In 2024, the global Specialty Insurance software market grew to $4.6 billion, marking an 11.3% year-over-year increase. The top 10 vendors accounted for 46.9% of the total market. Salesforce led the pack with a 12.7% market share, followed by Microsoft, Roper Technologies, and Oracle.

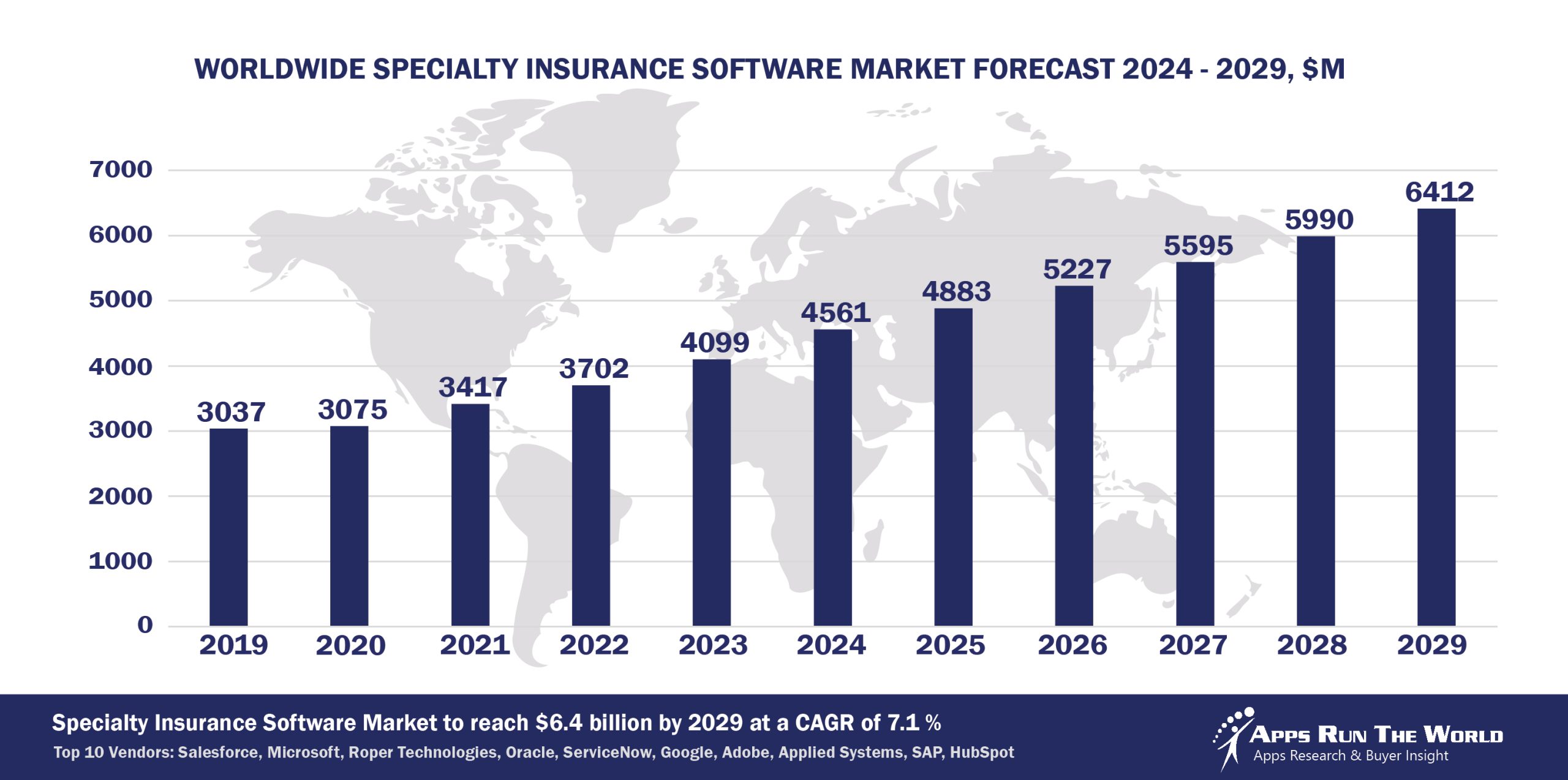

Through our forecast period, the Specialty Insurance applications market size is expected to reach $6.4 billion by 2029, compared with $4.6 billion in 2024 at a CAGR of 7.1%, as shown in the Apps Top 500 Report – Excel Edition [Preview] .

