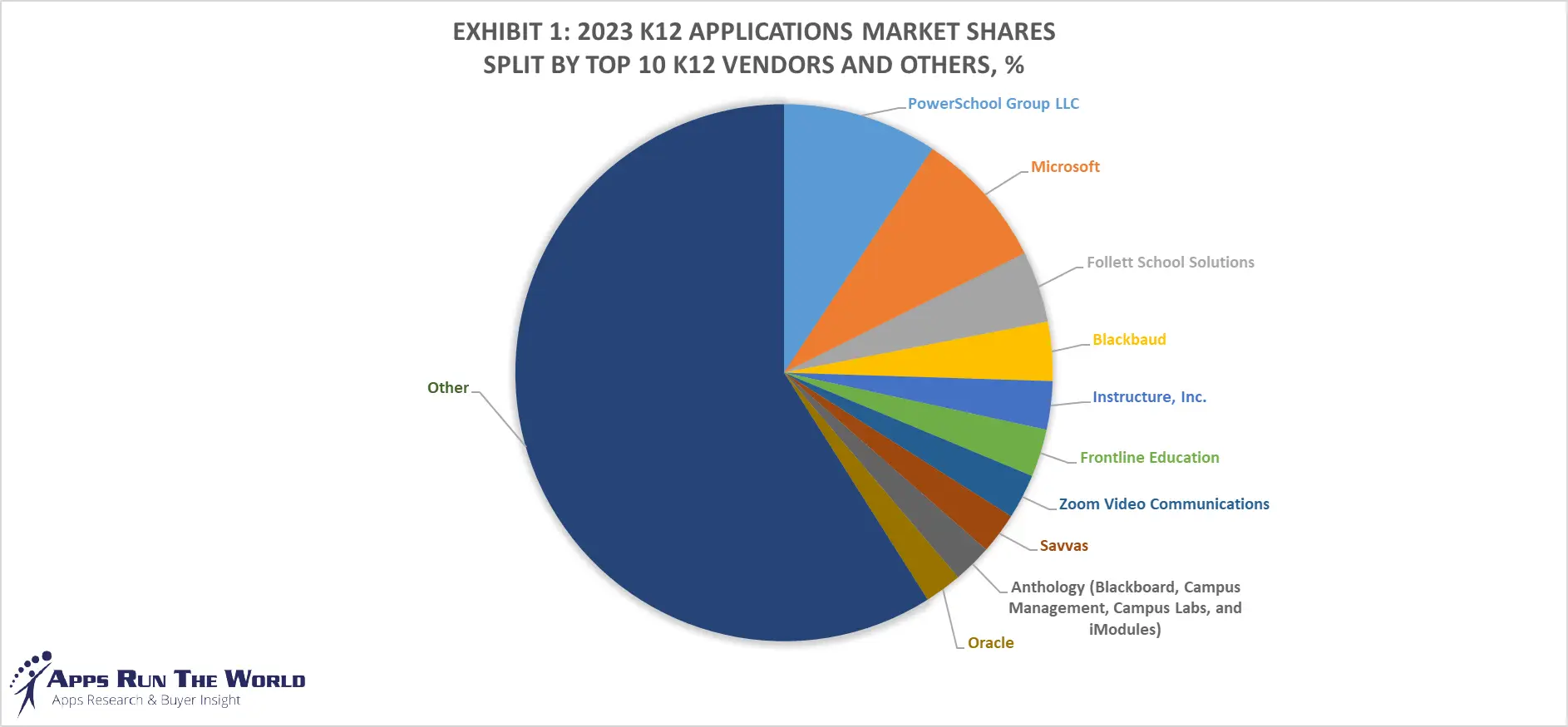

In 2023, the global K12 Education software market surged to nearly $5.8 billion, growing by 10.4%. The top 10 vendors commanded a significant 41% market share, with PowerSchool Group leading at 9.3%, followed by Microsoft, Follett School Solutions, Blackbaud, and Instructure.

Our APPS TOP 500 Market Report (Preview) covers hundreds of K12 Education software vendors, offering deep insights into market dynamics, vendor strengths, AI investments, customer momentum, and go-to-market strategies providing valuable perspectives on market trends and challenges.

Discover thousands of K12 Education Software Customer Wins with the ARTW Technographics Platform, an essential resource for technology enthusiasts, sales business leaders, and data-driven marketing executives, offering curated insights into the evolving landscape of the software industry, including the latest developments in K12 Education.

