In 2024, the global Leisure and Hospitality software market grew to $16.2 billion, marking a 12.2% year-over-year increase. The top 10 vendors accounted for 40.8% of the total market. Salesforce led the pack with a 9.4% market share, followed by Microsoft, Adobe, and Oracle.

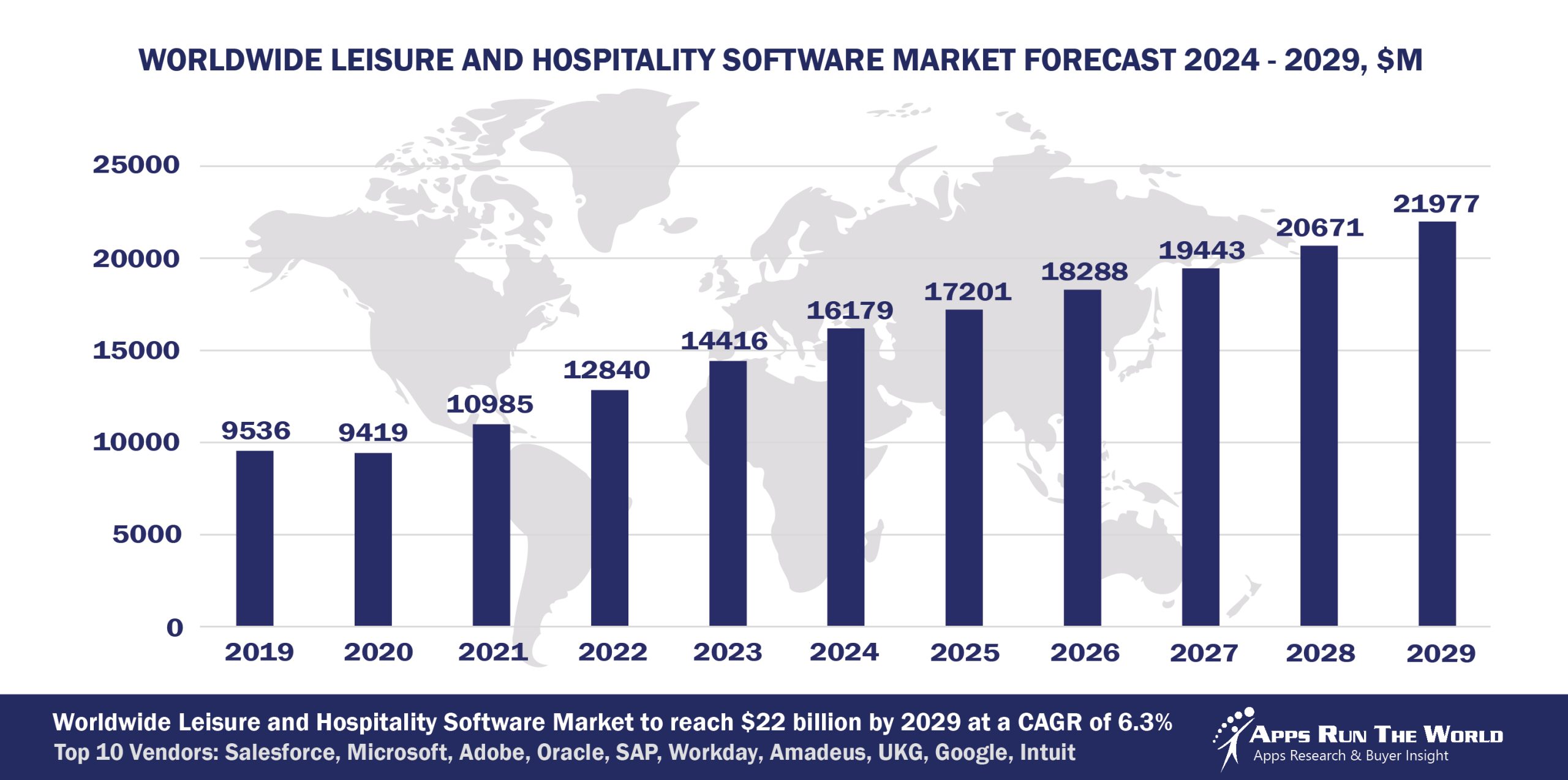

Through our forecast period, the Leisure and Hospitality applications market size is expected to reach $22 billion by 2029, compared with $16.2 billion in 2025 at a CAGR of 6.3%, as shown in the Apps Top 500 Report – Excel Edition [Preview] .

Leisure and Lodging (Gaming, amusement, recreation services, hotels, cruises, lodging facilities) – Property Management, Cash Journaling & Gratuity Automation, Revenue Optimization, Hotel distribution, CRS, Channel management, Inventory Management, Financials, HR, Procurement

Mobile and Cloud apps will become more pervasive among hotels, entertainment venues and resorts and sports arenas aim to deliver more personalized experiences to better differentiate their services against Airbnb and home-entertainment options.