Specialty Insurance (Entities that offer non-compulsory insurance of any kind) – Agency management system, Policy administration solutions, Pensions administration software, Billing and Claims software, Underwriting, Insurance Broker and Financial Planning Software, Financials, HR, Procurement

Big Data analytics will be one of the key investment areas for insurers aiming to capture and gain more insights on their customers while stepping up Cloud developments for tighter collaboration with agencies and brokers in moves that could redefine how insurance is being sold in the future.

Top 10 Specialty Insurance Software Vendors in 2024 and their Market Shares

Source: Apps Run The World, July 2025

Other Specialty Insurance software providers included in the report are: ACI Worldwide, Inc., ADP, Aptitude Software, Atlassian, Acturis Group, Asseco Group, Aurea, CCC Intelligent Solutions, eBaoTech Corporation, BriteCore, Insuresoft, EIS Group, Cegedim, Cisco Systems, Citrix, Constellation Software Inc., Cornerstone OnDemand, DATEV, DocuSign, Inc., Dropbox, Duck Creek Technologies, Edgeverve, an Infosys company, Edlund A/S, Envestnet, Equifax, Exela Technologies, Inc., Fadata, FICO, FIS Global, Fiserv, Genesys Telecommunications Laboratories, GoodData, Google, HubSpot, Hypoport SE, IBM, Insurity, Inc., Intuit Inc., Keylane, Kofax, Linedata Services S.A., Majesco, Mitchell International, Inc., Nice Systems, OneShield Software, Open Text Corporation, Pegasystems, Paycom, Paylocity, Rent Manager by London Computer Systems, RingCentral, Roper Technologies, Inc., SAS Institute, ServiceNow, Silverlake Axis, SimCorp, Sistran, Solera Holdings, Teradata Corporation, The Innovation Group, Verint Systems Inc., Verisk Analytics, Inc., Vitech Systems Group, Visma, Wolters Kluwer, Workday, Zywave, Zoom Video Communications, and others.

Vendor Snapshot: Specialty Insurance Market Leaders

Salesforce

Salesforce

Salesforce continues to drive innovation in the insurance sector through its Financial Services Cloud, Service Cloud, and Agentforce platforms. The FSC offers insurers a unified view of customer data, facilitating personalized service and efficient policy management. Service Cloud enhances customer support with AI-driven tools, improving response times and satisfaction. Agentforce, Salesforce’s autonomous AI platform, enables the creation of custom AI agents to automate tasks such as claims processing and customer inquiries, streamlining operations and reducing costs.

Microsoft

Microsoft Dynamics 365 Finance has incorporated AI-powered billing, accounts receivable, and collections functionalities, streamlining financial operations for insurers. The platform also offers predictive analytics for cash-flow forecasting, aiding insurance companies in proactive financial management. Additionally, Dynamics 365 Customer Insights has been enhanced with Copilot capabilities, enabling insurers to create personalized customer journeys and optimize engagement strategies.

Roper Technologies, Inc.

In 2024, Vertafore’s acquisition of Surefyre bolstered its offerings for Managing General Agents, and wholesalers by introducing modern agent portals and automated underwriting capabilities, thereby enhancing speed to market and operational flexibility. Additionally, Vertafore’s Sircon platform saw a 20% increase in license applications and a 24% rise in license renewals from 2020 to 2023, indicating a sustained growth in the insurance sector.

Oracle

In 2024, Oracle supported major insurers in deploying embedded AI tools for IFRS 17-compliant accounting analytics and predictive financial planning. Oracle Eloqua remains a leading B2B marketing automation platform, now providing specialized Cloud Services such as Oracle Eloqua Marketing for Insurance, which includes industry-specific templates and campaign modules. Oracle embeds AI-based lead scoring, campaign orchestration, and cross-channel analytics into Eloqua, enabling insurers to execute personalized outreach, agent recruitment, and agent onboarding workflows efficiently.