Through our forecast period, the K12 applications market size is expected to reach $7.1 billion by 2028, compared with $5.8 billion in 2023 at a compound annual growth rate of 4.1%.

| Exhibit 2: Worldwide K12 Software Market 2023-2028 Forecast, $M | |||

|---|---|---|---|

| Year | 2023 | 2028 | 2023-2028 CAGR, % |

| Total | 5822 | 7120 | 4.1% |

Source: Apps Run The World, June 2024

Top 10 K12 Software vendors

K12 (K-12 schools, technical and vocational, distance learning) – Student Information System, Enrollment Management System, Learning Management, Fund Accounting System, K12 Administration, Financials, HR, Procurement

Large-scale projects to implement new student information systems continue unabated as the global K12 market embraces the convergence of mobile learning, international testing standards as well as online instructions.

Here are the rankings of the top 10 K12 software vendors in 2023 and their market shares.

| Rank | Vendor | 2021 K-12 Apps Revenues, $M | 2022 K-12 Apps Revenues, $M | 2023 K-12 Apps Revenues, $M | YoY Growth | 2023 K-12 Market Share, % |

|---|---|---|---|---|---|---|

| 1 | PowerSchool Group LLC | Subscribe | Subscribe | Subscribe | 10.6% | Subscribe |

| 2 | Microsoft | Subscribe | Subscribe | Subscribe | 7.0% | Subscribe |

| 3 | Follett School Solutions | Subscribe | Subscribe | Subscribe | 5.9% | Subscribe |

| 4 | Blackbaud | Subscribe | Subscribe | Subscribe | 5.4% | Subscribe |

| 5 | Instructure, Inc. | Subscribe | Subscribe | Subscribe | 13.2% | Subscribe |

| 6 | Frontline Education | Subscribe | Subscribe | Subscribe | 10.0% | Subscribe |

| 7 | Zoom Video Communications | Subscribe | Subscribe | Subscribe | 3.1% | Subscribe |

| 8 | Savvas | Subscribe | Subscribe | Subscribe | 42.9% | Subscribe |

| 9 | Anthology (Blackboard, Campus Management, Campus Labs, and iModules) | Subscribe | Subscribe | Subscribe | 3.7% | Subscribe |

| 10 | Oracle | Subscribe | Subscribe | Subscribe | 7.9% | Subscribe |

| Subtotal | Subscribe | Subscribe | Subscribe | 9.4% | Subscribe | |

| Other | Subscribe | Subscribe | Subscribe | 11.0% | Subscribe | |

| Total | 4634 | 5275 | 5822 | 10.4% | 100.0% |

Source: Apps Run The World, June 2024

Other K12 software providers included in the report are ACI Worldwide, Inc., Adobe, Ansys Inc., Articulate, Autodesk, Axway, Capita Software, Community Brands, Cisco Systems, Civica, Constellation Software Inc., Corel Corporation, Cvent, Dominknow, Dropbox, Desire2Learn, Edmentum, ESM Solutions Corporation, Espressive, FIS Global, Genesys Telecommunications Laboratories, Google, Huron, IBM, Infinite Campus, Infor, Intuit Inc., Imagine Learning, Ivanti, Jenzabar, Kahoot, Laserfiche, LivePerson Inc., LearningMate, Nelnet, Inc., Open Text Corporation, PowerSchool Group LLC, Roper Technologies, Inc., Sage, SAP, Savvas Learning Co (formerly Pearson K12 Learning), Salesforce, SAS Institute, Selerix Systems, Inc, ServiceNow, Shiftboard, Skyward, Smartsheet, Squiz, TalentCircles, TechnologyOne, TalentMap, TeamDynamix, TMA Systems, Tyler Technologies, UNIT4, UKG, Zoom Video Communications, Zendesk, and others.

Custom data cuts related to the K12 Applications market are available:

- Top 700+ K12 Applications Vendors and Market Forecast 2023-2028

- 2023 K12 Applications Market By Functional Market (16 Markets)

- 2023 K12 Applications Market By Country (USA + 45 countries)

- 2023 K12 Applications Market By Region (Americas, EMEA, APAC)

- 2023 K12 Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2023 K12 Applications Market By Customer Size (revenue, employee count, asset)

- 2023 K12 Applications Market By Channel (Direct vs Direct)

- 2023 K12 Applications Market By Product

- Internet Archive, a United States based Non Profit organization with 169 Employees

- Trilogy, Inc, a United States based Professional Services company with 900 Employees

- Guidepost Growth Equity, a United States based Banking and Financial Services organization with 50 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