Top 10 Leisure and Hospitality Software Vendors in 2024 and their Market Shares

Source: Apps Run The World, July 2025

Other Leisure and Hospitality software providers included in the report are: 7shifts, Agilysys, Autodesk, Avalara, BirchStreet Systems, Buyers Edge Platform, Constellation Software Inc., Cornerstone OnDemand, Cvent, Dayforce, Epicor, Eventbrite, Fiserv, Fourth Enterprises, Genesys Telecommunications Laboratories, Harri US LLC, HireRight, IBM, IBS Software Services, Infor, Jolt Software, Medallia, MINDBODY, MYOB, Open Text Corporation, Partech, Paycom, Qualtrics, Quinyx, Revinate, RingCentral, Roper Technologies, Sage, ServiceNow, Momentive AI (formerly SurveyMonkey), Travelport, Workday, Zendesk, Zoho Corp. and others.

Vendor Snapshot: Leisure and Hospitality Market Leaders

Salesforce

Salesforce

Salesforce expanded Agentforce across Sales, Service, and Marketing Clouds for hospitality guest management, loyalty orchestration, and sustainability tracking. Its Data Cloud now unifies real-time guest data for predictive marketing and personalized engagement, supported by a strategic partnership with Amadeus for next-gen hotel service centers. Acquisitions in analytics and customer engagement strengthen its leadership in hospitality CRM and automation.

Microsoft

Microsoft’s 2025 Dynamics 365 release waves introduce deeper automation across sales, service, and finance modules, with enhancements focused on hospitality use cases like guest engagement, contact center, and field service integration. The platform’s integration into Teams and Power Platform fosters seamless collaboration and operational agility for venues and resorts. Strategic investment in cloud infrastructure, AI tooling, and partnerships underscores Microsoft’s growing role in digital transformation for hospitality operations.

Adobe

Adobe launched the Experience Platform Agent Orchestrator to manage AI agents for real-time guest interactions across Experience Manager and Journey Optimizer. Updates to Experience Manager support dynamic, personalized content, while investments in analytics, data privacy, and cross-channel campaign automation enhance guest engagement. These innovations underscore Adobe’s commitment to AI-driven hospitality marketing and operational efficiency.

Oracle

Oracle’s OPERA Cloud PMS and MICROS Simphony Cloud now feature AI-driven upselling, loyalty engagement, and multilingual mobile staff tools. Adoption has surged, with over 3,500 new OPERA Cloud properties in the past year and significant growth in guest-centric integrations. The company continues to integrate analytics, ERP, and POS to optimize multi-property hospitality operations.

SAP

SAP has enhanced its hospitality offerings by integrating AI-driven features into its SAP S/4HANA Cloud, improving processes like sales order fulfillment and fixed asset management. In 2025, SAP introduced significant updates to its Customer Experience portfolio, including SAP Emarsys, which now offers advanced omnichannel engagement powered by real-time data and AI. The company focuses on strengthening omnichannel guest engagement and operational efficiency through continuous product innovation. These efforts underscore SAP’s commitment to providing comprehensive solutions for the leisure and hospitality industry.

Workday

Workday’s Spring 2025 release introduced over 350 feature enhancements across HR and finance, streamlining workflows around recruiting, expense management, time tracking, and onboarding while improving overall user experience and compliance. In September 2024, Workday unveiled a set of AI agents, such as for expenses, recruitment, succession planning, and process optimization, that support earlier automation of key HR and finance operations. The platform also now offers natural-language data query and document intelligence services via its AI Gateway and Extend ecosystem, facilitating easier access to analytics and HR data insights. These developments, alongside investments in AI and cloud tools, underscore Workday’s continued expansion across workforce productivity and financial management for sectors including hospitality and services.

Amadeus

Amadeus upgraded its Property Management, TravelClick, and Delphi solutions with AI-powered guest service automation, centralized sales, and revenue optimization tools. Partnerships with Salesforce and cloud providers support a next-gen hotel service platform with predictive support capabilities. Increased R&D spending highlights Amadeus’s commitment to integrated hospitality and event technology innovation.

UKG

UKG is transforming workforce management in the Leisure and Hospitality sector by embedding agentic AI and autonomous systems that streamline scheduling, payroll, and labor optimization. Its platforms now leverage intelligent agents to predict staffing needs, automate compliance workflows, and provide real-time insights, reducing administrative overhead and enhancing operational agility. Recent upgrades emphasize low-code/no-code tools and conversational interfaces, enabling managers and employees to interact with AI agents seamlessly while accelerating adoption across diverse hospitality environments. By converging predictive analytics, autonomous workforce agents, and adaptive automation, UKG aligns its product roadmap and go-to-market strategy with the evolving demands of a dynamic, guest-centric industry.

Google’s recent developments for the hospitality sector include the use of BigQuery, Workspace, and Tag Manager to support data analytics, collaboration, and marketing functions. Partnerships with hospitality technology firms have expanded its role in cloud infrastructure and data management. Investments in artificial intelligence research and generative models are expected to influence how leisure providers use Google’s platforms for operations and marketing.

Intuit Inc.

