In 2024, the global Leisure and Recreation software market grew to $6.5 billion, marking a 12.7% year-over-year increase. The top 10 vendors accounted for 46.7% of the total market. Salesforce led the pack with a 10.6% market share, followed by Microsoft, Adobe, and Oracle.

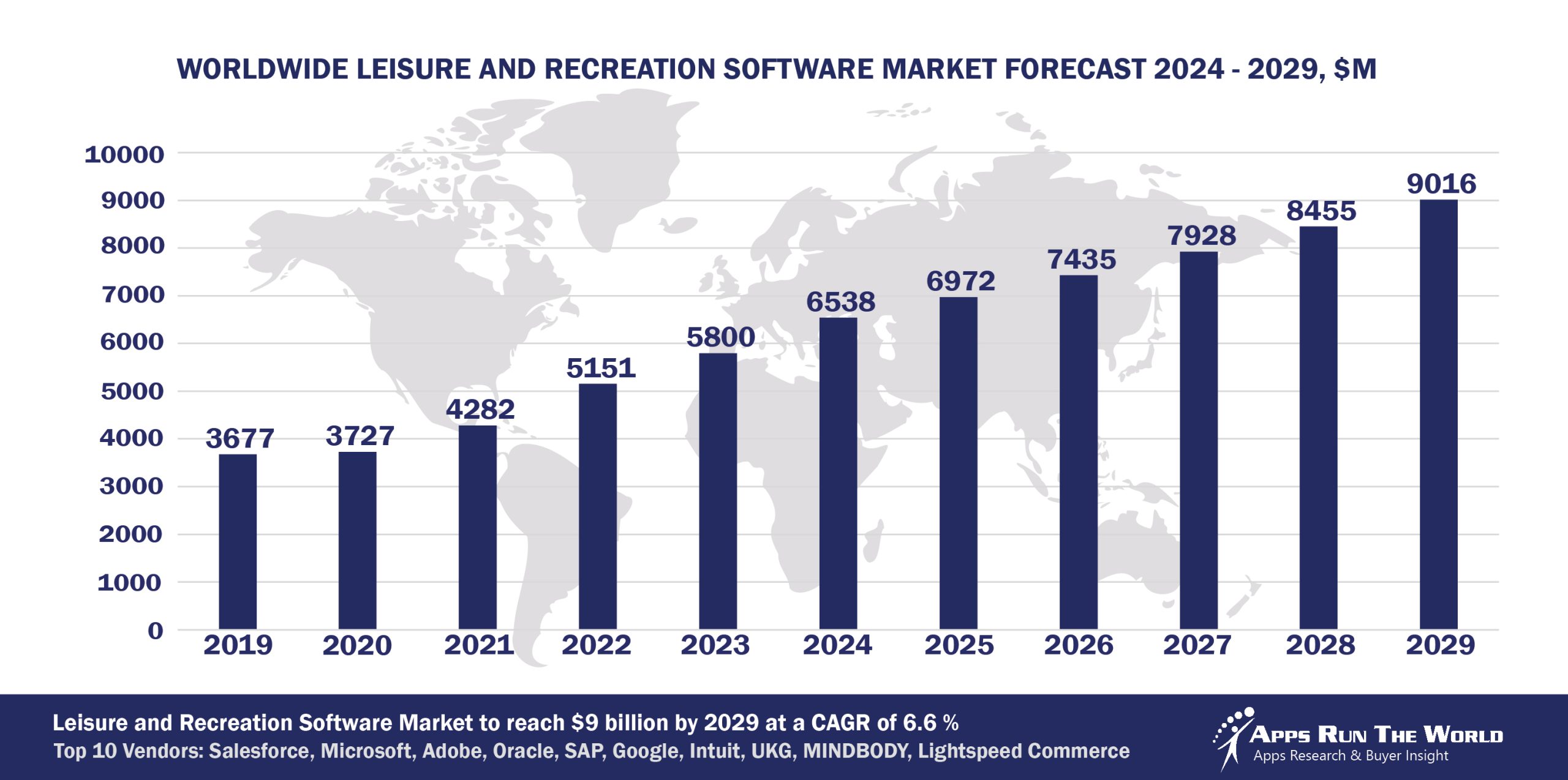

Through our forecast period, the Leisure and Recreation applications market size is expected to reach $9 billion by 2029, compared with $6.5 billion in 2024 at a CAGR of 6.6%, as shown in the Apps Top 500 Report – Excel Edition [Preview] .

Leisure and Recreation (Gaming, amusement, recreation services, hotels, cruises, lodging facilities) – Property Management, Cash Journaling & Gratuity Automation, Revenue Optimization, Hotel distribution, CRS, Channel management, Inventory Management, Financials, HR, Procurement

Mobile and Cloud apps will become more pervasive among hotels, entertainment venues as resorts and sports arenas aim to deliver more personalized experiences to better differentiate their services against Airbnb and home-entertainment options.