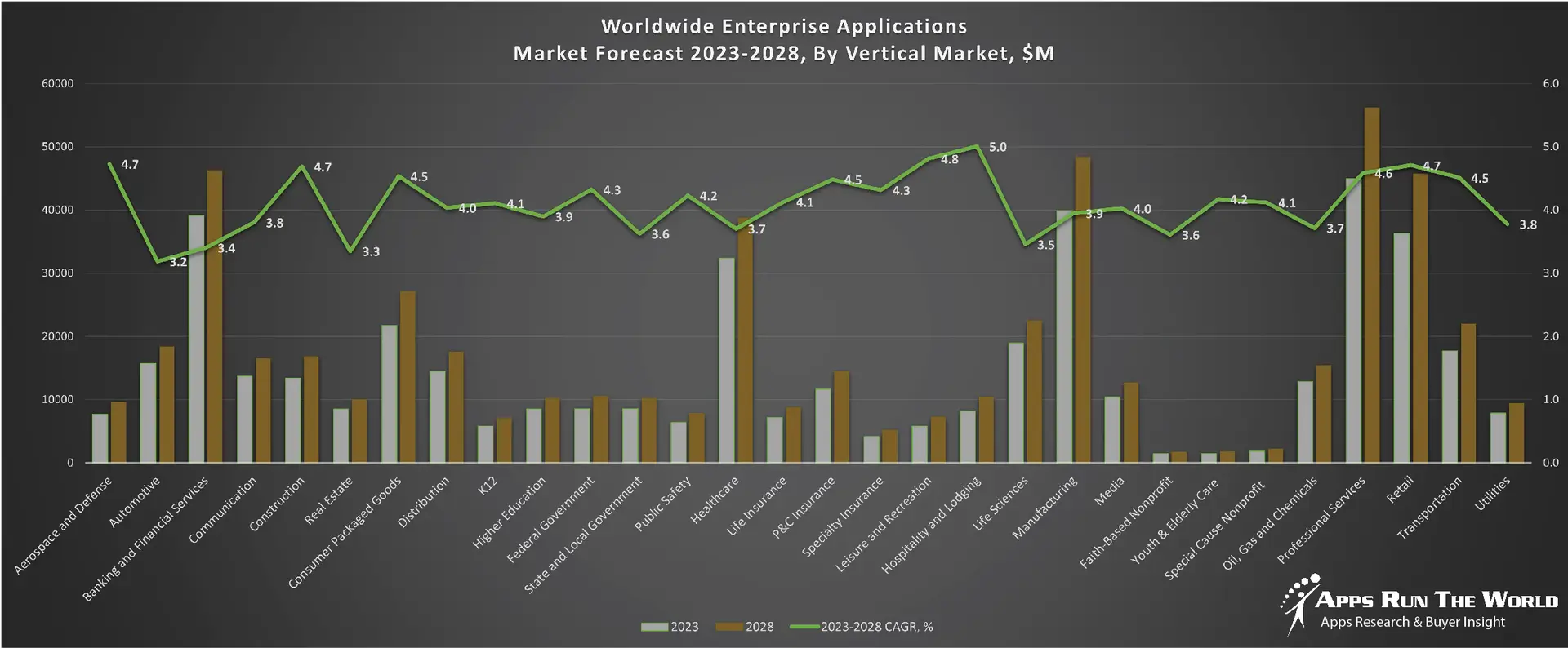

Worldwide Enterprise Applications by Vertical Market

Exhibit 3 provides a forecast of the worldwide enterprise applications by vertical market from 2023 to 2028, highlighting market sizes, year-over-year growth, and compound annual growth rates across different industry sectors from Aerospace and Defense to Utilities.

Exhibit 3: Worldwide Enterprise Applications by Vertical Market Forecast 2023-2028 by Functional Market ($M)

Source: Apps Run The World, June 2024

Exhibit 4 shows our projections for the enterprise applications market by vertical segment, based on the buying preferences and the customer propensity to invest in new software within those industries as they continue to upgrade and replace many legacy industry-specific applications that have been identified and tracked in our Buyer Insight Database.

K12 Software Purchases Win/Loss Analysis As Part Of Enterprise Applications Buyer Insight Customer Database

On the buyer side, customers are investing in K12 systems based on new features and capabilities that are expected to replace their existing legacy systems. In many cases, competitive upgrades and replacements that could have a profound impact on future market-share changes will become more widespread.

Since 2010, our global team of researchers has been studying the patterns of the latest K12 software purchases by customers around the world, aggregating massive amounts of data points that form the basis of our forecast assumptions and perhaps the rise and fall of certain vendors and their products on a quarterly basis.

Updated continuously, our database features extensive win/loss analysis. Each year our research team identifies tens of thousands of these K12 customer wins and losses from public and proprietary sources.