Intuit has recently introduced Intuit Assist, an AI-powered assistant within QuickBooks that automates tasks like invoice generation, expense categorization, and payment reminders using email, scanned documents, or chatbot interactions. It has also enhanced functionality tailored for hospitality businesses through integrations with POS systems, real-time dashboards, and automated financial reporting workflows. In April 2025, Intuit announced its acquisition of GoCo, a modern HR and benefits platform to strengthen its payroll and workforce management capabilities. These developments reflect Intuit’s strategy to integrate financial, HR, and marketing tools into a seamless operational platform for small and mid-sized hospitality operators.

ARTW Technographics Platform: Leisure and Hospitality customer wins

Since 2010, our research team has been studying the patterns of Leisure and Hospitality software purchases, analyzing customer behavior and vendor performance through continuous win/loss analysis. Updated quarterly, the ARTW Technographics Platform provides deep insights into thousands of Leisure and Hospitality customer wins and losses, helping users monitor competitive shifts, evaluate vendor momentum, and make informed go-to-market decisions.

List of Leisure and Hospitality customers

Source: ARTW Buyer Insights Technographic Database

Custom data cuts related to the Leisure and Hospitality Applications market are available:

- Top 900+ Leisure and Hospitality Applications Vendors and Market Forecast 2024-2029

- 2024 Leisure and Hospitality Applications Market By Functional Market (16 Markets)

- 2024 Leisure and Hospitality Applications Market By Country (USA + 45 countries)

- 2024 Leisure and Hospitality Applications Market By Region (Americas, EMEA, APAC)

- 2024 Leisure and Hospitality Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2024 Leisure and Hospitality Applications Market By Customer Size (revenue, employee count, asset)

- 2024 Leisure and Hospitality Applications Market By Channel (Direct vs Indirect)

- 2024 Leisure and Hospitality Applications Market By Product

Worldwide Enterprise Applications by Vertical Market

Exhibit 3 provides a forecast of the worldwide enterprise applications by vertical market from 2024 to 2029, highlighting market sizes, year-over-year growth, and compound annual growth rates across different industry sectors from Aerospace and Defense to Utilities.

Exhibit 3: Worldwide Enterprise Applications by Vertical Market Forecast 2024-2029 by Functional Market ($M)

Source: Apps Run The World, July 2025

Exhibit 4 shows our projections for the enterprise applications market by vertical segment, based on the buying preferences and the customer propensity to invest in new software within those industries as they continue to upgrade and replace many legacy industry-specific applications that have been identified and tracked in our Buyer Insight Database.

FAQ – APPS RUN THE WORLD Top 10 Leisure & Hospitality Software Vendors, Market Size & Forecast

Q1. What is the global Leisure & Hospitality software market size in 2024?

A: The global Leisure & Hospitality software market grew to $16.2 billion in 2024, marking a 12.2% year-over-year increase.

Q2. Who are the top 10 Leisure & Hospitality software vendors in 2024 and their combined share?

A: The top 10 vendors are Salesforce, Microsoft, Adobe, Oracle, SAP, Amadeus, Infor, Agilysys, Sabre, and Oracle Hospitality, together accounting for 40.8% of the total market.

Q3. Which vendor leads the Leisure & Hospitality software market in 2024?

A: Salesforce leads the Leisure & Hospitality software market in 2024 with a 9.4% market share.

Q4. What is the forecast for the Leisure & Hospitality software market through 2029?

A: The market is projected to reach $22 billion by 2029, growing at a compound annual growth rate (CAGR) of 6.3%.

Q5. What applications are included in the scope of the Leisure & Hospitality software market?

A: The scope includes Property Management Systems (PMS), Central Reservation Systems (CRS), Revenue Optimization, Channel Management, Inventory Management, Financials, Human Resources, Procurement, and Point of Sale (POS) systems.

Q6. Which other Leisure & Hospitality software vendors are covered beyond the top 10?

A: The report also profiles vendors such as Agilysys, Sabre, and Oracle Hospitality, offering specialized solutions for the Leisure & Hospitality industry.

Q7. When was this Leisure & Hospitality software report published, and by whom?

A: The Top 10 Leisure & Hospitality Software Vendors, Market Size & Forecast 2024–2029 report was published in July 2025 by APPS RUN THE WORLD analysts Albert Pang, Misho Markovski, and Aleksandra Markovska, as part of the APPS TOP 500 research program, which benchmarks the revenues and market share of the world’s 1,500+ largest enterprise application vendors.

More Enterprise Applications Research Findings

Based on the latest annual survey of 10,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 1,500 largest Enterprise Applications Vendors ranked by their 2024 product revenues. Their 2024 results are being broken down, sorted and ranked across 16 functional areas (from Analytics and BI to Treasury and Risk Management) and by 21 vertical industries (from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year our global team of researchers conduct an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market.

We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 2 million organizations around the world.

The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.

- Bharti Tele Ventures, a India based Communications organization with 100 Employees

- CLSA, a Hong Kong based Banking and Financial Services company with 1800 Employees

- HG Insights, a United States based Professional Services organization with 560 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

Salesforce

Salesforce