Top 10 Leisure and Recreation Software Vendors in 2024 and their Market Shares

Source: Apps Run The World, July 2025

Other Leisure and Recreation software providers included in the report are: 7shifts, Agilysys, Atlassian, Autodesk, Avalara, BirchStreet Systems, Buyers Edge Platform, Constellation Software Inc., Cornerstone OnDemand, Cvent, Dayforce, Dropbox, Emplif, Epicor, Eventbrite, Fiserv, Fourth Enterprises, Genesys, Global Payments Inc., Google, Harri US LLC, HireRight, IBM, IBS Software Services, HubSpot, Infor, Jolt Software, Medallia, MINDBODY, MYOB, Open Text Corporation, Partech, Paycom, Paylocity, Quinyx, Revinate, RingCentral, Roper Technologies, Sage, Sprinklr, SAS Institute, Sopra Steria Group SA, ServiceNow, Skillsoft, SurveyMonkey, Travelport, Workday, Zendesk, Zoho Corp., Zoom Video Communications, Zuora, and others.

Vendor Snapshot: Leisure and Recreation Market Leaders

Salesforce

Salesforce

Salesforce is steering its roadmap toward delivering autonomous guest engagement and operational intelligence rather than traditional CRM features. In Leisure & Recreation, this translates into AI agents that can manage bookings, upsell experiences, resolve service requests, and orchestrate back-office tasks without human intervention. The near-term roadmap emphasizes low-code agent composition, allowing hotel, resort, and attraction managers to deploy pre-built automation templates for loyalty recovery, concierge services, or housekeeping coordination with minimal IT support.

Microsoft

Microsoft continues enhancing its Dynamics 365 suite with AI integrations across Marketing, Sales, and Service, delivering predictive lead scoring, chatbot-based support, and real-time insights. The company invests heavily in emerging technologies such as mixed reality, generative AI through Copilot, and advanced analytics via Power BI to support leisure and recreation experiences. Targeted acquisitions like Nuance have strengthened its capabilities in customer engagement and operational automation.

Adobe

Adobe’s Experience Cloud has advanced with real-time journey orchestration and predictive analytics powered by Adobe Sensei. The platform now offers moment-based personalization, cross-channel campaign automation, and updated identity graphs for improved targeting of event-goers and resort customers. Adobe has also invested in data-clean room technology and enhanced video analytics to optimize customer experiences in entertainment and recreation venues.

Oracle

Oracle has modernized MICROS Simphony into a fully cloud-based point-of-sale and operations platform for hospitality, stadiums, and leisure venues, with built-in analytics and mobile ordering. CrowdTwist Loyalty and Engagement now features gamification, real-time personalized rewards, and integration with Oracle Fusion Analytics Cloud to boost guest retention. Oracle has also partnered with venue analytics and IoT providers to expand data-driven performance insights.

SAP

SAP’s Sports One Solution and Event Ticketing platforms now offer real-time fan engagement, dynamic pricing, and mobile ticket delivery for large leisure events. The integration of Emarsys enables advanced cross-channel marketing automation for wellness venues, resorts, and theme parks. SAP has also upgraded its Customer Checkout POS with better loyalty integration and real-time analytics to optimize visitor operations.

Google has enhanced BigQuery with augmented analytics, real-time visitor data processing, and machine learning for customer behavior analysis in leisure markets. Google Workspace tools such as Meet, Chat, and AI-driven scheduling are streamlining internal operations and guest communications for leisure operators. Tag Manager upgrades improve tracking and personalization, supported by ongoing investment in Vertex AI and multi-cloud analytics.

Intuit Inc.

Intuit has enriched QuickBooks Online with AI-based expense categorization, cash flow forecasting, and payroll prediction tailored for leisure-sector SMEs. The integration of Mailchimp supports targeted marketing campaigns for operators in wellness, recreation, and events. Intuit continues to invest in embedded financial insights, enhanced time tracking, and partnerships with fintech platforms to simplify payments and bookings.

UKG

UKG’s Pro Gaming workforce solution was strengthened by the acquisition of Shiftboard, adding AI-powered scheduling and rostering for casino resorts and gaming environments. The company is leveraging generative AI in partnership with Google Cloud to enhance workforce insights for guest-service industries. UKG continues to invest in analytics and tools designed for large-scale leisure and recreation staffing operations.

MINDBODY

MINDBODY, under the parent brand Playlist Technologies, is building a shared infrastructure across Mindbody, ClassPass, and Booker to deliver unified AI-powered tools for the wellness and fitness markets. Recent innovations include integration with AI-driven advertising to deliver more relevant in-app offers and improved customer engagement. The company is also automating scheduling, payments, and customer communications to streamline operations across spas, salons, and fitness venues.