The research results are being incorporated into regular updates in our Enterprise Applications Buyer Insight Customer Database. You can access the Quarterly Win/Loss Analysis Scoreboard and our Enterprise Applications Buyer Insight Customer Database by becoming a subscriber.

| Customer | Industry | Empl. | Revenue | Country | Vendor | New Product | Function |

| Minnesota State Colleges and Universities | Education | 16000 | $5.50B | United States | Oracle | Oracle Autonomous Data Warehouse | Autonomous Database |

| Marquette University | Education | 1100 | $550.0M | United States | Blackbaud | Blackbaud CRM | Customer Relationship Management |

| University of Stirling | Education | 1872 | $1.00B | United Kingdom | Box | Box | Content Management |

| InterGrupo | Education | 1500 | $200.0M | Columbia | CA Technologies | CA Service Desk Manager | IT Service Management |

| London School of Economics | Education | 1655 | $453.0M | United Kingdom | Cherwell Software | Cherwell ITSM | IT Service Management |

| ExxonMobil | Education | 69600 | $238.00B | United States | Chrome River Technologies | Chrome River Expense Management | ERP |

| University of Minnesota System | Education | 30000 | $3.80B | United States | Chrome River Technologies | Chrome River Expense Management | ERP |

| University of Georgia | Education | 18725 | $1.60B | United States | Cornerstone OnDemand | Cornerstone Learning Suite | Learning Management System |

| University of Tennessee | Education | 9744 | $1.70B | United States | Cornerstone OnDemand | Cornerstone Learning Suite | Learning Management System |

| ExxonMobil | Education | 69600 | $238.00B | United States | Dassault Systemes | 3DEXPERIENCE Platform | Project Portfolio Management |

| University of Tokyo | Education | 8210 | $2.29B | Japan | Dassault Systemes | 3DEXPERIENCE Platform | Project Portfolio Management |

| Arizona State University | Education | 10000 | $2.00B | United States | Dropbox | Dropbox Business | Content Management |

| Davidson College | Education | 800 | $200.0M | United States | Dropbox | Dropbox Business | Content Management |

| University of Sydney | Education | 12000 | $2.00B | Australia | Dropbox | Dropbox Business | Content Management |

| London South Bank University | Education | 1700 | $188.0M | United Kingdom | IBM | IBM Planning Analytics | Enterprise Performance Management |

| The Lenzing Group | Education | 6400 | $2.60B | Austria | JDA Software Group | JDA Sales & Operations Planning (S&OP) | SCM |

| RWJUH | Education | 10100 | $1.50B | United States | Kronos | Kronos Workforce Central | Human Capital Management, Workforce Management |

| University of Colorado Boulder | Education | 7800 | $1.60B | United States | Kronos | Kronos Workforce Dimensions | Workforce Management |

| Ithaca College | Education | 1600 | $234.0M | United States | Oracle | Oracle HCM Cloud | Human Capital Management |

| Kentucky State University | Education | 1600 | $53.0M | United States | Oracle | Oracle ERP Cloud | Enterprise Resource Planning |

| Lorain County Community College | Education | 1000 | $105.0M | United States | Oracle | Oracle EPM Cloud | Enterprise Performance Management |

| San Bernardino Community College District | Education | 14253 | $12.37B | United States | Oracle | Oracle ERP Cloud | Enterprise Resource Planning |

| Vanderbilt University | Education | 9162 | $4.13B | United States | Oracle | Oracle HCM Cloud | Human Capital Management |

| University of Virginia | Education | 15514 | $1.39B | United States | Qlik | QlikView | Business Intelligence |

| Tulane University | Education | 4600 | $1.31B | United States | SciQuest | Sciquest Source-to-Settle Suite | Procurement |

| Stanford University | Education | 11500 | $4.10B | United States | Tidemark | Tidemark EPM | Enterprise Performance Management |

| City of Irving | Education | 2300 | $308.0M | United States | Tyler Technologies | Minus ERP | Enterprise Resource Planning |

| Community ISD | Education | 300 | $30.0M | United States | Tyler Technologies | Minus ERP | Enterprise Resource Planning |

| Buckinghamshire New University | Education | 932 | $65.0M | United Kingdom | UNIT4 | Unit4 Business World | Enterprise Resource Planning |

| Buckinghamshire New University | Education | 932 | $65.0M | United Kingdom | UNIT4 | Unit4 Student Management | Enterprise Resource Planning |

| Dublin Business School | Education | 400 | $35.0M | United Kingdom | UNIT4 | Unit4 Student Management | Enterprise Resource Planning |

| IMC Worldwide | Education | 500 | $212.0M | United Kingdom | UNIT4 | Unit4 PSA Suite | Project Services Automation |

| Manchester Metropolitan University | Education | 4500 | $620.0M | United Kingdom | UNIT4 | Unit4 Student Management | Enterprise Resource Planning |

| Study Group | Education | 3325 | $380.0M | United Kingdom | UNIT4 | Unit4 Business World | Enterprise Resource Planning |

| Swiss Education Group | Education | 706 | $100.0M | Switzerland | UNIT4 | Unit4 Student Management | Enterprise Resource Planning |

| University of London |