ServiceNow

ServiceNow has rapidly expanded its influence in insurance with over 450 insurers globally deploying its Financial Services Operations (FSO) for Insurance platform, connecting claims, underwriting, and policy servicing workflows on a unified AI-driven platform. In partnership with DXC Technology launched the DXC Assure BPM powered by ServiceNow to deliver pre‑configured, AI‑powered insurance operations covering policy life‑cycle, claims, underwriting, and billing, supporting up to 40% reduction in manual processing cost.

Google continues to evolve Workspace by embedding AI into Gmail, Docs, Meet, and Chat through Duet AI. While Google’s AI agents are not fully autonomous, Workspace developers now have access to Vertex AI Agent Builder and AppSheet to create tailored collaborative experiences. The platform is increasingly allowing agents to summarize meetings, generate documents, and facilitate decisions through real-time content synthesis—bridging asynchronous and live collaboration seamlessly.

Adobe

Adobe’s combined marketing and experience platforms position it as a strategic enabler for insurance firms seeking AI-enhanced customer engagement and marketing efficiency. Adobe has steadily added industry relevance through real-time AI content generation and campaign analytics. As insurers increasingly prioritize hyper-personalization, digital claim journeys, and policyholder retention, Adobe Experience Cloud and Eloqua offer scalable tools to meet those demands.

Applied Systems Inc.

In July 2024, Applied Systems acquired Planck, an AI-first insurtech, bringing industry-leading AI and data science expertise into the Applied portfolio. Applied Epic continues to evolve with embedded AI-driven content creation tools, enhanced benefits account overviews, proactive quoting workflows, and browser-native UI enhancements that reduce task friction for agency staff.

SAP

SAP’s vector in insurance technology is clear: accelerate modernization via S/4HANA adoption, embed intelligent automation across sales and service, and unify data and workflow under a cloud-native, AI-enabled architecture. While new acquisitions have been limited, SAP’s ongoing investment in AI enhancements, migration enablers (RISE, GROW), and vertical use-case optimization solidify its positioning as a strategic ERP/CXM partner for insurers.

HubSpot

In 2024, HubSpot introduced Breeze, an AI-powered suite designed to streamline marketing, sales, and service operations. Breeze includes four AI agents: Content Agent, Social Media Agent, Prospecting Agent, and Customer Agent. The integration of AI tools like Breeze and ChatGPT, along with enhanced automation features, positions HubSpot as a forward-thinking platform that can help insurance companies streamline operations and improve customer engagement.

ARTW Technographics Platform: Specialty Insurance customer wins

Since 2010, our research team has been studying the patterns of Specialty Insurance software purchases, analyzing customer behavior and vendor performance through continuous win/loss analysis. Updated quarterly, the ARTW Technographics Platform provides deep insights into thousands of Specialty Insurance customer wins and losses, helping users monitor competitive shifts, evaluate vendor momentum, and make informed go-to-market decisions.

List of Specialty Insurance customers

Source: ARTW Buyer Insights Technographic Database

Custom data cuts related to the Specialty Insurance Applications market are available:

- Top 800+ Specialty Insurance Applications Vendors and Market Forecast 2024-2029

- 2024 Specialty Insurance Applications Market By Functional Market (16 Markets)

- 2024 Specialty Insurance Applications Market By Country (USA + 45 countries)

- 2024 Specialty Insurance Applications Market By Region (Americas, EMEA, APAC)

- 2024 Specialty Insurance Applications Market By Revenue Type (License, Services, Hardware, Support and Maintenance, Cloud)

- 2024 Specialty Insurance Applications Market By Customer Size (revenue, employee count, asset)

- 2024 Specialty Insurance Applications Market By Channel (Direct vs Indirect)

- 2024 Specialty Insurance Applications Market By Product

Worldwide Enterprise Applications by Vertical Market

Exhibit 3 provides a forecast of the worldwide enterprise applications by vertical market from 2024 to 2029, highlighting market sizes, year-over-year growth, and compound annual growth rates across different industry sectors from Aerospace and Defense to Utilities.