Lightspeed Commerce

Lightspeed’s Chronogolf platform now includes mobile booking, food and beverage ordering, and solo-play analytics to engage younger golfers. Its roadmap focuses on digital marketing tools, dynamic revenue management, and customer insights for golf facilities. The company is also expanding its analytics dashboards and guest experience features to help venues adapt to demographic shifts in recreational golf.

ARTW Technographics Platform: Leisure and Recreation customer wins

Since 2010, our research team has been studying the patterns of Leisure and Recreation software purchases, analyzing customer behavior and vendor performance through continuous win/loss analysis. Updated quarterly, the ARTW Technographics Platform provides deep insights into thousands of Leisure and Recreation customer wins and losses, helping users monitor competitive shifts, evaluate vendor momentum, and make informed go-to-market decisions.

List of Leisure and Recreation customers

Source: ARTW Buyer Insights Technographic Database

Custom data cuts related to the Leisure and Recreation Applications market are available:

- Top 850+ Leisure and Recreation Applications Vendors and Market Forecast 2024-2029

- 2024 Leisure and Recreation Applications Market By Functional Market (16 Markets)

- 2024 Leisure and Recreation Applications Market By Country (USA + 45 countries)

- 2024 Leisure and Recreation Applications Market By Region (Americas, EMEA, APAC)

- 2024 Leisure and Recreation Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2024 Leisure and Recreation Applications Market By Customer Size (revenue, employee count, asset)

- 2024 Leisure and Recreation Applications Market By Channel (Direct vs Indirect)

- 2024 Leisure and Recreation Applications Market By Product

Worldwide Enterprise Applications by Vertical Market

Exhibit 3 provides a forecast of the worldwide enterprise applications by vertical market from 2024 to 2029, highlighting market sizes, year-over-year growth, and compound annual growth rates across different industry sectors from Aerospace and Defense to Utilities.

Exhibit 3: Worldwide Enterprise Applications by Vertical Market Forecast 2024-2029 by Functional Market ($M)

Source: Apps Run The World, July 2025

Exhibit 4 shows our projections for the enterprise applications market by vertical segment, based on the buying preferences and the customer propensity to invest in new software within those industries as they continue to upgrade and replace many legacy industry-specific applications that have been identified and tracked in our Buyer Insight Database.

FAQ – APPS RUN THE WORLD Top 10 Leisure & Recreation Software Vendors, Market Size & Forecast

Q1. What is the global Leisure & Recreation software market size in 2024?

A: The global Leisure & Recreation software market reached $6.5 billion in 2024, growing 12.7% year-over-year as vendors expanded cloud deployments and integrated booking, POS, and CRM solutions.

Q2. Who are the top 10 Leisure & Recreation software vendors in 2024, and what share do they hold?

A: The top 10 vendors are Salesforce, Microsoft, Adobe, Oracle, SAP, Google, Intuit, UKG, Mindbody, and Lightspeed Commerce, capturing a combined 46.7% of the market.

Q3. Which vendor leads the Leisure & Recreation software market in 2024?

A: Salesforce leads the Leisure & Recreation software market in 2024 with a 10.6% market share, driven by its CRM and marketing automation platform adoption.

Q4. What is the forecast for the Leisure & Recreation software market through 2029?

A: The Leisure & Recreation software market is projected to grow to $9.0 billion by 2029, reflecting a 6.6% compound annual growth rate.

Q5. What applications are included in the scope of the Leisure & Recreation software market?

A: The market includes Property Management, Reservation Systems, POS, Revenue Optimization, Scheduling, Membership Management, CRM, HR, and Financials.

Q6. Which other Leisure & Recreation software vendors are covered beyond the top 10?

A: Additional vendors covered in the report include TravelClick, DaySmart, Zenoti, Virtuagym, ResortSuite, FareHarbor, and Amadeus Hospitality.

Q7. When was this Leisure & Recreation software report published and by whom?

A: The Top 10 Leisure & Recreation Software Vendors, Market Size and Forecast 2024–2029 was published in July 2025 by APPS RUN THE WORLD analysts Albert Pang, Misho Markovski, and Marija Ristik, as part of the APPS TOP 500 research program, which benchmarks the revenues and market share of the world’s 1,500+ largest enterprise application vendors.

More Enterprise Applications Research Findings

Based on the latest annual survey of 10,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 1,500 largest Enterprise Applications Vendors ranked by their 2024 product revenues. Their 2024 results are being broken down, sorted and ranked across 16 functional areas (from Analytics and BI to Treasury and Risk Management) and by 21 vertical industries (from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year our global team of researchers conduct an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market.

We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 2 million organizations around the world.

The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

Salesforce

Salesforce