Exhibit 3: Worldwide Enterprise Applications by Vertical Market Forecast 2024-2029 by Functional Market ($M)

Source: Apps Run The World, July 2025

Exhibit 4 shows our projections for the enterprise applications market by vertical segment, based on the buying preferences and the customer propensity to invest in new software within those industries as they continue to upgrade and replace many legacy industry-specific applications that have been identified and tracked in our Buyer Insight Database.

FAQ – APPS RUN THE WORLD Top 10 Specialty Insurance Software Vendors, Market Size & Forecast

Q1. What is the global Specialty Insurance software market size in 2024?

A: The global Specialty Insurance software market grew to $4.6 billion in 2024, marking an 11.3% year-over-year increase.

Q2. Who are the top 10 Specialty Insurance software vendors in 2024 and their combined share?

A: The top 10 vendors are Salesforce, Microsoft, Roper Technologies, Oracle, SAP, HubSpot, Duck Creek Technologies, Majesco, Guidewire, and Insurity, together accounting for 46.9% of the total market.

Q3. Which vendor leads the Specialty Insurance software market in 2024?

A: Salesforce leads the Specialty Insurance software market in 2024 with a 12.7% market share.

Q4. What is the forecast for the Specialty Insurance software market through 2029?

A: The market is projected to reach $6.4 billion by 2029, growing at a compound annual growth rate (CAGR) of 7.1%.

Q5. What applications are included in the scope of the Specialty Insurance software market?

A: The scope includes Agency Management Systems, Policy Administration Solutions, Pensions Administration Software, Billing and Claims Software, Underwriting, Insurance Broker and Financial Planning Software, Financials, HR, and Procurement.

Q6. Which other Specialty Insurance software vendors are covered beyond the top 10?

A: The report also profiles vendors such as Duck Creek Technologies, Majesco, and others offering specialized solutions for the Specialty Insurance industry.

Q7. When was this Specialty Insurance software report published, and by whom?

A: The Top 10 Specialty Insurance Software Vendors, Market Size & Forecast 2024–2029 report was published in July 2025 by APPS RUN THE WORLD analysts Albert Pang, Misho Markovski, and Aleksandra Markovska, as part of the APPS TOP 500 research program, which benchmarks the revenues and market share of the world’s 1,500+ largest enterprise application vendors.

More Enterprise Applications Research Findings

Based on the latest annual survey of 10,000+ enterprise software vendors, Apps Run The World is releasing a number of dedicated reports, which profile the world’s 1,500 largest Enterprise Applications Vendors ranked by their 2024 product revenues. Their 2024 results are being broken down, sorted and ranked across 16 functional areas (from Analytics and BI to Treasury and Risk Management) and by 21 vertical industries (from Aerospace to Utility), as shown in our Taxonomy. Further breakdowns by subvertical, country, company size, etc. are available as custom data cuts per special request.

Research Methodology

Each year our global team of researchers conduct an annual survey of thousands of enterprise software vendors by contacting them directly on their latest quarterly and annual revenues by country, functional area, and vertical market.

We supplement their written responses with our own primary research to determine quarterly and yearly growth rates, In addition to customer wins to ascertain whether these are net new purchases or expansions of existing implementations.

Another dimension of our proactive research process is through continuous improvement of our customer database, which stores more than one million records on the enterprise software landscape of over 2 million organizations around the world.

The database provides customer insight and contextual information on what types of enterprise software systems and other relevant technologies are they running and their propensity to invest further with their current or new suppliers as part of their overall IT transformation projects to stay competitive, fend off threats from disruptive forces, or comply with internal mandates to improve overall enterprise efficiency.

The result is a combination of supply-side data and demand-generation customer insight that allows our clients to better position themselves in anticipation of the next wave that will reshape the enterprise software marketplace for years to come.

- Raymond James & Associates, a United States based Banking and Financial Services organization with 19000 Employees

- Enrollment123, a United States based Professional Services company with 50 Employees

- Platned, a United Kingdom based Professional Services organization with 150 Employees

| Logo | Company | Industry | Employees | Revenue | Country | Evaluated |

|---|

Salesforce

Salesforce